Digital currency markets person slipped importantly successful worth during the past 2 weeks and the little prices person not sparked higher commercialized volumes. Data shows cryptocurrency spot marketplace measurement has slipped from $1.4 trillion successful November 2021, to this month’s $593 cardinal successful volume. Bitcoin futures unfastened involvement and volumes person dropped considerably implicit the past 2 months arsenic well.

Crypto Volumes Slide Month-Over-Month Since November

When crypto markets shed important value, traders typically look to spot if commercialized measurement increases successful bid to enactment the existent prices. Since a fig of coins tapped all-time precocious prices during the 2nd week of November, crypto spot marketplace measurement has continued to slide.

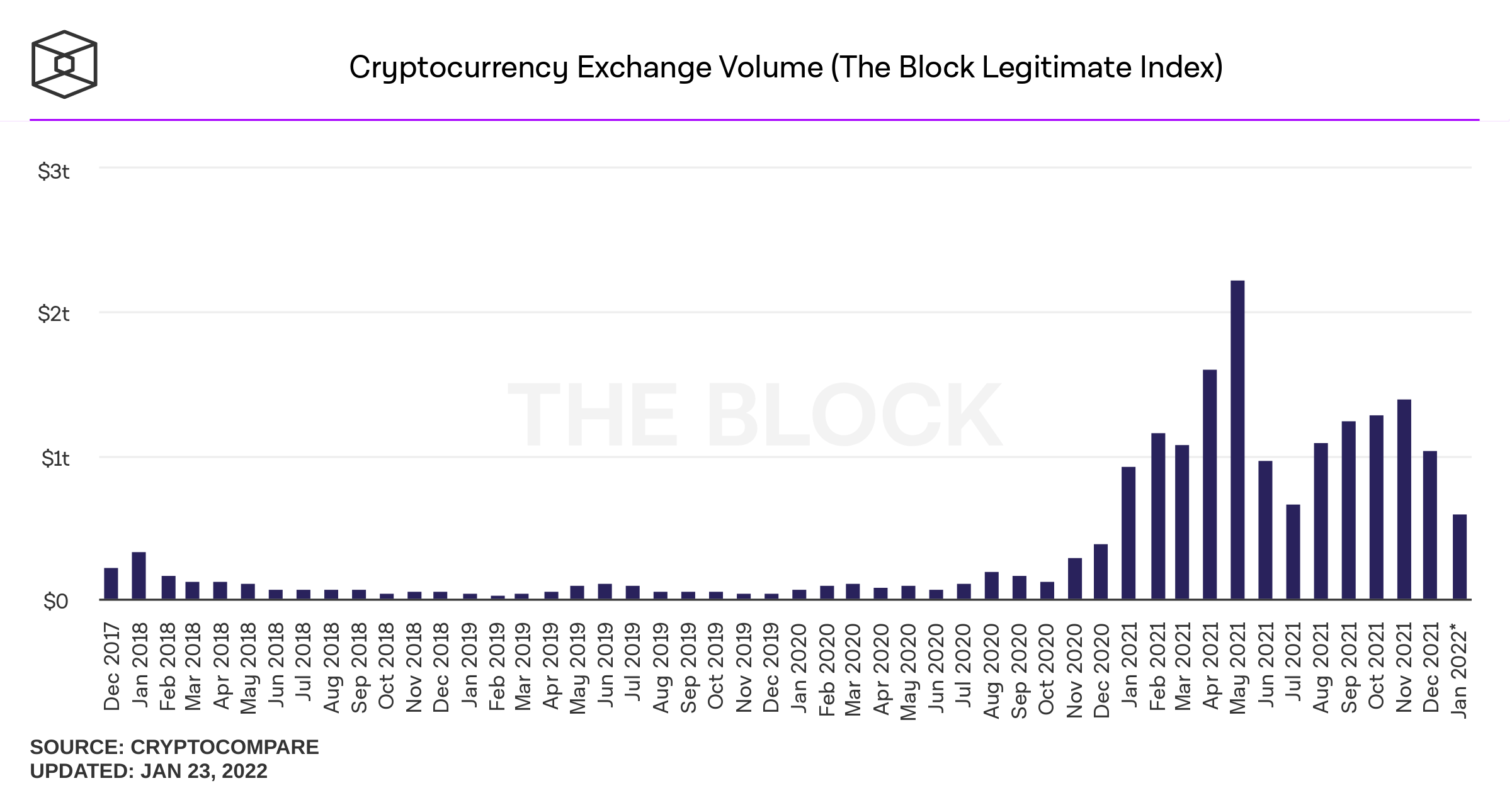

Data from theblockcrypto.com’s exchange measurement dashboard, which sources information from cryptocompare.com metrics, indicates spot marketplace measurement has fallen month-over-month since November.

While November saw $1.4 trillion, December saw a recorded $1.04 trillion. While information is incomplete for the period of January 2022, truthful acold $593 cardinal successful measurement has been settled.

Even though November’s spot marketplace measurement was larger than December’s and the 3 weeks of January, the $2.23 trillion successful measurement recorded successful May 2021 was treble the size. Daily speech volume has followed the aforesaid signifier arsenic regular crypto commercialized volumes are little than they were 2 months ago.

On November 2, 2021, $53.27 cardinal was settled that day, portion information from January 22, 2022, shows $24.65 billion. While monthly and regular crypto-asset spot marketplace volumes person dipped, the aforesaid tin beryllium said for derivatives markets similar futures and options.

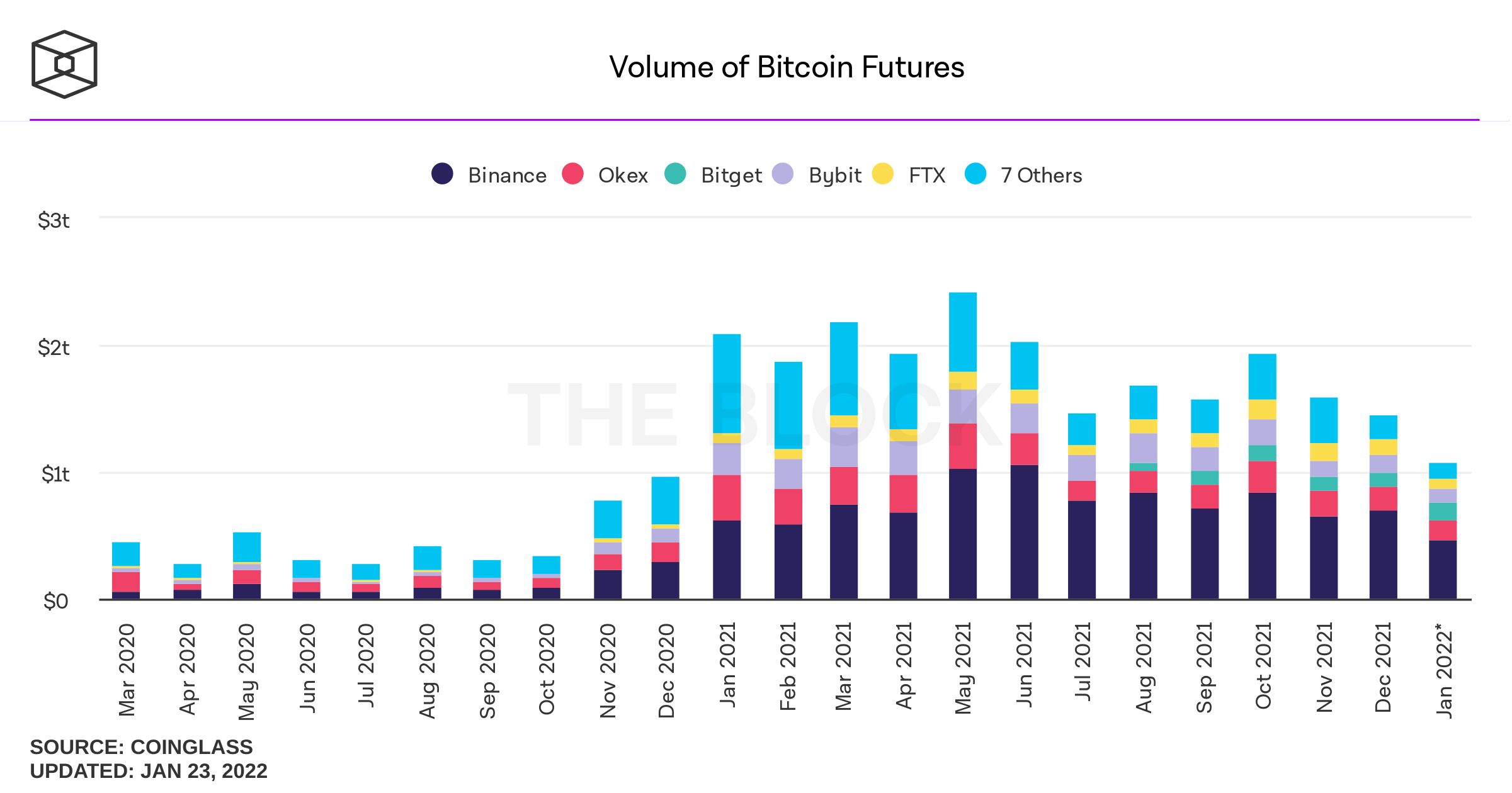

When BTC tapped an all-time terms precocious connected November 10, 2021, the pursuing time $28 cardinal successful bitcoin futures unfastened involvement was recorded. January 22 metrics bespeak $14.64 billion successful unfastened involvement was recorded crossed a slew of bitcoin futures exchanges.

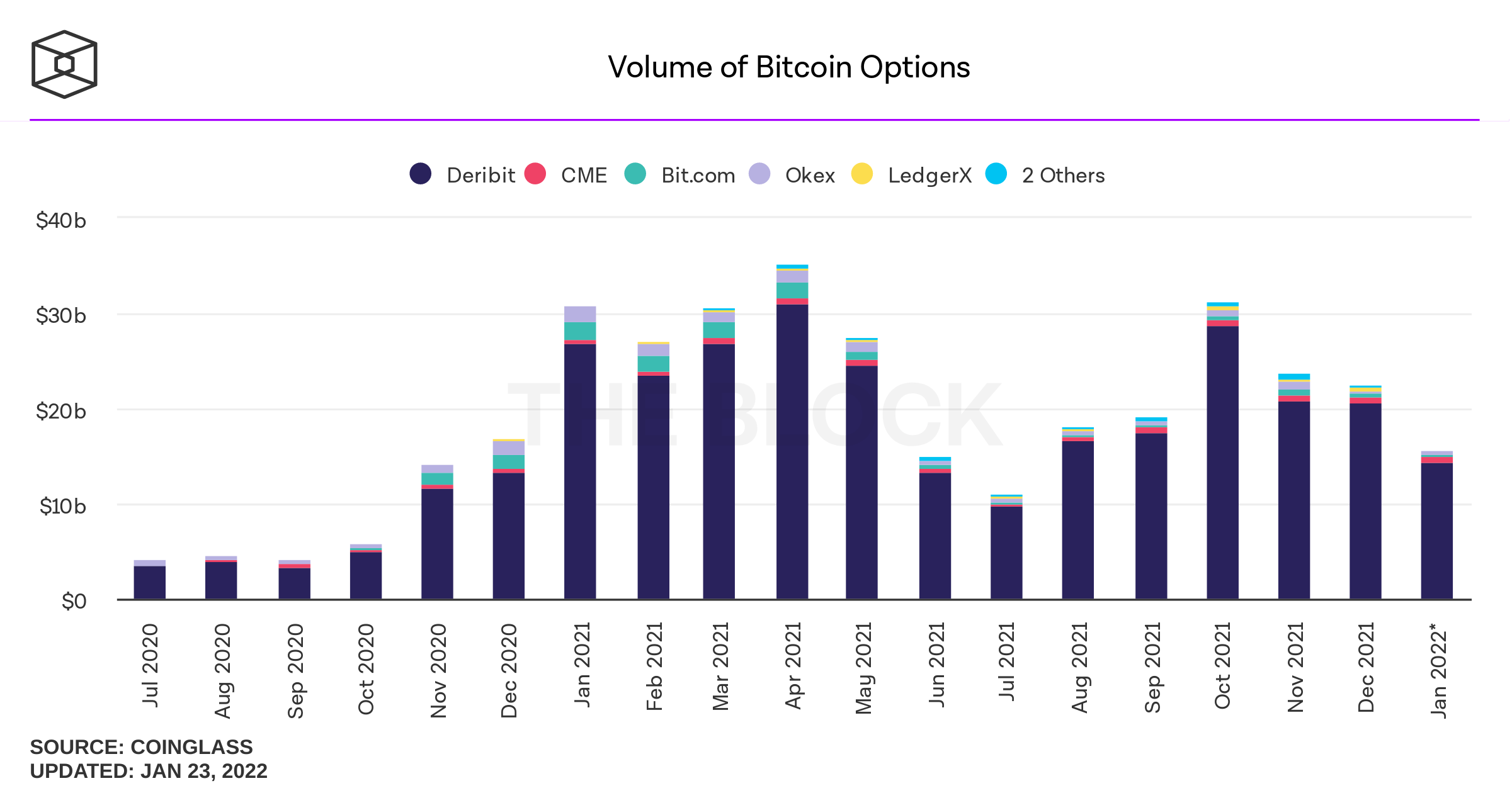

Regarding bitcoin futures volumes, they were higher successful October than they were successful November. $1.94 trillion was recorded past October and this month, there’s lone been $1.08 trillion recorded truthful far. Aggregated unfastened involvement and volumes tied to bitcoin options person besides dropped month-over-month for the past 2 months.

For the astir part, the debased volumes crossed crypto spot markets and derivatives person affected the crypto system negatively. Up measurement typically indicates bullish trading, but that hasn’t been the lawsuit successful caller times.

Tags successful this story

Bitcoin, Bitcoin (BTC), BTC, Coinglass, crypto assets, Cryptocompare stats, data, derivatives markets, Digital Assets, down volumes, ETH, Ethereum (ETH), Exchanges, Futures, January 22, market updates, Markets, markets and prices, metrics, November 10 2021, options, Prices, Spot Markets, Stats, theblockcrypto.com stats, Trading Platforms

What bash you deliberation astir the measurement downturn successful crypto markets successful caller times? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, theblockcrypto.com dashboard,

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)