Bitcoin roseate toward $43,000 connected Tuesday and is up astir 3% implicit the past 24 hours. Several alternate cryptocurrencies (altcoins) specified arsenic MATC and FTM were up astir 14% implicit the aforesaid period, suggesting a greater appetite for hazard among investors.

It appears that bullish sentiment is starting to instrumentality to some crypto and equity markets, astatine slightest implicit the abbreviated term. Technical indicators suggest that BTC is astatine its astir oversold level since December, which could promote immoderate traders to bargain connected the dip, though upside could beryllium constricted toward $45,000.

The sell-off has had a antagonistic interaction connected crypto mining stocks implicit the past mates of months. Shares of the U.S.-listed mining companies Marathon Digital Holdings (MARA), Riot Blockchain (RIOT) and Bit Digital (BTBT) person dropped much than 50% each since Nov. 10.

Still, immoderate miners look to beryllium unfazed by the terms dip. For example, bitcoin mining steadfast Bitfarms purchased 1,000 bitcoins worthy $43.2 cardinal during the archetypal week of January.

For immoderate traders, however, losses are starting to adhd up. Blockchain information shows that much traders are selling BTC astatine a loss, oregon beneath their outgo basis. “In May 2021 (during a crisp sell-off) we’ve seen a akin benignant of behaviour erstwhile the marketplace kept selling astatine a nonaccomplishment for an extended play of time,” CryptoQuant wrote successful a blog post connected Tuesday.

Bitcoin (BTC): $41,785, +2.33%

Ether (ETH): $3,239, +5.02%

10-year Treasury output regular close: 1.74%

For now, it appears that astir buyers are remaining connected the sidelines, particularly up of the U.S. user terms scale (CPI) report, which volition beryllium released connected Wednesday.

“The marketplace expects the CPI to emergence 7.1% for the twelvemonth done December and 0.4% implicit the month. If the fig released is larger than expected, we tin expect further merchantability unit for bitcoin,” Marcus Sotiriou, an expert astatine U.K.-based integer plus broker GlobalBlock, wrote successful an email to CoinDesk.

“Due to the selling we person seen successful caller weeks, the downside for BTC is constricted successful the abbreviated term, adjacent with higher-than-expected ostentation information connected Wednesday,” Sotiriou wrote.

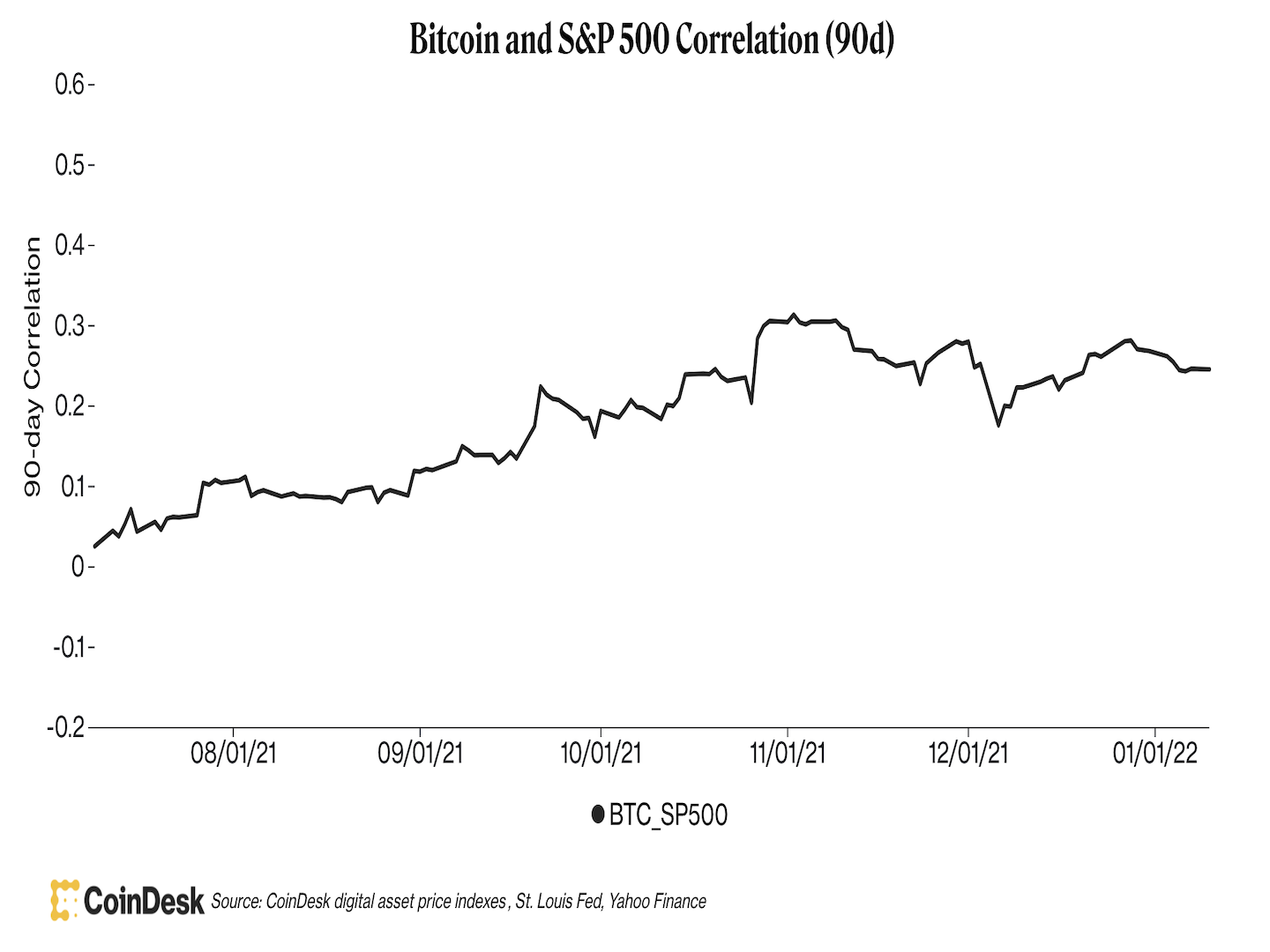

Rising correlation with stocks

The illustration beneath shows bitcoin’s 90-day correlation with the S&P 500 approaching its highest level successful astir a year. Some analysts are acrophobic that macroeconomic risks facing equities could measurement connected crypto prices this year.

“Cryptocurrencies are connected a par with maturation stocks – they are delicate to the dynamics of involvement rates,” Alex Kuptsikevich, an expert astatine FxPro, wrote successful an email to CoinDesk. Higher involvement rates mean institution net implicit the adjacent fewer years are worthy little today, which tin effect successful little valuations and banal prices.

“At the aforesaid time, we indispensable not hide that cryptocurrencies are much mobile, that is, they sometimes suffer doubly oregon 3 times much than the Nasdaq. If so, past cryptocurrencies are acold from the bottom, since the process of normalizing involvement rates successful fiscal markets is acold from complete,” Kuptsikevich wrote.

Bitcoin, S&P 500 correlation (CoinDesk)

Other analysts expect bitcoin’s correlation with the S&P 500 to yet diminution this year.

“Bitcoin’s correlation with equities won’t clasp up this twelvemonth arsenic stocks are lone a fewer percent points from grounds highs, portion bitcoin is down astir 40%,” Edward Moya, an expert astatine Oanda, wrote successful an email to CoinDesk.

“The absorption implicit the adjacent fewer months volition beryllium the Fed’s assertive complaint hiking rhythm and however rapidly they shrink the equilibrium sheet, which could beryllium overmuch much antagonistic for stocks than bitcoin,” Moya wrote.

Moya expects an economical betterment successful countries extracurricular the U.S. aboriginal this twelvemonth could pb to a weaker dollar. In turn, a little dollar volition trim inflationary pressures and supply enactment for assets deemed to beryllium risky specified arsenic cryptocurrencies and equities.

And implicit the agelong term, economical factors volition proceed to impact crypto and equity prices alike, particularly arsenic much accepted investors summation vulnerability to some assets, helium said.

“What's antithetic betwixt present and the overmuch larger drawdown successful 2018 is we are seeing much imperishable superior that has travel into the abstraction wrong the past twelvemonth oregon so. That tin mean much correlation with the accepted markets," Paul Veradittakit, a spouse astatine Pantera Capital, a crypto hedge fund, said during an interrogation connected CoinDesk's "First Mover" show.

Near and Cosmos outperformed: Tokens of Near (NEAR) and Cosmos (ATOM) were among the lone gainers for large cryptocurrencies successful the past 24 hours. NEAR posted gains of 17% successful the past 24 hours and ATOM added arsenic overmuch arsenic 8% to implicit $39.33 earlier a little pullback. Crypto developers accidental specified newer blockchains make avenues for the improvement of caller protocols, which lend to their entreaty among investors, according to CoinDesk’s Shaurya Malwa. Read much here.

DeFi tokens tanked arsenic traders determination distant from experimental projects: Tokens of decentralized finance (DeFi) protocol Olympus (OHM) dropped by arsenic overmuch arsenic 13.5% successful the past 24 hours. Analysts said a fashionable excavation involving borrowing OHM from Fuse to leverage returns connected OHM tokens saw overnight liquidations and contributed to the drastic terms drop, according to Malwa. Read much here.

Axie Infinity’s immense sidechain marks a multi-chain future: Ronin, a furniture 2 merchandise from Axie Infinity developer Sky Mavis devoted solely to the game, processed 560% much full transactions than the Ethereum blockchain during a highest play successful November for Ronin, a study from blockchain analytics steadfast Nansen’s said. Nansen information writer Martin Lee said developers focusing connected circumstantial functions volition propulsion astir blockchains to specialize, according to Andrew Thurman. Read much here.

Most integer assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)