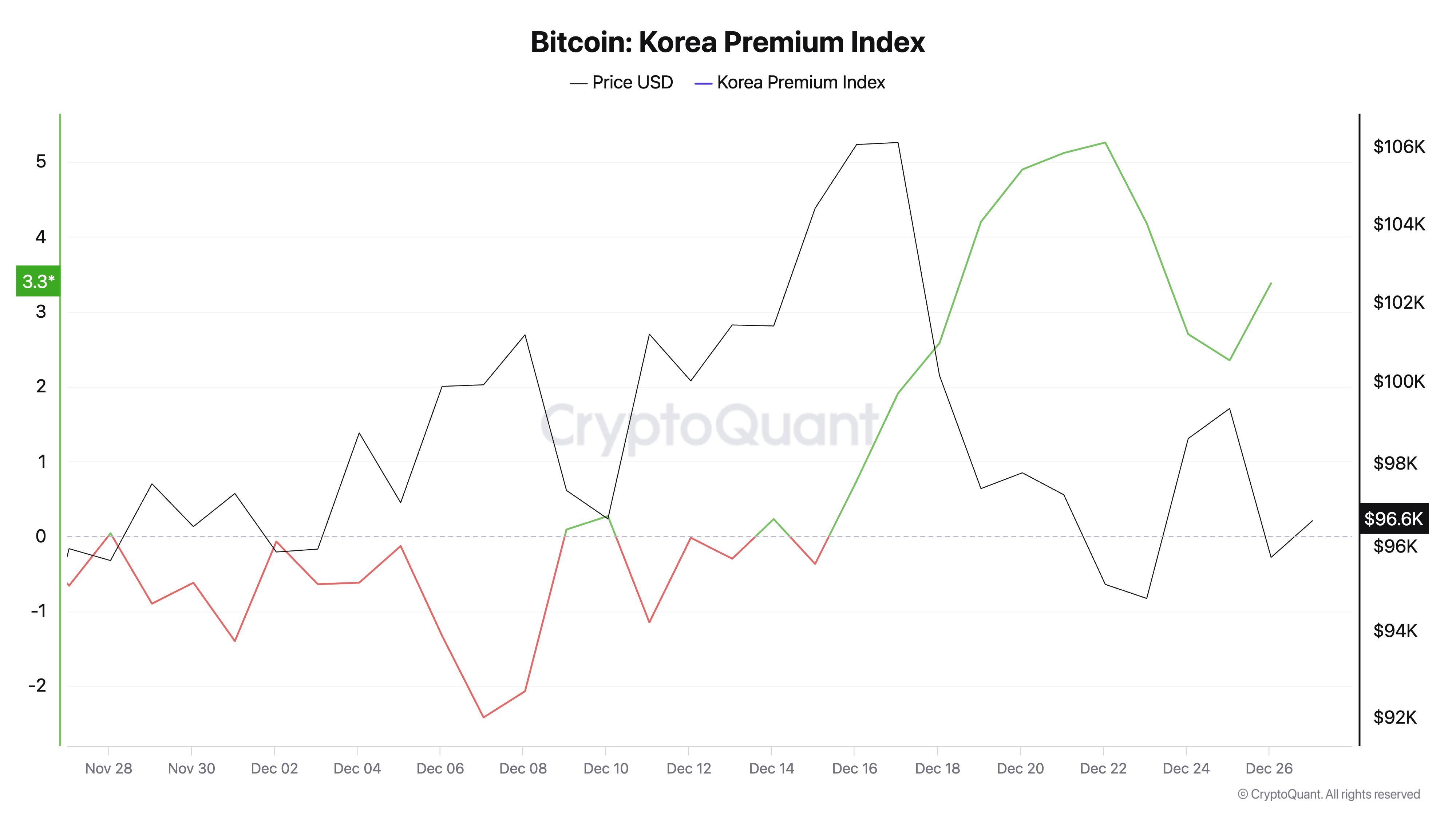

The Kimchi premium has seen a definite rebound aft Christmas, recovering to 3.83% connected Dec. 27. While this is inactive importantly little than the 5.26% recorded connected Dec. 22, it inactive represents a important quality successful Bitcoin prices betwixt South Korea and planetary markets.

Chart showing the terms spread betwixt South Korean and planetary exchanges from Nov. 27 to Dec. 27, 2024 (Source: CryptoQuant)

Chart showing the terms spread betwixt South Korean and planetary exchanges from Nov. 27 to Dec. 27, 2024 (Source: CryptoQuant)The existent rebound comes amidst governmental and economical turmoil successful South Korea, marked by the impeachment of the acting president, Han Duck-soo. This impeachment comes conscionable 2 weeks aft parliament voted to impeach its President Yoon Suk Yeol.

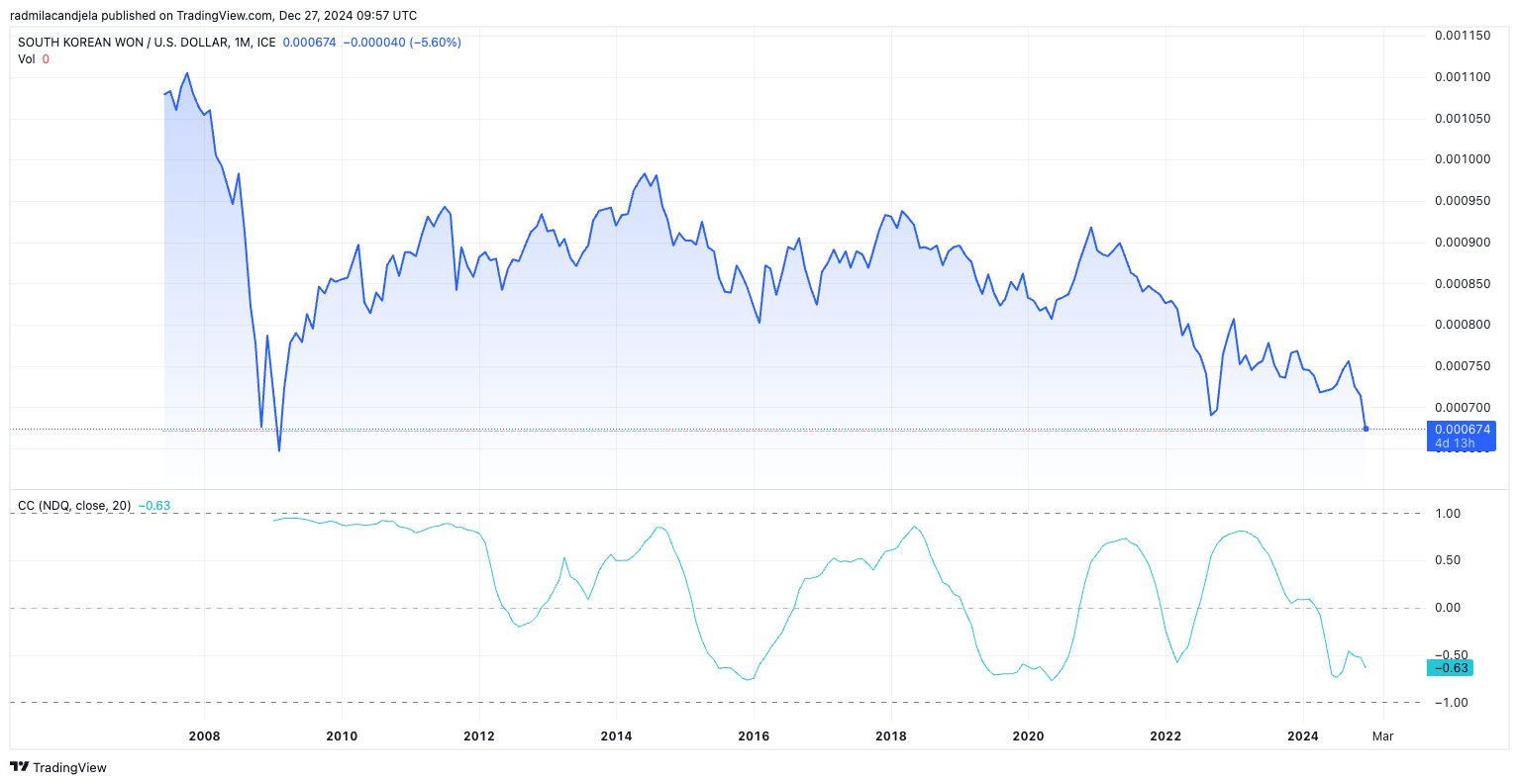

The ongoing governmental situation created fears of economical instability, prompting heightened request for Bitcoin. As section investors sought refuge successful Bitcoin, the accrued request drove home prices higher than planetary averages. The ongoing devaluation of the Korean won, which reached its lowest level against the dollar since February 2009, further fueled the emergence successful the premium.

Chart showing the show of KRWUSD from December 2007 to December 2024 (Source: TradingView)

Chart showing the show of KRWUSD from December 2007 to December 2024 (Source: TradingView)The kimchi premium has been peculiarly volatile successful the 2nd fractional of 2024. Late November and aboriginal December saw a important decline, with the premium turning negative. Several factors led to this decline, the main 1 being governmental instability successful the country. On Dec. 3, President Yoon Suk Yeol declared helium was imposing martial law, citing the request to support the state from governmental opposition. Shortly after, Yoon and officials from his authorities were arrested and indicted connected allegations of insurrection, portion Yoon is facing an impeachment trial.

The governmental unrest led to fears of regulatory tightening by South Korean authorities. Stricter measures connected crypto exchanges purpose to trim speculative trading, which weakens section request for Bitcoin. Additionally, planetary arbitrage enactment played a relation successful narrowing the premium. As planetary traders exploited the terms difference, Bitcoin inflows into South Korea increased, balancing proviso and demand. Market sentiment besides shifted during this period, with South Korean traders stepping backmost from speculative enactment arsenic planetary Bitcoin prices consolidated.

Despite these changes, the won continued to weaken against the dollar. Given that the devaluation didn’t instantly trigger an summation successful the kimchi premium, we tin safely accidental that section marketplace conditions astatine the clip were much influenced by regulatory and governmental factors.

By mid-December, the kimchi premium saw a crisp resurgence. This resurgence occurred against the backdrop of much governmental instability erstwhile the country’s acting president besides faced impeachment. However, this time, fears of economical turmoil and imaginable superior controls led investors to crook to Bitcoin arsenic a hedge, expanding section demand.

The speculative behaviour often accompanying periods of uncertainty besides intensified, further inflating Bitcoin prices successful South Korea comparative to planetary markets. Meanwhile, the continued depreciation of the won added to the attractiveness of Bitcoin arsenic a store of value, contributing to the upward trajectory of the premium. The operation of these factors created a cleanable storm, starring to a betterment of the premium.

The interaction of the kimchi premium isn’t constricted to South Korea. When the premium is high, it creates arbitrage opportunities for traders to determination Bitcoin into South Korea, which increases cross-border superior flows. This arbitrage enactment often results successful short-term volatility arsenic markets adjust. Additionally, a precocious premium tin distort planetary Bitcoin terms signals, arsenic South Korea often represents a important stock of trading volume. Rising premiums besides thin to pull regulatory scrutiny, arsenic authorities purpose to curb speculative trading and support retail investors from imaginable risks.

On the affirmative side, the premium has historically confirmed Bitcoin’s relation arsenic a hedge against economical and governmental instability. The kimchi premium has traditionally been a barometer for South Korean marketplace sentiment and macroeconomic conditions. During speculative booms, specified arsenic successful precocious 2017 and aboriginal 2021, the premium reached double-digit levels, driven by a frenzy of retail demand. In contrast, periods of antagonistic premium, similar mid-2024, reflected tighter regulations and diminished speculative interest. The caller emergence mirrors these humanities patterns but is rooted successful unsocial circumstances, including a governmental situation and important currency devaluation.

The station Kimchi premium recovers arsenic KRWUSD drops to 15-year low appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)