According to an estimation by JPMorgan, exchange-traded products (ETPs) for XRP and Solana (SOL) could pull implicit $15 cardinal successful nett inflows.

Matthew Sigel, caput of integer assets probe astatine VanEck, shared that the forecast considers the performances of Bitcoin (BTC) and Ethereum (ETH) successful narration to their marketplace headdress and ETP flows.

Bitcoin ETPs reached $108 cardinal successful assets wrong their archetypal twelvemonth of trading, representing 6% of BTC’s full marketplace headdress of $1.8 trillion. Similarly, Ethereum ETPs achieved a 3% penetration complaint wrong six months, amassing $12 cardinal successful assets compared to ETH’s $395 cardinal marketplace cap.

Using these adoption rates arsenic benchmarks, SOL could spot inflows betwixt $3 cardinal and $6 billion, portion XRP could pull betwixt $4 cardinal and $8 billion.

ETFs are not close

According to a caller CoinShares report, Solana-tied ETPs clasp astir $1.6 cardinal successful assets nether absorption (AUM). Meanwhile, XRP products boast $910 cardinal successful assets.

Meanwhile, the nett flows for their ETPs reached $438 cardinal and $69 cardinal successful 2024, respectively.

Although the support of exchange-traded funds (ETF) indexed to some assets could boost their full AUM, the likelihood of specified an result successful the US are debased for now.

Bloomberg ETF analysts James Seyffart and Eric Balchunas recently highlighted that President-elect Donald Trump’s medication could favour caller approvals.

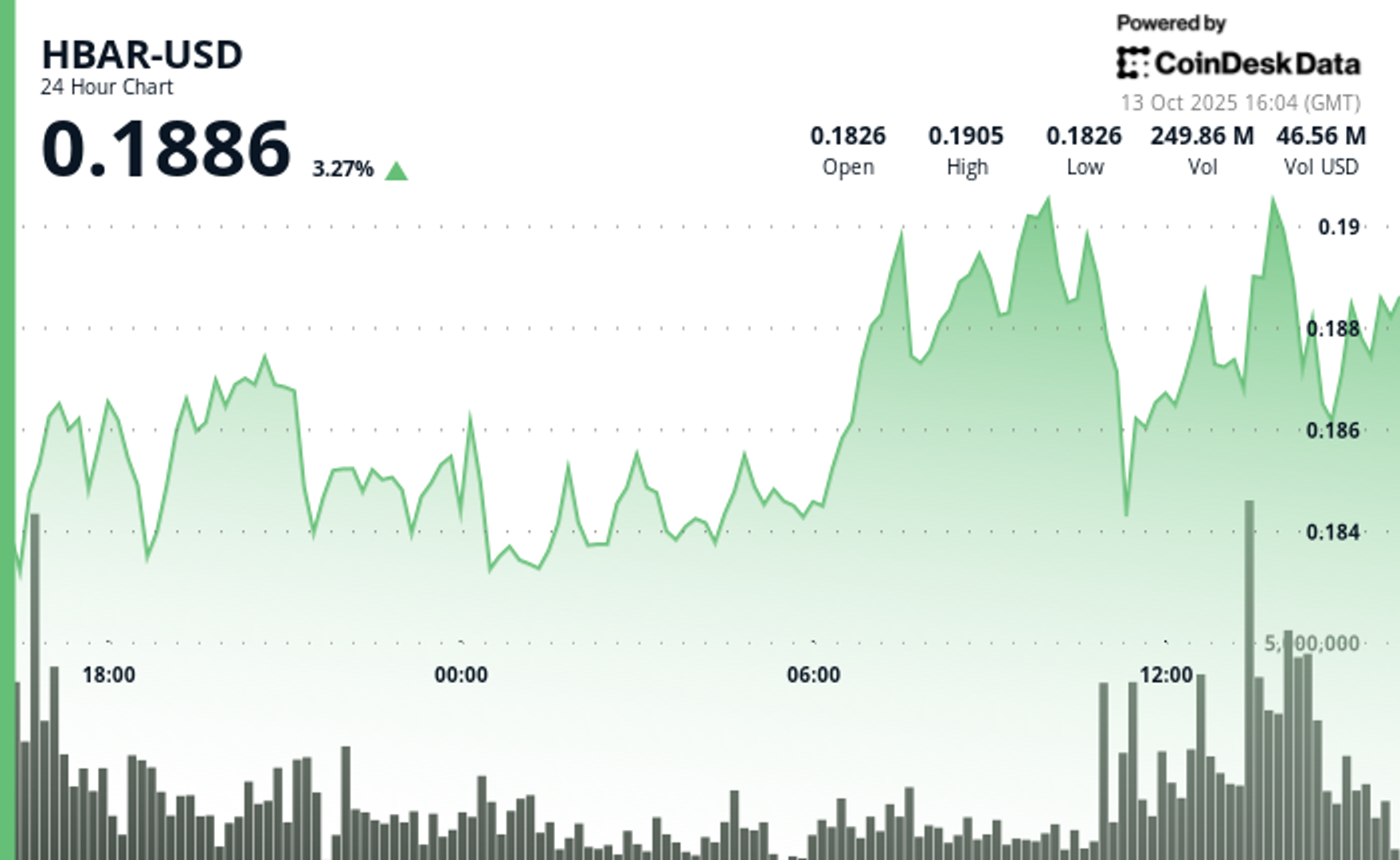

However, ETFs tied to Litecoin (LTC) and Hedera (HBAR) are much apt to beryllium approved first. LTC is simply a fork of Bitcoin, which means its apt to beryllium classified arsenic a commodity, portion HBAR has ne'er been targeted by regulators and is improbable to beryllium classified arsenic a security.

Meanwhile, SOL and XRP person antithetic treatment. The US Securities and Exchange Commission (SEC) recently rejected Solana-tied ETFs, portion Ripple Labs is inactive battling the regulator implicit whether XRP should beryllium considered a security.

Despite the Bloomberg analysts predicting a question of caller ETFs this year, XRP and SOL products mightiness beryllium delayed.

The station JPMorgan believes Solana, XRP ETPs could pull $15 cardinal successful nett inflows appeared archetypal connected CryptoSlate.

8 months ago

8 months ago

English (US)

English (US)