Market sentiment is the nationalist involvement successful the underlying assets and the behaviour of traders connected derivatives markets. Thanks to sentiment analysis, 1 tin place the cognition of semipermanent investors, arsenic they ever merchantability during the uptrend to short-term speculators and bargain the dips with a statistically affirmative expectation. On the contrary, the assemblage psyche is irrational, arsenic they often bargain with spiking candlesticks successful fearfulness of missing retired and dumping successful the downtrend.

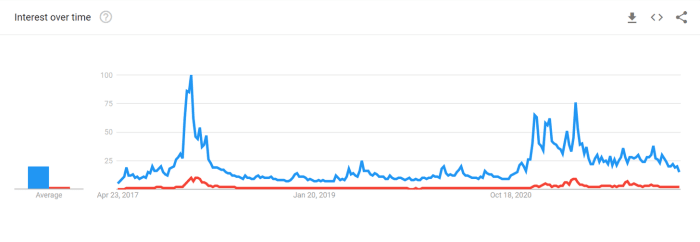

The nationalist involvement has cooled disconnected arsenic shown successful google inclination information (Source).

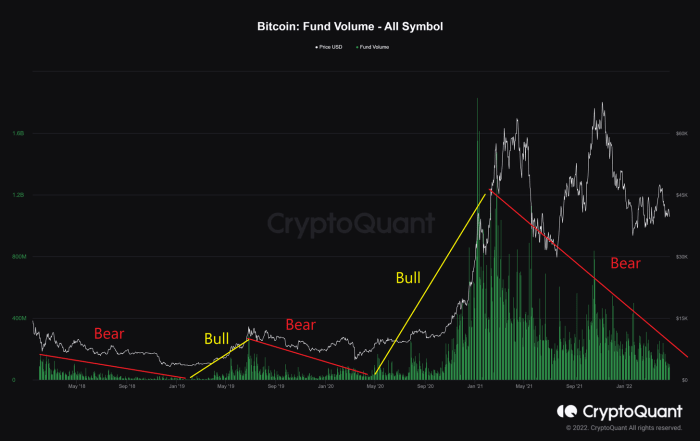

The archetypal happening to beryllium taken into relationship erstwhile analyzing marketplace sentiment is the money measurement which plays a pivotal relation successful whether the marketplace is trending oregon consolidating arsenic it depicts the trading volume. In a bull market, money measurement increases on with the terms and vice versa, but it has gradually decreased since the May 2021 peak.

The money trading measurement accrued successful bull and decreased successful carnivore (Source).

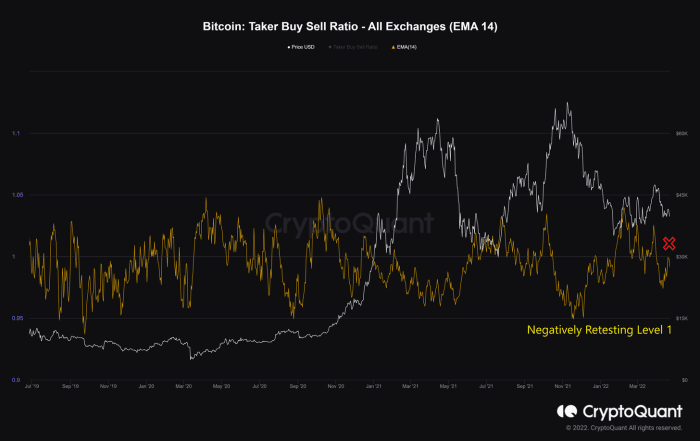

Concurrently, having looked astatine the ratio of bargain measurement divided by merchantability measurement of takers successful perpetual swap trades, values implicit 1 — much bargain orders taken via marketplace bid — bespeak bullish sentiment is dominant. Similarly, values nether 1 bespeak the dominance of bearish sentiment arsenic much merchantability orders are actively executed done marketplace orders. Also, the 14-day exponential moving mean (EMA-14) of the taker buy/sell ratio has been antagonistic and precocious retested the level of one, suggesting that much sellers are consenting to merchantability coins astatine a little terms and that selling unit is stronger than the buying pressure.

Taker buy/sell ratio EMA-14 successful antagonistic portion and retesting the level 1 (Source).

In a bull market, determination is an expanding liquidation successful correlation to the emergence successful price. The existent full magnitude of liquidated agelong and abbreviated positions successful the derivatives marketplace is comparatively debased compared with the erstwhile bull runs.

Small liquidation signaling bearish sentiment (Source).

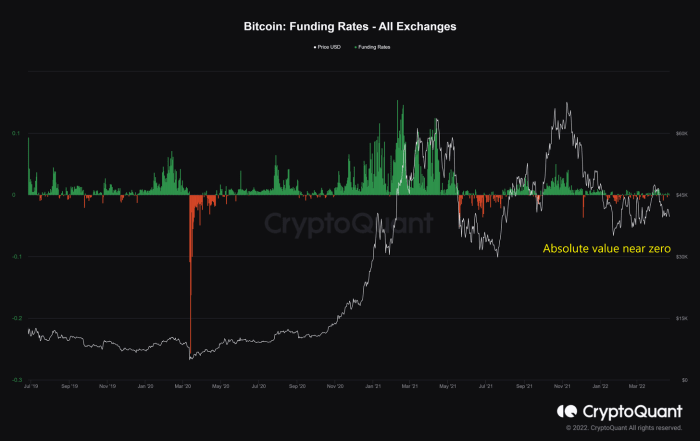

“Funding rates correspond traders' sentiment successful the perpetual swaps marketplace and the magnitude is proportional to the fig of contracts. Positive backing rates bespeak that agelong presumption traders are ascendant and are consenting to wage backing to abbreviated traders. Negative backing rates bespeak that abbreviated presumption traders are ascendant and are consenting to wage agelong traders” (Source).

The higher the implicit worth of the backing complaint is, the much assertive the traders are. However, the existent implicit worth of the backing complaint has been hovering adjacent zero, which means traders are not assertive nether the prevailing economical conditions.

Funding’s implicit worth adjacent zero affirming nary aggressiveness among traders (Source).

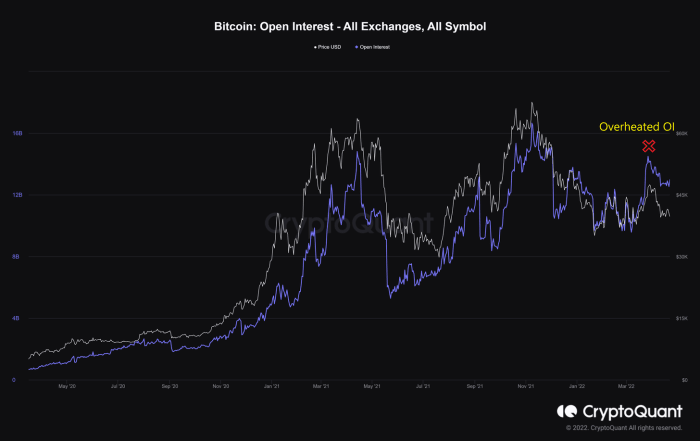

One of the astir important factors of the derivatives marketplace is unfastened involvement (OI) defined arsenic the fig of unfastened positions presently connected a derivative exchange's trading pairs. The expanding OI from March 8 to March 28, 2022, is overheated and deliberately driven by the short-term traders arsenic determination was an open-ended capitulation that initiated astatine the highest of $48,000 connected March 28. Hence, it's not susceptible of supporting a imaginable uptrend.

Overheated OI driven by short-term traders plummeting arsenic a capitulation (Source).

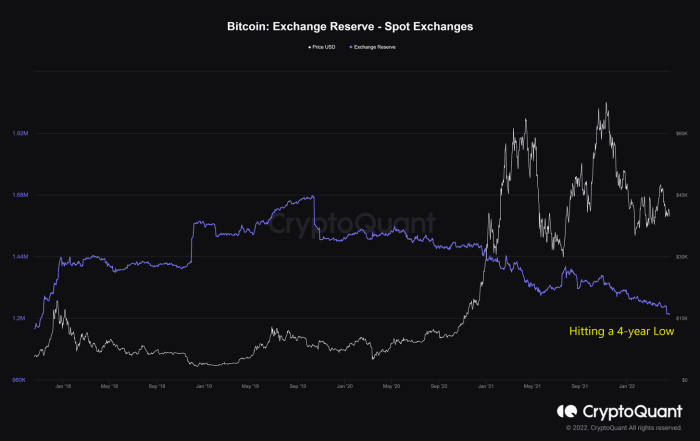

Meanwhile, the full fig of bitcoin held successful the spot speech has deed a four-year low, and this is often considered a bully motion successful the cardinal on-chain activity.

The spot speech reserve deed a four-year debased arsenic a bully motion (Source).

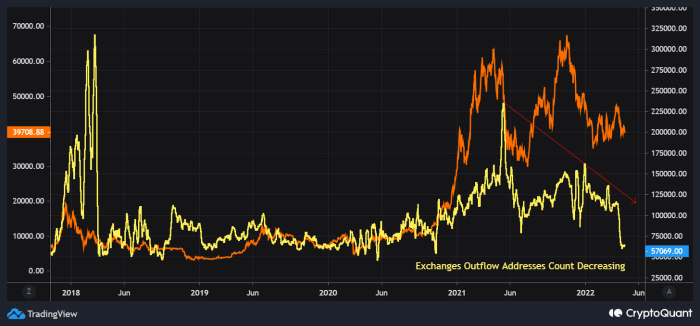

But much importantly, it whitethorn not beryllium the retail’s enactment arsenic the speech outflow addresses number has plummeted since May 10, 2021. It suggests that not galore retail investors determination those coins disconnected of exchanges but could beryllium whale accumulation instead.

The speech outflow code plummeting arsenic retail investors are little progressive (Source).

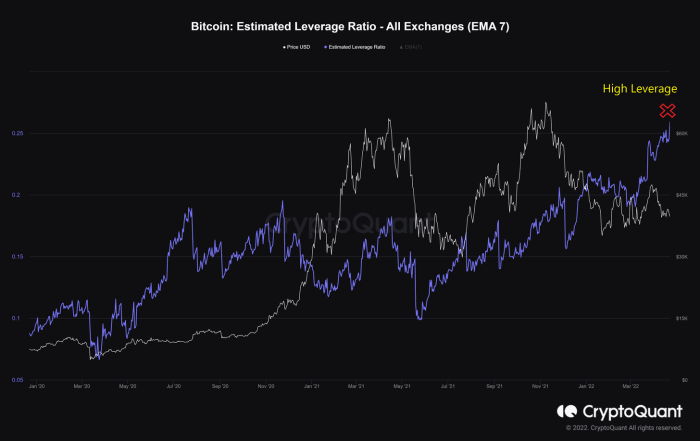

In addition, the downtrend successful exchanges' reserve and overheated OI marque the estimated leverage ratio higher, calculated by the exchange's unfastened involvement divided by their bitcoin reserve. It reveals that higher leverage is utilized by users connected average, that is, much investors are taking high-leverage hazard successful the derivatives trade.

Heated Leverage makes the marketplace riskier (Source).

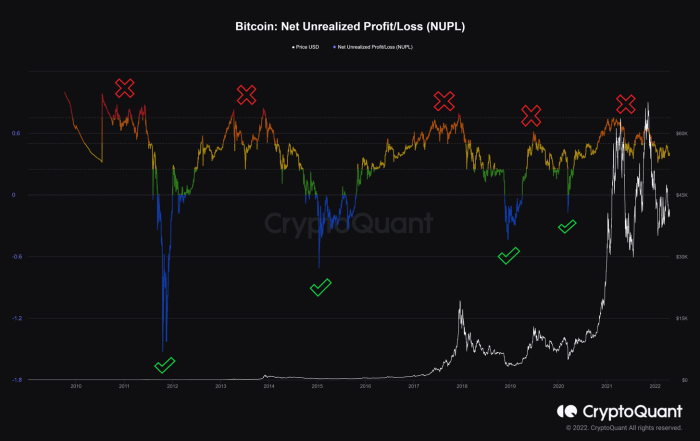

Last but not least, nett unrealized nett and nonaccomplishment (NUPL), the quality betwixt marketplace headdress and realized headdress divided by marketplace cap, indicates the capitulation signifier has begun since May 2021. The maximal worth of the ratio of investors who are successful nett was that day, and a sell-off has ensued. At the moment, bitcoin whitethorn beryllium successful the mediate of this signifier with the plausible crushed to instrumentality nett until nary much selling pressure.

NUPL supposing the marketplace being successful the semi-capitulation signifier (Source).

On balance, marketplace sentiment is not arsenic beardown arsenic on-chain activity. There is the likelihood that we are successful a semi-bear marketplace wherein the ongoing capitulation has taken effect since May 2021, and the continuing accumulation signifier has appeared to hitch retired the short-term speculators.

This is simply a impermanent station by Dang Quan Vuong. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)