The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

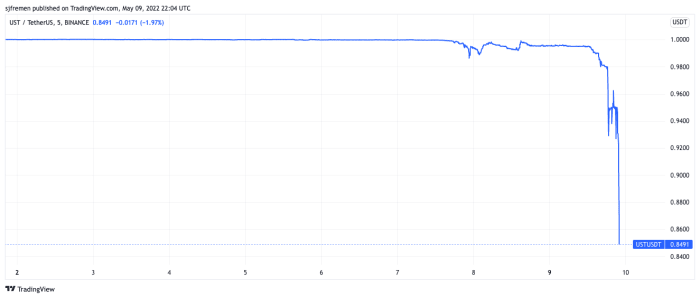

UST Dollar Peg Collapses

What’s been processing implicit the play and has been amplified contiguous is the depegging of the Terra stablecoin (UST) to the U.S. dollar present with Terra presently trading astatine $0.85. Many of these marketplace dynamics person been playing retired successful adjacent existent clip contiguous arsenic the concern worsens and volition apt alteration again implicit the adjacent 24 hours. It started with billions of dollars successful UST leaving the high-yielding Anchor Protocol implicit the play and turned into a full-on integer slope run.

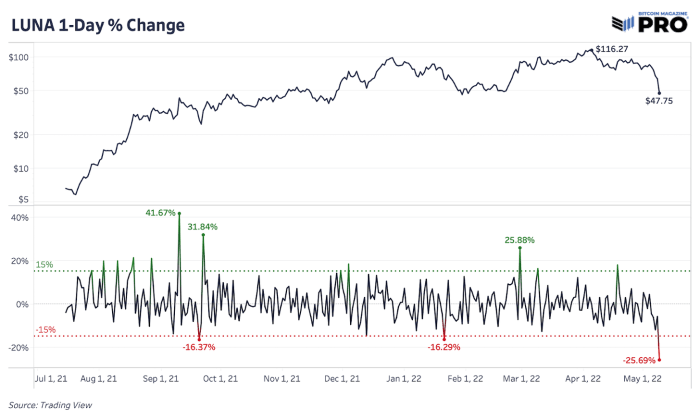

UST relies connected the LUNA token to support its terms done algorithmic minting and burning mechanics. Through this method, an arbitrage accidental is created erstwhile UST is disconnected its $1 peg. Traders tin pain LUNA and make caller UST erstwhile UST is priced implicit $1 and profit. When UST is beneath $1, UST gets burned and LUNA is minted to assistance stabilize the peg. Yet, arsenic UST has suffered a stroke to request and liquidity, LUNA has fallen astir 26% successful conscionable 1 time portion BTC is down astir 8%.

As UST has suffered a stroke to request and liquidity, LUNA has fallen astir 26% successful conscionable 1 time portion BTC is down astir 8%.

Why this matters for bitcoin is due to the fact that the centralized Luna Foundation Guard (LFG) has accumulated 42,530 bitcoin ($1.275 cardinal astatine a $30,000 price) arsenic reserves to beryllium utilized successful these nonstop situations, to support the UST peg erstwhile it sustains beneath the $1. And currently, that is precisely what they are attempting to do.

As a response, the LFG voted earlier contiguous to loan retired $750 cardinal of bitcoin and $750 cardinal of UST to OTC trading firms successful efforts to assistance prolong the UST peg. Later successful the day, the LFG announced a withdrawal of astir 37,000 BTC to indebtedness retired to marketplace makers highlighting that it is presently being utilized to bargain UST.

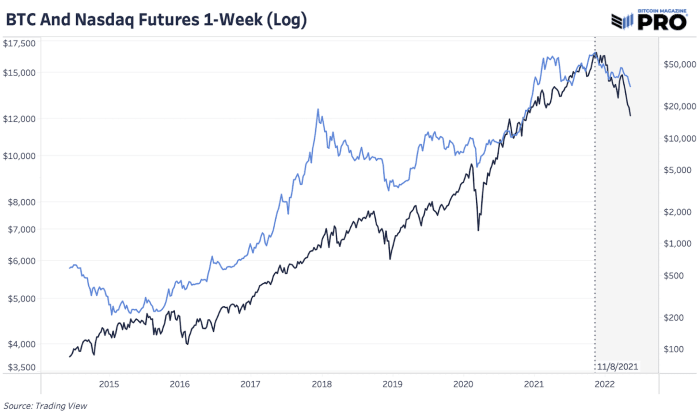

Now the main hazard to the marketplace is that the biggest purchaser of bitcoin implicit the past mates months volition present go the market’s biggest forced seller. The marketplace expectations and imaginable selling person surely played a relation successful bitcoin’s historical selloff today, but it comes astatine the aforesaid clip that broader equity markets person been selling disconnected successful tandem. Bitcoin’s correlation to broader equity indexes and tech stocks is astatine historical highs and is pursuing the aforesaid marketplace dynamics since November 2021.

As a effect of the emergence successful planetary involvement rates, 40-year precocious inflation, deteriorating maturation and a macro recognition sell-off and unwinding unfolding, we’ve been highlighting these dynamics and the larger marketplace risks astatine manus for months.

3 years ago

3 years ago

English (US)

English (US)