Bitcoin mining is the cornerstone of the crypto manufacture and the crypto market. At its core, the profitability of mining comes down to a single, important metric — the outgo of producing each bitcoin.

The value of this outgo becomes adjacent greater erstwhile it comes to publically traded Bitcoin mining companies, arsenic it’s fundamentally what keeps them operational and yet profitable. In this report, CryptoSlate volition absorption connected Marathon Digital and Riot Blockchain, 2 of the largest nationalist Bitcoin miners.

Marathon Digital (MARA) and Riot Platforms (RIOT) are 2 of the largest nationalist Bitcoin mining companies by marketplace cap. Their operational capableness and financials connection important insights into the authorities of Bitcoin mining astatine its highest and astir organized level.

While each nationalist Bitcoin mining companies, including Marathon and Riot, supply information connected their mining costs, there’s often much to the numbers they publish. Some companies usage antithetic accounting treatments for integer assets, which impacts their carrying value. Some companies person aggregate mining sites crossed assorted geographical regions, each with antithetic energy prices and mining capacities.

To amended recognize the mean outgo to excavation 1 bitcoin, CryptoSlate adopted an alternate attack — dividing the full costs of revenues for each institution by the fig of Bitcoins they produced. This method, albeit much speculative, promises a much telling reflection of existent mining costs.

Dividing the full costs of revenues by the fig of Bitcoins produced provides a broad presumption of the expenses incurred successful the mining process. This attack goes beyond conscionable the energy oregon operational costs, including each nonstop and indirect costs associated with mining, specified arsenic instrumentality depreciation, maintenance, staffing, and administrative expenses.

By aggregating these costs, this method shows what it genuinely costs a institution to excavation each Bitcoin. It accurately reflects the economical reality, capturing the afloat spectrum of expenses that interaction the bottommost line. This helps america recognize the ratio and profitability of Bitcoin mining operations and is simply a invaluable instrumentality for analysts and investors seeking to recognize mining companies’ fiscal wellness and operational efficacy.

Marathon Digital (MARA)

Marathon had a precise palmy 2023, expanding its operational capableness done acquisitions and caller mining equipment. The institution besides announced that its acquisitions enabled it to alteration operational costs by arsenic overmuch arsenic 30%, drastically influencing its profitability.

However, there’s small factual accusation coming straight from Marathon astir the company’s mining costs. A September analysis from Motley Fool enactment Marathon’s outgo to excavation 1 BTC astatine conscionable nether $19,000. The company’s latest monthly update for December 2023 lone states the increases successful hash complaint capableness and method details astir its mining show but contains nary accusation astir its mining costs.

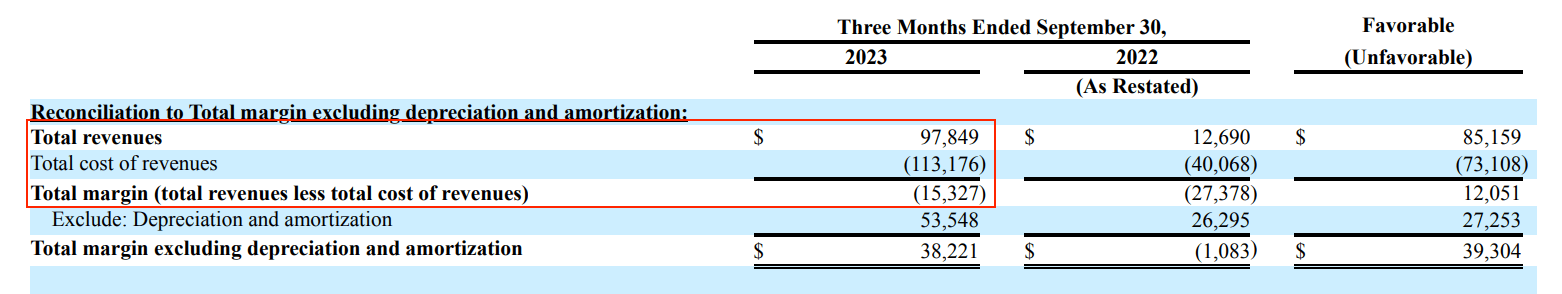

Our superior information root is the company’s 10-Q report for the 3rd 4th of 2023. To find the mean outgo of mining 1 BTC, we’ll employment the alternate method of dividing the full costs of revenues by the fig of Bitcoins produced successful the 3 months ending Sep. 30, 2023. Data from the study shows the full outgo of revenues arsenic $113.176 million. Subtracting the full borderline from the outgo of revenues puts it astatine $97.849 million.

Table showing Marathon Digital’s full gross and outgo of gross for Q3 2023 (Source: Marathon Digital)

Table showing Marathon Digital’s full gross and outgo of gross for Q3 2023 (Source: Marathon Digital)With the institution producing 3,490 BTC during the quarter, dividing the outgo of revenues by the fig of produced bitcoins brings america to a outgo of mining of astir $28,036.96.

Riot Platforms (RIOT)

Riot has spent the amended portion of 2023 implementing a semipermanent strategical program to assistance the institution enactment profitable aft Bitcoin’s halving successful April 2024. In its update for the 3rd 4th of 2023, the company’s CEO said its powerfulness strategy enabled it to trim its YTD outgo to excavation to $5,537 per Bitcoin.

This highly debased outgo tin beryllium attributed to Riot’s circumstantial concern strategy, which progressive earning powerfulness credits from the Electric Reliability Council of Texas (ERCOT). Riot participates successful ERCOT’s request effect program, which reduces energy depletion during highest request periods successful speech for powerfulness credits. These credits trim Riot’s energy costs, a large constituent of Bitcoin mining expenses.

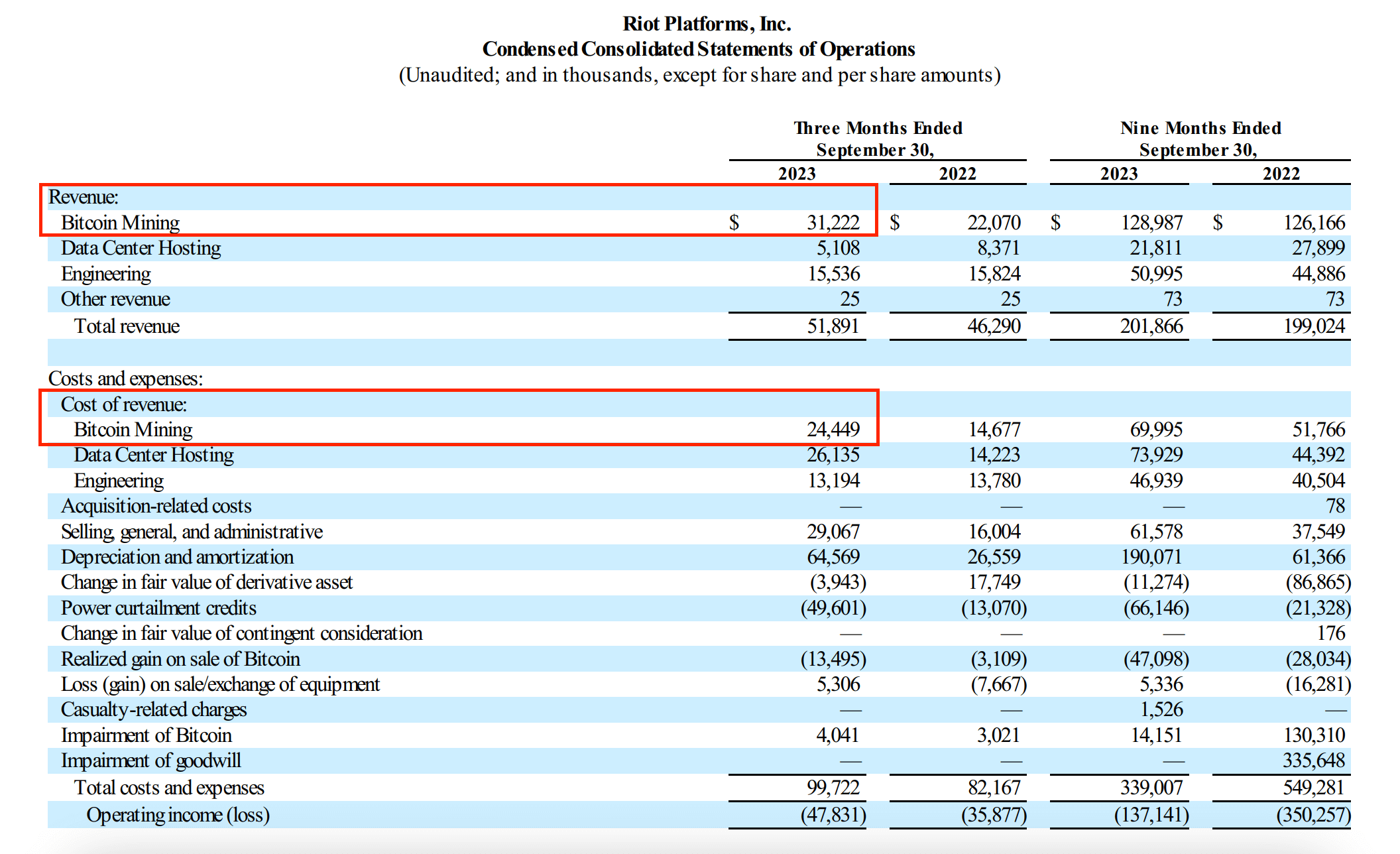

To get an mean outgo of mining 1 bitcoin for Riot, we’ll use the aforesaid methodology to Marathon – dividing the outgo of gross by the fig of bitcoins mined successful a fixed period. According to Riot’s 10-Q filing for the 3rd 4th of 2023, Riot’s outgo of gross for Bitcoin mining stood astatine $24.449 million. During this period, Riot mined 1,106 BTC.

Table showing Riot’s 10-Q filing for Q3 2023 (Source: Riot Platforms)

Table showing Riot’s 10-Q filing for Q3 2023 (Source: Riot Platforms)By dividing the full outgo of revenues circumstantial to Bitcoin mining by the fig of mined BTC, we find that Riot’s mean outgo for mining 1 Bitcoin successful the 3rd 4th was astir $22,105.78.

This puts Riot’s outgo for mining adjacent to Marathon’s $28,036.96. However, a captious constituent of Riot’s operational strategy is its engagement with ERCOT. During the 3rd 4th of past year, Riot received astir $49.6 cardinal successful powerfulness curtailment credits from ERCOT.

According to its 10-Q filing, if the $49.6 cardinal successful powerfulness curtailment credits for the 4th were straight allocated to Bitcoin mining outgo of gross based connected its proportional powerfulness consumption, it would alteration by $31.2 million. In this case, the adjusted outgo of gross would effect successful a antagonistic worth of -$6.751 million, showing that the credits would offset Riot’s archetypal cost.

Given this data, the mean outgo to excavation 1 bitcoin would beryllium astir -$6,105.78. While this is simply a highly improbable scenario, it shows however important the interaction of the powerfulness curtailment credits could beryllium connected Riot’s mining cognition and however overmuch it could lend to wide profitability.

The station Marathon vs Riot: Analyzing the existent outgo of mining 1 bitcoin appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)