The proviso of LUNA, the autochthonal token of the Terra blockchain, fell to an all-time-low level connected Tuesday – a price-boosting dynamic that's seen by crypto analysts arsenic an indicator of however fashionable the task remains contempt nagging concerns astir its sustainability.

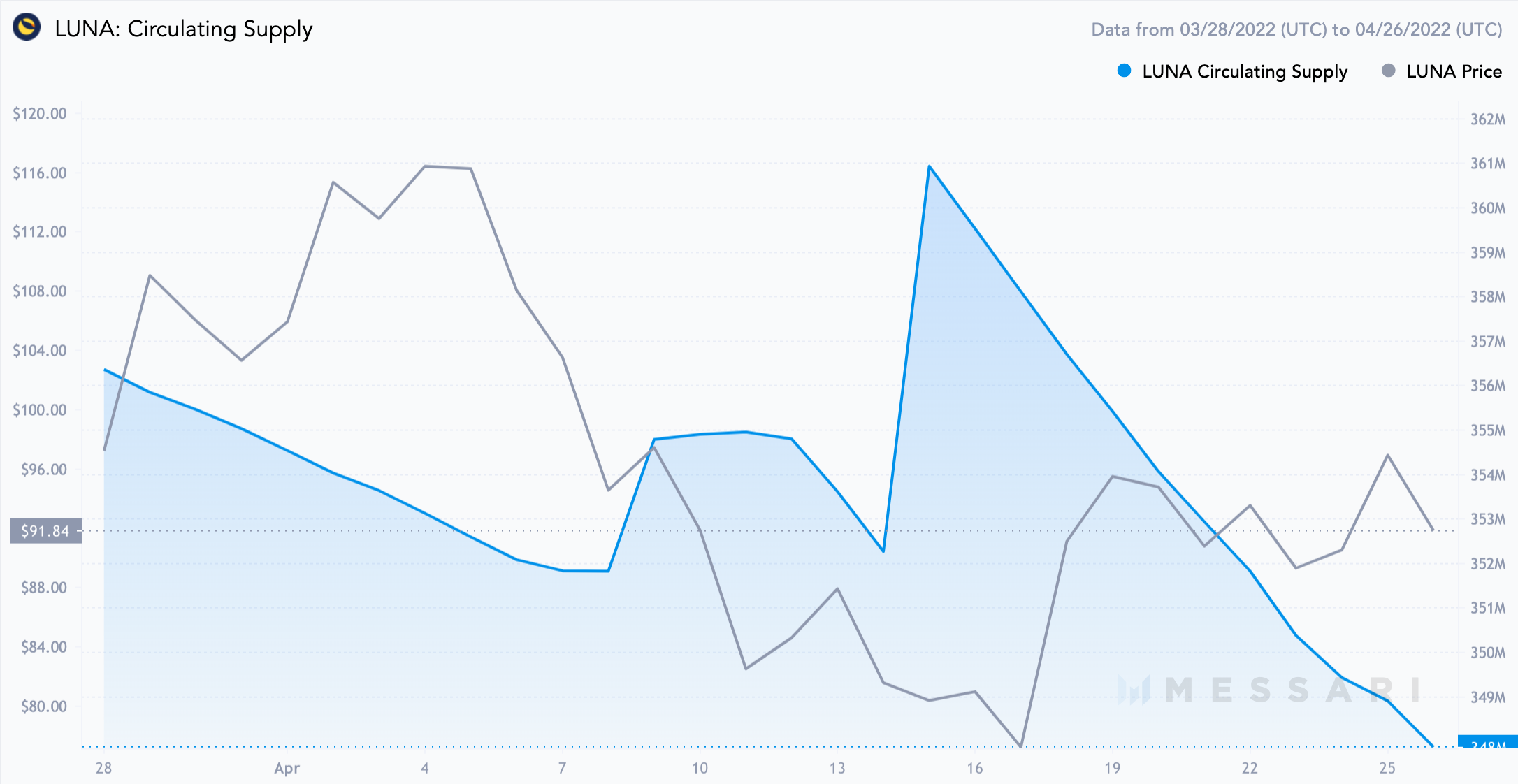

LUNA's circulating proviso – the fig of tokens connected the marketplace – slid to 346 million, down from 355 cardinal a period earlier and a precocious of 482 cardinal past November, according to Smart Stake, a information tracker level focused connected the Terra ecosystem. The liquid proviso – the fig of coins disposable connected the marketplace that are not locked for staking – dropped to 90 cardinal for the archetypal clip ever.

A little proviso of LUNA has helped to bolster the token's terms successful cryptocurrency markets; the terms hit an all-time-high of $119 connected April 5.

“This results successful a ample terms question for the LUNA plus arsenic determination is not lone important buying, but besides important proviso reduction," said Dustin Teander, expert astatine blockchain information level Messari, said. "Both forces propulsion the LUNA terms higher, starring america to wherever we are now.”

The Terra blockchain, founded and developed by South Korea-based Terraform Labs, has expanded rapidly from its roots arsenic a crypto outgo protocol for online purchases to caller ventures successful decentralized finance, gaming and non-fungible tokens. In the process Terra’s autochthonal token LUNA and algorithmic stablecoin UST person leapt into the ranks of the apical performing cryptocurrencies successful 2022. The task besides has drawn scrutiny astir however sustainable its maturation is.

The destiny of LUNA’s terms is intimately linked to UST, arsenic the LUNA token is indispensable to support the terms of Terra’s stablecoin, UST, anchored to $1. The pricing mechanics to sphere the peg is built utilizing an algorithm – an inducement for traders to measurement successful and bring backmost the terms to the peg – that permanently destroys and creates LUNA tokens to equilibrium proviso and request for UST tokens.

When UST is supra $1, LUNA is burned to mint UST. Similarly, if request is debased for UST and the terms falls beneath $1, UST is burned to mint LUNA.

The request for UST exploded, sending its marketplace capitalization to $18 cardinal from $2 cardinal successful a year, arsenic depositors flocked the Anchor protocol, a lending and redeeming task built connected Terra, with its market-beating 19.5% yearly yield.

“In bid to get the 20% yield, radical needed to get UST, which progressive archetypal acquiring LUNA and burning it for UST,” Teander said.

Circulating proviso of LUNA has been connected a dependable diminution (Messari).

Still, it does not marque LUNA a deflationary asset.

If UST request stalls and investors fly the Terra ecosystem, UST volition beryllium burned to support up the terms peg, diluting the proviso of LUNA.

University of Calgary instrumentality prof Ryan Clements said to Coindesk TV that Terra’s maturation is apt “unsustainable,” calling each algorithmic stablecoins “inherently unstable” successful a research paper.

In an utmost situation, the resulting sell-off successful LUNA could trigger a downward spiral causing UST to suffer its peg, sending shockwaves to different parts of the cryptocurrency market, immoderate analysts person warned.

This twelvemonth truthful far, LUNA’s terms has held up comparatively good during a clip erstwhile astir cryptocurrencies person struggled, arsenic red-hot inflation, complaint hikes and geopolitical uncertainties thrust investors to merchantability risky assets from stocks to bitcoin.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)