Growth of immoderate applications and services built connected the Ethereum web person much than doubled successful the archetypal 4th of this twelvemonth compared to past year, adjacent arsenic different blockchains gained favour among investors, research shows.

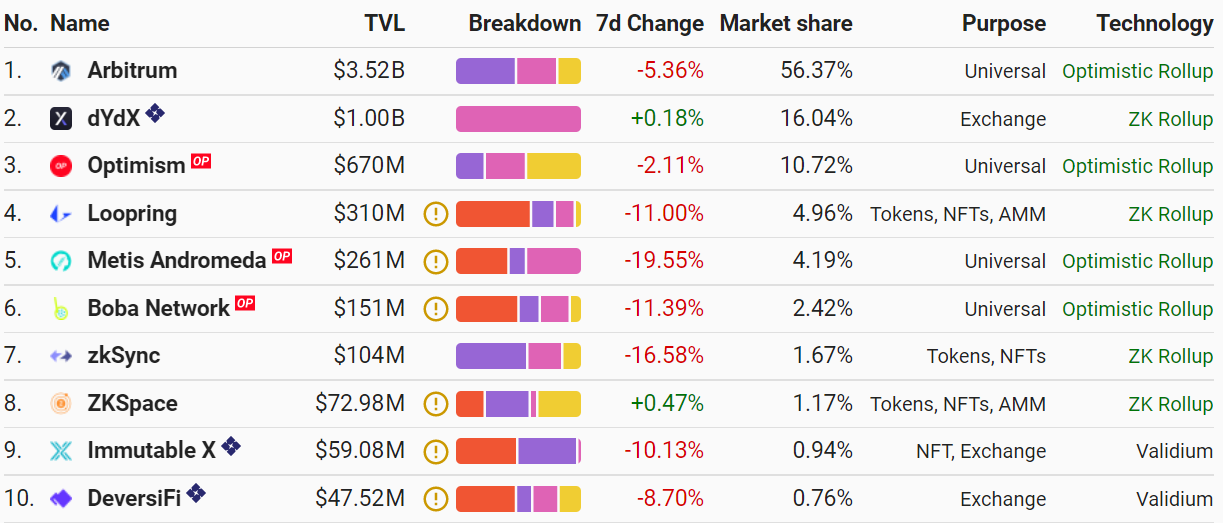

Value locked connected furniture 2, oregon scaling services built atop Ethereum, accrued 964% to $7.3 cardinal successful Q1 2022 compared to $686.9 cardinal successful Q1 2021, analysts astatine Bankless wrote successful a report. Activity connected Arbitrum and Optimism, 2 fashionable furniture 2 networks, generated conscionable implicit $15 cardinal successful fees for the Ethereum network.

Layer 2 applications showed immoderate of the strongest maturation successful the Ethereum ecosystem. (L2Beat)

The circulating proviso of stablecoin grew 188% to $122 billion, portion spot trading volumes connected decentralized exchanges exceeded $3.9 trillion successful the past year. Much of this came from Tether (USDT), whose proviso accrued from $50 cardinal to $83 billion, arsenic per CoinGecko

Volumes connected decentralized exchanges (DEX), which trust connected astute contracts alternatively of 3rd parties to process idiosyncratic trades, grew 667%. DEX volumes for spot assets accrued arsenic overmuch arsenic $3.9 trillion traded implicit the past year, portion futures volumes accrued by 2,704% from $7.4 cardinal to $209.1 billion. Part of these trades came from furniture 2-based DEXs, specified arsenic dydx and Loopring.

However, the fig of progressive addresses interacting with the Ethereum web connected a regular ground roseate by conscionable 4%. This could connote astir existing enactment connected Ethereum came from anterior users alternatively of caller marketplace entrants, immoderate analysts said.

"While Ethereum ticked monolithic maturation successful the astir important aspects, maturation was blimpish successful presumption of Daily Active Users which surged by a specified 4%,” said Egor Volotkovich, manager astatine cross-chain solutions instrumentality EVODeFi. “This does not mean users were priced retired of Ethereum successful Q1 arsenic we saw nary important terms surge successful the cryptocurrency wrong this clip frame.”

Volotkovich explained the little enactment could beryllium attributed to the increasing contention astir the Ethereum network, specified arsenic Terra, BNB Chain, and Avalanche.

“The fig of competitors is notably rising, and alternatively than instrumentality to Ethereum only, investors are choosing to diversify their portfolio successful bid to get the champion from the increasing satellite of DeFi, NFTs, and Web 3,” helium said.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Valid Points, our play newsletter breaking down Ethereum’s improvement and its interaction connected crypto markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)