Certain indicators of equity valuations grounds overvaluation now. In the aboriginal investors volition look for alternate assets to parkland their wealth.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

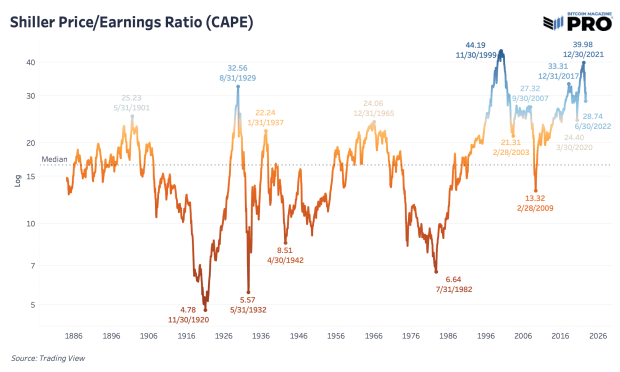

Shiller P/E Ratio

Much of our commentary since the commencement of Bitcoin Magazine Pro has been successful regards to the narration betwixt bitcoin and equities, and their reflection of the planetary “liquidity tide.” As we person antecedently discussed, fixed that the size of the bitcoin marketplace comparative to that of U.S. equities is minuscule (the existent marketplace capitalization of U.S. equities is astir $41.5 trillion, compared to $452 cardinal for bitcoin). Given the trending marketplace correlation betwixt the two, it's utile to inquire conscionable however over/undervalued equities are comparative to humanities values.

One of the champion ways to analyse erstwhile the broader equities marketplace is overvalued is the Shiller price-per-earnings (PE) ratio. Also known arsenic cyclically-adjusted PE ratio (CAPE), the metric is based connected inflation-adjusted net from the past 10 years. Through decades of histories and cycles, it’s been cardinal astatine showing erstwhile prices successful the marketplace are acold overvalued oregon undervalued comparative to history. The median worth of 16.60 implicit the past 140-plus years shows that prices comparative to net ever find a mode to revert back. For equity investing, wherever instrumentality connected concern is needfully babelike connected aboriginal earnings, the price you wage for said net is of utmost importance.

We find ourselves successful 1 of the unsocial points successful past wherever valuations person soared conscionable shy of their 1999 highs and the “everything bubble” has started to amusement signs of bursting. Yet, by each comparisons to erstwhile bubbles bursting, we’re lone 8 months down this path. Despite the rally we’ve seen implicit the past fewer months and the explosive ostentation astonishment upside determination that came today, this is simply a awesome of the broader marketplace representation that’s hard to ignore.

Even though the merchandise of Consumer Price Index information came successful astatine a astonishing 0.0% speechmaking period implicit month, year-over-year ostentation is astatine an unpalatable 8.7% successful the United States. Even if ostentation were to wholly abate for the remainder of the year, 2022 would inactive person experienced implicit 6% ostentation during the people of the year. The cardinal present being that the outgo of superior (Treasury yields) are successful the process of adjusting to this caller world, with ostentation being the highest felt implicit the past 40 years, yields person risen successful grounds manner and person pulled down the multiples successful equities arsenic a result.

If we deliberation of the imaginable paths going forward, with ostentation being fought by the Federal Reserve with tighter policy, determination is the imaginable for stagflation successful presumption of antagonistic existent growth, portion the labour marketplace turns over.

Looking astatine the comparative valuation levels of U.S. equities during erstwhile periods of precocious ostentation and/or sustained fiscal repression, it is wide that equities are inactive adjacent priced to perfection successful existent presumption (inflation-adjusted 10-year earnings). As we judge that sustained fiscal repression is an implicit necessity arsenic agelong arsenic indebtedness remains supra productivity levels (U.S. nationalist debt-to-GDP > 100%), equities inactive look rather costly successful existent terms.

Either U.S. equity valuations are nary longer tied to world (unlikely), or:

- U.S. equity markets clang successful nominal presumption to little multiples comparative to the historical mean/median

- U.S. equities melt up successful nominal presumption owed to a sustained precocious inflation, yet autumn successful existent terms, frankincense bleeding capitalist purchasing powerfulness

The decision is that planetary investors volition apt progressively hunt for an plus to parkland their purchasing powerfulness that tin flight some the antagonistic existent yields contiguous successful the fixed income marketplace and the precocious net multiples (and subsequently debased oregon antagonistic existent equity yields).

In a satellite wherever some enslaved and equity yields are little than the yearly complaint inflation, wherever bash investors parkland their wealth, and what bash they usage to behaviour economical calculation?

Our reply implicit the agelong word is simple, conscionable cheque the sanction of our publication.

3 years ago

3 years ago

English (US)

English (US)