Bitcoin is holding dependable astir $108,716, according to CoinDesk Data, but down the level terms enactment are signs of a imaginable breakout arsenic some retail and institutions ramp up accumulation.

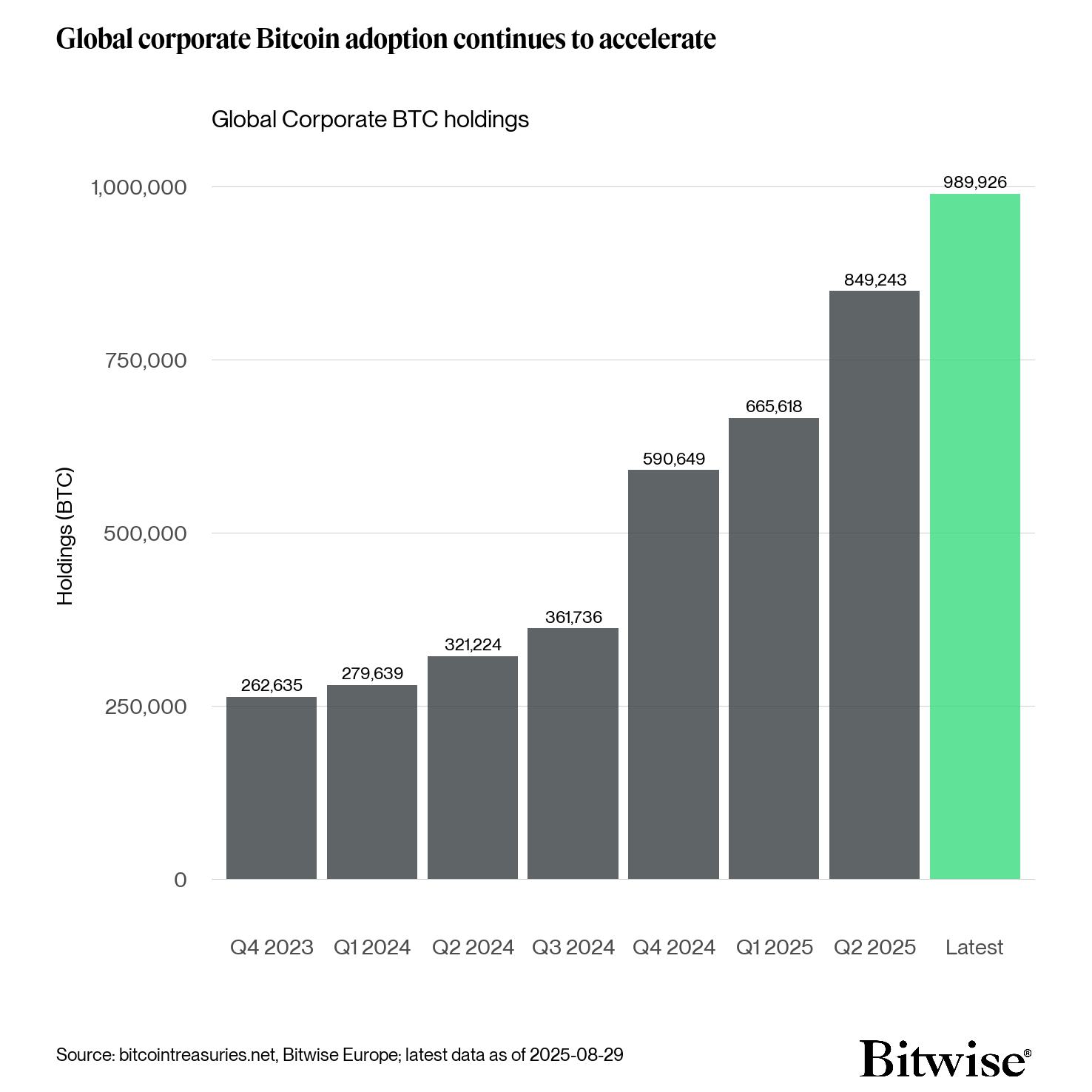

On Aug. 29, André Dragosch, European caput of probe astatine Bitwise, noted that firm adoption of bitcoin has accelerated astatine a historical pace. He said that July and August unsocial saw the instauration of 28 caller bitcoin treasury companies and an summation of much than 140,000 BTC successful aggregate firm holdings.

That fig is astir equivalent to the full magnitude of caller bitcoin mined successful a twelvemonth (which is astir 164,000 BTC), underscoring however request from treasuries is soaking up proviso faster than it is produced.

The accompanying Bitwise illustration showed a steep upward curve, highlighting however companies are progressively treating bitcoin arsenic a reserve plus successful the mold of Michael Saylors' Strategy (MSTR).

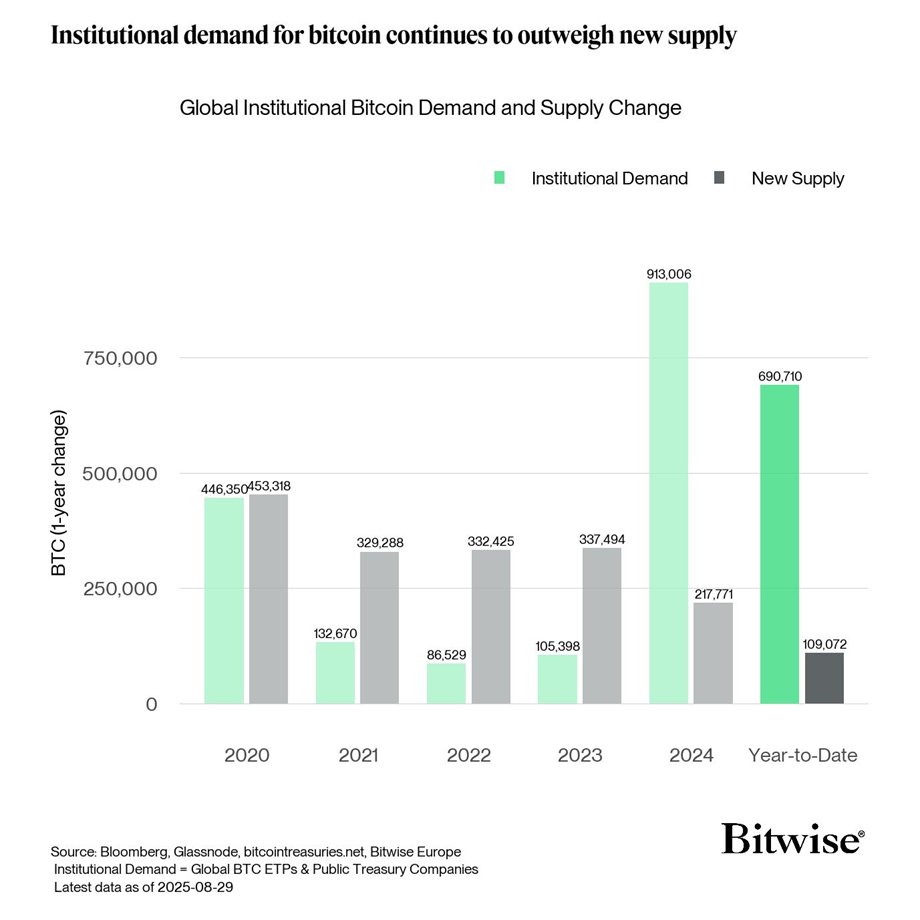

Moments later, Dragosch addressed a fashionable communicative among analysts that bitcoin could “top out” successful 2025 due to the fact that of post-halving rhythm patterns seen successful earlier years. He argued that specified reasoning overlooks the standard of organization request today.

His illustration showed that arsenic of Aug. 29, 2025, organization request has absorbed implicit 690,000 BTC, compared with a caller proviso of conscionable implicit 109,000 BTC, making request astir 6.3 times larger than supply.

While Dragosch described it arsenic astir 7 times, the precise ratio inactive illustrates an bonzer imbalance that challenges humanities rhythm comparisons. For investors, the accusation is that halving-driven proviso dynamics whitethorn substance little successful the existent epoch of organization adoption.

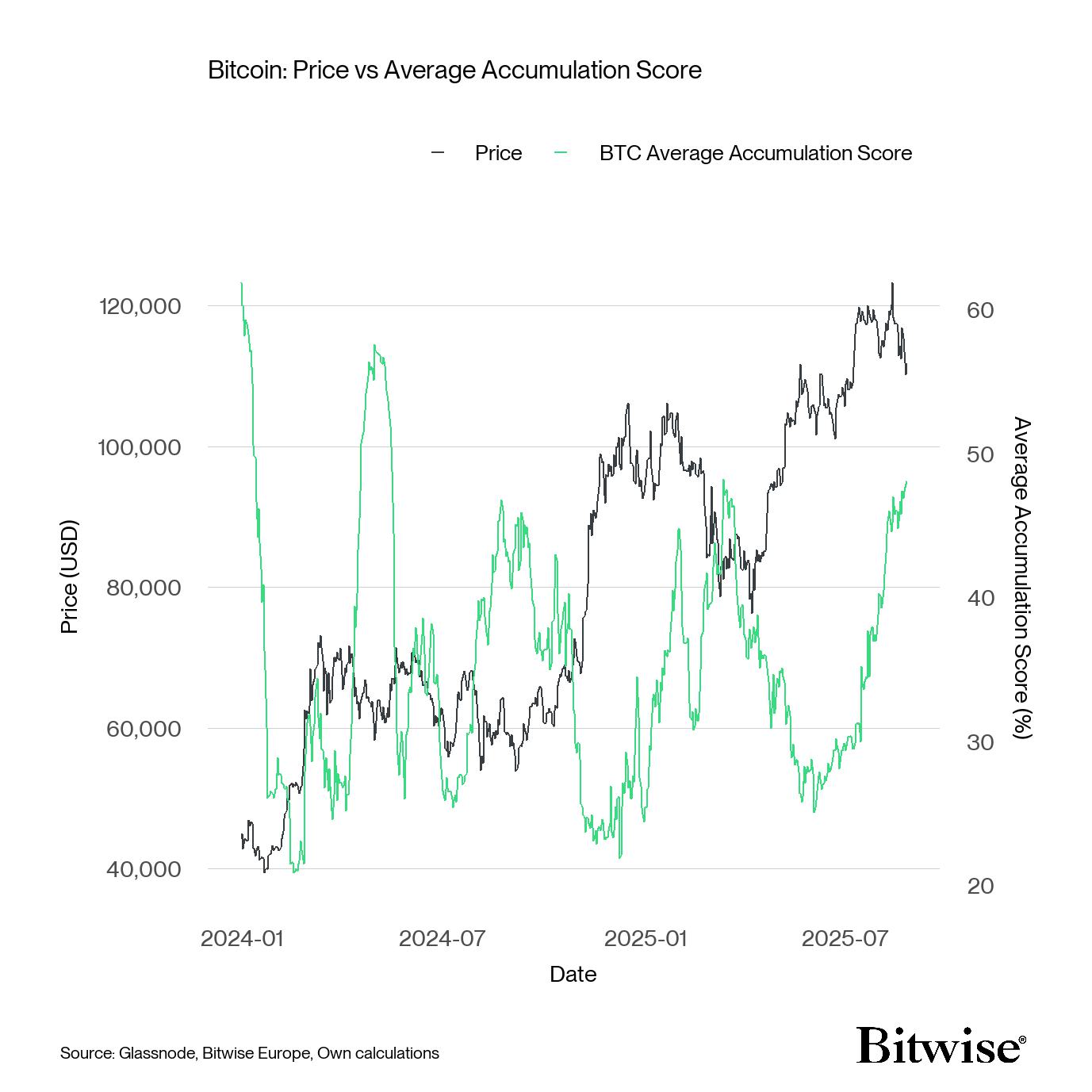

Two days earlier, connected Aug. 27, Dragosch pointed to retail buying arsenic different driver. He said the complaint of accumulation crossed each bitcoin wallet cohorts — from tiny holders to whales — had reached its highest level since April. In his words, investors look to beryllium “stacking relentlessly.”

The Bitwise illustration attached showed crisp upward moves crossed wallet groups, suggesting that retail request is lining up with organization flows. Historically, synchronized accumulation crossed cohorts has often preceded large upside moves, making the existent situation notable for bulls.

Despite the accumulation of data, bitcoin is small changed astatine $108,716 successful the past 24 hours, according to CoinDesk Data, arsenic markets await clearer catalysts.

Price Analysis Highlights

(All times are UTC)

- According to CoinDesk Research's method investigation information model, betwixt Aug. 30 astatine 15:00 and Aug. 31 astatine 14:00, BTC traded wrong a $2,150 range, fluctuating betwixt $107,490 and $109,640.

- Heavy buying enactment emerged adjacent $107,800, wherever volumes exceeded regular averages, establishing a cardinal short-term floor.

- Resistance formed astir $109,600, wherever repeated rejections indicated profit-taking pressure.

- In the last 60 minutes of the investigation period, BTC swung from $109,250 to $108,700 earlier closing adjacent $108,900, showing continued volatility but unchangeable enactment levels.

Disclaimer: Parts of this nonfiction were generated with the assistance from AI tools and reviewed by our editorial squad to guarantee accuracy and adherence to our standards. For much information, see CoinDesk's afloat AI Policy.

3 months ago

3 months ago

English (US)

English (US)