Tracking and analyzing transportation volumes is important for knowing the underlying economical enactment wrong the Bitcoin network. Spikes successful transportation volumes amusement heightened marketplace participation, either from caller entrants and organization investors — usually during bull runs — oregon important transactions by existing participants — usually during downturns.

While spikes successful transportation volumes usually travel aft large terms movements and aren’t bully predictive tools for terms action, they tin inactive beryllium utilized to infer the levels of liquidity and imaginable aboriginal volatility successful the market.

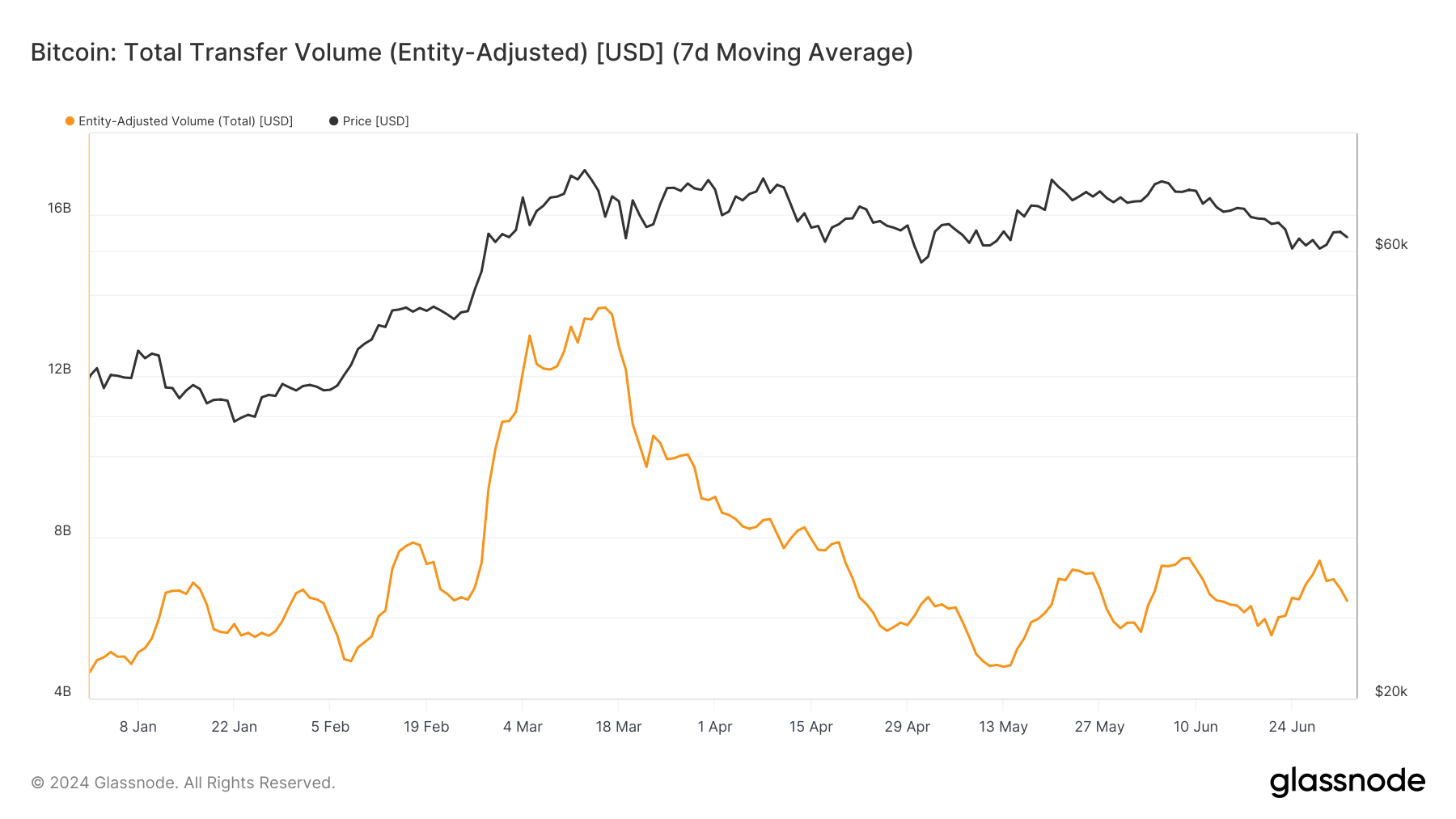

Glassnode’s entity-adjusted transportation measurement shows the existent economical enactment connected the Bitcoin web by measuring the USD worth of coins moved betwixt entities. This metric is peculiarly utile arsenic it filters retired interior transactions wrong entities similar exchanges, providing a clearer representation of genuine marketplace movements.

The full transportation measurement connected the Bitcoin web reached its all-time precocious of $13.67 cardinal connected March 15. The ATH was reached conscionable 2 days aft Bitcoin established its ain precocious of $73,104 connected March 13. This shows that a important magnitude of BTC was transferred betwixt entities astatine the tallness of marketplace euphoria.

However, the marketplace failed to scope anyplace adjacent that precocious since mid-March, struggling to surpass $7.5 cardinal since April 20. The simplification successful measurement shows a cooling disconnected from the highest marketplace activity, which comes arsenic Bitcoin’s terms consolidates and it struggles to interruption distant from its sideways trading pattern.

The comparatively unchangeable transportation measurement we’ve seen implicit the past period oregon truthful shows a marketplace successful a wait-and-see mode, wherever neither beardown bullish nor bearish currents predominate the volume. Bitcoin has remained bound successful a range, fluctuating betwixt $60,000 and $65,000, seeing upward movements lone connected large regulatory oregon broader marketplace movements.

Graph showing the full transportation measurement moved betwixt antithetic Bitcoin entities from Jan. 1 to July 2, 2024 (Source: Glassnode)

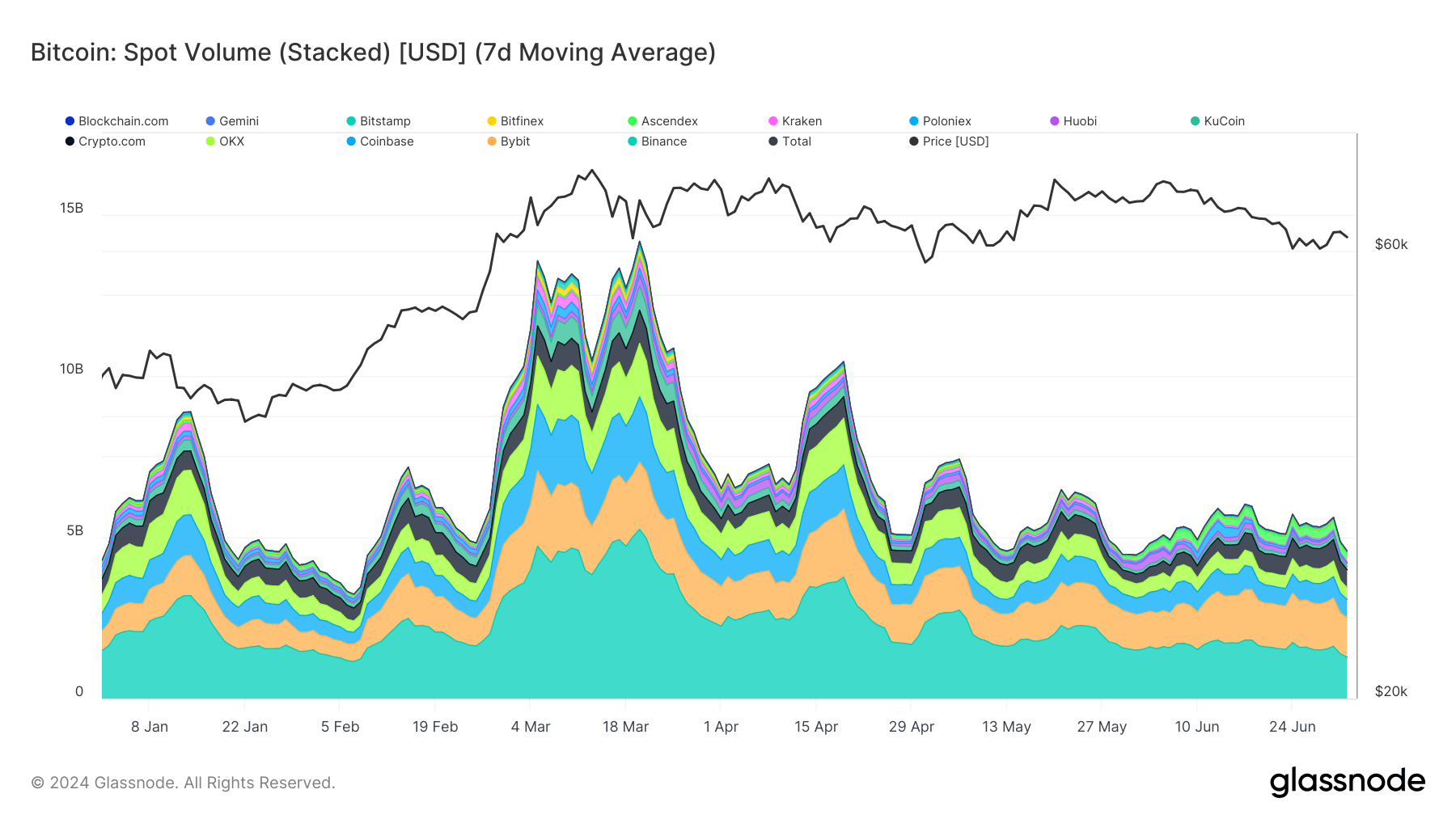

Graph showing the full transportation measurement moved betwixt antithetic Bitcoin entities from Jan. 1 to July 2, 2024 (Source: Glassnode)The stagnation successful marketplace enactment tin besides beryllium seen done Bitcoin’s spot trading volume. While some are essential, the full transportation and spot volumes supply somewhat antithetic insights into the market. Spot measurement represents the cumulative trading measurement connected exchanges, reflecting the trading enactment against USD-backed currencies, including some fiat and stablecoins.

This is wherefore spot measurement is much indicative of the contiguous trading behaviour and marketplace liquidity connected centralized exchanges alternatively than the broader market. While transportation volumes springiness a consciousness of the wide question of worth crossed the network, spot volumes amusement trading patterns and capitalist sentiment successful the shorter term.

Historically, spot volumes thin to highest somewhat aboriginal than transportation volumes, arsenic evidenced by the information showing a dip successful spot measurement to $10.465 connected March 13 contempt Bitcoin hitting its ATH. The yearly precocious for spot measurement was reached connected March 20 astatine $14.156 billion, demonstrating the lag betwixt terms and trading measurement peaks.

Graph showing the full Bitcoin trading measurement crossed centralized exchanges from Jan. 1 to July 2, 2024 (Source: Glassnode)

Graph showing the full Bitcoin trading measurement crossed centralized exchanges from Jan. 1 to July 2, 2024 (Source: Glassnode)Unlike transportation volumes, spot volumes thin to highest successful effect to crisp terms drops, not conscionable upward movement, arsenic traders respond to mitigate losses. During periods of terms stability, spot volumes thin to decline. This improvement has been peculiarly evident implicit the past 2 months, wherever spot volumes person remained beneath $6 billion, mirroring the deficiency of important enactment successful transportation volumes.

The information shows a chiseled trend: marketplace participants go little progressive arsenic Bitcoin’s terms stabilizes wrong a definite range. This signifier has go much evident successful the past fewer weeks, wherever Bitcoin has traded betwixt $60,000 and $65,000, starring to diminished trading volumes. Despite unchangeable prices, the driblet successful spot volumes by implicit $1 cardinal since the opening of July shows the marketplace is inactive reluctant to prosecute heavy without wide directional movements.

The marketplace is presently successful consolidation, wherever participants are waiting for caller cardinal drivers oregon outer factors to marque their adjacent move. Previous CryptoSlate investigation identified akin trends done different metrics — each pointing to a tense market that refuses to determination without important extracurricular factors.

If Bitcoin remains wrong its existent range, we tin expect debased trading volumes. However, immoderate regulatory, political, oregon macroeconomic developments could crook into a spark that ignites the marketplace and breaks this pattern.

The station Market successful wait-and-see mode arsenic Bitcoin volumes stagnate appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)