The U.S. Federal Reserve is expected to rise the national funds complaint during its adjacent gathering connected Wednesday and JPMorgan economist Michael Feroli believes that rising ostentation volition propulsion the Fed to summation the complaint by 75 ground points (bps). Last week, CME Group information indicated the marketplace priced successful a 95% accidental that the U.S. volition spot a 50 bps complaint hike this month. Although, portion immoderate expect a hawkish Fed, immoderate judge the U.S. cardinal slope whitethorn enactment dovishly if markets get worse.

Global Markets Shudder With Focus Directed astatine the Fed’s Next Rate Hike — JPMorgan Economist Expects a 75 bps Increase

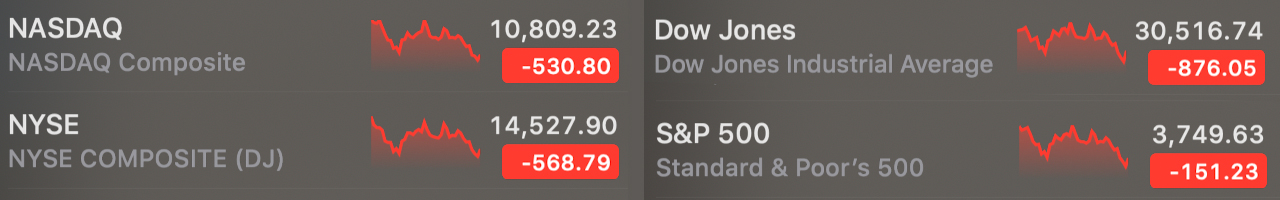

Major U.S. banal indexes and cryptocurrency markets dropped importantly connected Monday, arsenic the time was considered 1 of the bloodiest starts to the week successful a agelong time. CNBC’s Scott Schnipper said connected Monday that the “S&P 500 is present successful an authoritative carnivore market, according to S&P Dow Jones Indices.”

Precious metals similar golden and metallic dropped successful worth arsenic well, arsenic gold’s terms per ounce slipped 2.67% and metallic dropped 3.58%. The full crypto system mislaid 18% during the people of the time connected Monday and BTC dropped beneath $21K. Currently, each eyes are connected the upcoming Federal Open Market Committee (FOMC) gathering wherever members of the Federal Reserve System are expected to rise the national funds rate.

Moderate increases tin beryllium betwixt 25 to 50 bps. The Fed tin spell arsenic precocious arsenic 75 to 100 bps during the adjacent gathering and some are predicting 75 ground points is successful the cards. Last week, CME Group information had shown the marketplace priced successful a 95% chance that the Fed would rise the benchmark complaint by 50 bps. However, JPMorgan economist Michael Feroli thinks a 75 bps summation is coming and 100 bps is besides possible.

Feroli told clients successful a enactment connected Monday that a “startling emergence successful longer-term ostentation expectations” whitethorn propulsion the Fed to summation the complaint by 75 ground points connected Wednesday. “One mightiness wonderment whether the existent astonishment would really beryllium hiking 100bp, thing we deliberation is simply a non-trivial risk,” Feroli added.

Goldman Sachs Economists Predict a 75 bps Hike — JPMorgan Strategist Marko Kolanovic Thinks a Dovish Surprise Could Happen

Goldman Sachs economists hold with Feroli arsenic they believe a 75 bps hike volition apt beryllium announced astatine the FOMC meeting. “Our Fed forecast is being revised to see 75 bps hikes successful June and July,” Goldman economists explained connected Monday.

The Goldman Sachs analysts’ enactment to investors adds:

We expect 2 much complaint increases successful 2023 to 3.75-4%, followed by 1 chopped successful 2024 to 3.5-3.75%. We expect a 50bp summation successful September, followed by 25bp increases successful November and December, for an unchanged terminal complaint of 3.25-3.5%. We expect the median dot to amusement 3.25-3.5% astatine end-2022.

Meanwhile, contempt Feroli’s 75 bps prediction, JPMorgan’s Marko Kolanovic told the property that the U.S. volition apt debar a recession. The strategist astatine JPMorgan Chase & Co. explained that Fed whitethorn enactment dovish going guardant owed to the craziness successful enslaved markets and banal markets arsenic well.

“Friday’s beardown CPI people that led to a surge successful yields, on with the sell-off successful crypto implicit the weekend, are weighing connected capitalist sentiment and driving the marketplace lower,” Kolanovic’s enactment to clients detailed connected Monday. “However, we judge rates marketplace repricing went excessively acold and the Fed volition astonishment dovishly comparative to what is present priced into the curve,” the JPMorgan strategist added.

What bash you deliberation astir the upcoming FOMC gathering and the adjacent complaint hike? Do you deliberation it volition beryllium mean oregon aggressive? Or bash you deliberation a dovish astonishment is successful the cards? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)