The pursuing is simply a impermanent station from Christina Comben.

I archetypal met Mark Moss astatine the entranceway to the media halfway by the main signifier astatine Bitcoin MENA successful Abu Dhabi, the archetypal authoritative Bitcoin league successful this portion of the world. We haven’t met earlier but from his acquainted drawl, infectious personality, and volumes of insightful contented (including a YouTube channel and best-selling publication The Uncommunist Manifesto), I consciousness I cognize him already.

Mark has been championing the benefits of Bitcoin to anyone who volition perceive since 2016 and was a serial entrepreneur agelong before.

“I started a concern successful 1999 astatine the tallness of the dot-com boom. That crashed. I started different concern successful 2001, an e-commerce business, it wasn’t easy,” helium laments. “It was unspeakable timing. Everyone laughed astatine maine and said, nary 1 would ever bargain thing online. I built that up and had a large exit connected it.”

From Orange County to Abu Dhabi

What brings him to Bitcoin MENA successful UAE’s opulent superior each the mode from his location successful Orange County?

“I’m an pedagogue and contented creator,” helium says. “I’m besides a spouse astatine a Bitcoin Venture Capital fund, truthful we put successful the businesses gathering connected and astir the Bitcoin ecosystem. I besides person a caller institution that conscionable went nationalist successful Canada called Matador, and that’s moving a Microstrategy play with Bitcoin arsenic a equilibrium expanse plus and investing done the Bitcoin Layer 2 space. So I’m actively educating and investing successful the abstraction to effort to physique the satellite that I privation to see.”

What benignant of a satellite is that? For Mark, it’s firmly Bitcoin, not crypto. He’s been connected the altcoin rollercoaster but sees nary different cryptocurrencies with “long-term” staying power. “I surely made a batch of money,” helium says, “a lot of money,” helium repeats with added emphasis. I hold for him to stock the accustomed cautionary communicative of holding a stash down to zero oregon getting rugged astatine the sh**coin casino, but helium says:

“In 2017 and 2018, we were competing for Layer 1s. Ethereum, Cardano, Litecoin, NEO… well, Bitcoin won that. So past the crypto communicative went to DeFi and that each fell apart, past crypto went to NFTs, and that each fell apart, and present it’s meme coins. No one’s pretending that’s world-changing technology.”

He concedes that meme coins (and altcoins successful general) whitethorn service immoderate intent arsenic a “gateway drug” successful bringing radical implicit to Bitcoin. “People travel for the wealth and they enactment for the freedom,” embarking connected their Bitcoin journeys and discovering wherefore they request permissionless, censorship-resistant wealth successful the archetypal place.

“I deliberation stablecoins pb to that arsenic well,” helium says, “eventually radical get utilized to having a wallet and transferring integer assets, but past they wonderment wherefore their U.S. dollar stablecoins bargain them less goods and services, and wherefore Bitcoin buys them more, and I deliberation yet it each benignant of funnels over.”

The Flawed Fiat System and the Magic Money Printer

Mark says the main occupation with fiat is that it has nary outgo of capital.

“When you commencement to recognize money, you recognize that if printing wealth made radical wealthy, wherefore don’t we conscionable people a batch more? Money has to person a existent outgo of capital. So gold, for example, I person to bargain onshore and get instrumentality and walk vigor and superior to get the gold, with Bitcoin, caller coins are lone released if you walk the wealth and bash the enactment to get them. So the superior has to person a existent cost. You can’t conscionable people wealth retired of bladed air, otherwise, we’d each beryllium rich.”

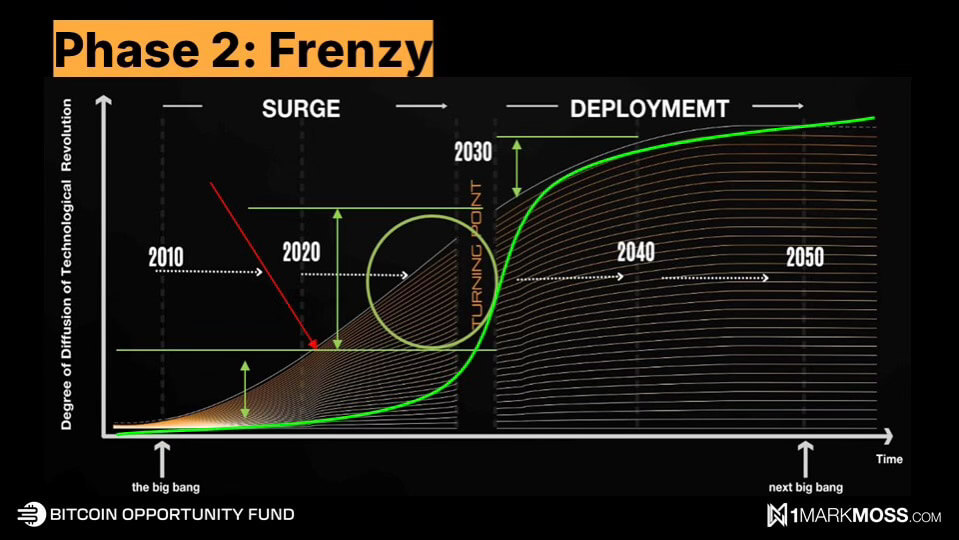

He points to the S-curve model for measuring Bitcoin adoption.

“The mode an S-curve works is the clip it takes to get to 10% adoption is the aforesaid clip it would instrumentality to get to 80-90%. So you tin spot that this 2nd signifier [between 2020 and 2030] is wherever we get the astir growth. We had retail adoption which brought [Bitcoin] to $1.2 trillion betwixt 2010 and 2020, and past with organization adoption, the 90% volition come.”

What does a satellite with 90% Bitcoin adoption look like? Is determination an inevitable illness of the fiat strategy and Armageddon connected the streets? Mark pauses and shakes his head.

“I deliberation 1 large misconception is radical deliberation that for Bitcoin to get to $1 cardinal [something Mark envisions cerca 2030] oregon $10 cardinal per coin, past that means that fiat is worthless and present it’s $1 cardinal for a gallon of gas, but that’s perfectly not true.”

A Readjustment of Store-of-Value Assets

He likens Bitcoin adoption to marketplace disrupters similar Uber and Airbnb saying,

“Airbnb takes a small spot from the hotels. It doesn’t mean hotels spell away, conscionable similar Uber continues to get much and much from taxis. Bitcoin is not taking distant from the dollar. Bitcoin is taking distant from different store-of-value assets, similar gold, equities, bonds, and existent estate.”

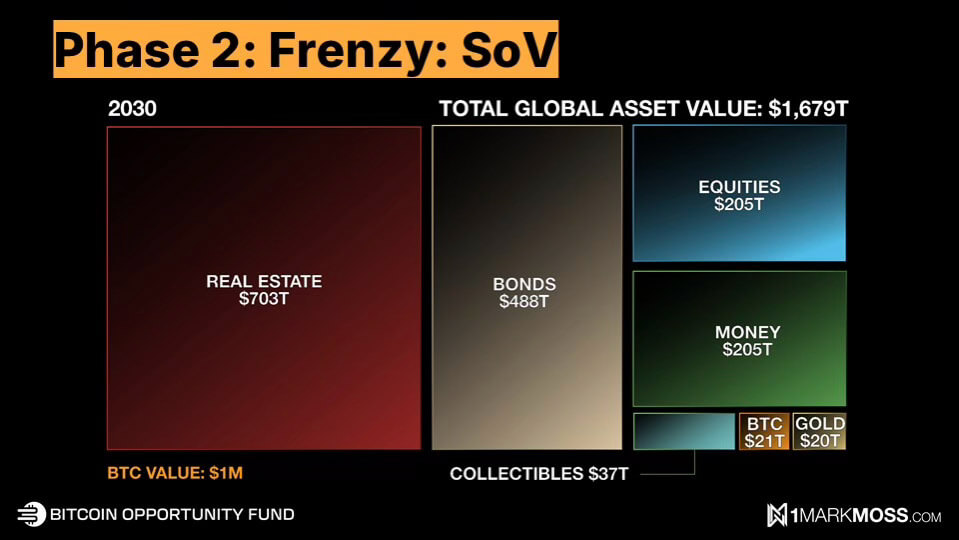

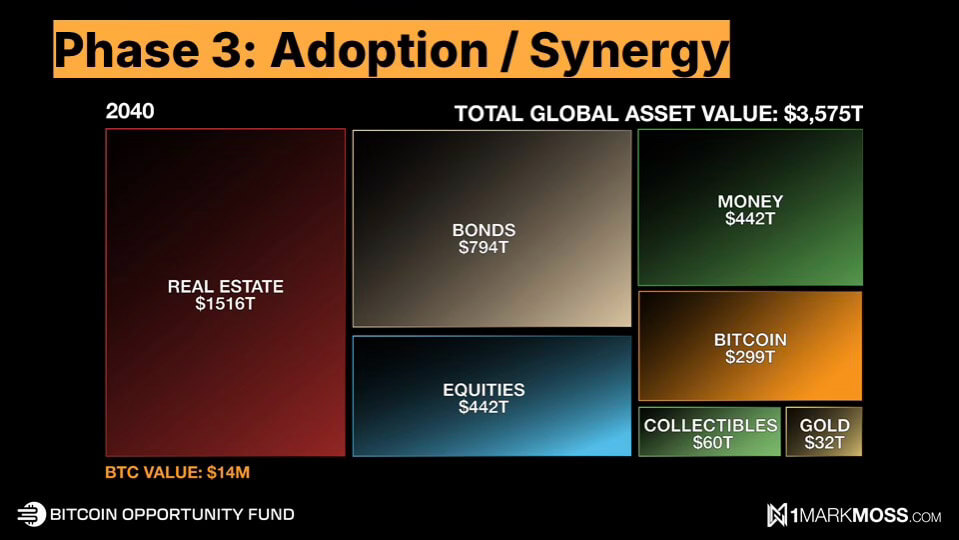

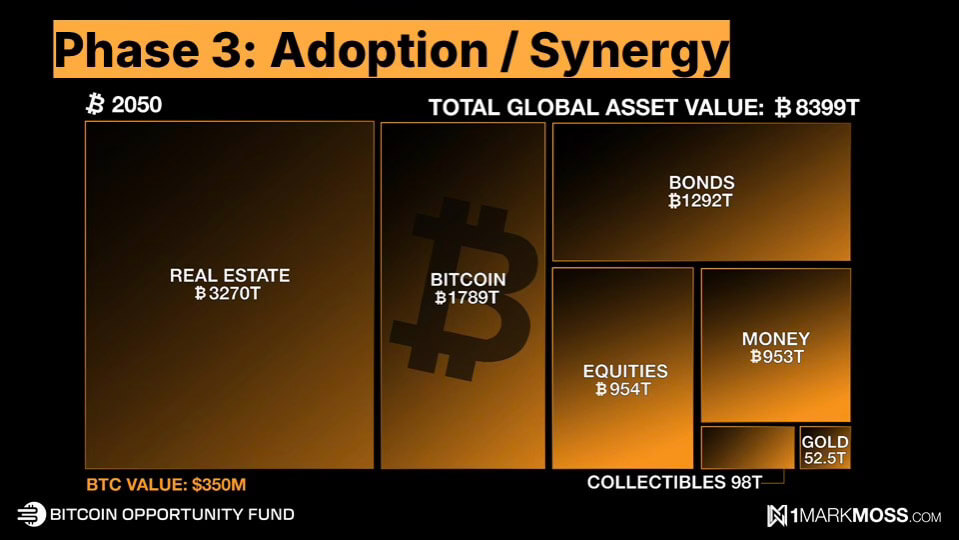

He pulls retired 3 charts comparing Bitcoin to store-of-value assets arsenic its price, size, and marketplace headdress grow.

“Bitcoin could turn to $21 trillion by 2030, which means $1 cardinal per Bitcoin, but it doesn’t mean each these different assets spell away. It’s connected par with gold. It’s taking a small spot from bonds, a small spot from money, and a small spot from equities.”

“If we accelerated guardant to 2050, Bitcoin becomes the 2nd biggest plus class, but it doesn’t mean the different plus classes spell away… By 2050, I judge each the store-of-value assets volition beryllium priced successful Bitcoin alternatively of U.S. dollars, and past 1 Bitcoin volition beryllium worthy 1 Bitcoin, alternatively of $100,000 oregon $1 million.”

He brings up Gresham’s law successful his statement for the continued beingness of the dollar.

“Gresham’s Law states that atrocious wealth drives retired bully money. So an illustration is successful the United States, up to 1965, quarters and dimes were made of axenic silver. After ‘65, they started making them retired of junk metal. You can’t find a pre-65 4th and dime successful circulation anymore, and if you did, you wouldn’t walk it due to the fact that it’s worthy similar $4. So you’d prevention it. The atrocious wealth drove retired the bully money, the pre-65s out. So I volition ever privation to usage fiat and store my Bitcoin.”

‘Good Times’ Ahead for Bitcoin

The incoming President’s son, Eric Trump, gave a keynote astatine the event, proclaiming to “absolutely emotion Bitcoin,” congratulating Bitcoiners connected their vision, stating that “America has to pb the mode successful a integer revolution,” and describing the infinitesimal helium called his begetter astatine 6 americium connected the time Bitcoin deed $100,000, starring to the now-infamous “You’re welcome” station connected Truth Social. So, does Mark expect a aureate property up for Bitcoin successful the United States? Will we spot a resurgence of innovation and a instrumentality of the endowment that bled retired to different jurisdictions during erstwhile administrations?

“The caller medication volition decidedly beryllium bullish for the industry,” helium states. “It’s not truly that Bitcoin that was connected the ballot. What was truly connected the ballot was freedom. The state to take however you privation to store your money, and however you privation to transact your money.”

He sees Trump creating a “much friendlier” situation for businesses but doesn’t envision a wide instrumentality of the companies that left. “Once you’re gone, you’re benignant of gone. Why would you travel back?” helium asks. “But possibly we’ll dilatory down the companies that are leaving and possibly much volition stay.”

What astir a nationalist strategical reserve successful Bitcoin igniting planetary Bitcoin crippled theory? He believes the chances are arsenic precocious arsenic 80%.

“I mean, RFK said helium would bash it and he’s present successful the Trump administration. Trump said helium would bash it. We person a reddish Republican House, Senate, and Presidency, and we already person the measure that’s been submitted by Senator Lummis. It conscionable has to beryllium approved. Maybe it fails and they’ll resubmit, but I would accidental successful the adjacent 24 months that goes through.”

Another prediction Mark has for the adjacent 24 months is that U.S. banking institutions volition commencement custodying Bitcoin, selling Bitcoin, and offering Bitcoin products.

“Last twelvemonth the banks tried to overturn an SEC regularisation called SAV21, which prevents banks from being capable to custody Bitcoin. It got to President Biden and helium vetoed it. So we cognize they privation to. They already tried to overturn it and Biden vetoed it. I’m guessing arsenic soon arsenic Trump takes implicit they’ll resubmit it and it volition get approved… it’s bully times,” helium beams, “I’m optimistic. I’m precise optimistic.”

If you privation to perceive much astir Mark’s imaginativeness for Bitcoin and its phases of planetary adoption, you tin travel him on X, drawback his keynote from Bitcoin MENA, oregon ticker his acquisition videos connected his YouTube channel.

The station Mark Moss connected Bitcoin adoption, freedom, and $1M Bitcoin appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)