In today’s micro update from Capriole, laminitis Charles Edwards presented a compelling investigation that draws parallels betwixt the existent debased volatility of Bitcoin and its humanities behaviour successful 2016. With Bitcoin’s terms stagnating astir the $29,000 mark, experts are intimately watching for signs of a imaginable bullish breakout.

“Bitcoin’s terms remains astatine $29K, successful a sideways consolidation that has created 1 of the implicit lowest volatility periods successful Bitcoin’s 14 twelvemonth history,” Edwards states. This prolonged play of debased volatility is reminiscent of 2016, suggesting that a important terms question could beryllium imminent.

Bitcoin Breakout Imminent?

While the technicals bespeak a bearish breakdown from the $30,000 mark, the lack of a downward momentum offers a glimmer of anticipation for bullish investors. “If terms was going to collapse, we would usually person seen that travel done by now,” the study notes. However, for a much factual bullish sentiment, “a adjacent backmost supra $30K connected the regular timeframe is required astatine the minimum arsenic a method confirmation of a failed breakdown.”

On the cardinal front, Bitcoin’s on-chain information continues to contract, albeit astatine a decelerating rate. The imminent decisions connected several Bitcoin ETF approvals could perchance disrupt the existent debased volatility phase. “An support could origin a interruption from the existent debased volatility range. Best not to pre-empt this though, arsenic these decisions often get pushed. Confirmations are cardinal to mitigate risk,” Edwards cautions.

Diving deeper into the technicals, the study highlighted 2 cardinal observations:

Since 2010, Bitcoin’s historical volatility has lone been little than contiguous successful 2016. Suggesting a large terms determination is connected the skyline erstwhile volatility enlargement (reversion to the mean) occurs.

Bitcoin’s $30K breakdown has (so far) failed to travel through… A adjacent backmost into the Wyckoff operation astatine $30K would signify a failed breakdown and truthful beryllium a precise affirmative method signal.

BTC On-Chain Indicators Are Neutral

Capriole’s Bitcoin Macro Index, a broad instrumentality that amalgamates implicit 40 Bitcoin on-chain, macro market, and equities metrics into a instrumentality learning model, presently scores astatine -0.36, indicating “Contraction”. This suggests that portion the short-term outlook remains neutral, the semipermanent position appears bullish. Remarkably, this strategy takes long-only positions successful Bitcoin. In slowdowns and contractions, currency is held.

“The Macro Index contiguous remains successful a play of comparative worth (below zero), suggesting decent semipermanent worth for multi-year skyline investors,” the study elucidated.

A noteworthy summation to Capriole’s investigation toolkit is the “Bitcoin Production Cost” model, which evaluates the outgo of mining a Bitcoin based connected planetary mean electrical consumption. Currently, this exemplary indicates that Bitcoin is trading wrong a semipermanent worth region, with the study speculating, “I would beryllium amazed if this holds into 2024.”

In conclusion, the investigation from Capriole paints a representation of imaginable semipermanent worth amidst the existent bearish technicals. Drawing parallels with 2016, the study suggests that Bitcoin’s existent debased volatility signifier could beryllium a precursor to a bullish breakout.

“All other equal, Bitcoin is similar a formation shot submerged underwater. Nonetheless, we stay successful a method breakdown. We don’t cognize however agelong that manus volition clasp the shot underwater for. Prudent risk-management volition await a method confirmation earlier acting.”

With the cyclical quality of Bitcoin’s enlargement and contraction cycles, lone clip volition archer if past volition so repetition itself; particularly with the backdrop of a wholly antithetic macro environment. At property time, the BTC terms remained stagnant, trading astatine $29,445.

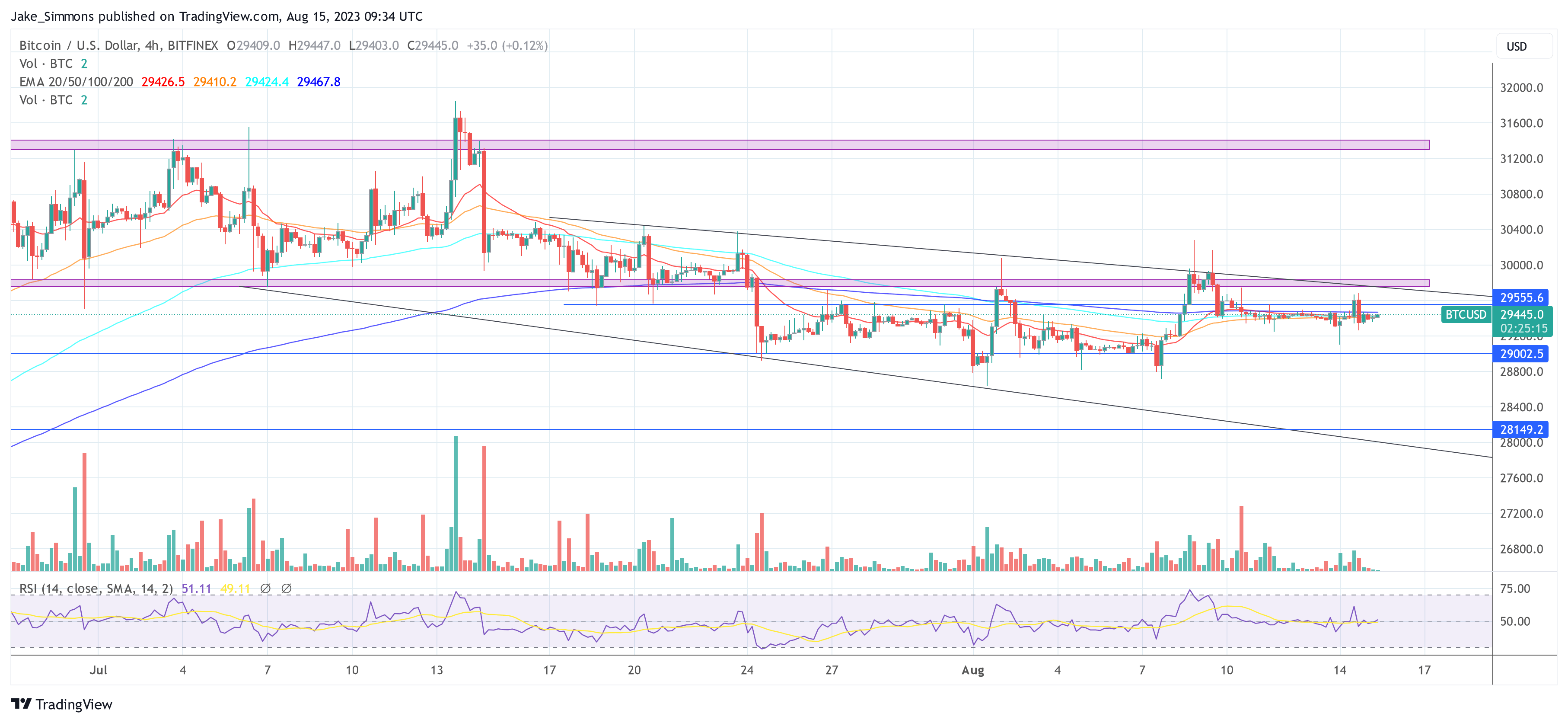

BTC terms remains stagnant, 4-hour illustration | Source BTCUSD connected TradingView.com

BTC terms remains stagnant, 4-hour illustration | Source BTCUSD connected TradingView.comFeatured representation from André François McKenzie / Unsplash, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)