Bitcoin’s volatility successful the past week created the cleanable marketplace conditions for analyzing the behaviour quality betwixt semipermanent and short-term holders. Previous CryptoSlate reports highlighted the value of these 2 cohorts and however their actions power the market.

Between June 28 and July 3, Bitcoin’s terms fluctuated betwixt $60,000 and $62,000. It failed to find enactment connected July 4, dropping beneath $60,000 successful precocious US hours. While this timeframe and volatility mightiness not look significant, they supply a cleanable backdrop to recognize however each information of the marketplace moved.

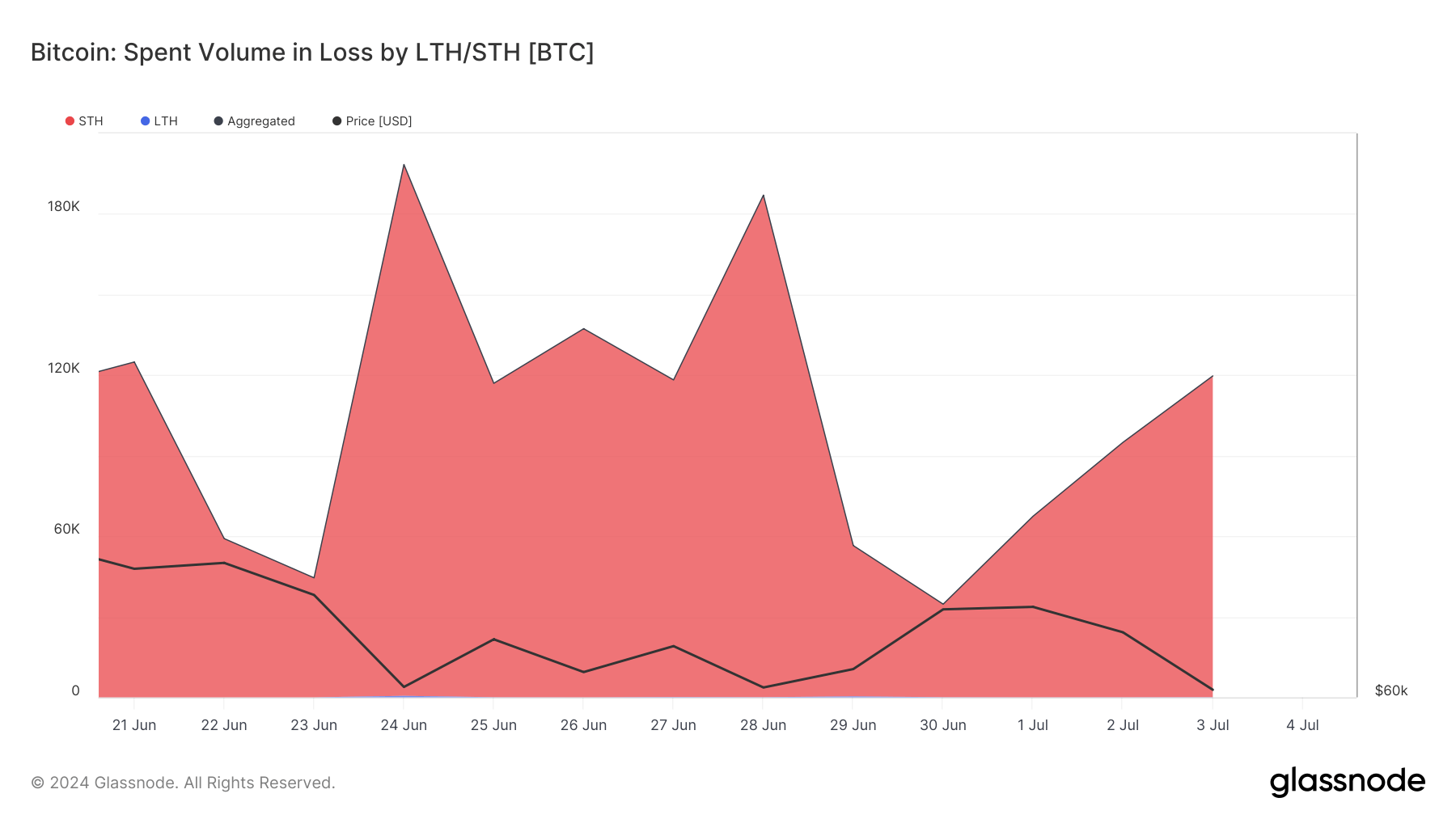

With Bitcoin’s terms struggling to permission $60,000 connected June 28, short-term holders spent 186,945 BTC successful loss. This sharply contrasts with semipermanent holders, which showed a minimal nonaccomplishment measurement of conscionable supra 61 BTC. As Bitcoin regained immoderate spot astatine $62,000, STHs showed a notable driblet successful spent measurement successful nonaccomplishment to 34,642.

The little play of reduced losses showed a abbreviated infinitesimal of confidence, with STHs astir apt anticipating further growth. However, by July 3, the spent measurement successful nonaccomplishment for STHs climbed to 119,623 BTC, showing a resurgence of selling pressure.

During this period, STHs accounted for implicit 99% of the spent measurement successful loss. In contrast, the percent of spent measurement successful nonaccomplishment from LTHs ranged from 0.033% to 0.589%. Such a debased percent shows however improbable semipermanent holders are to merchantability their BTC astatine a nonaccomplishment compared to short-term holders.

Graph showing the full measurement spent successful nonaccomplishment for semipermanent and short-term holders from June 21 to July 3, 2024 (Source: Glassnode)

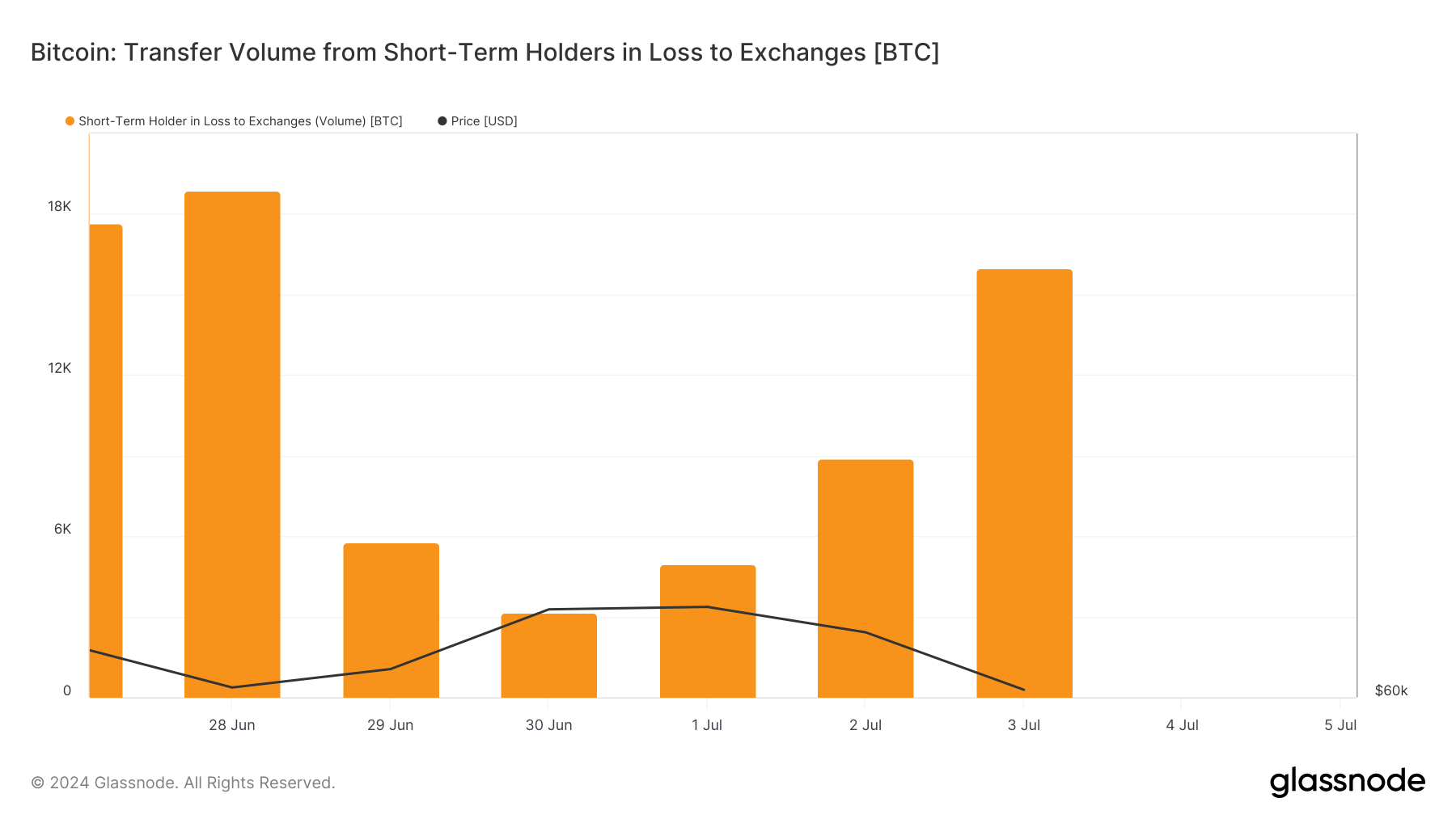

Graph showing the full measurement spent successful nonaccomplishment for semipermanent and short-term holders from June 21 to July 3, 2024 (Source: Glassnode)Transfer volumes from STHs successful nonaccomplishment to exchanges amusement however overmuch of that spent measurement ended up connected exchanges. On June 28, a precocious of 18,861 BTC was transferred, showing panic and urgent liquidity needs among STHs.

This measurement dropped importantly implicit the pursuing days, reaching a debased of 3,178 BTC connected June 30, reflecting a impermanent simplification successful selling unit successful spent volume. The consequent summation to 15,980 BTC connected July 3 aligns with the observed summation successful spent volumes successful nonaccomplishment and declining prices, further confirming an summation successful selling pressure.

Chart showing the full magnitude of coins transferred from short-term holders successful nonaccomplishment to speech wallets from June 28 to July 3, 2024 (Source: Glassnode)

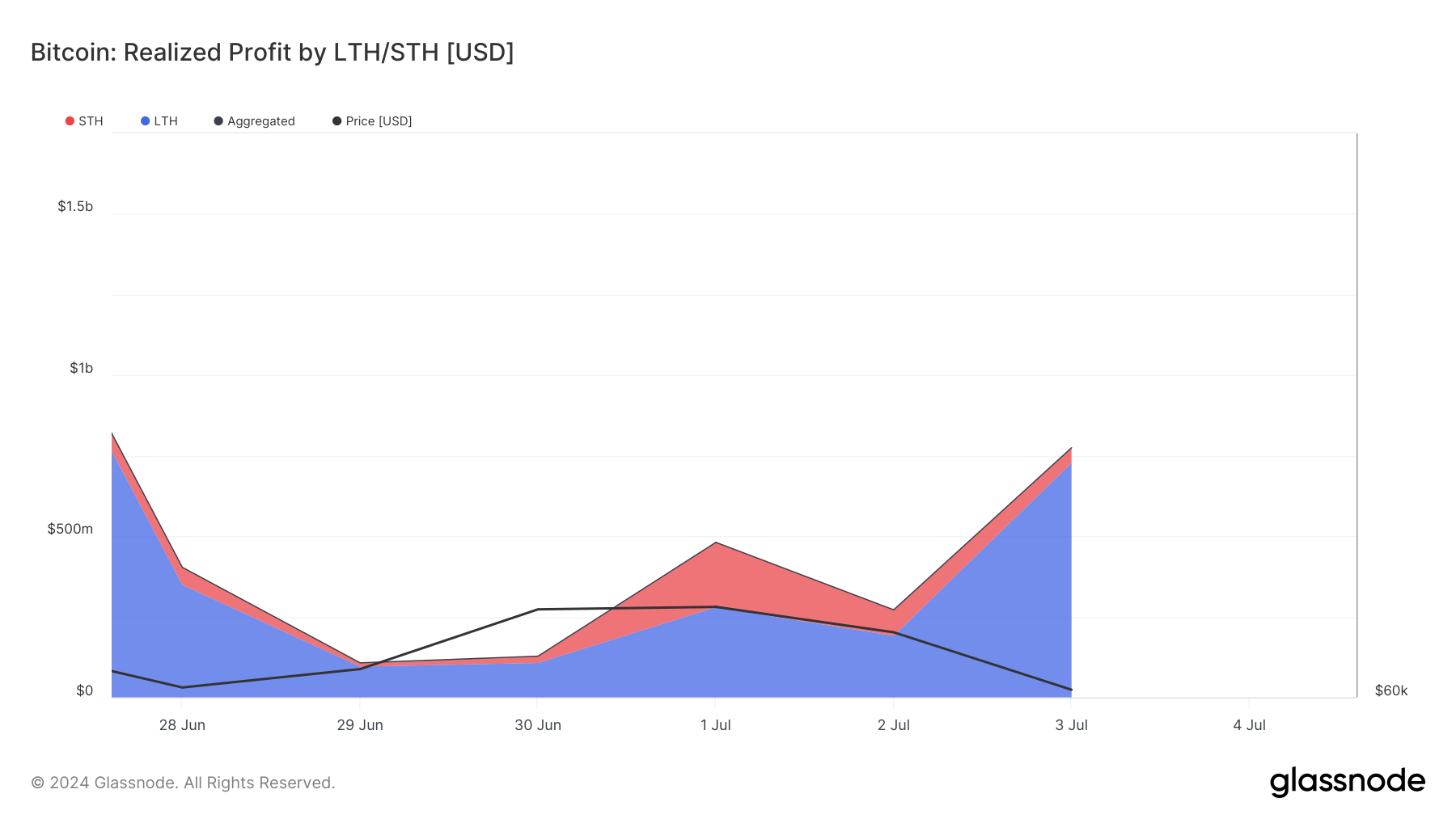

Chart showing the full magnitude of coins transferred from short-term holders successful nonaccomplishment to speech wallets from June 28 to July 3, 2024 (Source: Glassnode)The disparity betwixt LTHs and STHs is besides evident successful the quality successful realized profit. The realized nett percentages from semipermanent holders are importantly high, often exceeding 80% during this play and reaching up to 93.91% connected July 3. On June 28, LTHs realized important profits of $348.708 million, contrasting with STHs’ humble $54.773 million.

Interestingly, connected July 1, some groups realized important profits, with STHs astatine $201.597 cardinal and LTHs astatine $279.358 million, coinciding with a highest Bitcoin terms of $62,833. This suggests that some cohorts seized the accidental to fastener successful gains astatine this terms peak.

Graph showing the realized nett for semipermanent holders (blue) and short-term holders (red) from June 28 to July 3, 2024 (Source: Glassnode)

Graph showing the realized nett for semipermanent holders (blue) and short-term holders (red) from June 28 to July 3, 2024 (Source: Glassnode)This information paints a wide representation of the quality successful behaviour and strategies of these cohorts. Short-term holders amusement highly reactive behaviors, rapidly adjusting their positions and offloading important measurement based connected contiguous marketplace changes.

Long-term holders, connected the different hand, amusement a much strategical and calculated response. The disparity successful their behaviour shows a marketplace successful a authorities of flux, with terms movements and volumes showing a operation of profit-taking and loss-mitigation strategies.

The station Long-term holders recognize each of the nett and nary of the losses appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)