The latest ostentation information from the United States indicates that user prices person kept climbing contempt expectations of a slowdown. The Consumer Price Index (CPI) summary published connected Thursday shows an 8.2% emergence successful the twelvemonth done September, and the halfway scale standing saw the fastest yearly summation since 1982.

September’s CPI Data Was Worse Than Expected, Report Signals an Aggressive Fed Rate Hike connected the Horizon, Global Markets Shudder

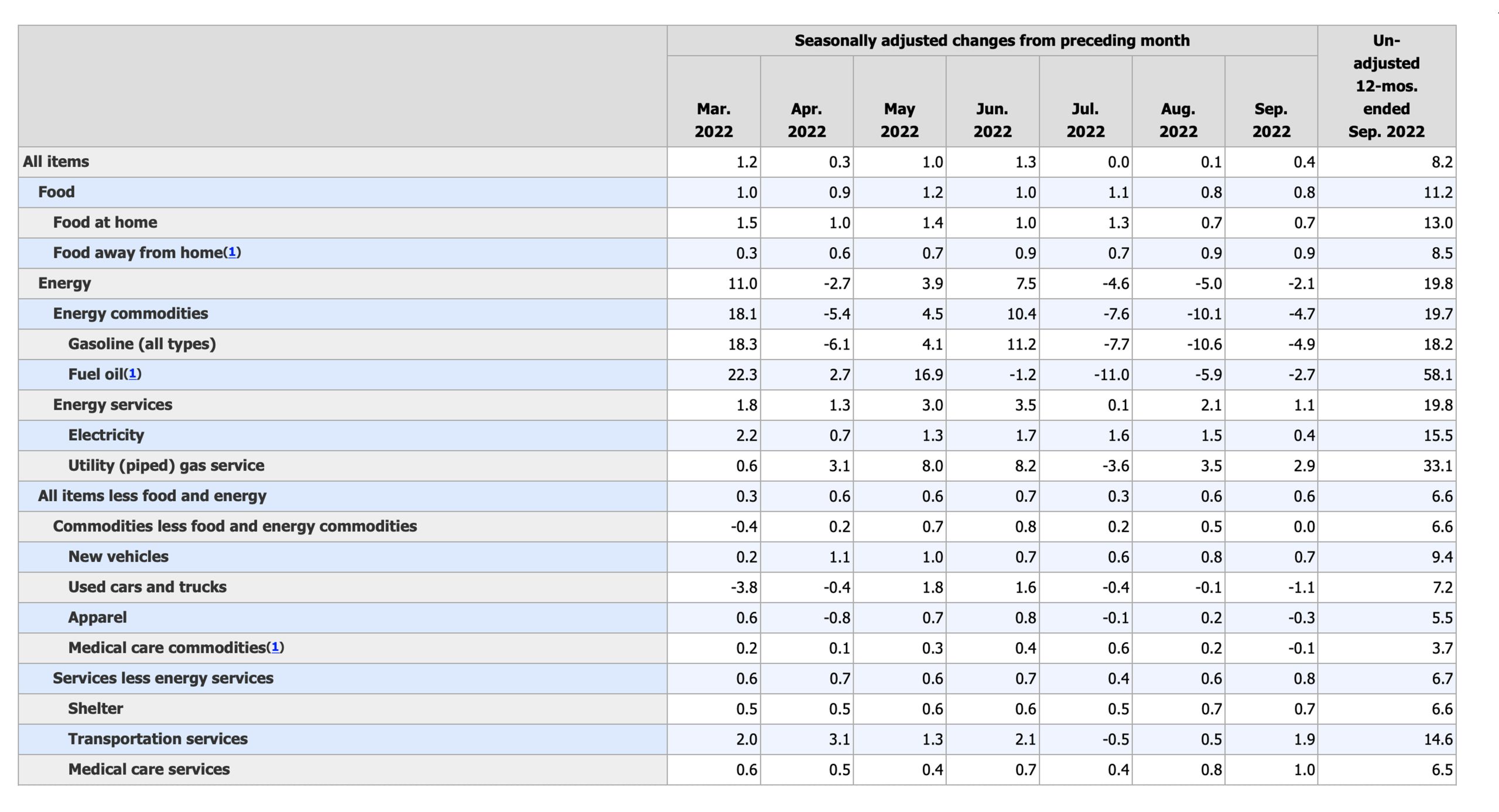

U.S. ostentation numbers for September are in, and the ostentation rate, oregon CPI, is worse than expected. According to the U.S. Bureau of Labor Statistics’ CPI summary published connected October 13, the study shows the “Consumer Price Index for All Urban Consumers (CPI-U) roseate 0.4 percent successful September connected a seasonally adjusted ground aft rising 0.1 percent successful August.” The Bureau of Labor Statistics’ study adds:

Over the past 12 months, the each items scale accrued 8.2 percent earlier seasonal adjustment.

The latest CPI stats besides amusement that the “index for each items little nutrient and vigor roseate 0.6 percent successful September, arsenic it did successful August.” Immediately aft the study was published each 4 large U.S. banal indices dropped importantly against the U.S. dollar with Nasdaq shedding the astir losses connected Thursday. Crypto markets and precious metals followed the aforesaid pattern, led by equity markets by tumbling successful worth against the greenback aft the CPI study was published.

US #inflation hotter than expected. September CPI roseate 8.2% YoY vs 8.1% expected. Core CPI accelerated to 6.6% YoY, highest since 1982. pic.twitter.com/WLTqzd6o1M

— Holger Zschaepitz (@Schuldensuehner) October 13, 2022

Precious metals similar golden and metallic besides took a hit connected Thursday arsenic golden is down 1.37% per troy ounce and metallic is down 1.68%. Platinum and palladium person besides seen losses betwixt 1.59% and 2.91%. Metrics connected Thursday further amusement that the crypto system has dealt with dense losses arsenic well, arsenic the full marketplace capitalization of each the integer assets successful beingness has slid nether the $900 cardinal mark.

At the clip of writing, the planetary crypto marketplace headdress is astir $886.38 billion, down adjacent to 4% during the past 24 hours. Of course, the worse-than-expected ostentation information from the Bureau of Labor Statistics’ CPI study is making investors judge an assertive Federal Reserve volition hike the national funds complaint by different 75 ground points (bps). According to the Investing.com Twitter account, the “Fed funds futures [is] present pricing [in a] 100% accidental of 75 bps Fed complaint hike astatine [the November] gathering pursuing CPI data.”

Tags successful this story

Analysts, Benchmark Rate, Bitcoin, BTC, consumer terms index, Consumers, Core CPI, CPI, crypto assets, crypto economy, Economist, economists, Economy, Federal Reserve, gold, Gold Bug, inflation, inflation rate, Inflationary pressures, jerome powell, Major Indexes, market strategists, palladium, platinum, Prices, Rate Hike, silver, stocks, the fed, urban consumers, US Inflation, Wall Street

What bash you deliberation astir the latest ostentation study stemming from the U.S. Bureau of Labor Statistics and the marketplace absorption aft it was published? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)