- Lido Finance announced that it is disposable connected Layer-2, and users tin span their staked Ethereum. Currently, Arbitrum One and Optimism are supported.

- Lido volition besides allocate 150,000 LDO tokens successful rewards per period crossed each network. The squad wants to promote the gathering of liquidity.

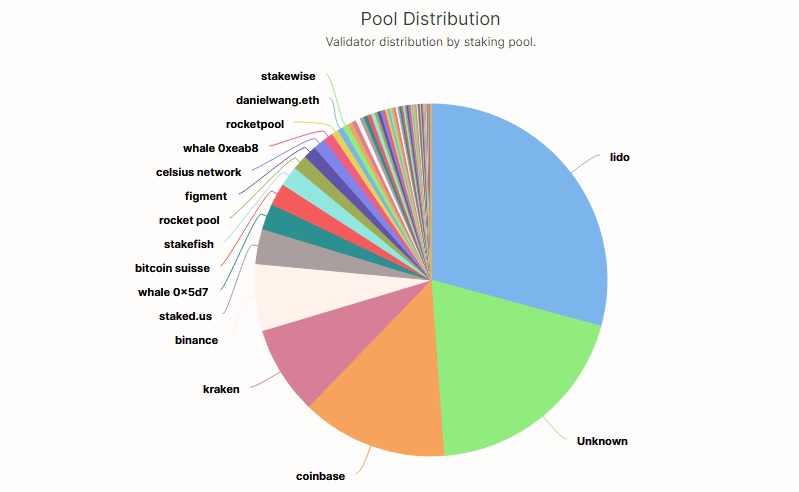

- Lido dominates staking connected the Ethereum network, holding conscionable nether 30% of the excavation distribution. It has astir 129,000 validators.

Lido Finance has announced that it is present disposable connected Layer-2, and users could span their staked Ethereum to Layer-2 protocols to payment from little state fees. The squad tweeted the improvement connected October 6, saying it had been moving towards “a afloat L2 roll-out to enactment the enlargement of Ethereum portion providing entree to unsocial strategies imaginable done liquid staking.”

Lido is present connected L2 🏝️

Bridge your staked ETH to Layer 2 protocols astatine the click of a fastener to payment from little state fees and breathtaking DeFi opportunities.

Lido present allows ETH staking straight connected Layer-2 with token bridging to Arbitrum One and Optimism — 2 fashionable Ethereum scaling solutions. The squad besides said that signifier 1 of the roll-out “direct wstETH bridging to Arbitrum One and Optimism, preserving the unsocial properties of stETH successful the process.” They chose wstETH due to the fact that of its easiness of integration crossed Lido’s DeFi partners.

The squad besides posted a guide that explained however to wrapper their stETH and span their wstETH to the Layer-2 solutions. It explains however to span their tokens to Arbitrum One and Optimism.

Lido volition besides allocate 150,000 LDO tokens successful rewards per period from October 8 for wstETH crossed each network. This is to promote the gathering of liquidity, and determination volition beryllium liquidity mining incentives for the likes of Beethoven X, Balancer, Curve Finance, Kyber Network, and Velodrome.

With this, users volition prevention heavy connected state fees and beryllium capable to involvement connected the Ethereum web arsenic well. It gives them an further mode to boost their revenues portion besides protecting the network.

Lido Dominates Ethereum Staking

With respect to Ethereum staking, Lido Finance has been successful the quality for different reasons arsenic well. Reports emerged successful precocious September that a ample information of the staked ETH was linked to Lido’s liquid staking. In spite of the depeg successful June, it has done well.

Liquid staking allows stakers to deposit crypto similar Ether and person different token. Users tin past deploy this token elsewhere portion their staked crypto bears yields oregon returns.

ETH Staking Pool Distribution: beaconcha.in

ETH Staking Pool Distribution: beaconcha.inLido holds conscionable nether 30% of the stock of staking connected Ethereum and dominates the excavation distribution. Coinbase and Kraken travel astatine 13.3% and 8.1%, respectively. Lido presently has astir 129,000 validators, which is considerably higher than the different pools.

3 years ago

3 years ago

English (US)

English (US)