Watch This Video On YouTube oregon Rumble

Listen To The Episode Here:

In this occurrence of the “Fed Watch” podcast, Christian Keroles and I, on with the livestream crew, sermon macro developments applicable to bitcoin. Topics see the caller 50 bps complaint hike from the Fed, a user terms scale (CPI) preview — the occurrence was recorded unrecorded connected Tuesday, earlier the CPI information was released — and a treatment connected wherefore owners’ equivalent rent is often misunderstood. We wrapper up with an epic treatment of the bitcoin price.

This could beryllium a pivotal occurrence successful the past of “Fed Watch,” due to the fact that I’m connected the grounds saying that bitcoin is “in the neighborhood” of the bottom. This is successful stark opposition to the mainstream uber-bearishness successful the marketplace close now. In this episode, I trust heavy connected charts that didn’t ever enactment up during the video. Those charts are provided beneath with a basal explanation. You tin spot the full descent platform that I utilized here.

“Fed Watch” is simply a podcast for radical funny successful cardinal slope existent events and however Bitcoin volition integrate oregon regenerate aspects of the accepted fiscal system. To recognize however bitcoin volition go planetary money, we indispensable archetypal recognize what’s happening now.

Federal Reserve And Economic Numbers For The U.S.

On this archetypal chart, I constituent to the Fed’s past 2 complaint hikes connected the S&P 500 chart. I wrote successful a blog station this week, “What I'm trying to amusement is that the complaint hikes themselves are not the Federal Reserve’s superior tool. Talking astir hiking rates is the superior tool, on with fostering the content successful the magic of the Fed.” Remove the arrows and effort to conjecture wherever the announcements were.

Same goes for the adjacent chart: gold.

Lastly, for this section, we looked astatine the bitcoin illustration with quantitative easing (QE) and quantitative tightening (QT) plotted. As you tin see, successful the epoch with “No QE,” from 2015 to 2019, bitcoin experienced a 6,000% bull market. This is astir the nonstop other of what 1 would expect. To summarize this section, Fed argumentation has small to bash with large swings successful the market. Swings travel from the unknowable analyzable ebbs and flows of the market. The Federal Reserve lone tries to creaseless the edges.

CPI Mayhem

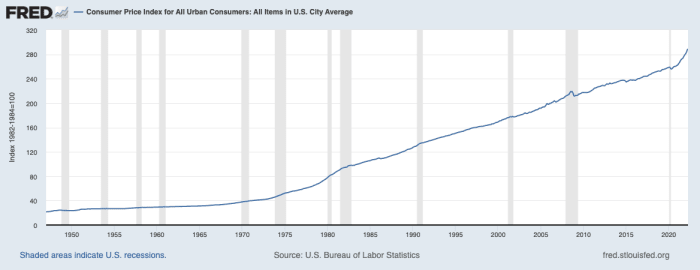

It’s hard to constitute a bully summary of this portion of the podcast, due to the fact that we were unrecorded 1 time anterior to the information dropping. In the podcast, I screen Eurozone CPI going somewhat higher, to 7.5% successful April year-over-year (YoY), with a month-over-month complaint of alteration dropping from a staggering 2.5% successful March to 0.6% successful April. That is the communicative astir radical are missing connected CPI: month-to-month changes rapidly slowed successful April. I besides covered CPI forecasts for the U.S. connected the podcast, but now, we person hard information for April. U.S. header CPI dropped from 8.5% successful March to 8.3% successful April. Month-to-month alteration fell from 1.2% successful March to 0.3% successful April. Again, a large diminution successful the complaint of CPI increase. CPI tin beryllium precise confusing erstwhile looking astatine YoY figures.

It looks similar ostentation successful April was measured astatine 8.3%, erstwhile successful fact, it was measured astatine lone 0.3%.

Year-over-year CPI, month-over-month CPI (source)

Next taxable we screen successful the podcast is rent. I precise often perceive misunderstandings of the CPI measurement connected structure and specifically owners’ equivalent rent (OER). For starters, it’s precise hard to measurement the interaction of increases to lodging costs connected consumers successful general. Most radical bash not determination precise often. We person 15- oregon 30-year fixed-rate mortgages that are not affected astatine each by existent location prices. Even rental leases are not renewed each month. Contracts typically past a year, sometimes more. Therefore, if a fewer radical wage higher rents successful a definite month, that does not impact the mean person’s structure expenses oregon the mean landlord’s revenue.

Taking existent marketplace prices for rentals oregon homes is simply a dishonest mode to estimation the mean outgo of housing, yet not doing truthful is the astir often-quoted critique of the CPI. Caveat: I’m not saying CPI measures ostentation (money printing); it measures an scale of prices to support your modular of living. Of course, determination are galore layers of subjectivity successful this statistic. OER much accurately estimates changes successful lodging costs for the mean American, smooths retired volatility and separates axenic structure costs from concern value.

Bitcoin Price Analysis

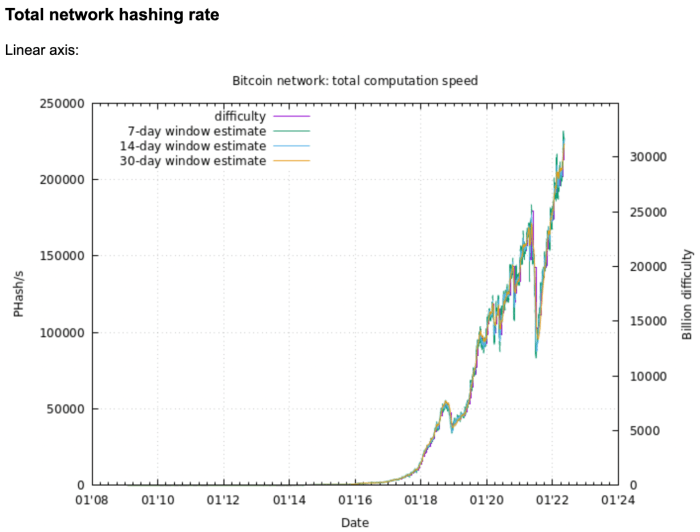

The remainder of the occurrence is talking astir the existent bitcoin terms action. I commencement my bullish rant by showing the hash complaint illustration and talking astir wherefore it is simply a lagging and confirming indicator. With the hash complaint astatine all-time highs and consistently increasing, this suggests that bitcoin is reasonably valued astatine its existent level.

Bitcoin hash complaint (source)

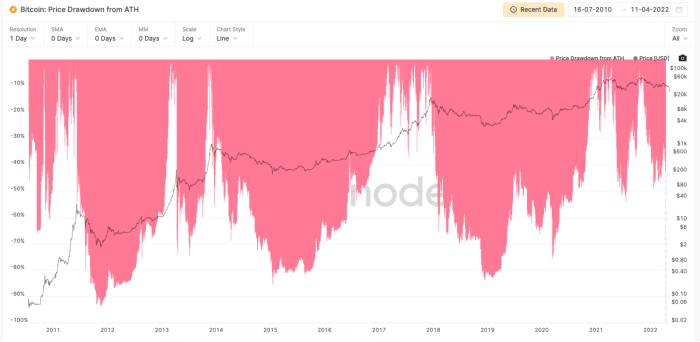

The past of bitcoin drawdowns (source)

Recent years person seen shorter, smaller rallies and shorter, smaller drawdowns. This illustration suggests that 50% drawdowns are the caller normal, alternatively of 85%.

Now, we get into immoderate method analysis. I ore connected the Relative Strength Index (RSI) due to the fact that it is precise basal and a cardinal gathering artifact of galore different indicators. Monthly RSI is astatine levels that typically awesome rhythm bottoms. Currently, the monthly metric shows that bitcoin is much oversold than astatine the bottommost of the corona clang successful 2020. Weekly RSI is arsenic arsenic oversold. It is arsenic debased arsenic the bottommost of the corona clang successful 2020, and earlier that, the bottommost of the carnivore marketplace successful 2018.

The Fear and Greed scale is besides extremely low. This measurement is showing “Extreme Fear” that typically registers astatine comparative bottoms and astatine 10, ties for the lowest standing since the COVID-19 clang successful 2020.

In summary, my contrarian (bullish) statement is:

- Bitcoin is already astatine historical lows and could bottommost astatine immoderate moment.

- The planetary system is getting worse and bitcoin is counterparty-free, dependable money, truthful it should behave likewise to 2015 astatine the extremity of QE.

- The Fed volition beryllium forced to reverse its communicative successful the coming months which could relieve downward unit connected stocks.

- Bitcoin is intimately tied to the U.S. system astatine this point, and the U.S. volition upwind the coming recession amended than astir different places.

That does it for this week. Thanks to the readers and listeners. If you bask this contented delight subscribe, reappraisal and share!

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)