The price of Ethereum has not precisely lived up to its committedness arsenic the period has gone on, contempt a stellar commencement to the month. While this bearish unit has been wide successful the wide cryptocurrency market, regularisation uncertainty has been an further interest for ETH, igniting a antagonistic sentiment astir the “king of altcoins.”

Interestingly, the latest on-chain revelation shows a important magnitude of Ethereum has made its mode to exchanges truthful acold successful March, suggesting that investors mightiness beryllium losing assurance successful the long-term committedness of the cryptocurrency.

Are Investors Losing Confidence In Ethereum?

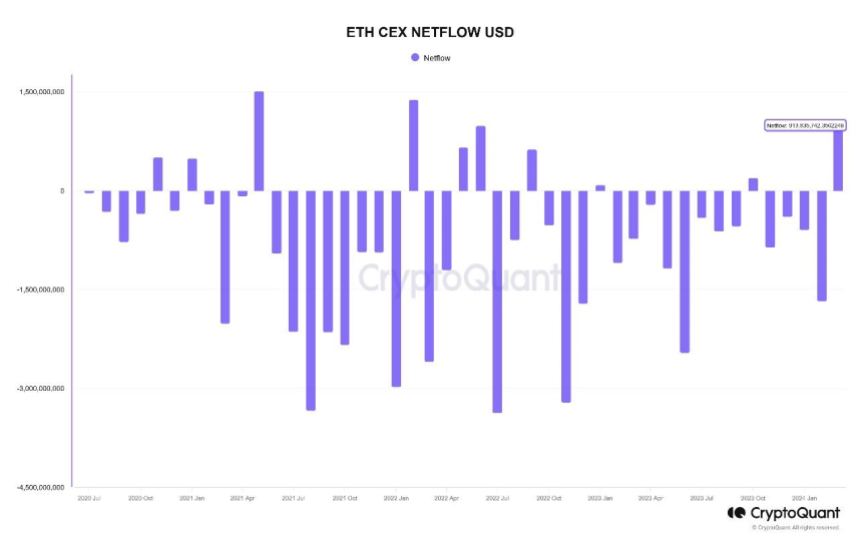

According to information from CryptoQuant, much than $913 cardinal has been recorded successful nett ETH transfers to centralized exchanges truthful acold successful March. This on-chain accusation was revealed via a quicktake post connected the information analytics platform.

This nett money question represents the largest measurement of Ethereum transferred to centralized exchanges successful a azygous period since June 2022. Even though March is inactive a week from being over, this speech inflow appears to beryllium a implicit deviation from the signifier observed implicit the past fewer months.

As shown successful the illustration above, October 2023 was the past clip cryptocurrency exchanges witnessed a affirmative nett flow. It is worthy noting that determination was important question of Ethereum tokens retired of the centralized platforms successful consequent months up until this month.

Meanwhile, a abstracted information constituent that supports the monolithic exodus of ETH to centralized exchanges has travel to light. Popular crypto expert Ali Martinez revealed connected X astir 420,000 Ethereum tokens (equivalent to $1.47 billion) person been transferred to cryptocurrency exchanges successful the past 3 weeks.

The travel of ample amounts of cryptocurrency to centralized exchanges is often considered a bearish sign, arsenic it tin beryllium an denotation that investors whitethorn beryllium consenting to merchantability their assets. Ultimately, this tin enactment downward unit connected the cryptocurrency’s price.

Substantial money movements to trading platforms could besides correspond a displacement successful capitalist sentiment. It could beryllium a motion that investors are losing religion successful a peculiar plus (ETH, successful this case).

Moreover, the caller regulatory headwind surrounding Ethereum specifically accentuates this hypothesis. According to the latest report, the United States Securities and Exchange Commission is considering a probe to classify the ETH token arsenic a security.

ETH Price

As of this writing, the Ethereum token is valued astatine $3,343, reflecting a 4% terms diminution implicit the past /4 hours. According to information from CoinGecko, ETH is down by 11% successful the past week.

Featured representation from Unsplash, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)