By Omkar Godbole (All times ET unless indicated otherwise)

The sell-off successful the cryptocurrency marketplace deepened implicit the past 24 hours, with bitcoin (BTC) falling beneath $109,000 for the archetypal clip since July 9 and ether (ETH) posting a 13% correction from the grounds precocious of astir $4,950 it deed conscionable 2 days ago.

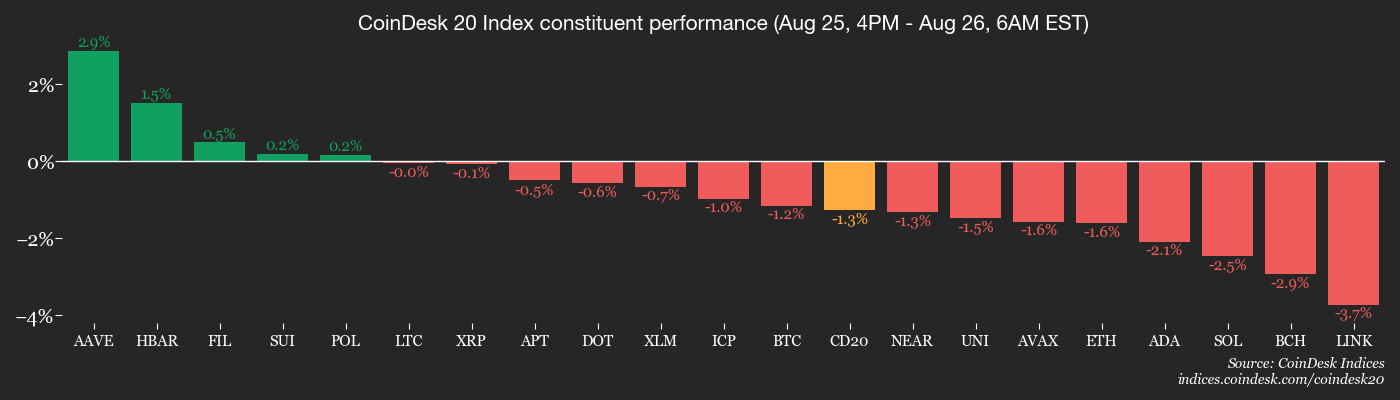

The CoinDesk 20 (CD20) and CoinDesk 80 (CD80) indices person dropped 2% and 3.3%, respectively, indicating larger losses successful the broader altcoin market.

The downside volatility toasted leveraged futures bets worthy implicit $900 million, with agelong positions accounting for the bulk of the tally.

The descent kicked disconnected connected Sunday, erstwhile a whale sold 25,000 BTC successful an illiquid market, sparking a flash crash. Several theories person been projected to explicate the whale's strategy, the astir salient being that they intentionally removed the bid wall — oregon artifact of bargain orders — assuming that institutions would bargain much done ETFs during the week, thereby lifting prices.

"This whale is showing america thing bigger, they cognize the ETF/sovereign bid is infinite. So the lone mode to triumph is to unit anemic hands to puke and past accumulate backmost into the structural wall," pseudonymous perceiver SightBringer said connected X.

According to MEXC Ventures, BTC is present astatine an inflexion point. It could participate a play of consolidation betwixt $110,000 and $120,000 oregon interruption little toward $105,000 to $100,000.

"The lack of a caller macro catalyst, specified arsenic a dovish Fed argumentation pivot, complaint cuts, oregon renewed inflows, is apt to thrust BTC into a play of marketplace consolidation arsenic the marketplace digests the caller distribution," MEXC's Investment Director Leo Zhao said successful an email.

Similarly, the statement remains bullish connected ether. However, the crisp diminution from Sunday's grounds suggests a sustained breakout to caller highs volition astir apt necessitate a important catalyst beyond conscionable firm treasury adoption.

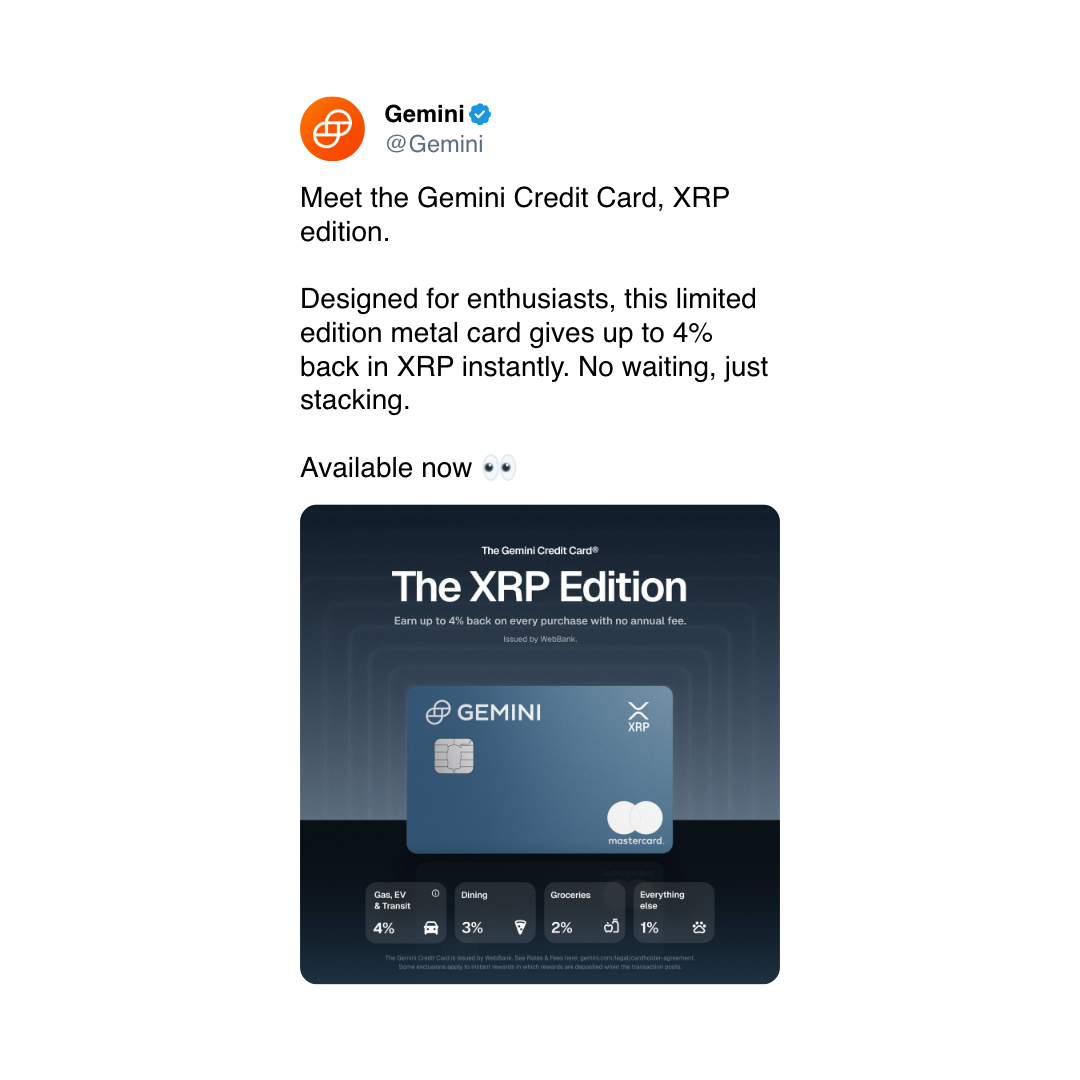

XRP, meanwhile, lacks a wide directional trend.

"With Bollinger Bands constricting and RSI sitting astatine a neutral 44, but bladed connected buying volume, the illustration is whispering of a imaginable retest of $2.60 to $2.00," Ryan Lee, the main expert astatine Bitget said. "A interruption supra the $3.10 level with condemnation and volume, and a tally toward $3.40 could follow. But derivative markets are skewed short, and upside stays guarded until momentum firms."

In accepted markets, the Treasury output curve, represented by the dispersed betwixt 10- and two-year yields and 30- and two-year yields, continues to steepen arsenic traders stake connected a September Fed complaint cut.

Meanwhile, longer-duration Japanese authorities enslaved yields are connected the verge of hitting caller multidecade highs, which could perchance inject volatility into planetary fiscal markets. Stay alert!

What to Watch

- Crypto

- Aug. 27, 3 a.m.: Mantle Network (MNT), an Ethereum layer-2 blockchain, volition rotation retired its mainnet upgrade to mentation 1.3.1, enabling enactment for Ethereum’s Prague update and introducing caller features for level users and developers.

- Macro

- Aug. 26, 8:30 a.m.: The U.S. Census Bureau releases July manufactured durable goods orders data.

- Durable Goods Orders MoM Est. -4% vs. Prev. -9.3%

- Durable Goods Orders Ex Defense MoM Prev. -9.4%

- Durable Goods Orders Ex Transportation MoM Est. 0.2% vs. Prev. 0.2%

- Aug. 26, 10 a.m.: The Conference Board (CB) releases August U.S. user assurance data.

- CB Consumer Confidence Est. 96.4 vs. Prev. 97.2

- Aug. 27: The U.S. volition enforce an further 25% tariff connected Indian imports related to Russian lipid purchases, raising full tariffs connected galore goods to astir 50%.

- Aug. 28, 8 a.m.: Mexico's National Institute of Statistics and Geography releases July unemployment complaint data.

- Unemployment Rate Est. 2.9% vs. Prev. 2.7%

- Aug. 28, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (2nd Estimate) Q2 GDP data.

- Core PCE Prices QoQ st. 2.6% vs. Prev. 3.5%

- GDP Growth Rate QoQ Est. 3.1% vs. Prev. -0.5%

- GDP Price Index QoQ Est. 2% vs. Prev. 3.8%

- GDP Sales QoQEst. 6.3% vs. Prev. -3.1%

- PCE Prices QoQ Est. 2.1% vs. Prev. 3.7%

- Real Consumer Spending QoQ Est. 1.4% vs. Prev. 0.5%

- Aug. 28, 1:30 p.m.: Uruguay's National Statistics Institute releases July unemployment complaint data.

- Unemployment Rate Prev. 7.3%

- Aug. 28, 6:00 p.m.: Fed Governor Christopher J. Waller volition talk connected “Payments” astatine the Economic Club of Miami Dinner, Miami, Fla. Watch live.

- Aug. 26, 8:30 a.m.: The U.S. Census Bureau releases July manufactured durable goods orders data.

- Earnings (Estimates based connected FactSet data)

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

- Aug. 28: IREN (IREN), post-market, $0.18

Token Events

- Governance votes & calls

- IOTA (IOTA) is voting connected whether to "go all-in IOTA infrastructure and maturation with Tangle DAO." Voting closes Aug. 26.

- IoTeX (IOTX) is voting connected whether to introduce slashing for underperforming IoTeX delegates. Voting closes Aug. 26.

- Aug. 26: Zebec Network (ZBCN) to big ask maine thing with World Mobile astatine 10 a.m.

- Aug. 26: Solana (SOL) to host Solana Live astatine 4.30 p.m.

- Unlocks

- Aug. 28: Jupiter (JUP) to unlock 1.78% of its circulating proviso worthy $26.36 million.

- Sep. 1: Sui (SUI) to merchandise 1.25% of its circulating proviso worthy $153.1 million.

- Sep. 2: Ethena (ENA) to merchandise 0.64% of its circulating proviso worthy $25.64 million.

- Token Launches

- Aug. 26: Centrifuge (CFG) to database connected Bybit and Bitrue.

- Aug. 26: alt.town (TOWN) to database connected Gate.io and Bitget.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Aug. 26: WebX 2025 (Tokyo)

- Aug. 27: Blockchain Leaders Summit 2025 (Tokyo)

- Aug. 27-28: Stablecoin Conference 2025 (Mexico City)

- Aug. 28-29: Bitcoin Asia 2025 (Hong Kong)

Token Talk

By Shaurya Malwa

- Blue-chip NFT collections faced steep play losses arsenic ether (ETH) pulled backmost from grounds highs, wiping much than 10% disconnected the worth of astir apical projects.

- Pudgy Penguins, the starring postulation by trading volume, dropped 17% to a 10.32 ETH floor, showing that adjacent the sector’s strongest liquidity magnet couldn’t flight the downturn.

- Bored Ape Yacht Club (BAYC) mislaid 14.7% to 9.59 ETH, portion Doodles recorded 1 of the sharpest corrections, falling 18.9% to 0.73 ETH.

- Secondary projects besides slumped: Moonbirds fell 10.5%, and Lil Pudgys shed 14.6%, reflecting however terms unit cascaded crossed some flagship and derivative collections.

- CryptoPunks proved astir resilient, losing conscionable 1.35% implicit the week, underscoring its presumption arsenic the market’s antiaircraft benchmark erstwhile hazard appetite collapses.

- Despite little floors, trading enactment stayed high. Pudgy Penguins saw 2,112 ETH ($9.36 million) successful play volume, followed by Moonbirds (1,979 ETH), CryptoPunks (1,879 ETH), and BAYC (809 ETH).

- Overall NFT marketplace capitalization shrank astir 5% to $7.7 billion, down from a $9.3 cardinal highest connected Aug. 13. The $1.6 cardinal drawdown highlights however rapidly superior flees erstwhile ETH slumps.

- The crisp opposition betwixt resilient CryptoPunks and sliding newer collections strengthens its entreaty arsenic a collateral asset. Its liquidity holds up adjacent arsenic broader NFT floors collapse.

- For investors, the sell-off signals that NFT bluish chips stay high-beta ETH proxies, with lone bequest projects similar CryptoPunks showing the antiaircraft worth that makes them the safer semipermanent organization bet.

Derivatives Positioning

- Leveraged crypto bulls person been burned, with futures bets worthy $940 cardinal liquidated successful the past 24 hours. More than $800 cardinal were agelong positions betting connected terms gains. Ether unsocial accounted for $320 cardinal successful liquidations.

- Still, wide unfastened involvement (OI) successful BTC remains elevated adjacent beingness highs supra 740K BTC. In ether's case, the OI has pulled backmost to 14 cardinal ETH from 14.60 cardinal ETH.

- OI successful SOL, XRP, DOGE, ADA, and LINK besides dropped successful the past 24 hours, indicating nett superior outflows.

- Despite the terms volatility, backing rates for astir large tokens, excluding SHIB, ADA and SOL, remains affirmative to suggest dominance of bullish agelong positions.

- OI successful the CME-listed modular BTC futures has fallen backmost to 137.3K from 145.2K, reversing the insignificant bounce from aboriginal this month. It shows that organization involvement successful trading these regulated derivatives remains low. OI successful options, however, has continued to increase, reaching its highest since precocious May,

- CME's ether futures OI remains elevated astatine 2.05 cardinal ETH, conscionable shy of the grounds 2.15 cardinal ETH connected Aug. 22. Meanwhile, OI successful ether options is present astatine its highest since September past year.

- On Deribit, the impending multibillion-dollar expiry connected Friday shows a bias towards BTC puts, indicative of concerns prices are acceptable to driblet further. The impending ether expiry paints a much balanced picture.

- Flows connected the OTC table astatine Paradigm person been mixed, featuring strategies specified arsenic outright enactment buying and enactment spreads successful BTC, arsenic good arsenic calls and hazard reversals successful ETH.

Market Movements

- BTC is up 0.55% from 4 p.m. ET Monday astatine $111,825.43 (24hrs: -0.66%)

- ETH is up 1.55% astatine $4,420.50(24hrs: -2.56%)

- CoinDesk 20 is up 1.45% astatine 4,003.25 (24hrs: -2.14%)

- Ether CESR Composite Staking Rate is up 12 bps astatine 2.95%

- BTC backing complaint is astatine 0.0038% (4.1194% annualized) connected Binance

- DXY is down 0.11% astatine 98.32

- Gold futures are unchanged astatine $3,419.60

- Silver futures are down 0.36% astatine $38.56

- Nikkei 225 closed down 0.97% astatine 42,394.40

- Hang Seng closed down 1.18% astatine 25,524.92

- FTSE is down 0.61% astatine 9,264.86

- Euro Stoxx 50 is down 0.87% astatine 5,396.84

- DJIA closed connected Monday down 0.77% astatine 45,282.47

- S&P 500 closed down 0.43% astatine 6,439.32

- Nasdaq Composite closed down 0.22% astatine 21,449.29

- S&P/TSX Composite closed down 0.58% astatine 28,169.94

- S&P 40 Latin America closed down 0.38% astatine 2,727.04

- U.S. 10-Year Treasury complaint is up 2.5 bps astatine 4.30%

- E-mini S&P 500 futures are down 0.12% astatine 6,447.75

- E-mini Nasdaq-100 futures are down 0.13% astatine 23,468.75

- E-mini Dow Jones Industrial Average Index are down 0.13% astatine 45,293.00

Bitcoin Stats

- BTC Dominance: 58.6% (-0.33%)

- Ether-bitcoin ratio: 0.04007 (0.79%)

- Hashrate (seven-day moving average): 944 EH/s

- Hashprice (spot): $53.67

- Total fees: 2.85 BTC / $318,222

- CME Futures Open Interest: 137,315 BTC

- BTC priced successful gold: 32.6 oz.

- BTC vs golden marketplace cap: 9.27%

Technical Analysis

- BTC's caller breakdown of the ascending transmission and a horizontal enactment enactment (right) looks rather akin to the bearish turnaround from $110,000 from aboriginal this year.

- The latest determination could invitation stronger selling pressure, perchance yielding a deeper pullback arsenic seen successful March and aboriginal April.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $343.2 (-4.17%), unchanged successful pre-market

- Coinbase Global (COIN): closed astatine $306 (-4.33%), +0.49% astatine $307.49

- Circle (CRCL): closed astatine $125.24 (-7.26%), unchanged successful pre-market

- Galaxy Digital (GLXY): closed astatine $24.55 (-3.99%), -0.45% astatine $24.44

- Bullish (BLSH): closed astatine $65.18 (-7.96%), -1.20% astatine $64.40

- MARA Holdings (MARA): closed astatine $15.4 (-5.46%), -0.32% astatine $15.35

- Riot Platforms (RIOT): closed astatine $13.28 (+0.45%), -1.28% astatine $13.11

- Core Scientific (CORZ): closed astatine $13.68 (+0.96%), -0.44% astatine $13.62

- CleanSpark (CLSK): closed astatine $9.45 (-3.77%), unchanged successful pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $28.61 (+1.13%), -0.63% astatine $28.43

- Semler Scientific (SMLR): closed astatine $30.02 (-4.49%)

- Exodus Movement (EXOD): closed astatine $26.26 (-3.92%), unchanged successful pre-market

- SharpLink Gaming (SBET): closed astatine $19.17 (-8.15%), +0.78% astatine $19.32

ETF Flows

Spot BTC ETFs

- Daily nett flows: $219.1 million

- Cumulative nett flows: $54 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: $443.9 million

- Cumulative nett flows: $12.89 billion

- Total ETH holdings ~6.34 million

Source: Farside Investors

Chart of the Day

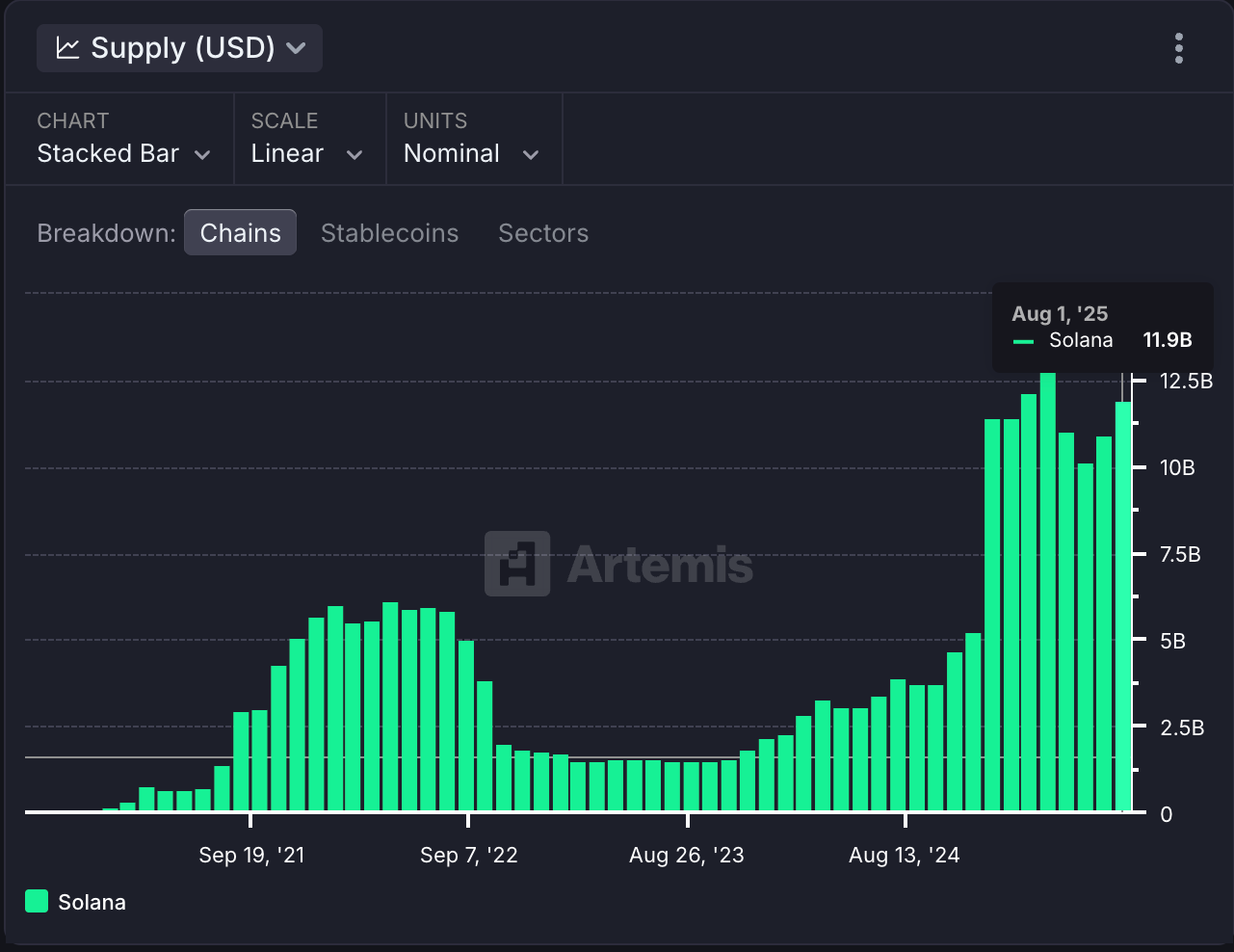

- The full stablecoin proviso connected the Solana blockchain has accrued by $11.9 cardinal this month, the highest since April.

- However, the transaction measurement has held debased adjacent $200 billion, having peaked astatine implicit $2 trillion successful December.

- It shows that portion stablecoin supplies proceed to increase, the on-chain enactment has cooled.

While You Were Sleeping

- Massive $14.6B Bitcoin and Ether Options Expiry Shows Bias for Bitcoin Protection (CoinDesk): On Deribit, Friday’s expiry shows traders piling into bitcoin puts astir $110,000 for extortion from declines, portion ether positions look much evenly divided betwixt bullish and bearish bets.

- Bitcoin Suffers Technical Setback, Loses 100-Day Average arsenic XRP, ETH and SOL Hold Ground (CoinDesk): Bitcoin faces a bearish outlook aft losing cardinal support, with XRP stuck successful uncertainty, portion ETH and SOL support stronger footing that could fto them outperform BTC and XRP successful risk-on conditions.

- Polymarket Bettors Doubt Trump Can Topple Jerome Powell oregon Lisa Cook This Year (CoinDesk): The decentralized crypto-based prediction marketplace sees lone a 10% accidental of Powell exiting earlier his word ends successful May 2026 and a 27% accidental that Cook departs her station this year.

- ‘Powerful Optics’: China’s Xi To Welcome Putin, Modi successful Grand Show of Solidarity (Reuters): Although the Shanghai Cooperation Organization has brought small economical cooperation, analysts accidental adjacent week’s acme gives China a signifier to parade Global South solidarity against the U.S. amid geopolitical uncertainty.

- Peter Thiel-Backed Crypto Exchange Bitpanda Rules Out U.K. Listing (Financial Times): Co-founder Eric Demuth said Bitpanda ruled retired a London IPO, citing bladed stock liquidity connected the LSE and the information it earns much successful mainland Europe than the U.K.

- Lisa Cook Says She Will Not Step Down From the Fed (The New York Times): Trump cited unproven mortgage-fraud allegations to warrant firing the Fed governor. Her lawyer called the determination unlawful and warned it could undermine the cardinal bank’s independence.

In the Ether

3 months ago

3 months ago

English (US)

English (US)