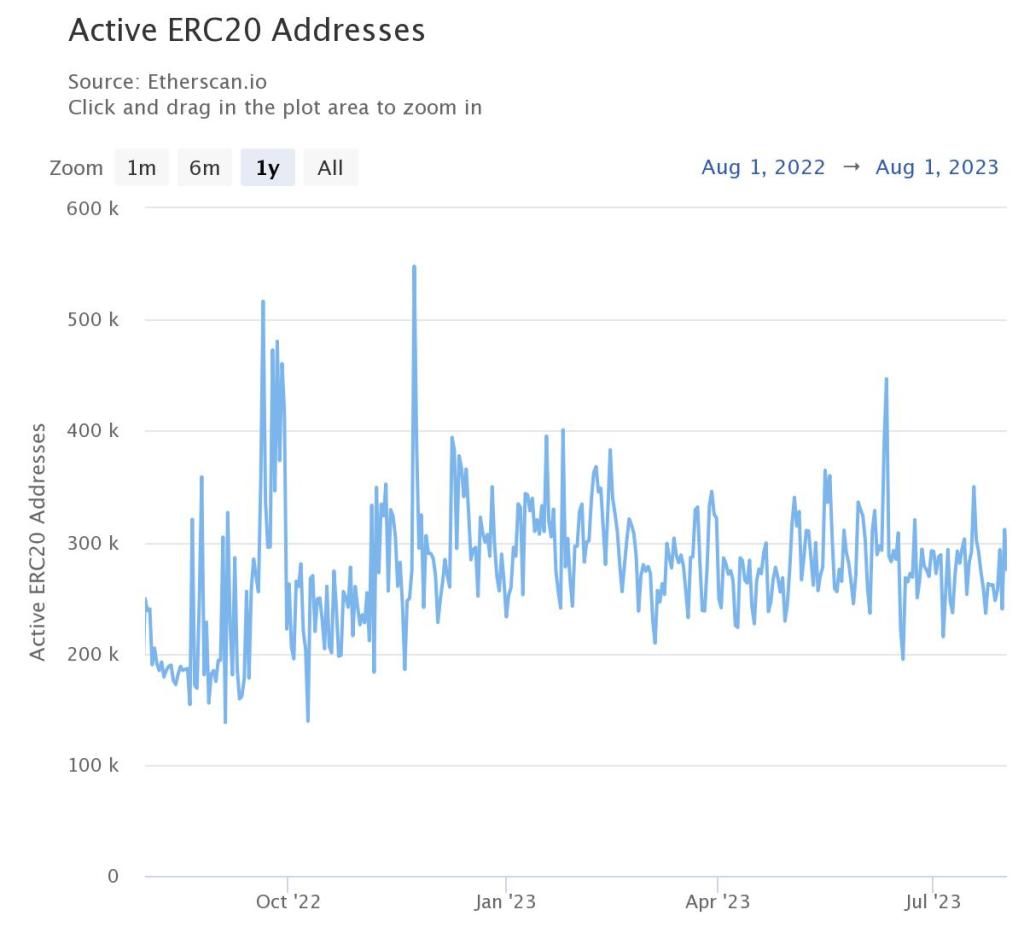

According to Etherscan data, the fig of progressive ERC-20 addresses has not changed overmuch successful 2023. It has stayed betwixt 200,000 and 300,000 portion Ethereum prices stagnate beneath July 2023 highs. As of August 2, determination were astir 275,000 progressive ERC-20 addresses, up from 156,000 connected June 18. Although enactment has been debased overall, determination was a important summation connected June 11, with implicit 446,000 progressive ERC-20 addresses.

Active ERC-20 Addresses: Etherscan

Active ERC-20 Addresses: EtherscanEthereum’s terms trajectory has been tumultuous successful tandem with this enactment pattern, looking astatine the charts. For instance, Ethereum bulls person failed to breach the $2,100 liquidation level posted successful the second stages of H1 2023.

Ethereum Prices Volatile, Few Coins Burned

At the moment, ETH prices hover astir the $1,800 range, teetering precariously and apt to drop, looking astatine candlestick arrangements successful the regular chart. Although Ethereum has been bullish successful the past 2 months, bulls person been tamed, and a driblet beneath the $1,800 level whitethorn awesome a displacement from bullish to bearish successful the mean term.

With ETH nether pressure, the fig of progressive ERC-20 addresses remains changeless and comparatively little than the 2021 peaks. This means determination is little request for ETH, which is utilized to wage transaction fees. As a result, state fees are little due to the fact that determination is little contention for artifact space. Typically, this would promote much radical to enactment and adjacent deploy analyzable contracts successful decentralized concern (DeFi).

With EIP-1559 in the equation, debased enactment means less coins are taken retired of circulation. Despite debased web activity, the protocol continues to contented 2 ETH aft each validated block, watering down deflationary effects enforced by EIP-1559.

DeFi Activities Falling

Falling enactment could beryllium attributed to the waning involvement successful decentralized concern (DeFi) activities implicit caller months. As of August 2, the full worth locked (TVL) remains below $50 billion, with a important information of assets tied successful Ethereum. DeFi projects similar LidoDAO, Curve, and Uniswap facilitate the trading of ERC-20 tokens.

Furthermore, on-chain data highlights USDT arsenic the astir actively transacted token. Given its presumption arsenic the third-largest coin by marketplace cap, with important circulation successful Ethereum and Tron networks, specified a inclination is expected.

Looking backmost astatine ERC-20 transactions from June and July, it is evident that transfers stayed changeless contempt impermanent terms increases. Ethereum prices roseate from $1,630 to $2,000 betwixt mid-June and mid-July 2023, but ETH is present lower.

On-chain ERC-20 enactment has remained unchangeable contempt terms volatility. It’s unclear whether determination volition beryllium a alteration successful enactment arsenic prices proceed to drop. However, little prices whitethorn unit token holders to hold and see, starring to little activity.

Feature representation from Canva, illustration from TradingView

2 years ago

2 years ago

English (US)

English (US)