Most cryptocurrencies traded higher connected Tuesday arsenic tensions betwixt Russia and Ukraine eased.

Russian President Vladimir Putin said during a quality league connected Tuesday helium is “ready to enactment further” with the West to de-escalate tensions implicit Ukraine. Russia besides decided to partially propulsion backmost troops from subject districts bordering Ukraine.

Equities and cryptocurrencies rose, portion accepted harmless havens specified arsenic golden and the U.S. dollar declined implicit the past 24 hours.

Alternative cryptocurrencies (altcoins) led the rally connected Tuesday, indicating a renewed appetite for hazard among crypto traders. ETH was up 8% implicit the past 24 hours, compared with a 4% emergence successful BTC implicit the aforesaid period.

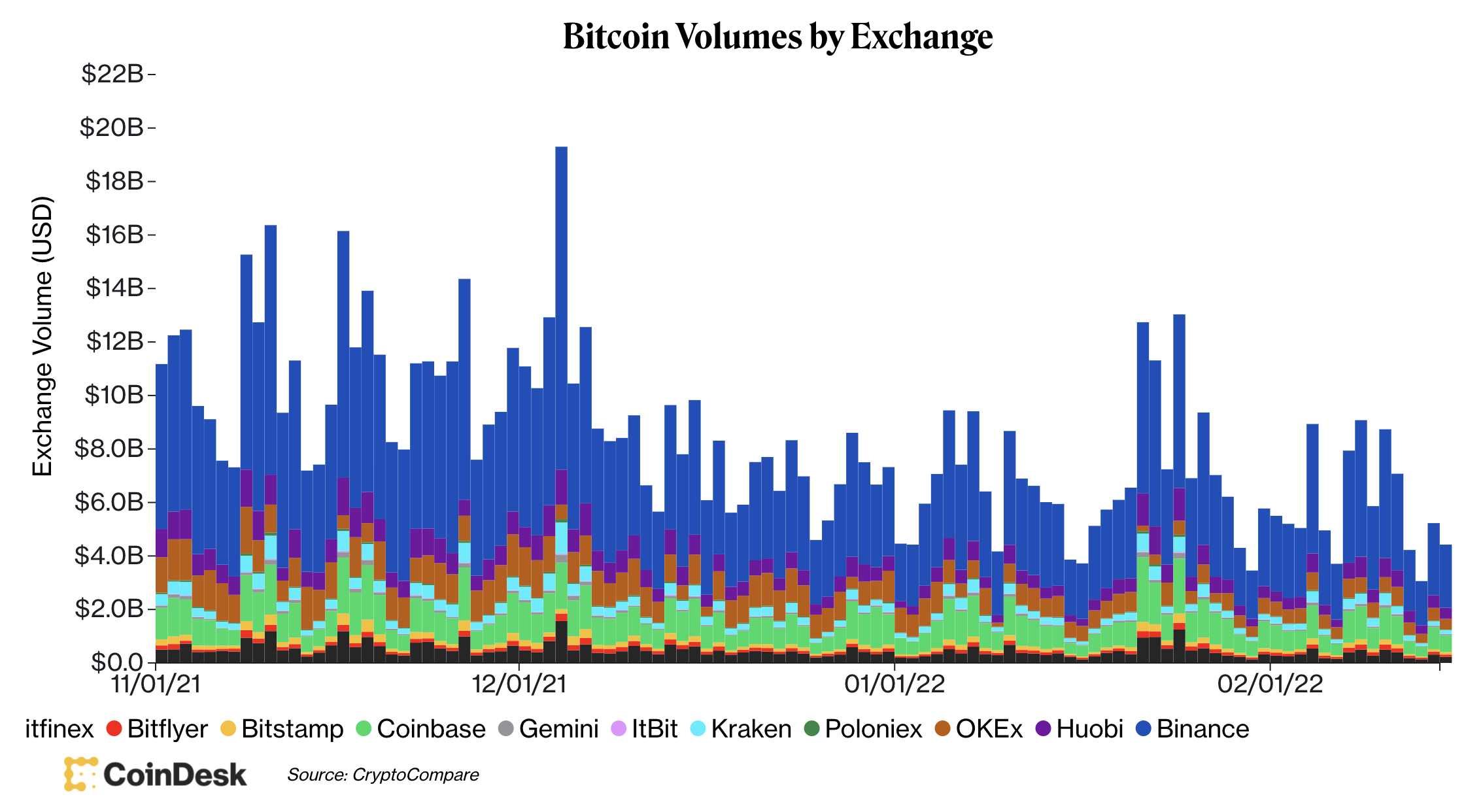

Still, trading measurement successful the bitcoin spot marketplace remained anemic comparative to erstwhile terms jumps connected Feb. 4 and Feb. 10. That could constituent to constricted gains astir $46,000-$50,000 BTC according to immoderate method indicators.

●Bitcoin (BTC): $44172, +4.73%

●Ether (ETH): $3115, +7.60%

●S&P 500 regular close: $4471, +1.58%

●Gold: $1855 per troy ounce, −0.67%

●Ten-year Treasury output regular close: 2.04%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

The illustration beneath shows the diminution successful BTC trading measurement implicit the past fewer months.

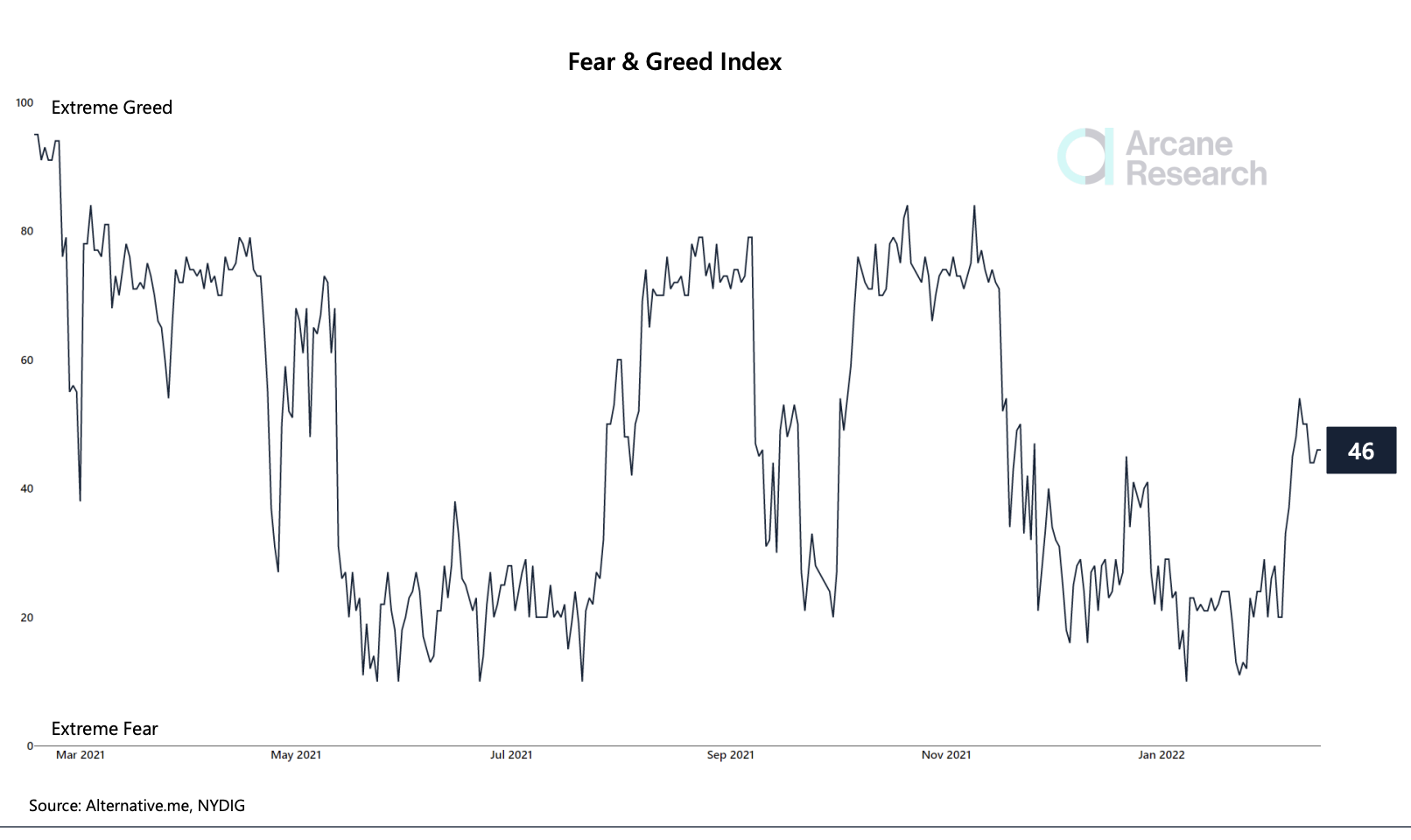

"Currently, traders look indecisive, shown by the marketplace sentiment hovering betwixt fearfulness and greed and bitcoin ranging betwixt the $42,000 enactment and the $46,000 resistance," Arcane Research wrote successful a Tuesday report. "If bitcoin breaks retired of this range, we mightiness spot accrued marketplace enactment going forward."

Over the past 24 hours, the measurement of merchantability orders exceeded the measurement of bargain orders successful the BTC perpetual swaps market, according to marketplace information compiled by CryptoQuant. That indicates short-term selling pressure.

Bitcoin trading measurement (CryptoCompare)

Over the past year, "trading volumes arsenic a percent of marketplace headdress successful galore of the large cryptocurrencies are little compared with erstwhile months," CoinDesk's Lawrence Lewitinn stated. "The extremity effect is that it whitethorn instrumentality smaller amounts of superior to determination the markets wildly."

The bitcoin Fear & Greed Index dipped backmost into "fear" territory arsenic traders reacted to macroeconomic and geopolitical uncertainty. The existent speechmaking of 46 is neutral, however, which means determination is nary beardown bullish oregon bearish bias among marketplace participants.

The Fear & Greed Index tin oscillate betwixt utmost lows and highs for galore months, akin to the erratic signals during the 2018 crypto carnivore market. Frequent shifts successful sentiment could awesome short-term opportunities for buyers and sellers, portion those who are much committed to a trading presumption would trust connected smoother indicators specified arsenic cycles and trends.

Some technical indicators amusement semipermanent inclination weakness, which could bounds imaginable upside successful BTC.

Bitcoin Fear & Greed Index (Arcane Research)

Still, implicit the past month, sentiment has improved arsenic the crypto sell-off stabilized.

For tactical traders, 1 affirmative blockchain indicator to show is the stablecoin proviso ratio (SSR), which shows erstwhile determination is capable liquidity disposable to bargain into the marketplace (locked into stablecoins) or, connected the different hand, erstwhile the buying powerfulness is not capable to determination up the terms comparative to BTC's marketplace cap, according to CryptoQuant.

SSR precocious triggered a affirmative signal, akin to what occurred during the July and October terms rallies.

GALA jumps 20%, leads metaverse scale gains: GALA, the eponymous token of blockchain-based gaming level Gala Games, surged arsenic overmuch arsenic 20% successful the past 24 hours, outpacing different large metaverse tokens arsenic good arsenic Meta’s stock. The determination came aft Gala Games said it plans to deploy $5 cardinal wrong the adjacent twelvemonth to bolster its non-fungible token (NFT) offerings by buying intelligence spot rights and gathering a taxable park, according to CoinDesk’s Sam Reynolds. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

There are nary losers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)