When markets crook reddish and ostentation starts soaring, some regulators and consumers crook to CPI arsenic a gauge for the harm done by soaring prices but successful the chaos that ensues arsenic markets participate into a recession, 1 metric ever seems to beryllium overlooked — the M2 wealth supply.

The M2 is simply a measurement of the wealth proviso successful an system that includes currency and checking deposits, savings deposits, wealth marketplace securities, and assorted different clip deposits. The assets included successful M2 are little liquid than M1, which includes conscionable currency and checking deposits, but are usually liquid and tin beryllium rapidly converted to cash.

Central banks usage M2 to signifier monetary argumentation erstwhile ostentation arises, making it 1 of the astir important metrics erstwhile economies commencement to dilatory down.

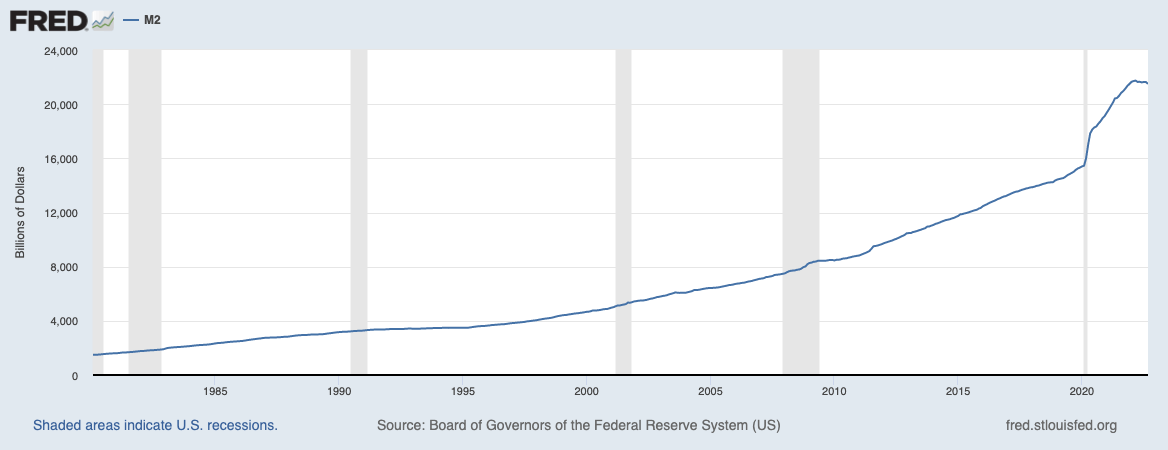

Looking astatine the data from the U.S. Federal Reserve shows that M2 has been increasing exponentially since 1980. Every clip the Federal Reserve attempted to trim its equilibrium expanse recession ensued. Periods of recession person historically sped up the maturation of M2, arsenic the Fed’s quantitative easing attack accrued the proviso of wealth successful the economy.

This is evident successful the Fed’s information — grey areas connected the graph beneath bespeak periods of recession and amusement the summation successful M2.

Graph showing the M2 wealth proviso successful the U.S. from 1980 to 2022 (Source: The Federal Reserve)

Graph showing the M2 wealth proviso successful the U.S. from 1980 to 2022 (Source: The Federal Reserve)Many economists judge that M2 is simply a overmuch amended gauge for ostentation than CPI. The coveted user terms scale tracks the mean summation crossed a handbasket of user products and is utilized to estimation the mean summation successful prices consumers experience.

However, CPI presents mean increases and has a inclination to amusement a overmuch little terms summation than consumers really experience.

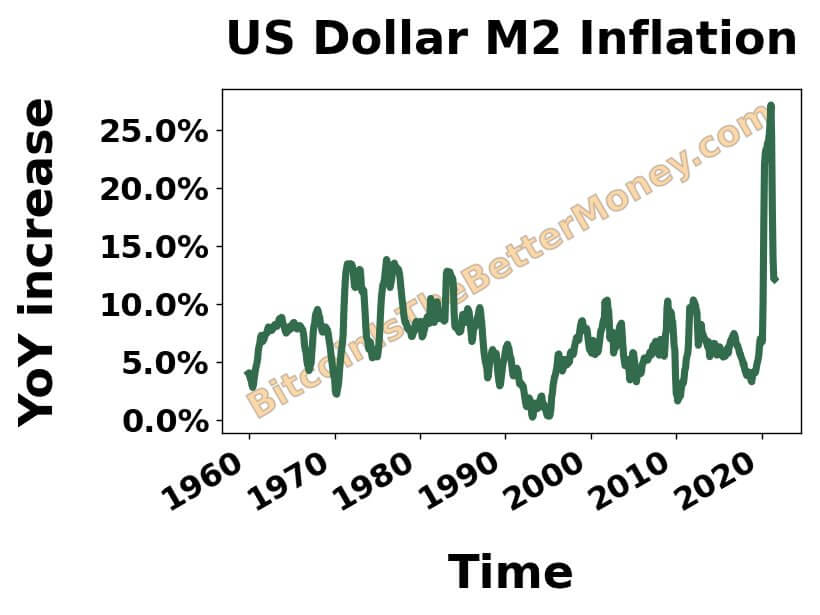

The latest numbers enactment the CPI summation astatine astir 8%. However, consumers person felt a terms summation that acold exceeds 8%. Looking astatine the summation successful M2 paints a overmuch much realistic representation of terms increases.

The year-over-year summation successful M2 presently stands astatine supra 25% and feels much successful enactment with what consumers experience.

Graph showing the YOY summation successful M2 (Source: BitcoinIsTheBetterMoney.com)

Graph showing the YOY summation successful M2 (Source: BitcoinIsTheBetterMoney.com)The increasing M2 wealth proviso isn’t lone a gauge for ostentation — it’s besides a coagulated indicator of Bitcoin’s performance.

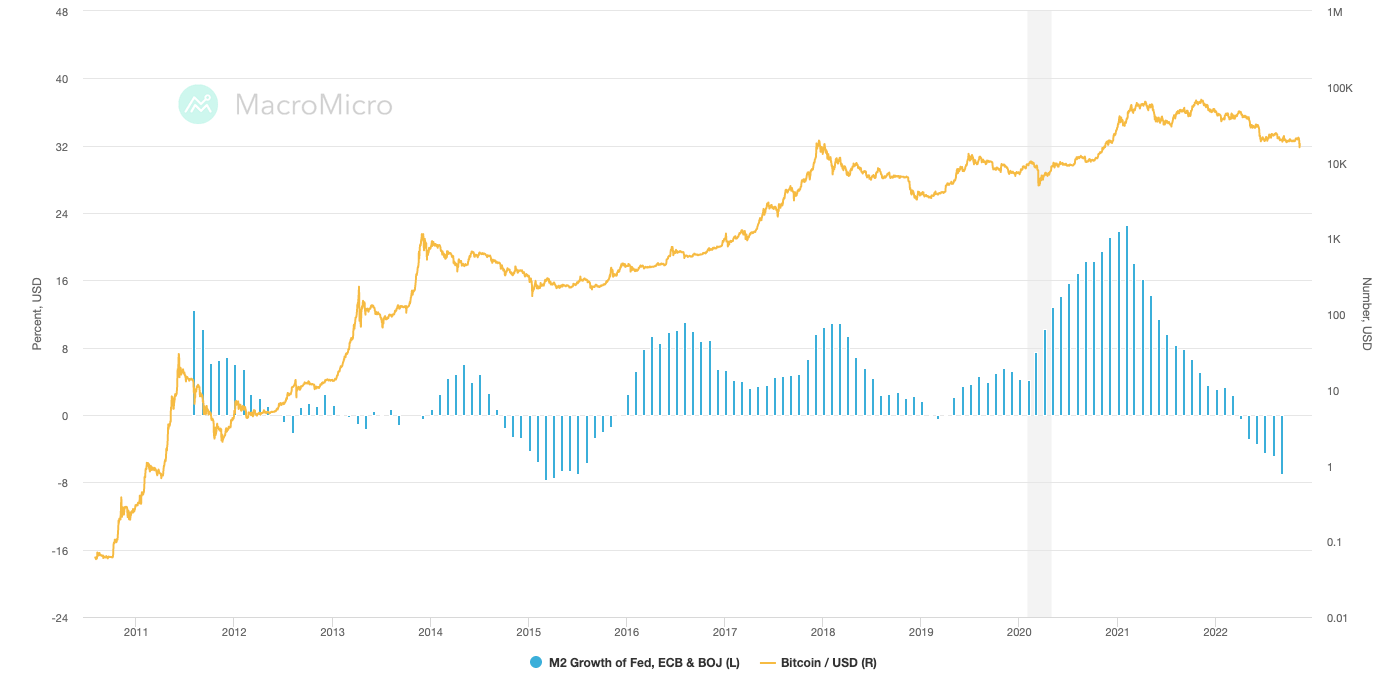

The planetary M2 plays a cardinal relation successful Bitcoin’s terms movements — erstwhile it shrinks, Bitcoin’s terms drops. When the M2 grows, Bitcoin’s terms grows arsenic well.

Looking astatine the data for the Federal Reserve, the European Central Bank (ECB), and the Bank of Japan (BOJ) shows the correlation betwixt M2 and Bitcoin’s performance. Every clip the planetary M2 grew Bitcoin’s terms saw a parabolic tally that triggered a bull market. Every clip it decreased, Bitcoin experienced a slump that led to a carnivore market.

In 2015, 2019, and 2022 the Federal Reserve embarked connected an assertive quantitative tightening spree. Each of those years Bitcoin’s terms deed a bottom.

Graph showing the M2 maturation of the Federal Reserve, ECB, and BOJ compared to Bitcoin’s terms from 2011 to 2022 (Source: MacroMicro)

Graph showing the M2 maturation of the Federal Reserve, ECB, and BOJ compared to Bitcoin’s terms from 2011 to 2022 (Source: MacroMicro)It’s inactive excessively aboriginal to foretell however Bitcoin volition respond successful this rhythm of quantitative tightening. The existent M2 wealth proviso successful the U.S. stands astatine astir $21.5 trillion and is continuing to somewhat alteration since peaking astatine $21.7 trillion successful March this year.

The dropping M2 correlates with Bitcoin’s terms slump. If it continues the downward inclination Bitcoin’s terms could neglect to retrieve and regain its yearly high. However, for the existent credit-based system successful the U.S. to stay a credit-based economy, the proviso of U.S. dollars indispensable proceed to rise. In the agelong run, the endless rhythm of printing wealth could beryllium good for Bitcoin.

The station M2 wealth proviso could beryllium a amended measurement of ostentation than CPI appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)