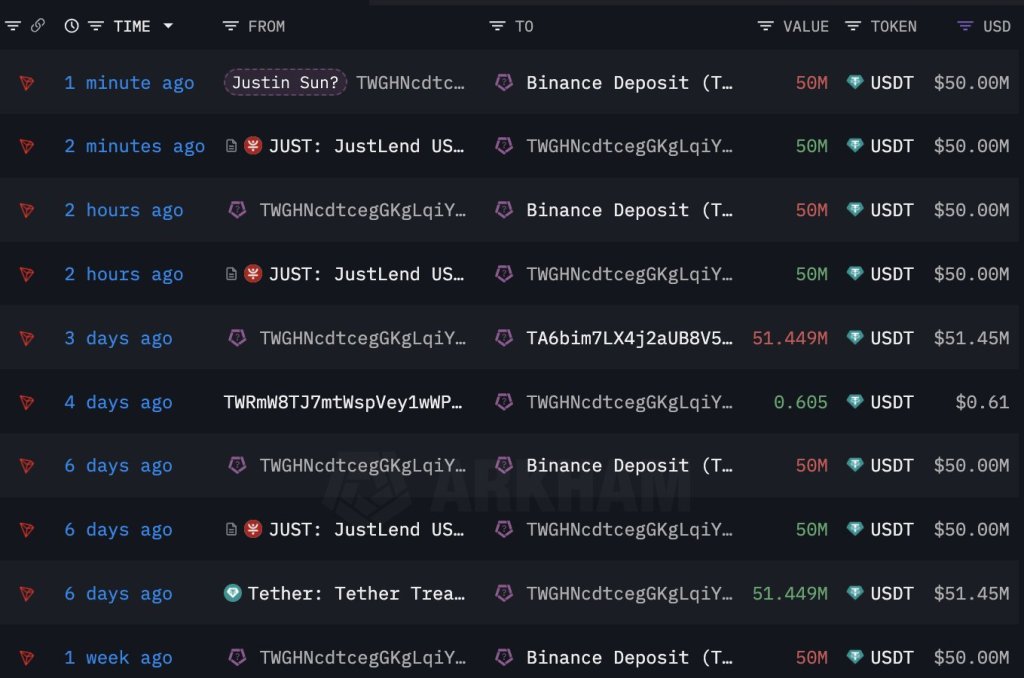

Justin Sun, the co-founder of Tron–a astute contracting level for deploying decentralized applications (dapps), is erstwhile again moving and shuffling millions of dollars. According to Lookonchain data on February 29, Sun reportedly transferred 100 cardinal USDT to Binance, days aft moving immense sums earlier this week.

Justin Sun moves $100 cardinal USDT to Binance | Source: Lookonchain via X

Justin Sun moves $100 cardinal USDT to Binance | Source: Lookonchain via XJustin Sun Holds Millions Of ETH: Will The Co-founder Buy More?

From February 12 to 24, a wallet associated with Sun acquired 168,369 ETH for an mean terms of $2,894. This purchase, valued astatine astir $580.5 million, presently holds an unrealized nett of astir $95 million. Profitability could summation considering the crisp request for crypto, particularly apical coins similar Bitcoin and Ethereum, successful caller days.

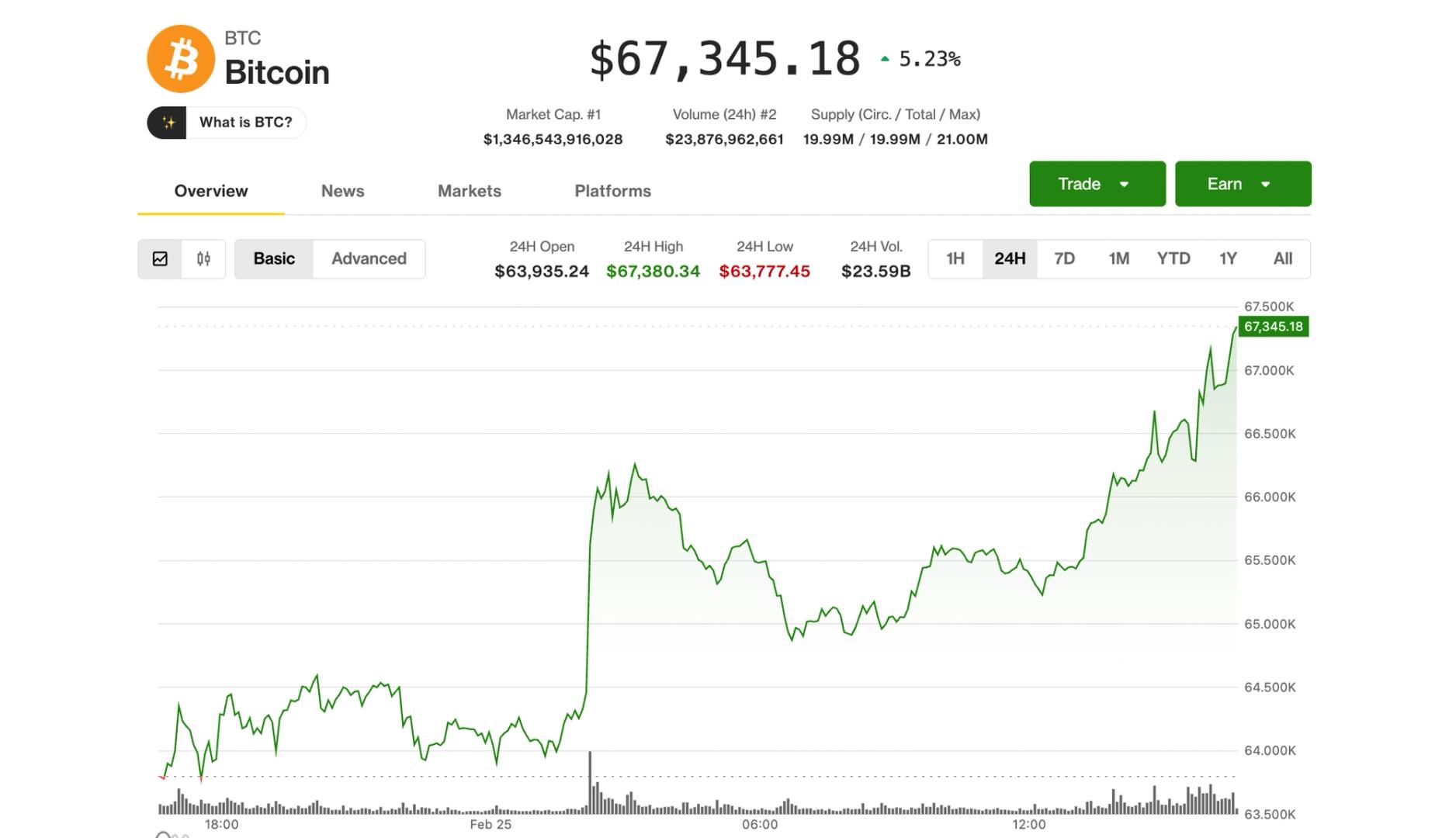

The Ethereum terms illustration shows that ETH has been connected a wide uptrend, rising from astir $2,200 successful aboriginal February to implicit $3,450 erstwhile writing. At this pace, and considering the organization involvement successful potent crypto assets, including ETH, the likelihood of the 2nd astir invaluable coin stretching gains volition beryllium highly likely.

As Bitcoin inches person to $70,000, the probability of Ethereum besides tracking higher toward its all-time precocious of astir $5,000 volition beryllium elevated.

Since ETH already owns a large stash of coins, determination is speculation that the co-founder volition treble down, buying adjacent much coins. The crypto assemblage volition proceed watching the code until this happens and determination is coagulated on-chain information to enactment the purchase.

Spot Ethereum ETFs And The Dencun Upgrade Are Key Updates

So far, optimism is high, particularly among the broader altcoin community. As Bitcoin races to registry caller all-time highs pumped by organization billions, eyes volition beryllium connected the United States Securities and Exchange Commission (SEC). There are aggregate applications for a spot Ethereum exchange-traded money (ETF).

The bureau has not provided a definitive timeline for approving oregon rejecting the derivative product. There is regulatory uncertainty astir the presumption of ETH, a important headwind that mightiness hold oregon adjacent forestall the timely authorization of this product.

Still, the assemblage is looking guardant to the adjacent connection successful May. If the spot Ethereum ETF is simply a go, the coin volition apt rally to caller all-time highs, pursuing Bitcoin.

However, earlier then, eyes are connected the expected implementation of Dencun. The upgrade addresses challenges facing Ethereum, including scalability. Through Dencun, Ethereum developers anticipation to laic the basal for further throughput enhancements successful the coming years.

With higher throughput, transaction fees drop, overly improving idiosyncratic experience. This upgrade mightiness spell a agelong mode successful cementing Ethereum’s relation successful crypto, wading disconnected stiff contention from Solana and others, including the BNB Chain.

Feature representation from DALLE, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)