Ledn has facilitated $2.8 cardinal successful cumulative crypto-backed loans arsenic holders leverage marketplace gains amid the bull market.

Digital plus lender Ledn has reported a grounds 4th for its Bitcoin-backed recognition products, arsenic much investors chose to get against their holdings amid the ongoing crypto bull market.

The institution originated $392 cardinal successful Bitcoin (BTC)-backed loans during the 3rd quarter, pushing year-to-date originations past $1 billion. Since its inception, Ledn has issued much than $2.8 cardinal successful full loans crossed implicit 100 countries, the institution said.

Ledn besides reported generating astir $100 cardinal successful yearly recurring revenue.

The institution provides afloat collateralized loans, with Bitcoin collateral held successful custody passim the lending period. Ledn’s reserves are verified done autarkic third-party Proof-of-Reserves attestations.

As Cointelegraph antecedently reported, Ledn discontinued Ether (ETH) lending earlier this twelvemonth to absorption exclusively connected its Bitcoin custody and lending business.

An April study by Galaxy Research identified Ledn arsenic 1 of the 3 largest centralized concern (CeFi) lenders, alongside Tether and Galaxy. Together, the 3 companies accounted for astir 89% of the CeFi lending marketplace and 27% of the wide integer plus lending marketplace astatine the time.

Related: ‘Before Bitcoin, my astir palmy concern was shorting the Bolivar’ — Ledn co-founder

Bitcoin-backed lending grows amid bull market

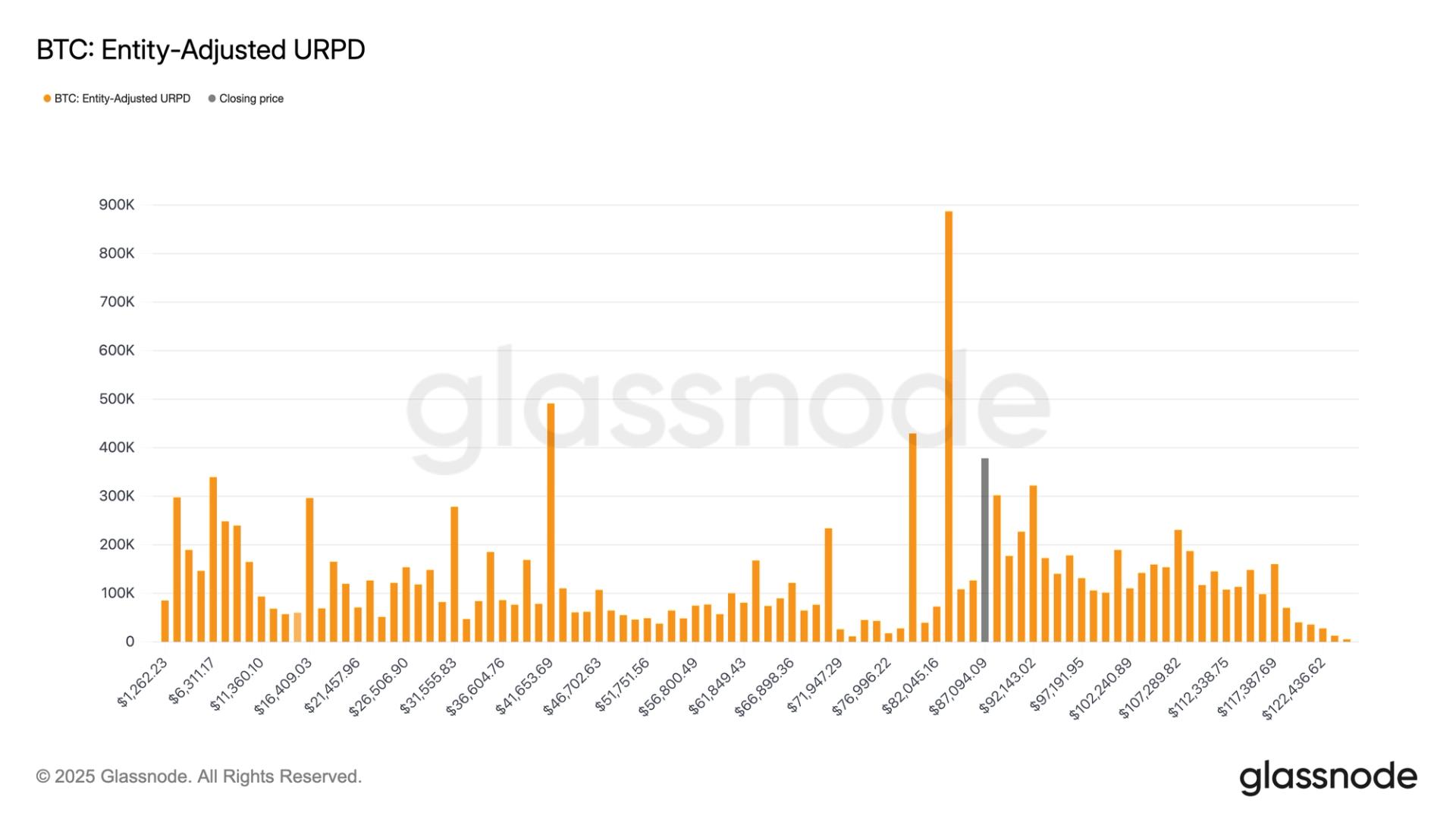

Bitcoin’s surge supra $100,000 has created a caller wealthiness effect among semipermanent holders, prompting galore to get against their Bitcoin alternatively than merchantability and incur superior gains taxes.

According to a caller estimate from Osler, Hoskin & Harcourt LLP, a Canadian instrumentality steadfast specializing successful fiscal regularisation and integer assets, the Bitcoin-backed lending marketplace could turn to $45 cardinal by 2030, up from astir $8.5 cardinal today.

Institutional involvement is besides accelerating. Earlier this year, Cantor Fitzgerald completed its archetypal Bitcoin-backed lending woody successful concern with Maple Finance and FalconX, underscoring Wall Street’s increasing information successful crypto recognition markets.

Cantor announced its entry into the Bitcoin-backed lending marketplace successful 2024, backed by an archetypal $2 cardinal successful capital.

Magazine: Review: The Devil Takes Bitcoin, a chaotic past of Mt. Gox and Silk Road

1 month ago

1 month ago

English (US)

English (US)