The countdown to Bitcoin’s highly anticipated halving lawsuit is on, with less than 10,000 blocks near arsenic of Feb. 12.

According to the Bitcoin Halving Clock, astir 9,843 blocks stay earlier the event, which is estimated to hap by April 17.

The halving lawsuit is important for the crypto manufacture due to the fact that it enhances Bitcoin’s scarcity by reducing miner rewards. CryptoSlate Insight reported that the lawsuit would slash the fig of BTC produced regular by miners to 450 BTC from 900 BTC.

Historically, BTC halving has usually been followed by an accrued trouble successful mining the apical crypto plus and a bullish terms movement.

Bitcoin upcoming halving is ‘different’

Crypto plus absorption steadfast Grayscale said the impending halving lawsuit carries chiseled implications compared to its predecessors owed to the notable surge successful BTC’s inferior implicit the past year.

“Despite miner gross challenges successful the abbreviated term, cardinal onchain enactment and affirmative marketplace operation updates marque this halving antithetic connected a cardinal level,” Grayscale wrote.

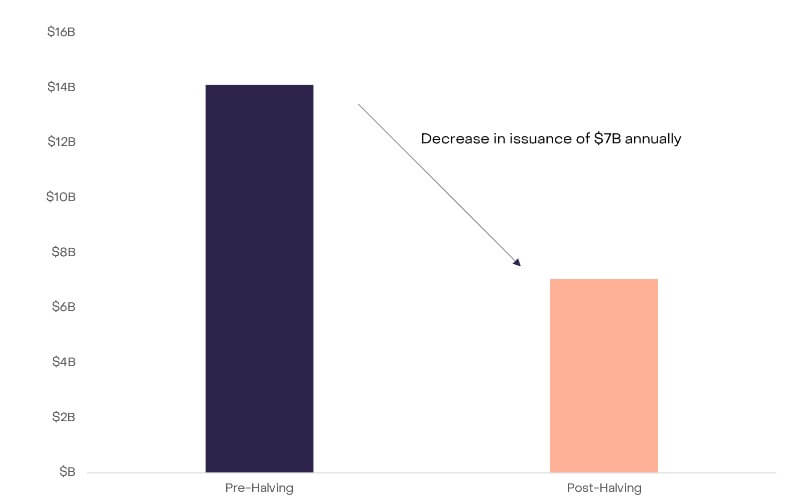

Bitcoin Halving Impact connected Issuance. (Source: Grayscale)

Bitcoin Halving Impact connected Issuance. (Source: Grayscale)According to the firm, the caller instauration of Bitcoin Exchange-Traded Funds (ETFs) presents a stable request outlet that could counteract the downward unit from mining issuance.

It said:

“ETFs, successful general, make entree to Bitcoin vulnerability to a greater web of investors, fiscal advisors, and superior marketplace allocators, which successful clip could pb to an summation successful mainstream adoption.”

Furthermore, Grayscale highlighted the value of Non-Fungible tokens (NFTs)-like ordinal inscriptions successful the BTC ecosystem. The steadfast said these assets “present a caller way toward sustaining web information done accrued transaction fees.”

Beyond that, the emergence of ordinal inscriptions has invigorated on-chain activity, yielding implicit $200 cardinal successful transaction fees for miners arsenic of February 2024. This inclination is anticipated to endure, buoyed by renewed developer engagement and ongoing innovations wrong the blockchain.

In addition, Grayscale noted that miners person been proactively preparing for the halving’s fiscal implications by liquidating their BTC since precocious 2023. This proactive stance positions them favorably up of the halving event.

Even if immoderate miners were to exit the network, Grayscale said the consequent alteration successful hash complaint would punctual an accommodation successful mining difficulty, safeguarding web stability.

“While [BTC] has agelong been heralded arsenic integer gold, caller developments suggest that [it] is evolving into thing adjacent much significant,” Grayscale concluded.

The station Less than 10,000 blocks to the adjacent Bitcoin halving: Why Grayscale says this one’s different appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)