One of the astir communal ways to gain output successful DeFi is by providing liquidity successful decentralized exchanges. While for caller investors this whitethorn look initially arsenic a straightforward process to gain returns, providing liquidity successfully has much intricacies that 1 should beryllium alert of. There are definite indicators that tin assistance to marque much informed decisions astir which pools are the astir convenient to supply liquidity.

First, it is cardinal to recognize wherever yields are coming from. Trading fees are paid by traders that usage these liquidity pools arsenic a work to transact betwixt the underlying 2 coins. Most pools person yields that are sourced exclusively from these fees. But the root of output tin besides travel from liquidity mining programs, wherever definite tokens are issued arsenic a reward to those that supply liquidity successful definite pools. These tokens are issued by protocols that person an involvement successful a excavation maintaining a just magnitude of liquidity to accommodate trades and damp volatility connected the terms of the token. This mode they periodically wage liquidity providers a fixed magnitude of coins for providing liquidity. These incentivized pools are usually labeled arsenic ‘farms’.

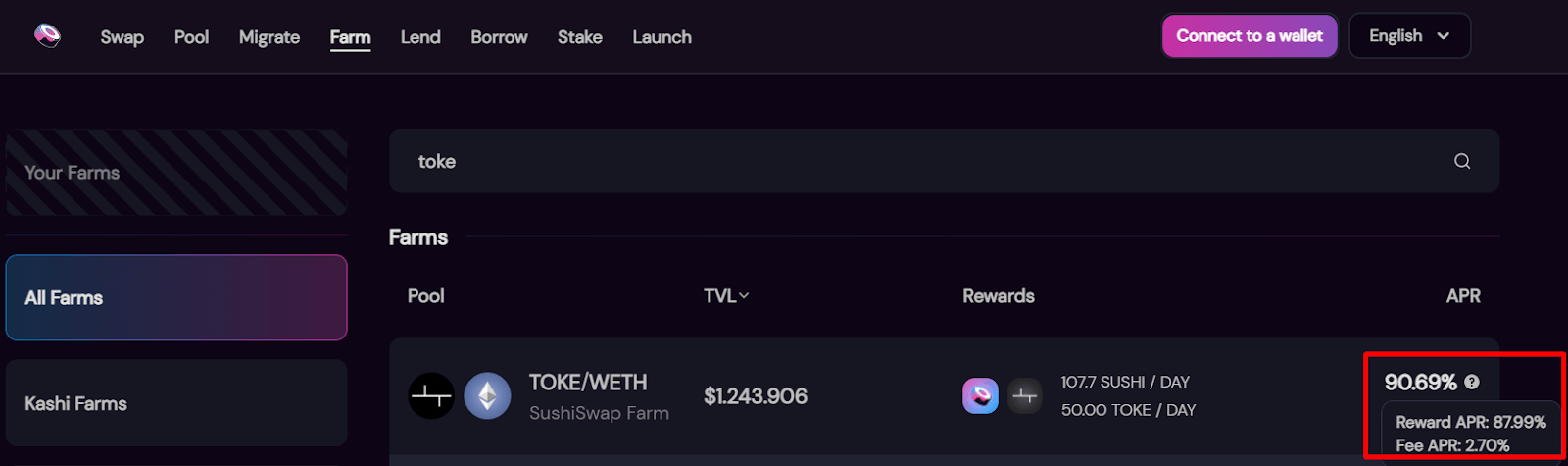

A doubly incentivized workplace from SushiSwap

A doubly incentivized workplace from SushiSwapIn this screenshot, it tin beryllium seen that this TOKE/WETH excavation is incentivized by Sushiswap and Tokemak protocol by rewarding a definite magnitude of tokens periodically. The full yearly percent instrumentality (90.69%) is composed mostly from liquidity mining rewards (87.99%), since the fees generated by traded measurement betwixt these 2 coins would accrue for a instrumentality of conscionable 2.70%.

Monitoring liquidity provided

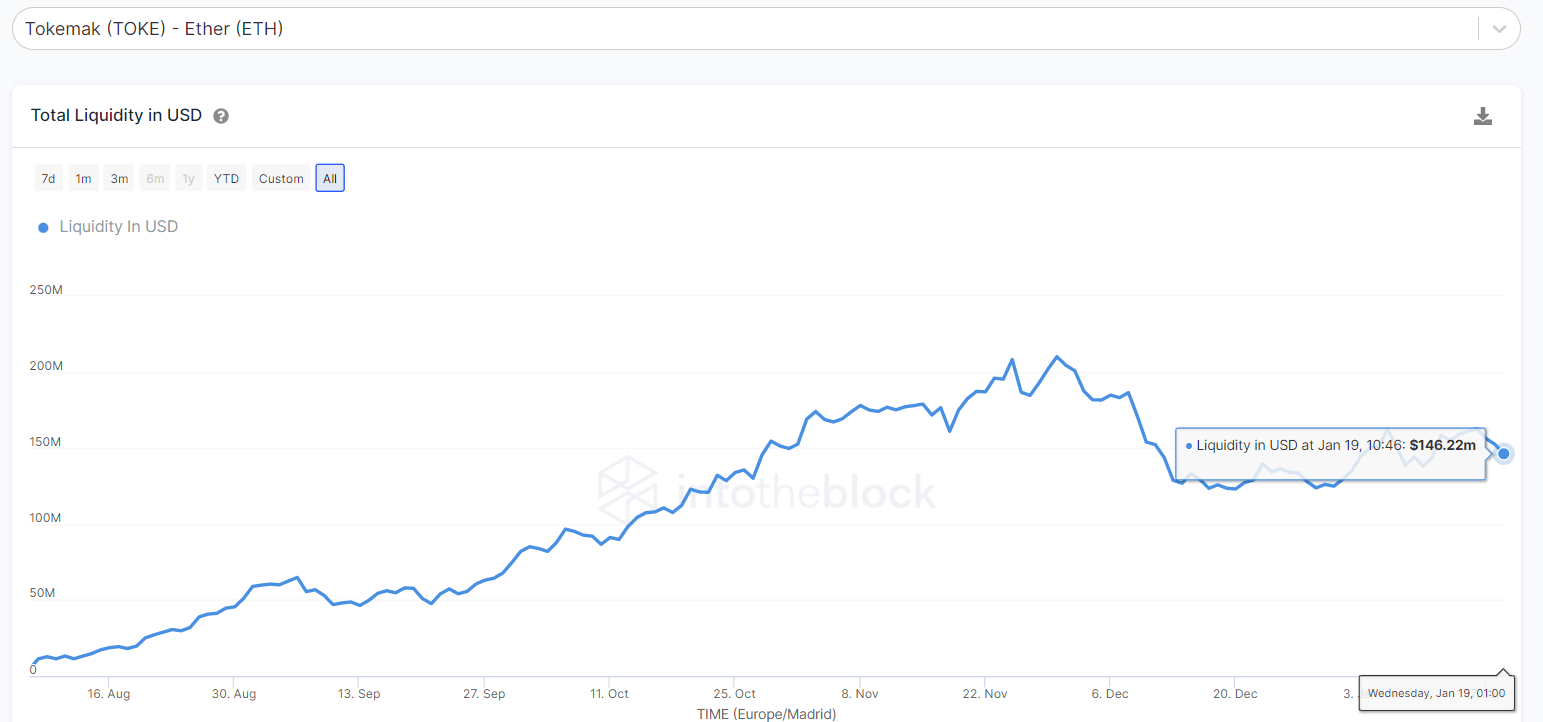

The full magnitude of liquidity disposable successful a excavation is simply a sum of the full worth of each of the 2 tokens locked successful a pool. An summation implicit clip of the liquidity successful a excavation is simply a motion that the excavation is rewarding distinctively and superior is flowing into it. Liquidity ever follows yields. Thus, a sustained alteration of liquidity implicit clip could awesome that the yields offered successful that excavation are not truthful incentivizing anymore.

Furthermore, it could awesome that traders abruptly person a bearish position of the terms enactment of the underlying coin and fearfulness a terms driblet that could effect successful them holding the bulk of the underperforming coin (this is impermanent loss, but much astir this volition beryllium covered later).

Historical liquidity of the TOKE-ETH brace connected Sushiswap, according to IntoTheBlock analytics

Historical liquidity of the TOKE-ETH brace connected Sushiswap, according to IntoTheBlock analyticsBut determination is simply a trade-off. An summation of liquidity means that the speech fees (and coin rewards successful the lawsuit of a farm) accrued by the excavation person to beryllium distributed among much investors that provided liquidity. This means that the expected instrumentality mightiness alteration for each of the liquidity providers. Overall, liquidity that is not consistently decreasing tends to beryllium a bully indicator of the wellness of the pool.

Review the output provided

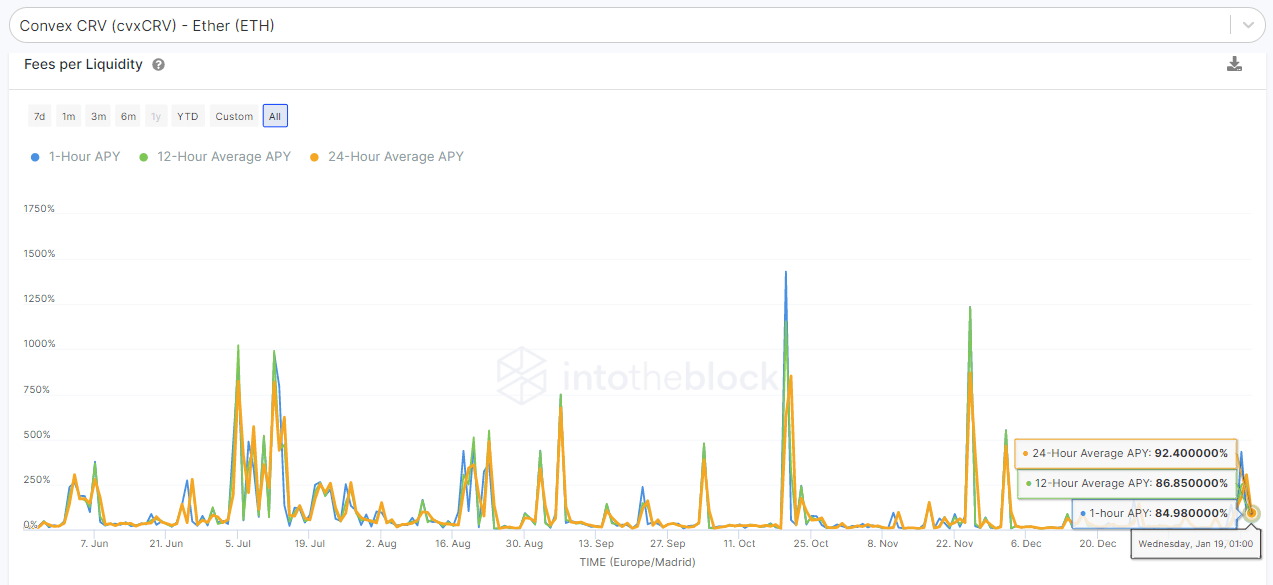

As seen connected the Sushiswap workplace example, non-incentivized pools that conscionable trust connected fees arsenic rewards thin to instrumentality debased yields. But that is not ever the lawsuit and present is an illustration of a excavation wherever it tin perchance beryllium precise profitable to supply liquidity. The operation of a precocious trading measurement and a comparatively choky liquidity tin amplify the yields of liquidity providers.

Avg. yearly instrumentality of CVXCRV/ETH excavation according to IntotheBlock Analytics

Avg. yearly instrumentality of CVXCRV/ETH excavation according to IntotheBlock AnalyticsThe APY calculated successful this indicator is based conscionable connected trading fees; liquidity mining rewards are heavy adaptable per excavation and are not included successful this calculation. These fees earned are wholly babelike connected the measurement traded connected each pool, truthful it pays disconnected to beryllium monitoring it arsenic good and checking if it does not consistently alteration implicit time. Remember, output from trading fees is proportional to the measurement traded but inversely proportional to liquidity provided.

Checking impermanent loss

Due to however an automatic marketplace shaper works, providing liquidity makes consciousness mostly erstwhile determination is simply a affirmative anticipation of the underlying terms enactment of the coin. For example, if a excavation is composed of TKN and ETH, and the position of the trader is that TKN volition alteration successful worth comparative to ETH, it would not marque consciousness to supply liquidity due to the fact that a liquidity supplier would extremity up accumulating the worst performing coin (TKN) and losing connected the champion performer (ETH). owed to the changeless rebalancing of the pool

That thought tin beryllium enactment successful position erstwhile providing liquidity with pools that incorporate assets that are successful the involvement of being accumulated implicit clip by the liquidity provider. Maybe the store of worth communicative and the thought of appreciation successful the agelong word means that the terms enactment of the coins is thing comparatively negligible. The champion illustration would beryllium a WBTC-ETH pool. A liquidity supplier that conscionable wants to accumulate arsenic overmuch BTC and ETH arsenic imaginable would find it perfect, since it would beryllium lone accumulating a sum of some coins by providing liquidity.

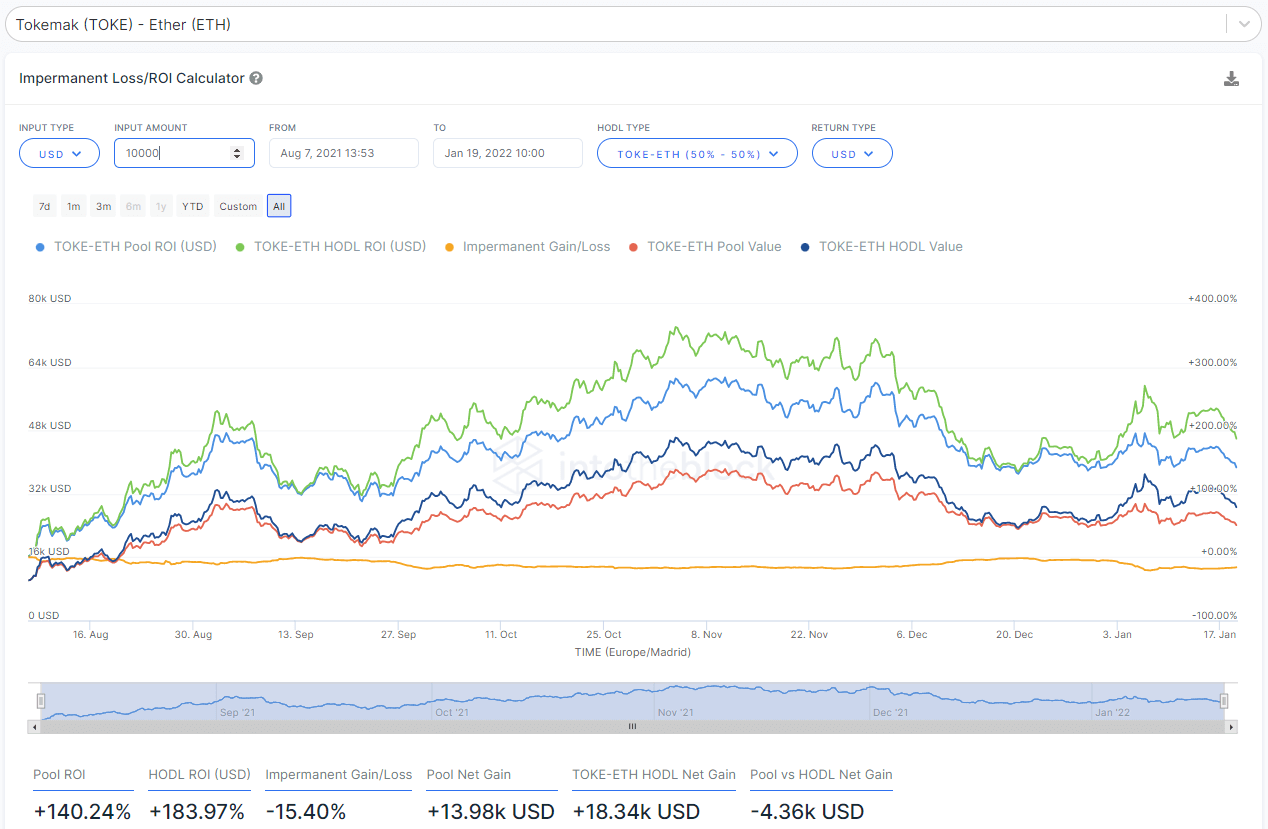

An impermanent nonaccomplishment calculator by IntotheBlock analytics

An impermanent nonaccomplishment calculator by IntotheBlock analyticsBut erstwhile determination is simply a affirmative presumption connected the aboriginal terms of a coin determination tin beryllium times erstwhile providing liquidity to a excavation becomes little profitable than conscionable holding some coins separately. This is owed to the terms divergence that happens betwixt these 2 coins. Coins that are correlated successful terms person little impermanent nonaccomplishment risk, oregon adjacent nary impermanent nonaccomplishment astatine each if some coins person the aforesaid terms (like a USDC-DAI pool).

In the illustration below, providing liquidity to the TOKE-ETH excavation would person gained 140% successful USD presumption since it was launched (not considering farming rewards, conscionable trading fees and terms appreciation). Holding some coins would person outperformed providing liquidity by 15% more. This impermanent nonaccomplishment is mitigated by the farming rewards seen before, accounting for 90% APR (without compounding) if some rewards and impermanent nonaccomplishment stay akin implicit time.

As a bully regularisation of thumb for remembering impermanent nonaccomplishment equivalents, is that a alteration betwixt prices of 2 times (for illustration a TKN-ETH excavation wherever TKN doubles successful terms respective to ETH) is equivalent to a 5.7% loss. A alteration successful terms of 5 times would effect successful a 25.5% nonaccomplishment portion a 10 times alteration would beryllium a 42.5% loss.

For caller DeFi users, Understanding these dynamics afloat tin beryllium intimidating and it tin necessitate providing liquidity to pools respective times to get utilized to the mechanics arsenic good arsenic continuously monitoring returns and replicating the calculations. Using these indicators tin assistance to find pools that maximize output and minimize risk.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)