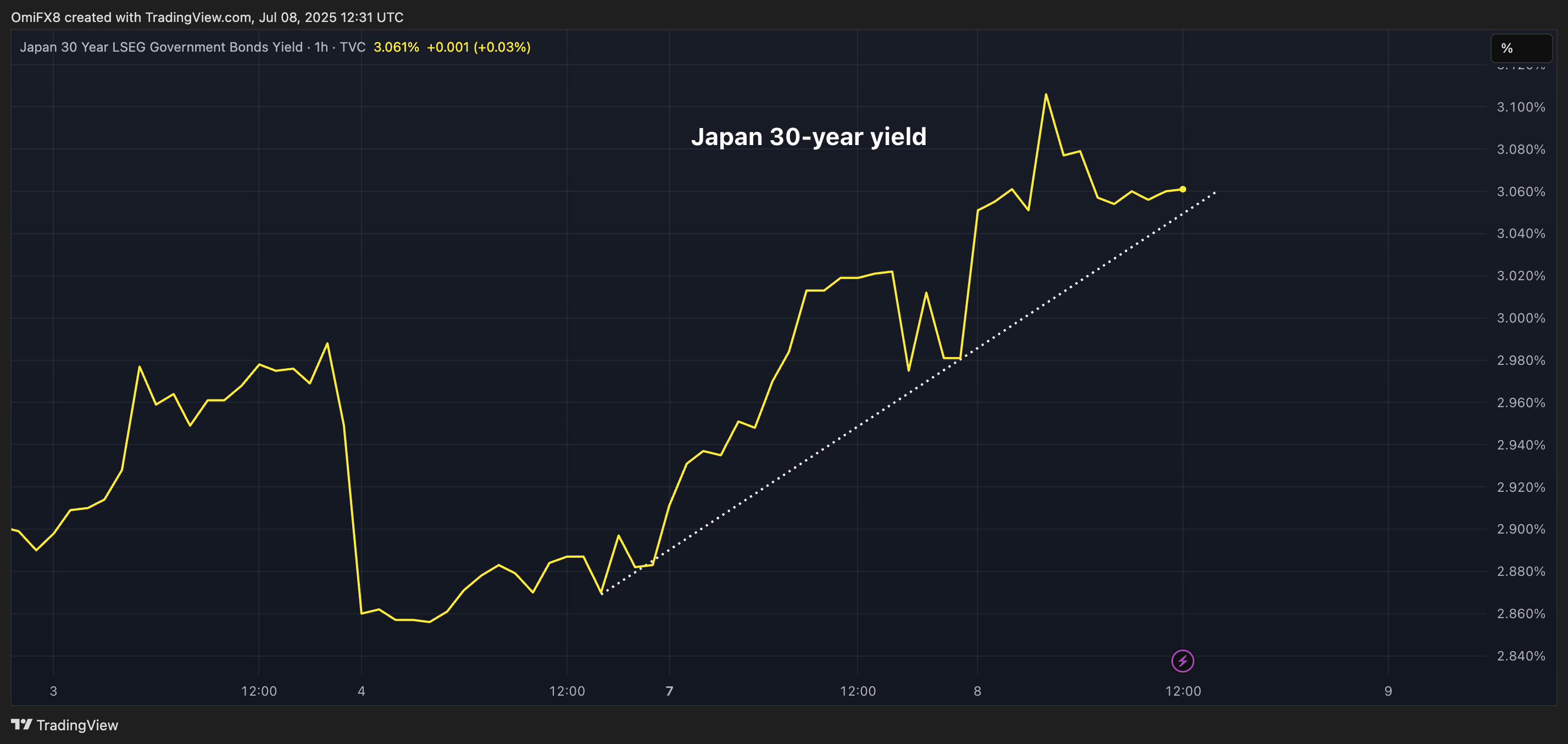

The output connected the superlong Japanese indebtedness has surged importantly since Friday, informing of volatility successful enslaved markets crossed precocious nations. This concern typically leads to fiscal tightening and zaps investors' hazard appetite.

The output connected the Japanese 30-year authorities enslaved (JGB) has surged implicit 30 ground points (bps), topping the 3% people for the archetypal clip since May 23, erstwhile it deed a precocious of 3.20%, according to information root TradingView. The 40-year output has risen astir 15 ground points to 3.36%.

The uptick apt represents markets' concerns astir fiscal profligacy up of the impending Upper House predetermination successful Japan aboriginal this month. Last week, Japan's Prime Minister Shigeru Ishiba defended his plans to administer currency handouts arsenic the absorption called for taxation cuts.

Further, President Donald Trump's determination to impose a 25% tariff connected Japan whitethorn beryllium causing accent successful the market.

Watch retired for rates volatility

The latest uptick successful the Japanese ultra-long enslaved yields could adhd to the momentum successful yields successful the U.S. and different countries, whose governments are spending beyond their means.

That, successful turn, whitethorn assistance rates volatility, perchance causing fiscal tightening and weighing implicit hazard assets, including bitcoin. Crypto bulls, therefore, whitethorn privation to support way of the MOVE index, which measures the options-based 30-day implied volatility successful the U.S. Treasury notes.

Historically, majors tops successful BTC person corresponded to bottoms successful the MOVE scale and vice versa.

Focus connected Thursday's auction

The volatility successful JGB and different enslaved markets whitethorn summation aboriginal this week if the Japanese Ministry of Finance’s merchantability of 20-year bonds connected Thursday disappoints expectations.

According to Bloomberg, the 20-year enslaved auction has a past of disappointing outcomes, starring to volatility successful longer-duration enslaved yields.

Japan is nary longer a root of debased rates

For years, Japan maintained ultra-low enslaved yields done a cocktail of unconventional monetary argumentation measures. That efficaciously exerted downward unit connected yields crossed the precocious world, portion underpinning the Japanese yen's relation arsenic backing currency for the risk-on transportation trades.

However, since 2023, Japan has dilatory normalized its monetary policy, greasing the rally successful yields worldwide.

3 months ago

3 months ago

English (US)

English (US)