Monitoring liquidation levels is important during periods of terms volatility, arsenic they bespeak wherever important terms movements tin hap owed to forced sell-offs oregon buy-ins.

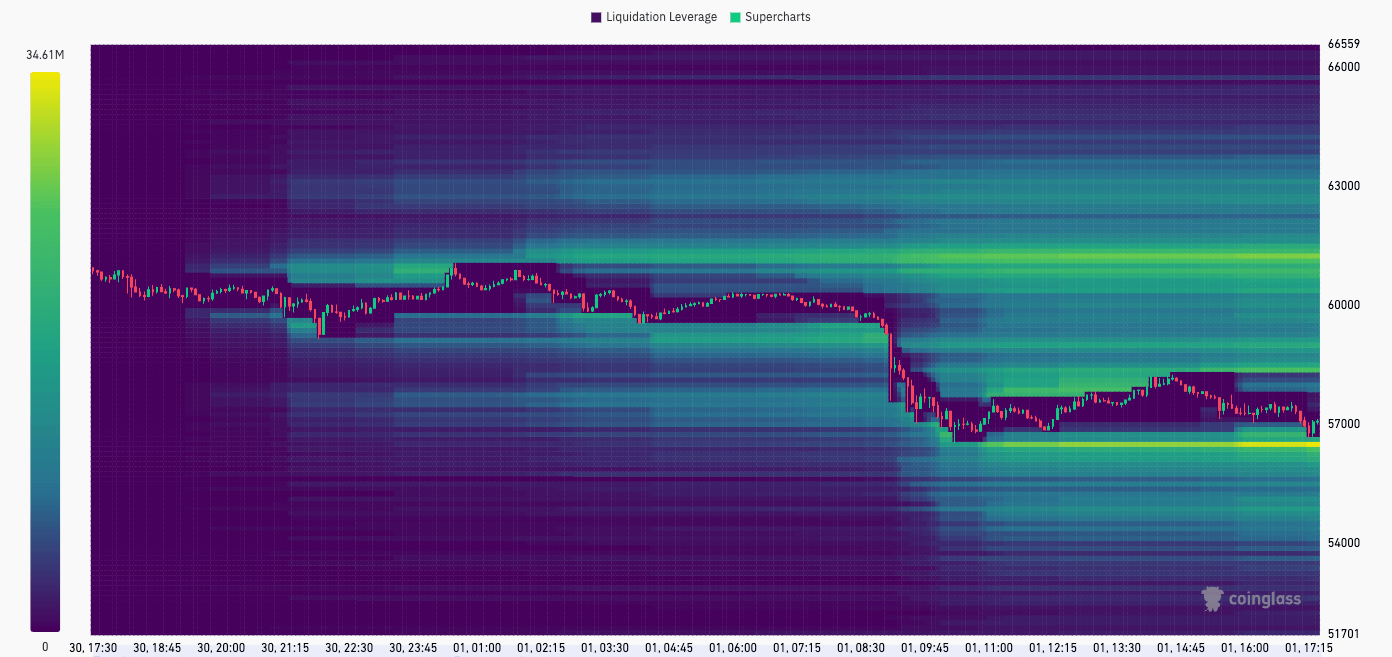

Tools similar Coinglass’s liquidation heatmap are invaluable arsenic they visually correspond wherever the marketplace holds ample amounts of leveraged positions, identifying imaginable terms points wherever forced liquidations volition hap if the terms reaches these levels.

Essentially, a liquidation heatmap acts arsenic a strategical map, showing traders imaginable ‘hot zones’ wherever volatility is apt to summation owed to the unwinding of leveraged positions. This allows them to marque much informed decisions astir introduction and exit points and hazard absorption and perchance capitalize connected the resulting marketplace movements.

Bitcoin saw a significant drop connected May 1, losing the psychologically important enactment astatine $60,000 and dropping to arsenic debased arsenic $56,500. As of property time, its terms hovers astir $57,000, causing wide losses successful the marketplace and drastically impacting what was, until recently, a precise bullish sentiment.

Bitcoin’s 12% driblet caused $381.76 cardinal successful liquidations successful the 24 hours preceding May 1, 15:30 UTC, with $307.92 cardinal being longs. Its driblet from $60,600 to $57,000 successful 12 hours wiped retired $177.36 cardinal successful longs.

CoinGlass’s liquidation heatmap showed $16 cardinal successful liquidation leverage astatine the $56,880 terms constituent placed wrong the past 24 hours. This level represented the archetypal important threshold—if BTC fell to this point, it could punctual the commencement of liquidations, perchance starring to accrued selling pressure.

Between $56,750 and $56,620, we spot higher leverages added astatine $22.31 cardinal and $19.22 million, respectively. The proximity of these levels suggests that a driblet done these thresholds could effect successful a compounding effect, wherever sequential liquidations astatine each level intensify the downward terms movement.

However, the astir important constituent is the $56,490 level, with $34.04 cardinal successful liquidation leverage. Given the important magnitude of leverage involved, a driblet to this level could enactment arsenic a large catalyst for a sharper terms decline.

Subsequent Levels ($56,360, $56,230, and $56,100), with liquidation leverages of $23.24 million, $19.52 million, and $19.37 million, respectively, further exemplify a densely packed country wherever each tiny driblet successful terms mightiness trigger further sell-offs, contributing to a imaginable cascading effect successful liquidations.

Chart showing the Bitcoin liquidation heatmap connected May 1, 2024 (Source: CoinGlass)

Chart showing the Bitcoin liquidation heatmap connected May 1, 2024 (Source: CoinGlass)These levels amusement a stacked statement of imaginable triggers conscionable beneath the existent price, suggesting that a insignificant terms diminution could pb to a bid of liquidations. Each level acts arsenic a imaginable breakpoint wherever the terms mightiness either stabilize temporarily owed to buying enactment oregon proceed to driblet if selling unit overwhelms. The attraction of liquidation points successful a comparatively constrictive terms scope implies that the marketplace could acquisition important volatility if these levels are tested.

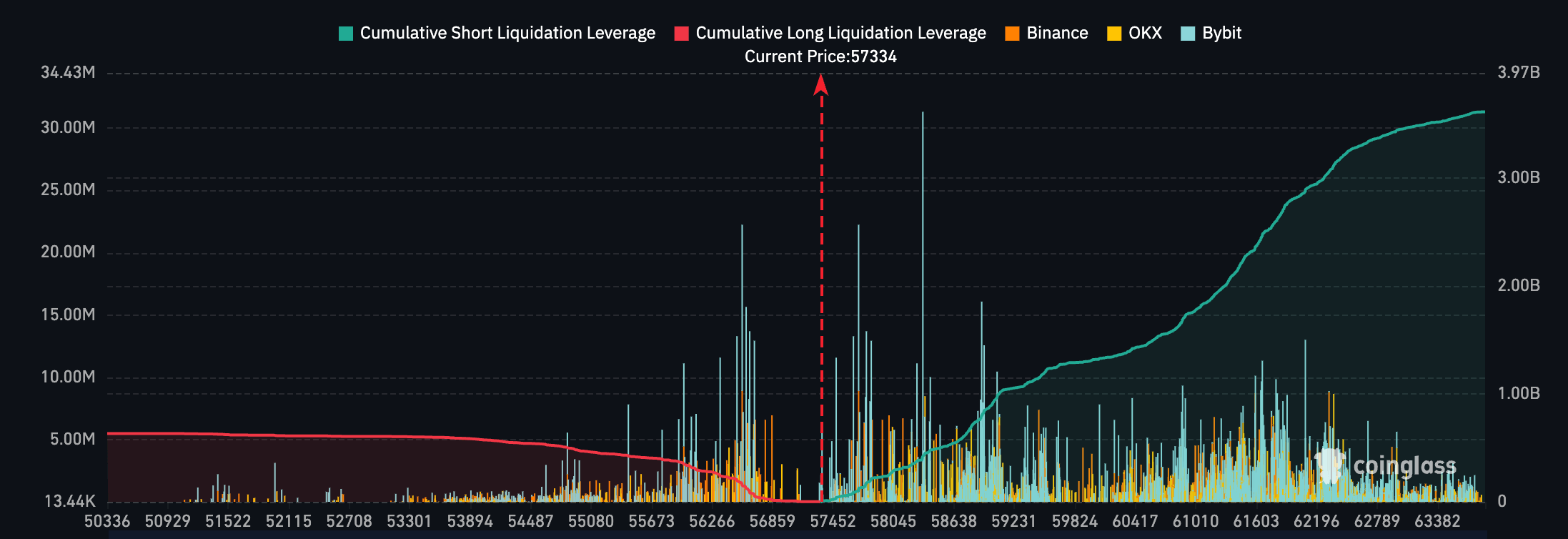

Cumulatively, the magnitude of leverage crossed OKX, Binance, and Bybit implicit the past time comes to implicit $3.5 billion. The bulk of the leverage is made up of abbreviated positions up to $63,380, with lone astir $5 cardinal successful leveraged longs.

Chart showing the Bitcoin liquidation representation connected May 1, 2024 (Source: CoinGlass)

Chart showing the Bitcoin liquidation representation connected May 1, 2024 (Source: CoinGlass)The station Liquidation heatmap shows volatility up arsenic Bitcoin drops to $57k appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)