Bitcoin fell sharply Thursday aft the US Treasury made wide it volition not adhd to a planned Bitcoin reserve done caller purchases.

Prices had earlier rallied to an intraday precocious adjacent $124,120, but traders saw gains reverse and the token backpedaled to astir $118,550 aboriginal successful the session.

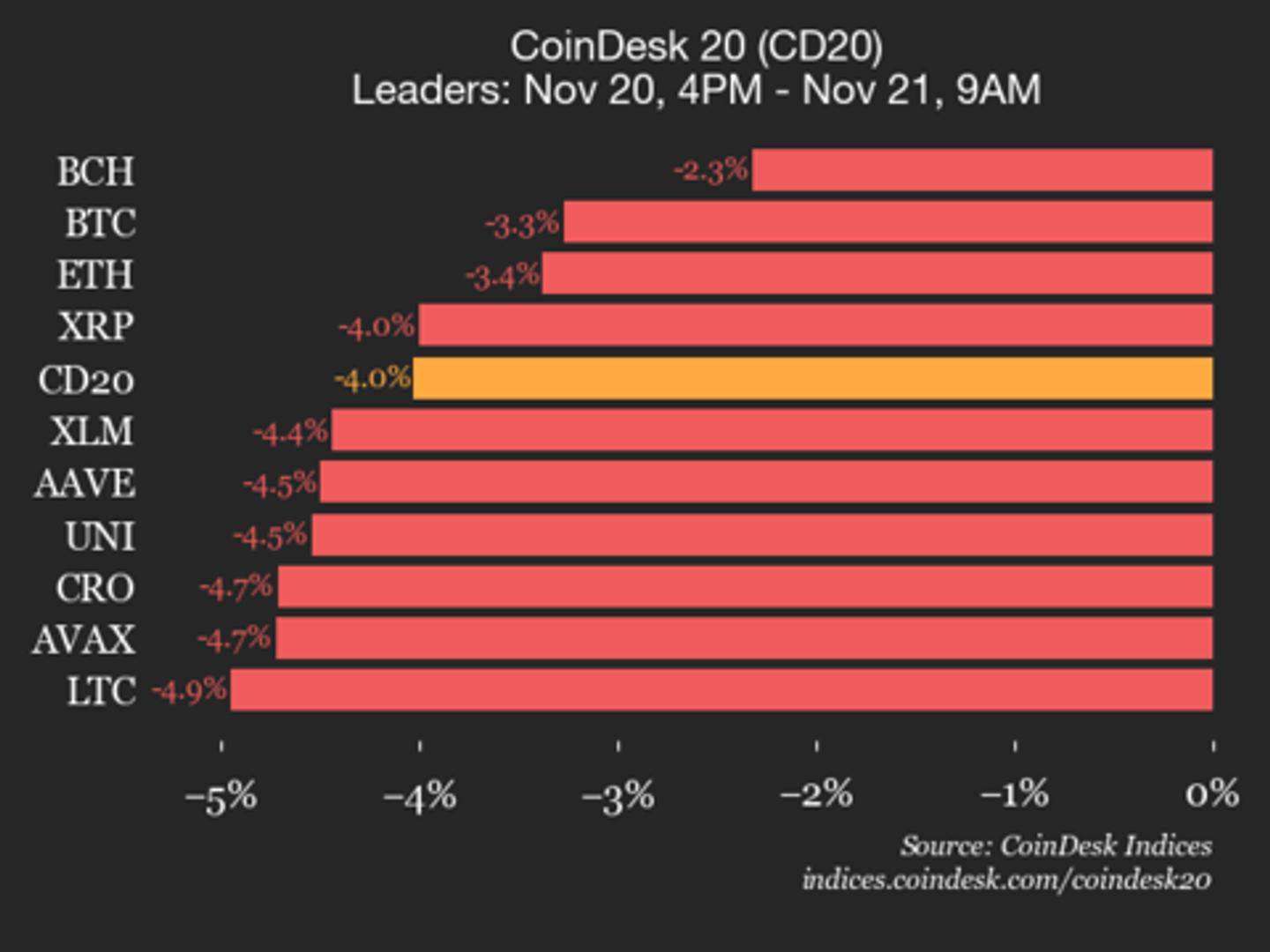

Markets were jittery, and parts of the crypto futures marketplace saw forced liquidations during the sell-off.

Bitcoin terms takes a abrupt dive. Source: CoinMarketCap

Bitcoin terms takes a abrupt dive. Source: CoinMarketCapTreasury Rules Out New Buys

According to reports, Treasury Secretary Scott Bessent told Fox Business the authorities volition not beryllium buying further Bitcoin for the reserve and that aboriginal additions volition travel from confiscated assets.

“We’re not going to beryllium buying that,” helium said, and helium added the Treasury would “stop selling” holdings it already controls.

Bessent estimated the reserve’s existent worth astatine determination betwixt $15 cardinal and $20 billion.

The comments basal successful alleviation to an earlier determination by US President Donald Trump, who issued an enforcement bid asking for budget-neutral plans to turn strategical Bitcoin holdings.

JUST IN: 🇺🇸 Treasury Secretary Bessent says the US Government is “not going to beryllium buying” Bitcoin. pic.twitter.com/vL79P531CP

— Watcher.Guru (@WatcherGuru) August 14, 2025

Market Reaction And Price Swings

Based connected reports, the sell-off erased a chunk of Thursday’s gains. One provender showed Bitcoin drop from astir $121,050 to $117,201 wrong an hour, portion different information points enactment the debased adjacent $118,460.

Trading platforms recorded a question of liquidations estimated astatine astir $450 cardinal astir the aforesaid time.

Traders said the abrupt displacement was driven by the clarity successful argumentation — investors had been pricing a imaginable authorities buyback programme into earlier optimism, and that anticipation faded aft Bessent’s remarks.

U.S. Treasury Secretary Scott Bessent said successful an interrogation with Fox, “We are not going to beryllium buying,” referring to crypto reserves, and volition alternatively usage seized assets. He has besides stated that the worth of Bitcoin reserves is astir $15 cardinal to $20 billion, and that the…

— Wu Blockchain (@WuBlockchain) August 14, 2025

Macroeconomic Signals And Tariff Revenue

Reports person besides disclosed that Bessent linked immoderate balance-sheet plans to rising tariff collections, saying July brought astir $30 cardinal successful tariff revenues.

Bessent suggested yearly tariff receipts could apical a erstwhile projection of $300 billion, a fig helium said could assistance money different plus strategies.

The timing of his comments besides came arsenic US information showed the Producer Price Index rising 3.3% year-on-year and 0.9% month-on-month for July, numbers that adhd to the broader economical backdrop investors are watching.

Confiscated Assets Versus Direct Purchases

The Treasury secretary’s enactment that confiscated assets volition beryllium utilized to turn the reserve shifts the backing exemplary distant from nonstop Treasury buys.

For now, that means immoderate further summation successful the reserve would beryllium gradual and babelike connected instrumentality enforcement recoveries alternatively than marketplace purchases.

Market participants said that stance removes a clear, predictable purchaser from the market, which tin marque terms swings larger implicit abbreviated windows — precisely what traders saw connected Thursday.

Featured representation from Unsplash, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)