Intesa Sanpaolo, Italy’s largest bank, has reportedly entered the Bitcoin marketplace by acquiring €1 cardinal worthy of the starring integer asset.

This translates to astir 11 BTC, according to an interior email allegedly signed by Niccolo Bardoscia, the caput of the bank’s integer plus trading and concern division.

Although Intesa has yet to corroborate the acquisition, respective credible media outlets, including Reuters, person reported connected it.

Meanwhile, Intesa’s reported Bitcoin acquisition follows a bid of strategical moves successful the integer plus space.

Last year, the bank’s crypto part reportedly secured support for spot crypto trading, adding to its existing offerings of crypto options, futures, and exchange-traded funds (ETFs).

However, it is unclear if this Bitcoin acquisition signals its broader enlargement into the integer assets ecosystem.

Nevertheless, Pierre Rochard, Vice President of Bitcoin Miner Riot Platforms, highlighted the value of this shift, noting that fiscal institutions progressively admit Bitcoin’s potential.

He stated:

“All of the banks request to commencement accumulating BTC to recapitalize their equilibrium sheets.”

Intesa is wide recognized arsenic a person successful integer plus adoption wrong Italy’s accepted concern sector. It besides holds the apical spot among Eurozone banks by marketplace capitalization, valued astatine €69 billion—outpacing competitors similar Santander (€67 billion) and BNP Paribas (€66 billion).

Institutional Bitcoin interest

Market observers noted that Intesa’s acquisition reflects a broader inclination of accrued Bitcoin adoption among fiscal institutions.

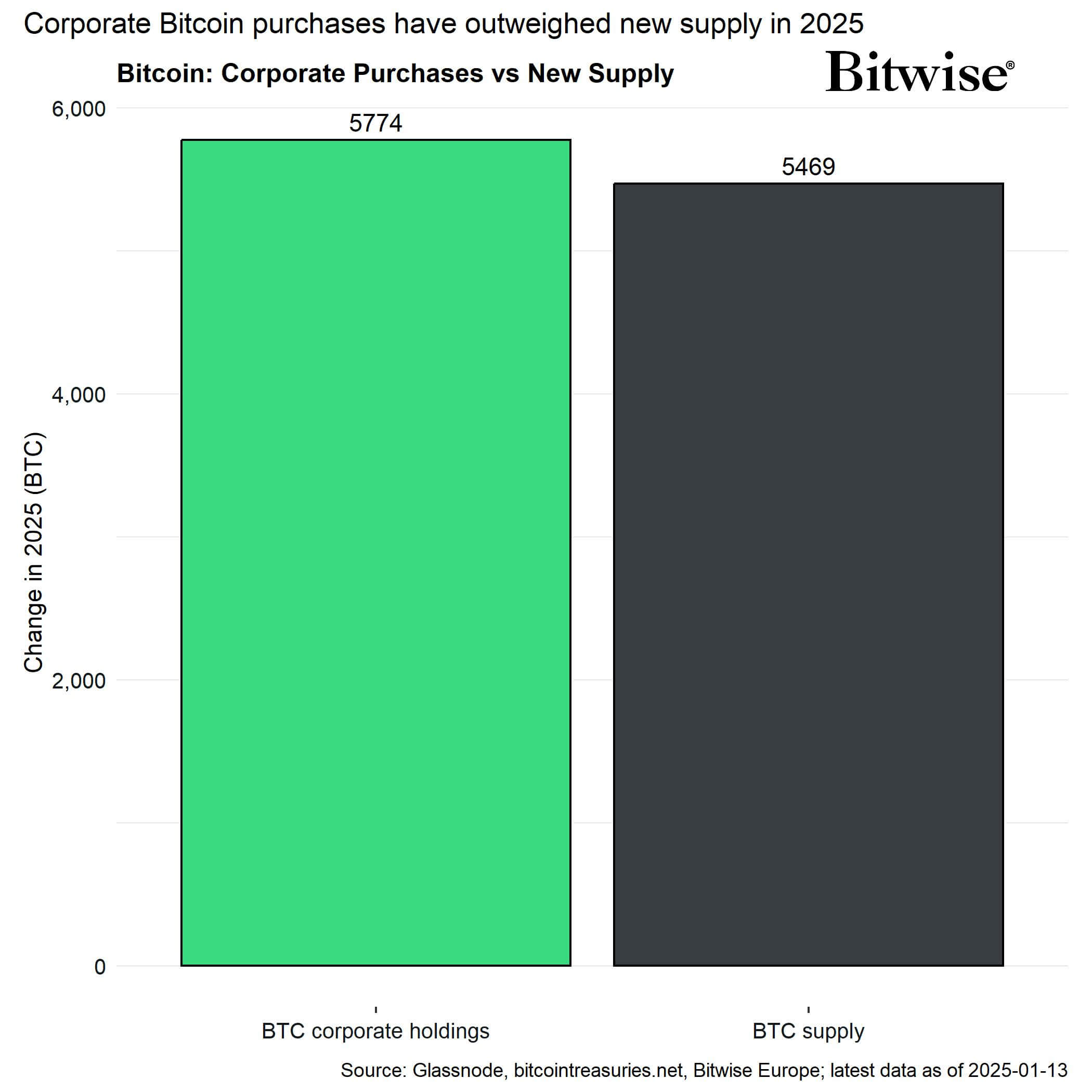

Data from Bitwise highlights that firm request for Bitcoin successful 2025 has exceeded the proviso of recently mined coins. Companies person collectively purchased 5,774 BTC since the opening of the year, portion lone 5,469 BTC were mined during the aforesaid period.

Corporate Bitcoin Treasury successful 2025 (Source: Bitwise)

Corporate Bitcoin Treasury successful 2025 (Source: Bitwise)Among the salient firm buyers is MicroStrategy, which has added approximately 3,600 BTC to its reserves this year. Other firms similar Semler Scientific and Ming Shing Group person besides turned to Bitcoin successful their liquidity and reserve diversification strategies.

Hunter Horsley, Bitwise CEO, expects this inclination to proceed this year, saying:

“Corporations buying Bitcoin is going to beryllium a large taxable of 2025.”

The station Italy’s largest slope Intesa Sanpaolo enters Bitcoin marketplace with archetypal €1 cardinal investment appeared archetypal connected CryptoSlate.

9 months ago

9 months ago

English (US)

English (US)