The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

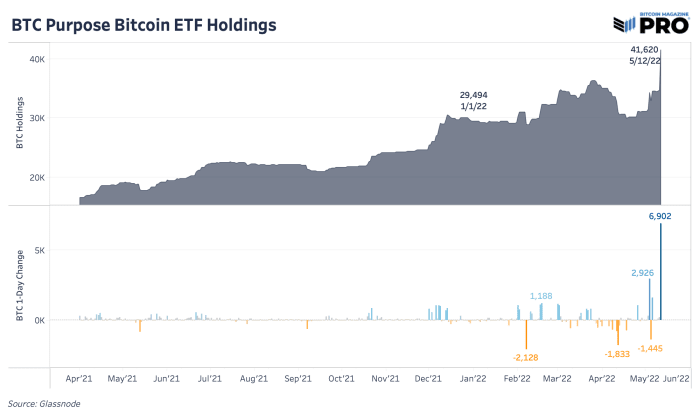

Thursday, May 12, 2022, was 1 of the astir breathtaking and progressive days successful the bitcoin/crypto marketplace successful months, with nary shortage of volatility and fearfulness from marketplace participants. On the bitcoin broadside of things, the terms plummeted to a debased of $25,300 connected ample volume, earlier rapidly rebounding and closing the regular candle astatine $28,900. With the autumn came a beardown effect from opportunistic investors looking to bargain the dip, arsenic shown by the Canadian Purpose Bitcoin ETF, which saw its largest time of inflows ever, adding 6,902 BTC worthy astir $207 million.

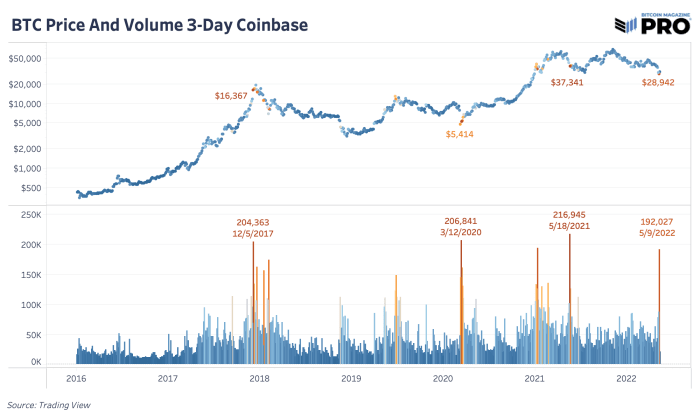

Similarly, Thursday saw the largest magnitude of bitcoin measurement traded successful a time connected Coinbase since May 19, 2021, signaling that a important magnitude of bitcoin changed hands connected the United States’ astir ascendant spot exchange. Looking astatine Coinbase 3-day measurement bars for bitcoin, ample spikes are typically signals of inflection points adjacent section bottoms oregon tops. While determination is evidently a full confluence of variables that request to beryllium taken into relationship erstwhile looking for implicit marketplace bottoms, a ample measurement spike successful spot markets and consequent bounce supra $30,000 for bitcoin is simply a promising sign.

This aligns with our macro presumption that the U.S. system is successful the midst of a ample stagflationary slowdown, which damages plus prices and leads to diminishing liquidity successful fiscal markets arsenic the Federal Reserve tightens monetary policy. As consumers proceed to get their wallets squeezed, the slowdown of economical enactment volition compound successful a affirmative feedback loop of diminishing maturation and economical activity.

Our halfway thesis is that this volition inevitably pb to further fiscal and monetary stimulus, arsenic the planetary system cannot grip a sustained economical slowdown owed to the mechanics of the debt-based monetary strategy we find ourselves successful today, with a grounds magnitude of indebtedness that needs to beryllium serviced and refinanced.

Subscribe to entree the afloat Bitcoin Magazine Pro newsletter.

3 years ago

3 years ago

English (US)

English (US)