The marketplace has been gearing up for volatility earlier the motorboat of spot ETH ETFs successful the US today. While ETH’s terms enactment has been comparatively uninteresting successful the past fewer weeks, it seems that ample holders are expecting terms swings and are rushing to currency out.

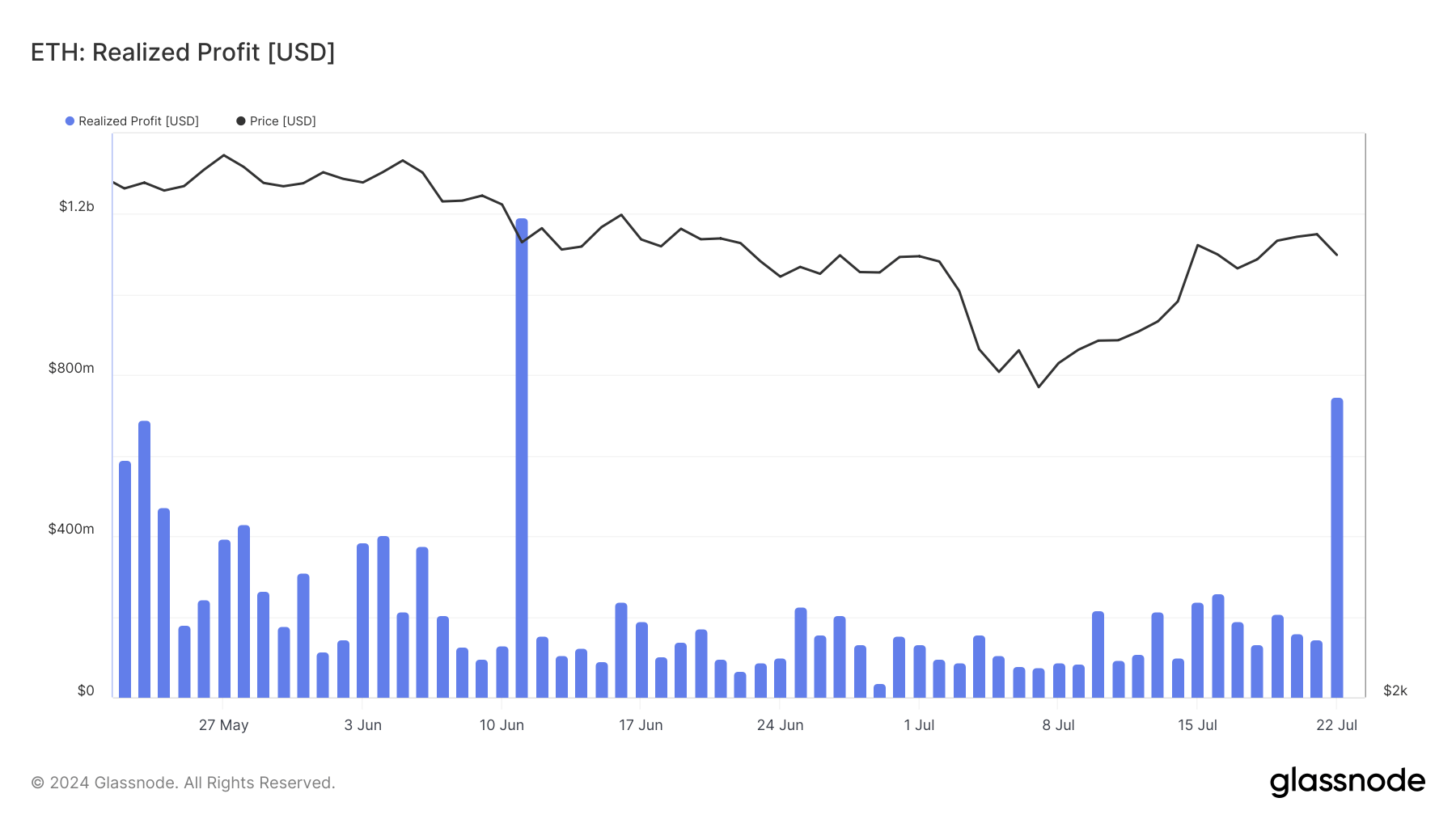

Glassnode’s information connected realized nett for Ethereum holders shows a melodramatic summation from $144.598 cardinal connected July 21 to $747.311 cardinal connected July 22. This is simply a important spike and the highest realized nett successful implicit 40 days.

Graph showing the realized nett for Ethereum holders from May 22 to July 22, 2024 (Source: Glassnode)

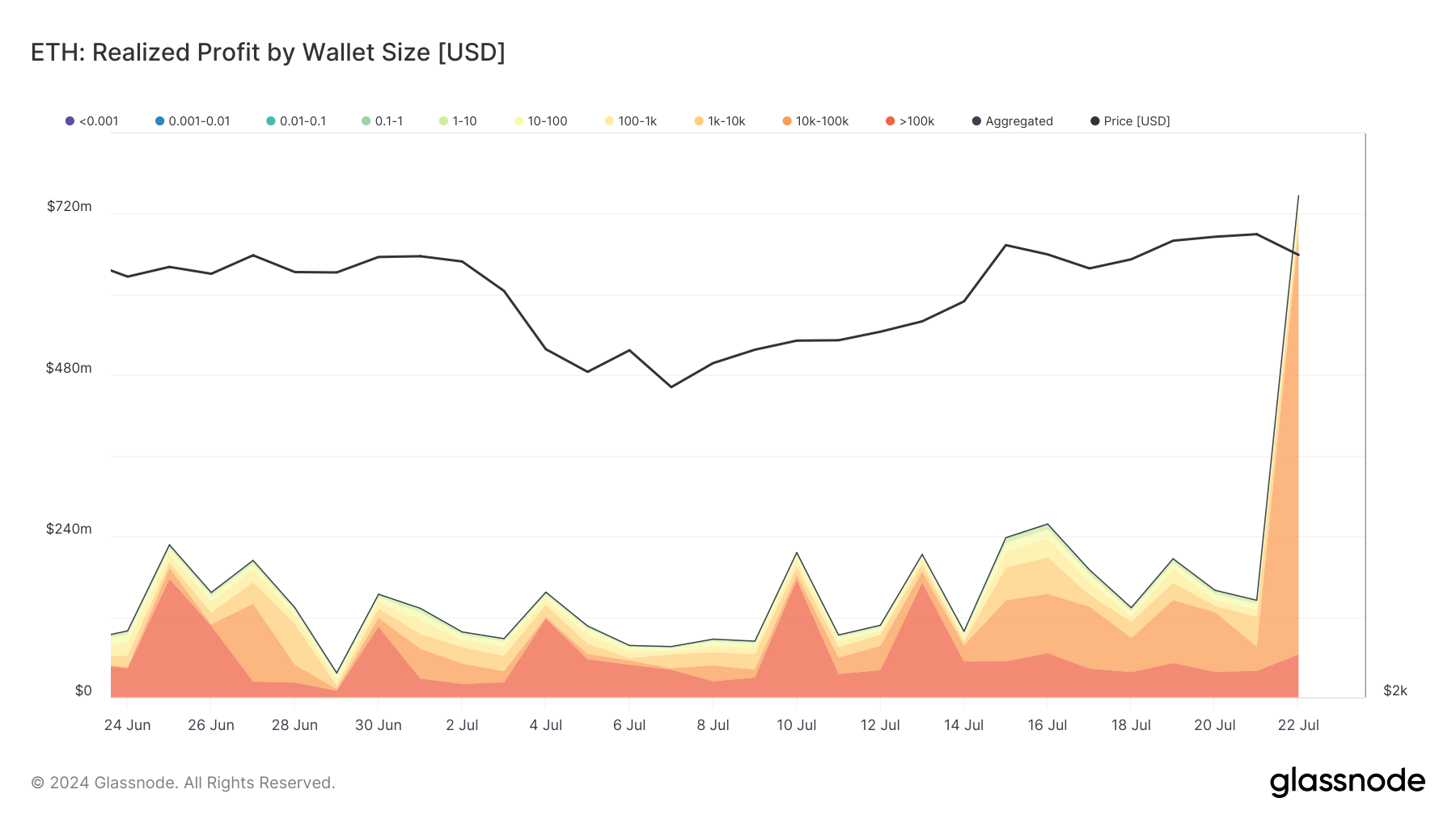

Graph showing the realized nett for Ethereum holders from May 22 to July 22, 2024 (Source: Glassnode)Such a precocious spike warrants a elaborate introspection of wallet sizes and holding periods progressive successful the sell-off. Data shows that wallets holding betwixt 10,000 and 100,000 ETH realized $626.982 cardinal successful profits connected July 22, up from $35.744 cardinal the erstwhile day. This indicates that ample holders, astir apt organization players oregon high-net-worth individuals, are cashing retired up of the ETF launch.

Graph showing the realized nett for Ethereum holders by wallet size from June 24 to July 22, 2024 (Source: Glassnode)

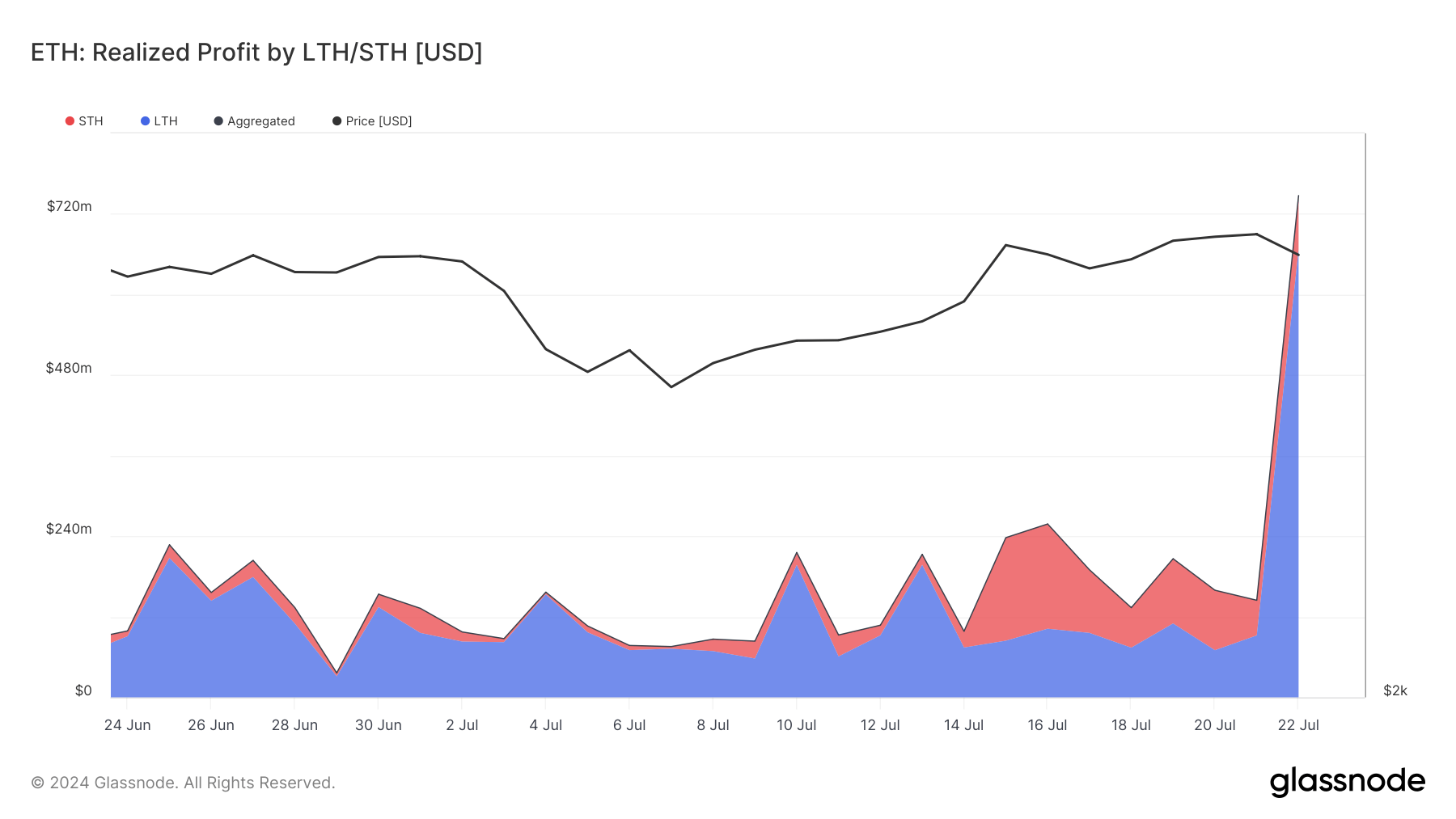

Graph showing the realized nett for Ethereum holders by wallet size from June 24 to July 22, 2024 (Source: Glassnode)Additionally, semipermanent holders were chiefly liable for the important summation successful realized profits. Profits from wallets holding ETH for implicit a twelvemonth surged from $92.751 cardinal to $666.227 million. This behaviour aligns with a strategical determination to fastener successful gains earlier imaginable marketplace volatility associated with the ETF launch.

Graph showing the realized nett for Ethereum semipermanent (blue) and short-term holders (red) from June 24 to July 22, 2024 (Source: Glassnode)

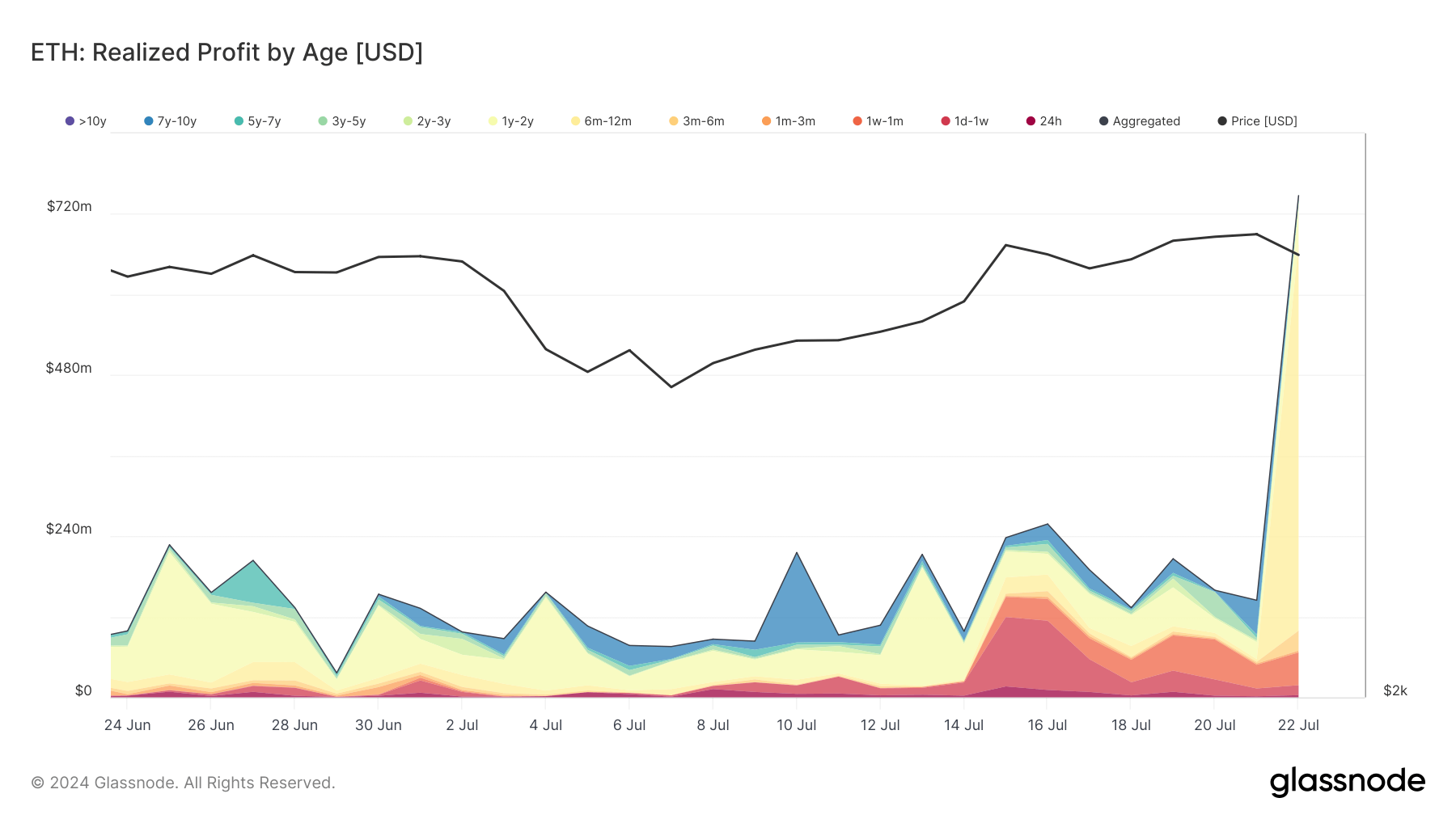

Graph showing the realized nett for Ethereum semipermanent (blue) and short-term holders (red) from June 24 to July 22, 2024 (Source: Glassnode)Analyzing realized profits by holding age, the astir important summation is seen successful the 6 to 12-month holding property category, with realized profits jumping to $577.677 cardinal from $3.964 million. This suggests that holders from mid-2023 are securing their profits.

Graph showing the realized nett for Ethereum holders based connected proviso property from June 24 to July 22, 2024 (Source: Glassnode)

Graph showing the realized nett for Ethereum holders based connected proviso property from June 24 to July 22, 2024 (Source: Glassnode)The spike successful realized profits highlights the market’s cautious attack to the anticipated changes with the advent of spot ETH ETFs. As trading heats up, we tin expect much realized profits successful the coming weeks. CryptoSlate antecedently reported that premarket trading of ETH ETFs has already generated significant interest, showing that the marketplace is positioning itself for each of the imaginable opportunities and risks associated with the caller ETFs.

It’s besides imaginable that ample and organization Ethereum holders are realizing profits and reinvesting them into ETH ETFs alternatively of holding spot ETH directly. For organization investors and high-net-worth individuals, ETFs’ regulatory oversight and transparency tin trim the risks associated with holding ETH directly. Another important payment is the simplified taxation reporting associated with ETFs. In galore jurisdictions, ETFs are treated much favorably for taxation purposes than holding the underlying assets directly. This tin construe into much businesslike taxation absorption for investors, particularly with ample plus measurement sets.

Liquidity is different captious factor. ETFs are traded connected accepted banal exchanges, which thin to connection amended liquidity and easier transaction settlement. For ample holders, the quality to rapidly liquidate ETH positions without importantly impacting the marketplace terms could beryllium a important advantage.

The station Large holders cashed retired up of Ethereum ETF launch appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)