Bullish sentiment is returning to crypto markets aft a sluggish commencement to the year. The caller outperformance of alternate cryptocurrencies (altcoins) indicates a greater appetite for hazard among traders.

Bitcoin (BTC) and ether (ETH) were down 1% implicit 24 hours, compared with an 8% emergence successful Cardano's ADA token and a 3% leap successful dogecoin (DOGE). Meanwhile, LRC, the autochthonal token connected the Ethereum scaling web Loopring, rallied arsenic overmuch arsenic 34% aft the blockchain task shared an update connected its partnership with GameStop (GME).

Some analysts expect crypto prices to stay elevated implicit the abbreviated term, albeit successful a higher range. That means a alleviation rally could beryllium short-lived. For reference, BTC's anterior scope betwixt $30,000-$40,000 earlier this twelvemonth preceded the existent scope betwixt $40,000-$45,000, indicating a diminution successful selling pressure.

"There volition beryllium an precocious bounds to prices of hazard assets, depending connected however large [Federal Reserve] complaint hikes volition be," Justin Chuh, a trader astatine Wave Financial, said during an interview with CoinDesk. Chuh besides mentioned that immoderate traders person not been picking terms bottoms. Instead, traders person been unwinding downside hedges and selling volatility contracts arsenic prices stabilize, according to Chuh.

From a method perspective, short-term indicators are improving for bitcoin. "We expect caller highs adjacent $45,000 to soon beryllium cleared arsenic a affirmative catalyst," Katie Stockton, managing spouse astatine Fairlead Strategies wrote successful a report. "A breakout earlier this period suggested bitcoin has upside toward $51,000."

●Bitcoin (BTC): $42,334, −0.36%

●Ether (ETH): $2,978, −0.81%

●S&P 500 regular close: $4,456, −1.23%

●Gold: $1,947 per troy ounce, +1.38%

●Ten-year Treasury output regular close: 2.32%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

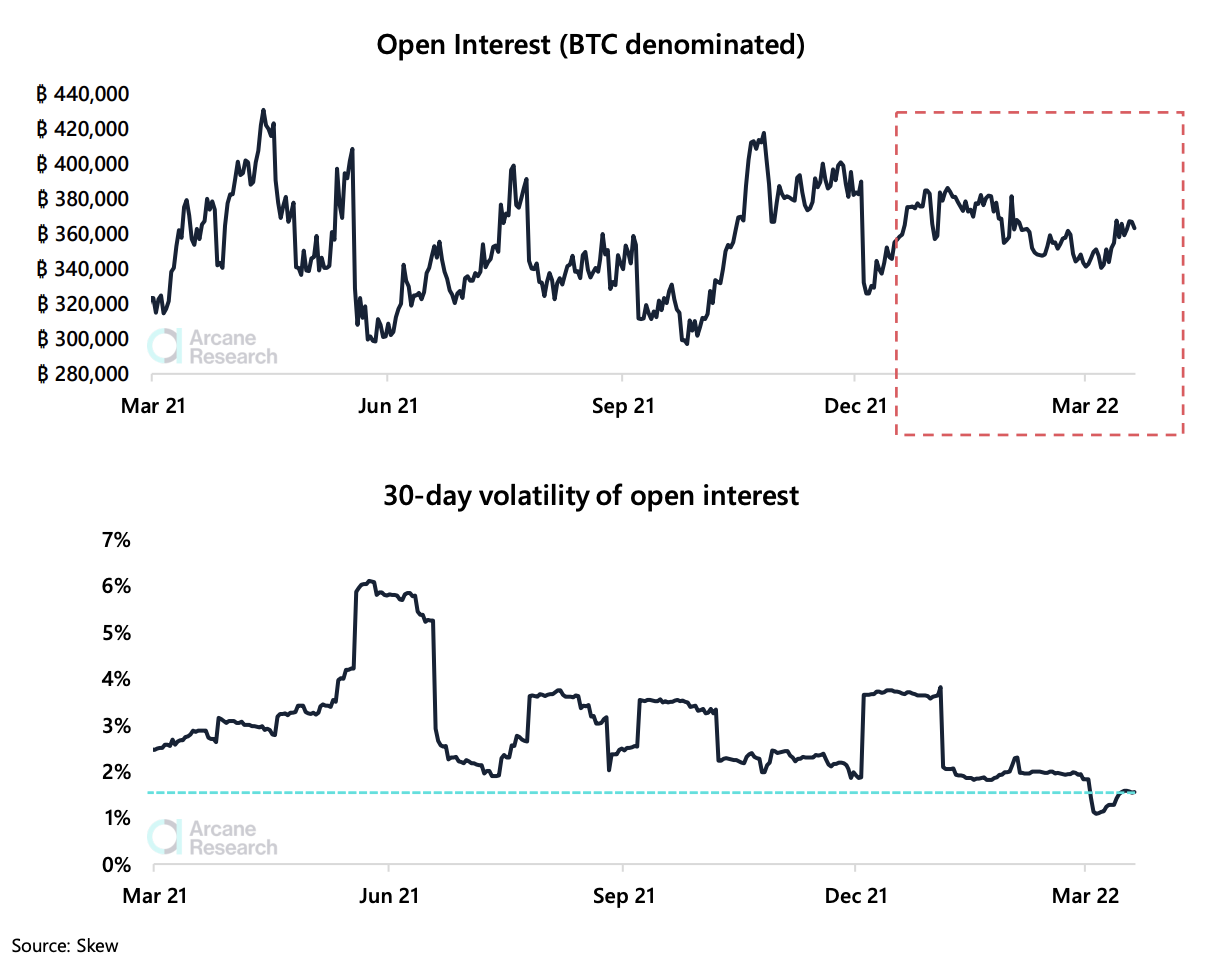

Open interest, oregon the full magnitude of outstanding contracts successful the bitcoin futures market, has stabilized implicit the past fewer months. That could constituent to less liquidations arsenic bitcoin trades wrong a constrictive terms range, according to a study by Arcane Research.

Liquidations hap erstwhile an speech forcefully closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. That happens chiefly successful futures trading, which lone tracks plus prices, arsenic opposed to spot trading, wherever traders ain the existent assets.

"We’ve seldom seen unfastened involvement being maintained astatine specified levels for specified a agelong duration without immoderate large squeeze setbacks," Arcane wrote. Low trading enactment doesn't past long, however, which means a breakout of the existent BTC trading scope could beryllium imminent.

The illustration successful the 2nd sheet beneath shows the 30-day volatility of BTC unfastened interest, which is acold little than the erstwhile lows of 2% seen successful July, precocious August and aboriginal December, which preceded little upticks successful trading activity.

Bitcoin unfastened involvement and volatility (Arcane Research, Skew)

Still, immoderate indicators amusement a precocious grade of uncertainty among bitcoin traders, which suggests upswings successful terms could beryllium limited.

For example, backing rates, oregon the outgo holding agelong BTC positions successful perpetual futures listed connected large exchanges, person been neutral/negative implicit the past fewer months. That means sentiment among traders is neither bullish oregon bearish (lacking conviction) contempt bitcoin's 30% beforehand from its Jan. 24 terms debased adjacent $33,000.

SportsIcon to unfastened metaverse wherever athletes tin interact with fans: Non-fungible token (NFT) level SportsIcon unveiled plans for a sports-focused metaverse that volition let athletes to interact with supporters. The Sports Metaverse volition let users to commercialized non-fungible tokens (NFT), bargain and make land, and sojourn stadiums. The London-based institution is processing games wherever users tin gain its autochthonal token, ICONS, according to CoinDesk’s Camomile Shumba. Read much here.

Loopring’s LRC up 34% connected beta merchandise of GameStop NFT marketplace: LRC, the autochthonal token of Ethereum scaling web Loopring, soared connected Wednesday aft the blockchain task shared an update connected its concern with GameStop, the video crippled retailer whose volatile and sometimes coordinated terms enactment successful aboriginal 2021 made it a darling of meme banal traders. The LRC token's terms roseate arsenic overmuch arsenic 34% implicit the past 24 hours. Read much here.

Stablecoin Cashio suffers 'Infinite Glitch' exploit, TVL Drops by $28M: Solana-based stablecoin protocol Cashio was exploited successful an “infinite glitch” attack, developers said connected Wednesday. Following the exploit, the worth of Cashio's CASH token dropped to astir zero. “Please bash not mint immoderate CASH. There is an infinite mint glitch. We are investigating the contented and we judge we person recovered the basal cause. Please retreat your funds from pools,” the squad wrote successful a tweet, according to CoinDesk’s Shaurya Malwa. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)