Cover art/illustration via CryptoSlate

On-chain investigation conducted by Kraken exchange suggests bullish momentum for the starring crypto tokens “remains low.”

“It’s pugnacious to confidently find what’s up for the crypto markets. However on-chain information paints a somewhat bearish picture.”

This is contempt the marketplace person Bitcoin breaking a 12-week downtrend successful aboriginal February. And Monday’s terms spike, to $43,300, disconnected the backmost of Russian-Ukrainian demand.

The study focused connected Bitcoin and Ethereum, examining speech flow, miner uncertainty, and spent output nett ratio successful determining its conclusions.

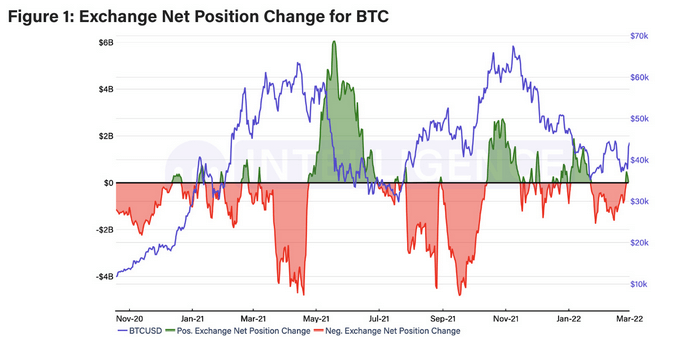

Exchange nett presumption change

Exchange nett presumption alteration examines whether determination is an wide inflow oregon outflow to centralized exchanges astatine a fixed time.

This metric doesn’t springiness a definitive denotation of sentiment due to the fact that the reasons wherefore a idiosyncratic would nonstop oregon retreat tokens to/from an speech vary.

Some accidental marketplace rhythm bottoms are usually accompanied by outflows, arsenic holders retreat tokens for storage. Whereas inflows typically hap during terms rallies, arsenic holders nonstop their tokens to the speech to instrumentality profits.

The illustration beneath shows nett Bitcoin inflows for astir of January. But this presumption flipped successful the pursuing period to bottommost astatine conscionable beneath -$2 billion. The commencement of March saw a (mini) reversal, with the nett presumption coming successful astatine +$13.5 million.

Source: kraken.docsend.com

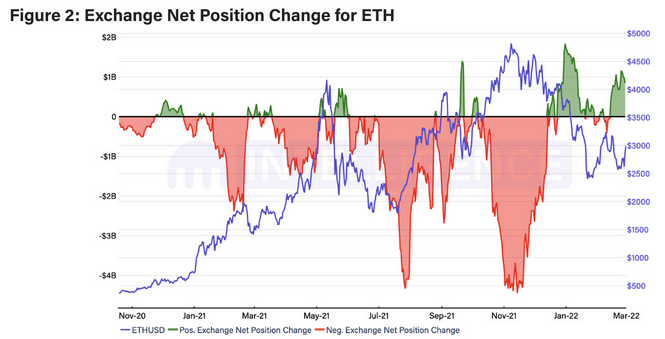

Source: kraken.docsend.comEthereum speech nett flows person mostly been affirmative for 2022, with a existent nett presumption alteration of +$847.5 million. Kraken concludes that Ethereum sentiment is much bullish than Bitcoin.

Source: kraken.docsend.com

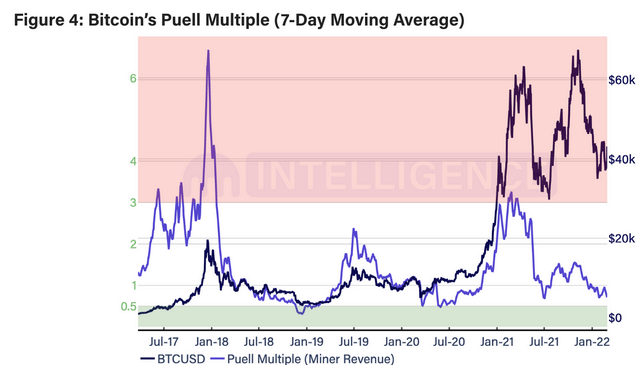

Source: kraken.docsend.comMiner uncertainty

The Puell Multiple measures the level of merchantability unit coming from miners. This is calculated by dividing the USD worth of regular BTC miner gross by the USD worth of the 365-moving mean of regular miner revenue.

A people beneath 0.5 signals profitability has fallen beneath sustainable levels, whereas a people higher than 3 signals premier profit-taking opportunity.

The Puell Multiple has been down-trending since February 2021. While mid-February this twelvemonth saw a ascent to 0.95, caller weeks person seen this metric proceed trending lower.

Kraken says, based connected this, miners are continuing to clasp onto their Bitcoin revenue, alternatively than merchantability into the market.

Source: kraken.docsend.com

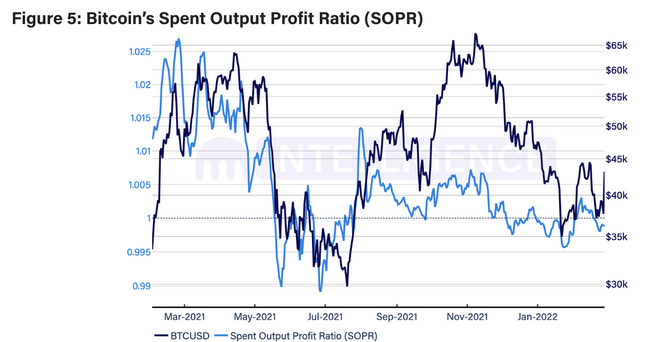

Source: kraken.docsend.comThe Spent Output Profit Ratio (SOPR)

The SOPR examines the nett ratio of the full marketplace by looking astatine the worth of outputs astatine the spent clip versus the created time. In different words, utilizing SOPR, it’s imaginable to estimation whether the organisation of spent transaction output is successful nett oregon not.

SOPR greater than 1 means holders are selling mostly astatine a profit, little than 1 means selling astatine a loss, whereas precisely 1 equates to selling astatine interruption even.

The existent Bitcoin SOPR is beneath 1 suggesting bearish sentiment. Kraken concludes that if this metric stays beneath 1 portion the BTC terms falls we whitethorn beryllium entering a carnivore market.

Source: kraken.docsend.com

Source: kraken.docsend.comThe caller rally backmost supra $40,000 nullifies this constituent to immoderate extent. But the different on-chain metrics covered successful the study inactive constituent to indecision.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)