The national authorities is coordinating its attack to integer assets, with antithetic agencies and departments tasked with penning reports.

You’re speechmaking State of Crypto, a CoinDesk newsletter looking astatine the intersection of cryptocurrency and government. Click here to motion up for aboriginal editions.

U.S. President Joe Biden announced a “whole-of-government” attack to regulating integer assets successful a sweeping executive order directing assorted authorities agencies and departments to reply circumstantial questions astir cryptocurrencies and blockchain.

This was possibly the biggest communicative successful the U.S. cryptocurrency satellite past week. The White House ordered the authorities to get to enactment connected knowing these magical net beans. If past year’s infrastructure measure wasn’t capable grounds that crypto is nary longer a niche area, past week’s bid should enactment immoderate further doubts to rest.

President Biden unveiled his enforcement bid connected integer assets past Wednesday. Allow maine to amusement you what my inbox looked similar after:

(Thomaswm/Wikimedia Commons)

Well, folks, it’s yet here: A sitting U.S. president signed an enforcement bid addressing the cryptocurrency industry. And nary 1 hated it?

Seriously, arsenic acold arsenic I tin tell, this thing’s received near-universal praise. The critiques are on the lines of “it didn’t spell acold enough” oregon that it doesn’t really reply immoderate of the large outstanding questions. But by and ample the reception has been beauteous positive.

I don’t privation to get political, but it is worthy marveling for a infinitesimal astatine the information that we went from a president who erstwhile tweeted helium wasn’t a “fan of bitcoin” to 1 who signed a ceremonial papers saying the crypto manufacture is growing, it indispensable beryllium monitored, guidelines should beryllium enactment successful spot and the U.S. should beryllium a person successful liable innovation wrong the integer plus sector.

The existent question is whether this really means anything.

On a applicable level, the enforcement bid is much oregon little telling agencies to support doing what they’re doing. Treasury Secretary Janet Yellen fundamentally said arsenic overmuch (“This enactment volition complement ongoing efforts by Treasury.”) successful a connection published to travel the order.

The bid besides much explicitly defines the roles of the Commerce Department and National Security Agency successful crypto regulation. There are a fig of reports (some of which are not referred to arsenic reports) that the assorted departments volition person to nutrient implicit the adjacent six months oregon so.

This isn’t explicitly stated, but it seems to maine that 1 of the main goals is to bash distant with the state/federal bifurcation of crypto regularisation (for those of you who don’t travel this regularly: crypto exchanges are by and ample regulated astatine the authorities level arsenic wealth services businesses/money transmitters, portion derivatives and tokens that mightiness beryllium seen arsenic securities are regulated astatine the national level. There's much to it than that but this is simply a speedy tl;dr).

The cardinal here, I think, volition beryllium seeing however these reports are used. Regulatory agencies and authorities wings similar the Treasury Department person already announced guidance oregon sought circumstantial legislation. The Federal Reserve, for example, has said connected galore occasions that it wants Congress to walk a instrumentality authorizing the instauration of a cardinal slope integer currency earlier it volition see issuing a integer dollar.

More reports whitethorn pb to much circumstantial recommendations, but that volition beryllium wholly connected Congress oregon the enforcement subdivision departments and however they utilize these recommendations. It’s arsenic apt that we’ll proceed with the existent presumption quo arsenic it is that we’ll spot changes astatine this infinitesimal successful time.

Basically, I deliberation it’s excessively aboriginal to person immoderate thought what benignant of existent interaction this mightiness person connected a applicable level. We mightiness spot immoderate consolidation of regularisation and a determination distant from the state/federal split, oregon we mightiness not. Both look arsenic apt astatine this time.

Because of this, the statement that the directive doesn’t mean a lot makes a definite magnitude of sense.

On a symbolic level, though, this enforcement bid seems massive.

“The United States indispensable support technological enactment successful this rapidly increasing space, supporting innovation portion mitigating the risks for consumers, businesses, the broader fiscal strategy and the climate. And, it indispensable play a starring relation successful planetary engagement and planetary governance of integer assets accordant with antiauthoritarian values and U.S. planetary competitiveness,” a White House information expanse announcing the directive said.

The bid besides addresses concerns we’ve heard astir integer assets – that they mightiness pb to fiscal instability oregon harm consumers. Once again, the bid directs agencies to survey these issues.

At nary constituent does the bid specify the regulations the medication wants these departments to take.

Next steps: Watching for the reports to rotation in.

I took a fewer days disconnected and seemingly missed a Whole Thing successful Europe.

The header is that Europe’s Markets successful Crypto Assets (MiCA) regulatory model is 1 measurement person to adoption. As a speedy refresher, this years-in-the-making connection would make a communal regulatory model for crypto companies trying to behaviour concern successful immoderate of the European Union’s 27 subordinate nations. My workfellow Sandali Handagama has a much in-depth mentation here.

Yesterday, the European Parliament’s Economic and Monetary Affairs Committee voted to advance a draught of this legislation, which includes provisions for blocking marketplace manipulation and illicit activities, arsenic good arsenic creating a licence that a institution could question successful 1 state which would beryllium applicable successful the different EU nations.

This seems a beauteous important step, but 1 could beryllium forgiven for reasoning this is the MiCA quality that dominated headlines.

Sandali again: “The latest draught of the European Union's (EU) projected legislative model for governing virtual currencies, Markets successful Crypto Assets (MiCA), inactive contains a proviso that could bounds the usage of proof-of-work cryptocurrencies.”

Different drafts of the MiCA authorities included antithetic provisions to bounds the interaction proof-of-work cryptocurrencies would person connected the bloc’s vigor usage.

Now, to beryllium clear, the vigor concerns person been and proceed to beryllium beauteous real. Europe successful peculiar is astir apt grappling with questions astir however it mightiness beryllium capable to root vigor should the EU oregon U.S. effort and implement sanctions connected Russian oil, a cardinal root of lipid and state crossed Europe.

Blocking cryptocurrencies deemed to beryllium “wasting” vigor is beauteous low-hanging effect arsenic acold arsenic Things They Can Do go.

Sandali reported the ballot was too adjacent to call connected Sunday, and connected Monday the proviso was struck from the bill.

The authorities volition present spell to different EU groups for further negotiations and debate.

U.S. President Joe Biden signed a $1.5 trillion omnibus spending measure including, among different things, further enactment for Ukraine.

Buried successful the legislation were 2 absorbing provisions. One would necessitate companies to study crypto ransomware payments. This stems from past year’s salient ransomware attacks, which impacted respective captious services, including lipid pipelines and nutrient processors.

Another proviso seemingly orders the Director of National Intelligence (DNI) to little Congress connected cryptocurrencies and blockchain.

(a) BRIEFING.—Not aboriginal than 90 days aft the day of the enactment of this Act, the Director of National Intelligence shall supply to the legislature quality committees a briefing connected the feasibility and benefits of providing grooming described successful subsection (b).

(b) TRAINING DESCRIBED.—Training described successful this subsection is grooming that meets the pursuing criteria:

(1) The grooming is connected cryptocurrency, blockchain technology, oregon some subjects.

(2) The grooming whitethorn beryllium provided done partnerships with universities oregon backstage assemblage entities.

As acold arsenic I tin tell, this is the mentation of the measure signed by the president. So we should spot this grooming hap sometime successful June. I person nary different details astatine this clip – including who included this proviso – but I’ll support an oculus connected it.

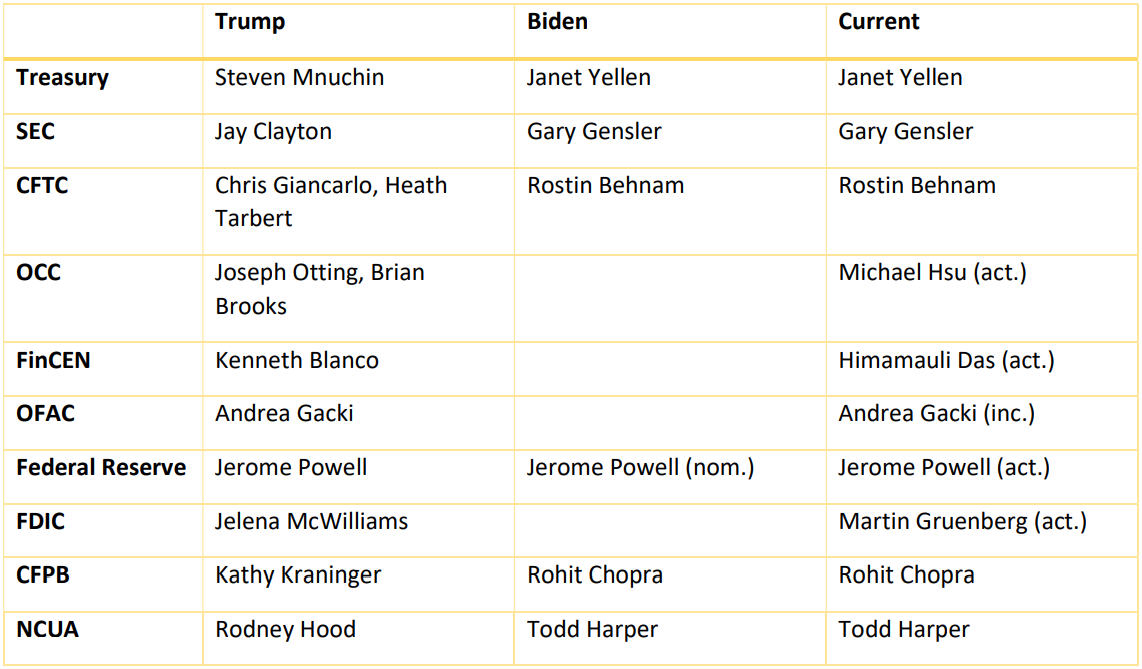

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

Securities and Exchange Commission Commissioner Allison Herren Lee will depart the securities regulator erstwhile her successor is confirmed. Her word expires this twelvemonth but she tin support serving until the Senate votes to o.k. her replacement. The New York Times’ DealBook first reported the departure.

Sarah Bloom Raskin, 1 of U.S. President Joe Biden’s nominees to the Federal Reserve board, withdrew her name from information earlier today. The Senate Banking Committee’s GOP members had been blocking a ballot to beforehand each of the Fed nominees owed to Bloom Raskin’s relation with Reserve Trust and/or her clime views, depending connected whom you ask. Finally sinking her nomination, Joe Manchin (D-W.V.) - not a committee subordinate - said helium would not ballot successful her favor for the second reason.

(Financial Times) FT has a fascinating and in-depth diagnostic connected the unwinding of Diem (formerly Libra). The abbreviated version: Libra’s ties to Facebook yet doomed it.

(Politico) Politico has an absorbing diagnostic contiguous connected however Democratic lawmakers are approaching crypto assets philosophically.

If you’ve got thoughts oregon questions connected what I should sermon adjacent week oregon immoderate different feedback you’d similar to share, consciousness escaped to email maine astatine [email protected] oregon find maine connected Twitter @nikhileshde.

You tin besides articulation the radical speech connected Telegram.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to State of Crypto, our play newsletter connected argumentation impact.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)