For mining insight, others specified arsenic @Diverter and @Econoalchemist person published elaborate reports connected their experiences and lessons, helping others done the acquisition and avoiding pitfalls successful the mining space. I would similar to adhd to this compendium and code economical aspects, specifically, the question of mining versus outright purchases of bitcoin.

There are galore benefits to mining bitcoin, specified arsenic acquiring non-KYC bitcoin, enhanced privateness and contributing to the bitcoin ecosystem. Outside of these benefits lies a much nonsubjective benefit: The quantity of bitcoin 1 tin get with fiat. By solving however overmuch bitcoin 1 tin acquire, it clears immoderate of the uncertainty of the determination to beryllium made and reveals an absorbing broadside benefit: By focusing connected the quantity of bitcoin, 1 tin disregard speech rates backmost to fiat.

Thinking successful bitcoin presumption makes fiat sound autumn distant and you tin absorption connected the hard-money awesome bitcoin provides, identifying the way that provides much bitcoin. I americium not suggesting different benefits are to beryllium disregarded, but determining which facet delivers much bitcoin improves your wide investigation and decision-making. When 1 considers economical outcomes successful bitcoin presumption — the purest signifier of currency connected the satellite — 1 divests baggage associated with accepted concern and agenda-pushing rent-seekers. By archetypal knowing however overmuch bitcoin each alternate volition supply you, you tin determine for yourself if the subjective benefits are worthy the quality successful the magnitude of bitcoin.

Miner marketplace prices are driven by buyers with debased operational costs. Buyers with debased operational costs are capable to walk much connected a miner for a fixed instrumentality and outbid setups with higher operational costs, resulting successful a higher marketplace price. Whether the marketplace terms is the “right” terms for your ain concern depends connected however inexpensively you are capable to instal and tally a miner, and what magnitude of aboriginal planetary hashrate maturation you are comfy with, implied by the miner’s cost.

Putting these concepts into practice, immoderate basal rules of thumb that mightiness assistance anyone facing the aforesaid questions.

Bitcoin Miner Annuity

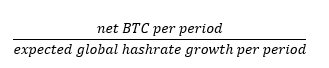

A elemental look for calculating a miner’s break-even terms versus the existent outgo is to measurement the nett bitcoin received implicit a abbreviated interval divided by the estimated hash complaint maturation implicit the aforesaid interval. The effect is the estimated magnitude of bitcoin received by mining into the foreseeable future. This look is comparative to valuing a shrinking bitcoin annuity. If the effect of the calculation is adjacent oregon greater than the miner’s outgo successful bitcoin, it indicates mining bitcoin volition bring the miner’s proprietor much bitcoin implicit clip compared to purchasing bitcoin today. Exceptions for this look beryllium astir timing until halving and complaint of planetary hashrate growth, estimates used, however to incorporated the simplification of bitcoin revenues aft the adjacent halving, etc., but that is what spreadsheets and online mining calculators are for, and determination are a fig of bully resources disposable should you privation a much elaborate analysis.

Inputs Matter

Of the galore inputs for determining miner profitability, wage attraction to 3 inputs that person the astir interaction connected the analysis: Your estimation of the planetary hashrate growth, upfront outgo of your miner and energy costs. Of course, determination are galore much variables that interaction the nett bitcoin generated by a miner; you request to analyse this for your ain situation. When it comes to these 3 aforementioned inputs, wage peculiar attraction to the outgo of the miner, and adjacent person attraction to the estimated hash complaint growth. A miner’s marketplace terms implies a planetary hash complaint maturation complaint for a fixed acceptable of costs: Low energy costs are important, but 1 tin perchance make much nett bitcoin than the outgo of the miner with precocious energy costs arsenic agelong arsenic the outgo of the miner was sufficiently low. However, it is imaginable to not recoup the upfront costs erstwhile 1 has underestimated planetary hash complaint maturation and overpaid for the miner.

No Discounts

The risk-free complaint of bitcoin is zero. This is heresy to immoderate fiscal wizards, but determination it is. Bitcoin’s issuance codification could beryllium efficaciously considered an ostentation rate; it tin beryllium incorporated into the investigation should 1 consciousness it amended represents the “time value” of bitcoin erstwhile looking astatine existent rates crossed antithetic currencies, but remember, we are measuring our show successful bitcoin presumption wherever transportation of aboriginal bitcoin is governed by the mathematics of bitcoin, letting america simplify our investigation with a discount complaint of zero. Outside of the discount rate, 1 indispensable see the expected planetary hash complaint increase, oregon said differently, the complaint a miner’s revenues volition shrink successful each period.

Pulling these concepts together, this is the simplified look for the miner break-even value:

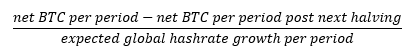

The interaction of the adjacent halving connected the annuity whitethorn beryllium incorporated by subtracting mislaid bitcoin revenues:

One could repeatedly adhd further reductions for consequent halvings, but for this elemental analysis, it mightiness beryllium overkill. It is important to enactment that the nett BTC per period, post–net halving, volition beryllium astatine the forecasted guardant planetary hash rate, and fixed caller past of hash complaint maturation and the clip to the adjacent halving, the worth successful (and beyond) the adjacent halving rhythm volition person debased interaction connected your investigation arsenic of the clip of this writing, but marque definite to cheque for yourself and your ain situation.

Coming afloat circle, bitcoin arsenic a non-sovereign wealth creates a zero, risk-free complaint currency allowing for a elemental examination for the mine-or-purchase decision. In a hypothetical world, the worth provided by a bitcoin miner would beryllium the terms wherever the purchaser deciding betwixt mining versus buying would beryllium indifferent to the prime made, but determination are galore drivers of mining’s value. Mining inputs and the galore benefits from mining alteration crossed the globe, and fixed a comparatively escaped market, a miner’s terms volition not apt beryllium adjacent to immoderate 1 individual’s hypothetical value. All is not mislaid for the prospective miner, arsenic this implies a divers marketplace wherever low-cost inputs beryllium and wherever worth is ascribed to bitcoin’s assorted aspects, tangibly demonstrating successful different mode that mining contributes worth supra and beyond the bitcoin generated.

This is simply a impermanent station by DP. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)