Tracking changes successful liquidity is arsenic important arsenic monitoring changes successful Bitcoin‘s on-chain data. Each terms movement, beryllium it up oregon down, exerts important unit connected liquidity. One mode to analyse changes terms swings bring to the marketplace is to look astatine marketplace depth.

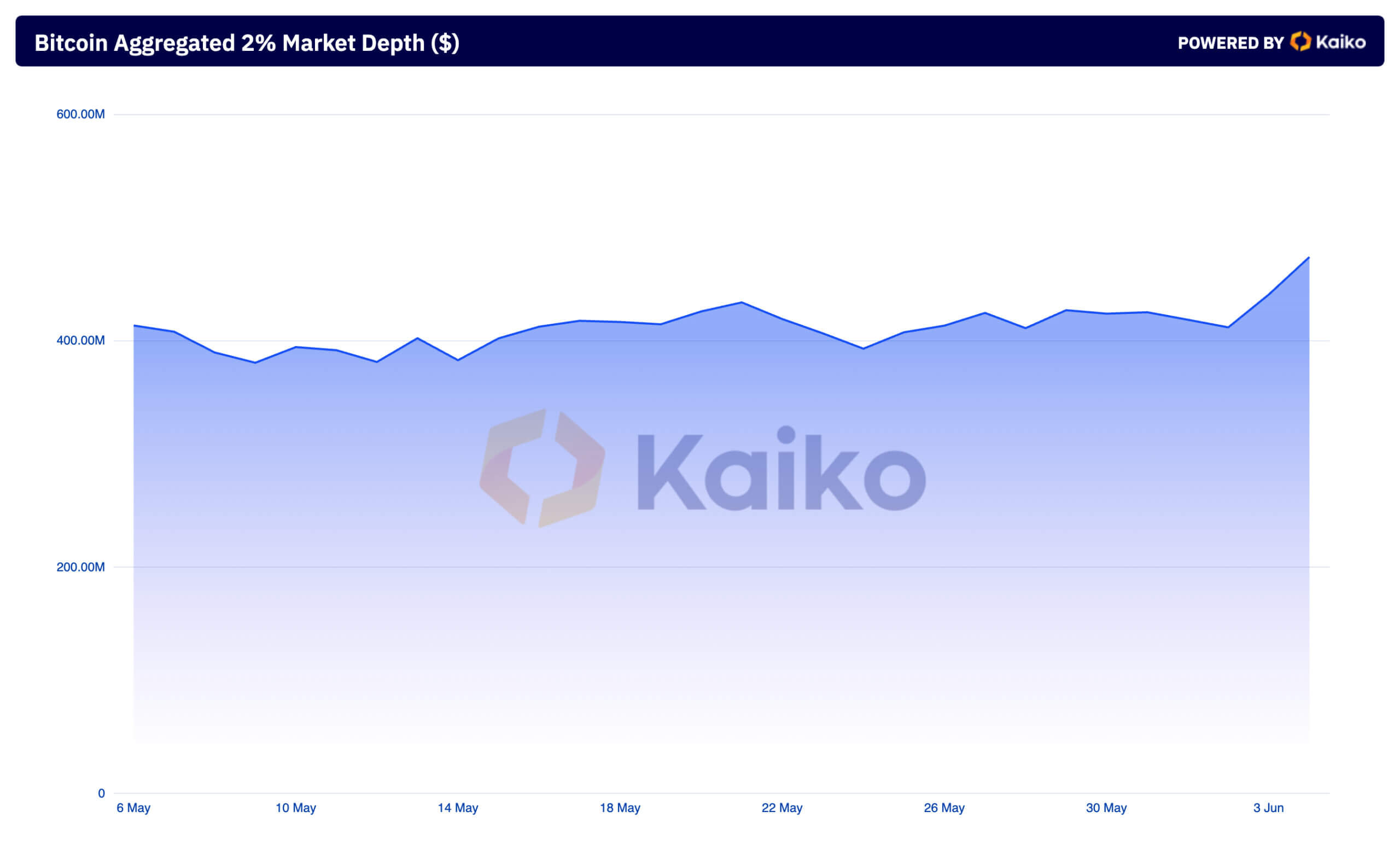

The aggregated 2% marketplace extent and the 2% bid vs. inquire extent are fantabulous indicators of marketplace liquidity and sentiment for Bitcoin. The aggregated marketplace extent represents the combined worth of bargain and merchantability orders wrong a 2% scope of the existent price. It provides penetration into however overmuch BTC tin beryllium traded without causing important terms movements. On June 2, the aggregated marketplace extent was $411.83 cardinal crossed centralized exchanges tracked by Kaiko. The extent spiked to $473.97 cardinal connected June 4, the highest successful the past 2 months.

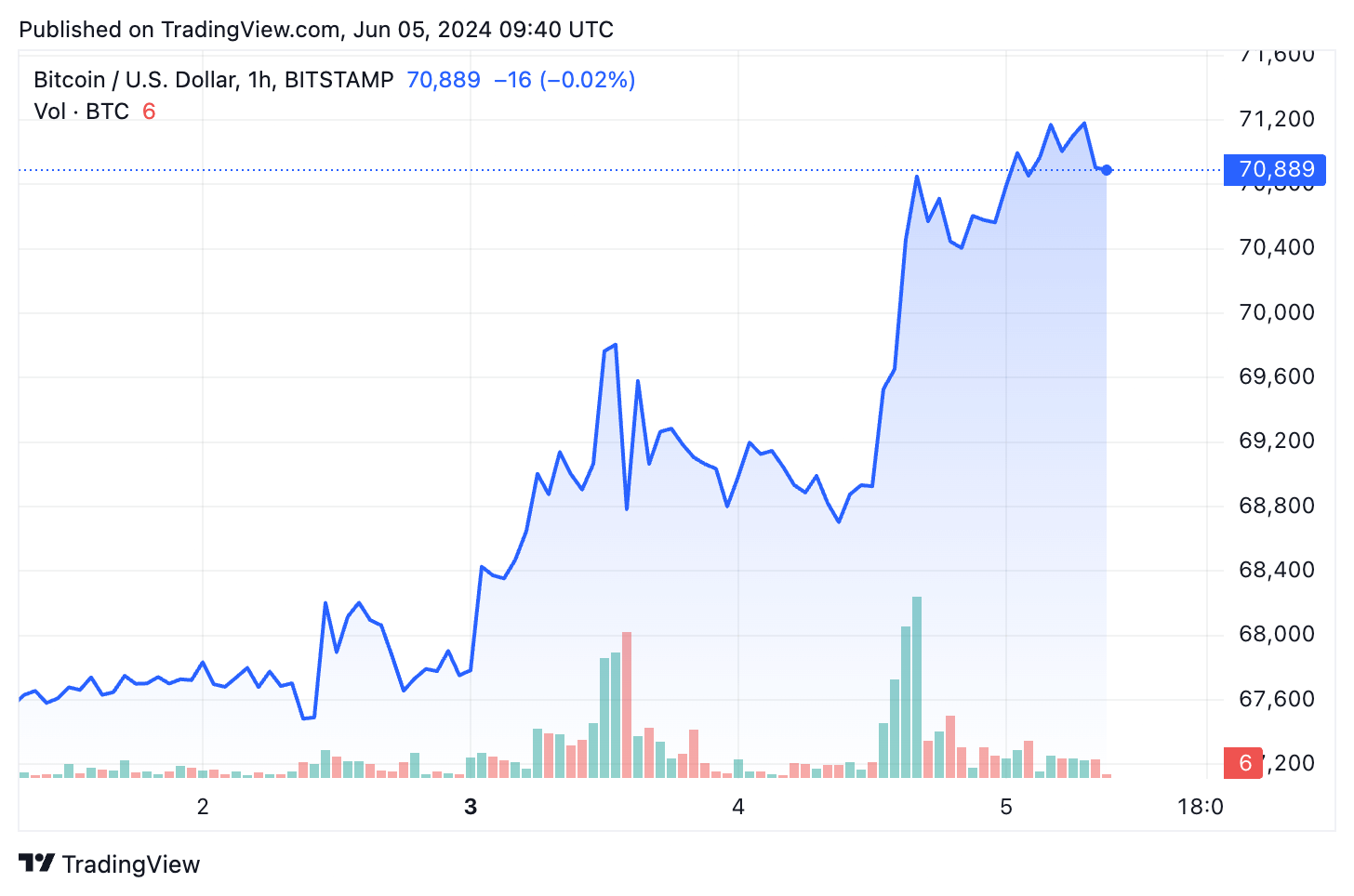

The spike successful marketplace extent followed Bitcoin’s terms summation from $67,750 to $70,600. While this mightiness not beryllium a important percent increase, $70,000 is an particularly important intelligence milestone. This spike becomes adjacent much important erstwhile accounting for the information that BTC spent weeks successful the mid $60,000 range.

Graph showing Bitcoin’s terms from June 2 to June 5, 2024 (Source: CryptoSlate BTC)

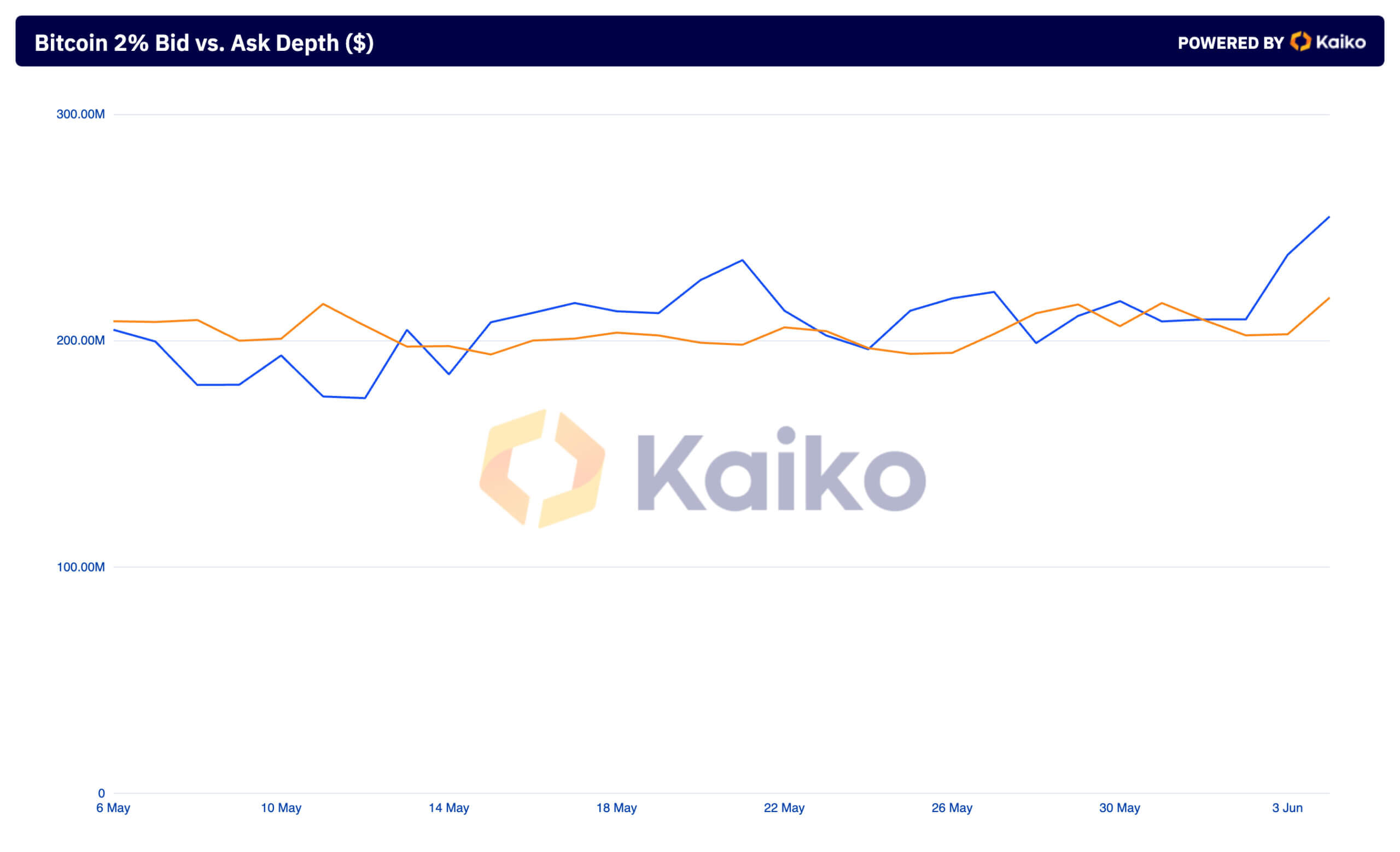

Graph showing Bitcoin’s terms from June 2 to June 5, 2024 (Source: CryptoSlate BTC)The bid vs. inquire extent shows the worth of bargain and merchantability orders wrong the aforesaid 2%. This dispersed besides saw a notable summation implicit the past mates of days. On June 2, determination were $202.40 cardinal successful bids and $209.44 cardinal successful asks. This aligns with erstwhile CryptoSlate analysis, which recovered the marketplace astir arsenic divided betwixt buying and selling.

Graph showing the aggregated 2% marketplace extent for Bitcoin from May 6 to June 4, 2024 (Source: Kaiko)

Graph showing the aggregated 2% marketplace extent for Bitcoin from May 6 to June 4, 2024 (Source: Kaiko)By June 4, the bids had accrued to $219.06 million, and the asks had risen sharply to $254.91 million, resulting successful the largest dispersed betwixt asks and bids since aboriginal April. This summation successful some marketplace extent and bid vs. inquire extent shows heightened marketplace activity.

The emergence successful aggregated marketplace extent suggests that the marketplace tin grip larger trades with little interaction connected price. This is simply a wide motion of greater liquidity successful the market. This higher liquidity means traders tin execute important transactions without causing important terms fluctuations, contributing to wide marketplace stability. The simultaneous summation successful bid and inquire extent reflects the accrued enactment and assurance among traders. More bargain and merchantability orders wrong the 2% scope amusement that traders are much actively participating successful the market.

Graph showing the 2% bid vs. Ask extent for Bitcoin from May 6 to June 4, 2024 (Source: Kaiko)

Graph showing the 2% bid vs. Ask extent for Bitcoin from May 6 to June 4, 2024 (Source: Kaiko)The larger summation successful inquire extent compared to bid extent implies that sellers are mounting higher prices, anticipating continued terms gains. This sentiment is supported by the important emergence successful bid depth, indicating beardown request for Bitcoin astatine higher terms levels. As much buyers participate the market, consenting to acquisition astatine these elevated prices, the market’s upward momentum is reinforced. The accrued liquidity, coupled with higher bid and inquire values, paints a representation of a robust trading situation wherever ample trades tin beryllium executed with minimal interaction connected the price.

A important information of this enactment resulted from spot Bitcoin ETFs. Farside information showed that spot Bitcoin ETFs saw $886.6 cardinal successful inflows connected June 4, making it the second-largest time of inflows since launch. CryptoSlate reported that this was the largest inflow ever for a time erstwhile nary US ETF recorded an outflow, including GBTC. The larger dispersed betwixt asks and bids suggests that sellers expect continued terms increases, mounting higher prices accordingly. The accrued liquidity supports terms stability, making the marketplace much charismatic to organization investors and ample traders. The increasing organization interest, evidenced by the emergence successful ETF inflows, cements the request for Bitcoin, contributing to the imaginable for sustained terms gains successful the coming months.

The station Market extent reveals Bitcoin’s underlying spot astatine $70k appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)