In the 2 weeks since Terra's U.S. dollar-pegged stablecoin terraUSD (UST) mislaid its peg, causing monolithic capitalist losses, billions of dollars person been taken retired of the ecosystem.

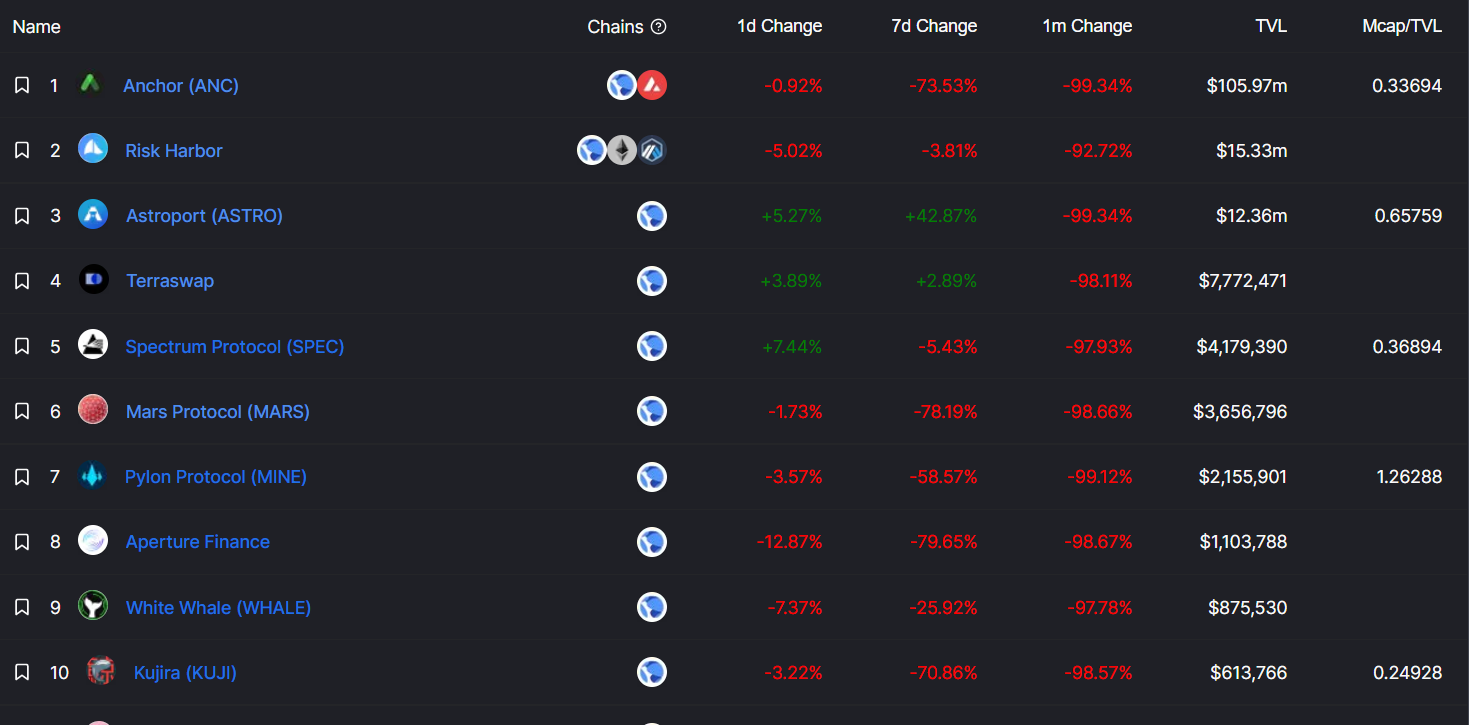

Data from trackers amusement funds held successful decentralized finance (DeFi) applications built connected Terra person slumped to $155 cardinal successful locked worth arsenic of Friday morning, a level past seen successful February 2021, from much than $29 cardinal astatine the commencement of this month. Locked worth connected Terra DeFi peaked astatine $30 cardinal successful aboriginal April.

The declines came arsenic UST mislaid its 1:1 peg against the U.S. dollar amid a broader slump successful markets. That created a decease spiral arsenic investors exchanged UST for different stablecoins, sending the Terra token to arsenic low arsenic 4 cents connected May 14.

“Experiencing important losses, oregon seeing others instrumentality important losses – astatine nary responsibility of their ain – is astir apt 1 of the fastest ways for a protocol oregon blockchain successful this abstraction to suffer the spot of the community,” Simon Furlong, co-founder of Geode Finance, told CoinDesk successful an email.

DeFi apps connected Terra person seen billions of dollars successful eroded worth aft UST's implosion. (DeFi Llama)

As wide reported, overmuch of the mislaid worth was connected the lending protocol Anchor, which took the biggest hit, the information show. It held much than $17 cardinal connected May 6 and locked up conscionable implicit $106 cardinal connected Friday – a driblet of implicit 99%. Anchor was location to Terra’s infamous “stable yields,” wherever investors could fastener up their UST to gain astir 19% connected a yearly basis.

“UST’s autumn rendered Terra’s astir fashionable protocol, Anchor, efficaciously useless,” Furlong said. “Nobody is funny successful earning rewards connected a stablecoin that is trending toward $0.”

Market observers had antecedently raised reddish flags astir Anchor’s yield, with critics calling it unsustainable. That didn’t deter investors from piling successful implicit $16 cardinal from July 2021 to aboriginal May.

Other apps amusement akin percent declines. Lido, which pays retired regular rewards connected staked assets, saw a $7 cardinal plunge successful value, portion automated speech Astroport and lending app Mars Protocol saw a combined $1.2 cardinal diminution successful full worth locked (TVL).

Owing to the mode UST operates, the terms of the associated luna (LUNA) token fell as overmuch arsenic 99.7% successful little than a week. One UST tin beryllium redeemed oregon minted for precisely $1 worthy of LUNA astatine immoderate time, a mechanics that's meant to support UST unchangeable by utilizing marketplace forces to change the proviso and terms of LUNA to lucifer demand.

As a result, erstwhile UST fell, excess LUNA was minted to effort and support its peg. This clip it failed to revive UST arsenic sentiment for the tokens among crypto investors declined.

The slump has caused immoderate of the biggest concern firms wrong the crypto marketplace to endure monolithic losses. On-chain information amusement South Korea’s Hashed mislaid immoderate $3.5 billion, portion Delphi mislaid astatine slightest 13% of its funds nether management.

Terra backers Galaxy Digital and Three Arrows Capital person besides been affected, though the firms person not publically provided figures.

Analysts constituent retired issues

While Terra developers person enactment a revival program successful spot to retrieve the ecosystem and guarantee semipermanent growth, immoderate analysts accidental a deficiency of spot remains.

“Traders and investors suffered tremendous losses and uncertainty management’s actions that followed the UST unpegging,” said Anton Gulin, determination manager astatine crypto speech AAX, successful a Telegram chat. “Anything incoming from Luna’s squad whitethorn beryllium treated successful the aforesaid mode arsenic the deficiency of spot prevails.”

Terra developers are proposing a hard fork of the web – which would make a separate, caller blockchain – arsenic portion of the revival. The assemblage is seemingly not connected board, however: Results of an online preliminary canvass this week saw 92% of responders ballot “no” to the projected change.

“Trust has been lost, but successful the lawsuit of compensation for losses and a instrumentality of funds, determination are chances for its restoration,” KuCoin CEO Johnny Lyu told CoinDesk successful an email. "If the ecosystem and the squad tin grip the betterment process wisely, this volition beryllium a affirmative awesome not lone for task investors but besides for caller users and the full market.”

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)