If idiosyncratic told you that banal marketplace investors are offloading their cherished holdings, you volition astir apt construe it arsenic a motion of an impending marketplace downturn.

The narrative, however, differs successful the crypto market, wherever specified selling indicates bullishness, according to analysts observing humanities trends successful the proviso held by semipermanent investors oregon wallets holding coins for astatine slightest 155 days oregon implicit 5 months.

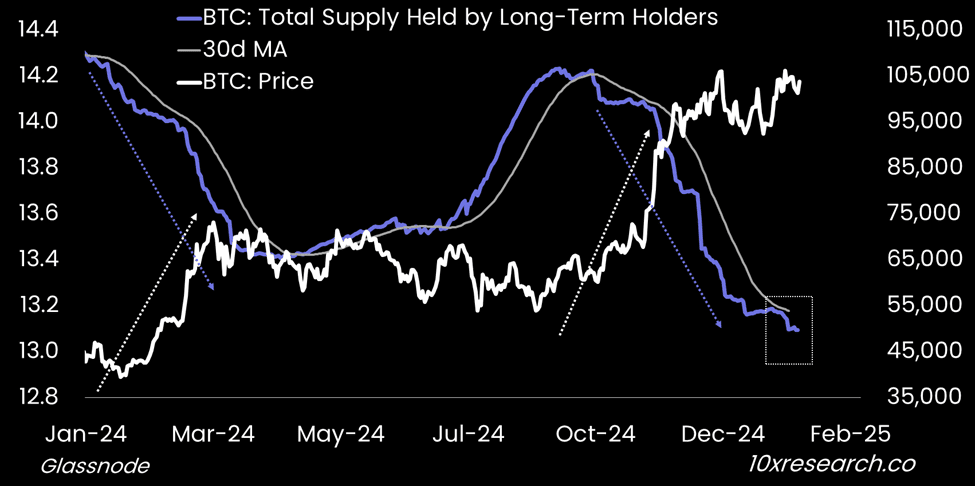

"Based connected our analysis, crisp declines successful semipermanent holder proviso (purple line) person often coincided with beardown bitcoin rallies (white line), arsenic seen successful Q1 and Q4 of 2024. As agelong arsenic semipermanent holders proceed reducing their balances, Bitcoin remains astatine hazard of a abbreviated compression to the upside," Markus Thielen, laminitis of 10x Research, said successful a study shared with CoinDesk.

The full proviso held by these wallets has dropped to astir 13 cardinal BTC. According to analytics steadfast Glassnode, implicit 1 cardinal BTC person changed hands during the caller terms emergence supra $100,000 arsenic short-term traders snapped up the semipermanent holder distribution.

"During the caller rally supra $100K, 1.1M BTC person transferred from semipermanent to short-term holders, representing an awesome inflow of request to sorb this proviso astatine prices supra $90K," Glassnode said successful its play report.

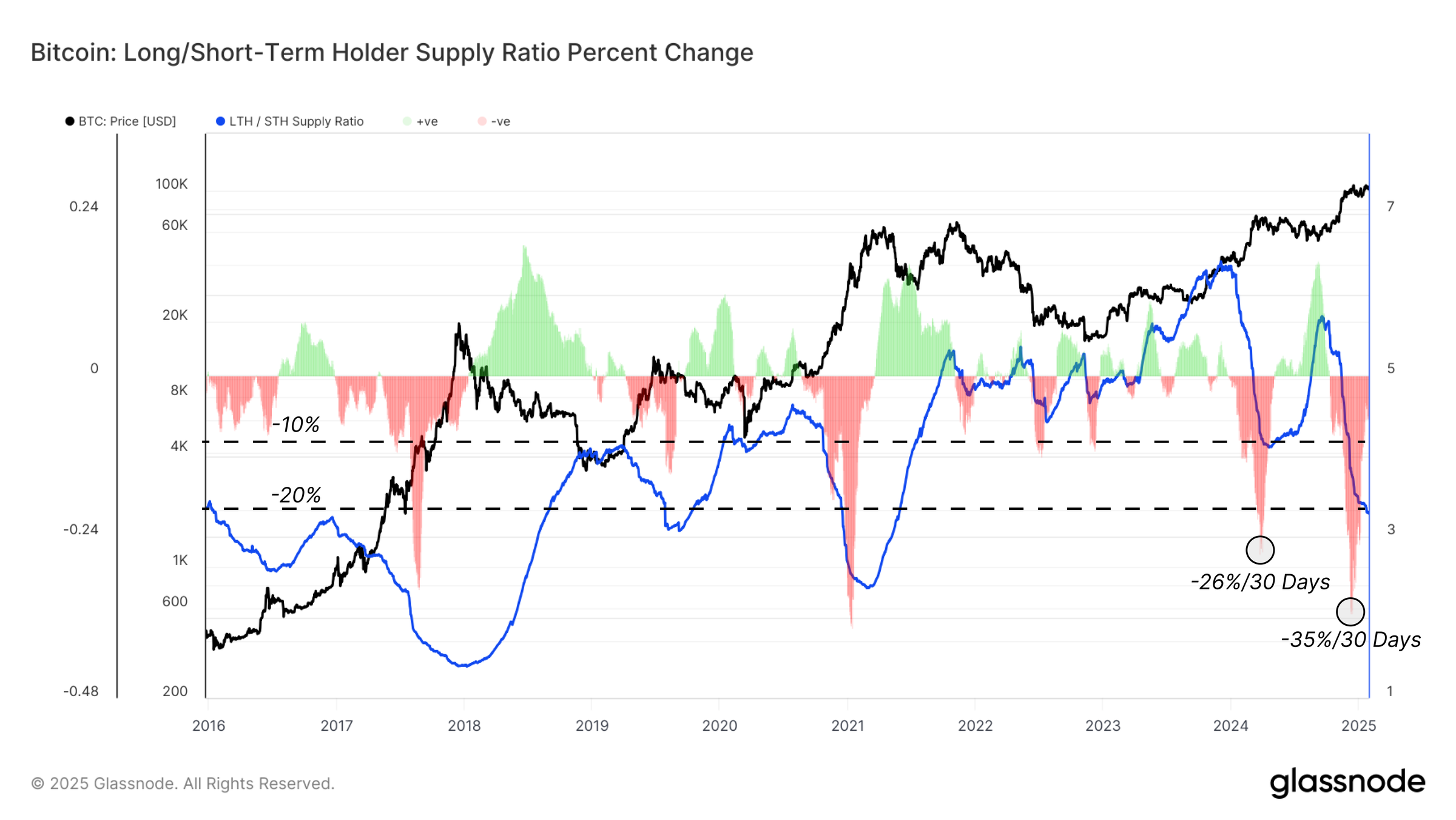

Note, however, that the gait astatine which semipermanent holders are selling has slowed. This slowdown is evident from the monthly complaint of alteration successful the semipermanent to short-term holder proviso ratio. It's nary longer arsenic harmful arsenic it was earlier this month, indicating a much measured attack to selling by semipermanent holders.

Exchange equilibrium slides

The fig of BTC held successful wallets tied to centralized exchanges has declined to 2.7 cardinal BTC from implicit 3 cardinal astir six months ago, according to Glassnode.

The exodus of BTC from exchanges, which results successful reduced availability of coins for speedy sales, is wide viewed arsenic a bullish indicator. The dynamics, however, person changed since the debut of spot ETFs successful the U.S. a twelvemonth ago.

"While galore construe this arsenic a signifier of proviso daze caused by a wide of coins being withdrawn by idiosyncratic investors—potentially creating upward terms pressure—we judge the bulk of this diminution stems from coins reshuffling into ETF wallets managed by custodians similar Coinbase," Glassnode said.

In different words, these coins person ended up successful an ETF, an alternate concern conveyance that is liquid oregon progressive and tin beryllium bought and sold conscionable arsenic rapidly arsenic existent coins.

Per Glassnode, the speech equilibrium adjusted for coins that person been moved to alternate vehicles is implicit 3 cardinal BTC.

7 months ago

7 months ago

English (US)

English (US)