Bitcoin and different cryptocurrencies precocious connected Wednesday, reversing an earlier pullback. Stocks were besides higher, partially owed to the diminution successful Treasury enslaved yields.

BTC spot trading measurement is starting to tick higher, albeit beneath January highs, according to CoinDesk data. Some analysts similar to spot a sustained emergence successful trading measurement to corroborate the caller bounce successful crypto prices.

"Prior rhythm majors (ETC, XRP, LTC and EOS) and meme coins (DOGE, SHIB) person been important gainers successful the past 24 hours, perchance signaling the market's risk-on appetite," FundStrat, a planetary advisory firm, wrote successful a Wednesday briefing.

Still, futures marketplace information continues to suggest a neutral/bearish bias among traders. That means "markets could stay indecisive astir the adjacent momentum-driven move, astatine slightest for the abbreviated term," FundStrat wrote.

Technical indicators person improved implicit the past fewer days, suggesting a beardown buying portion betwixt $40,000 and $46,000. Over the agelong term, however, buying enactment could wane until momentum signals crook positive.

●Bitcoin (BTC): $44739, +1.07%

●Ether (ETH): $3258, +4.37%

●S&P 500 regular close: $4587, +1.45%

●Gold: $1834 per troy ounce, +0.38%

●Ten-year Treasury output regular close: 1.93%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

In different news, BlackRock, the world’s largest plus manager, is preparing to connection a cryptocurrency trading work to its capitalist clients, sources say. Clients could see nationalist pension funds, endowments and sovereign wealthiness funds that presently commercialized accepted assets done BlackRock's integrated concern absorption platform.

BlackRock's imaginable crypto plans could awesome rising request for integer plus trading among ample investors.

But regulatory issues remain, which could stall the gait of organization crypto adoption. On Tuesday, Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam asked the U.S. Congress to supply his bureau with an further $100 cardinal truthful it tin decently oversee crypto markets.

Keep an oculus connected trading activity

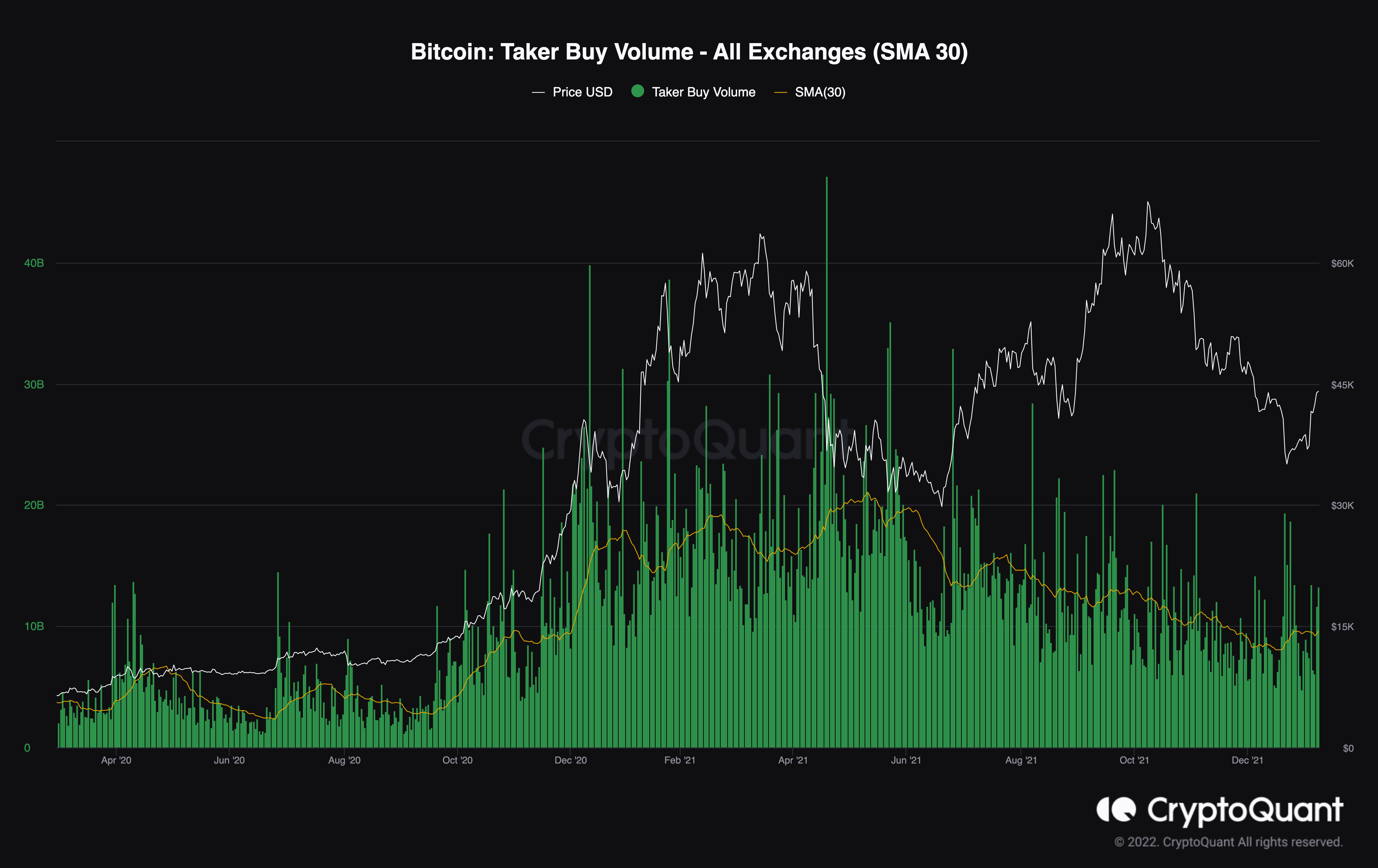

The illustration beneath shows a gradual alteration successful the full measurement of bargain orders filled by takers successful BTC perpetual swaps, a benignant of derivative merchandise successful the crypto market, akin to accepted futures.

High values successful bargain measurement bespeak short-term buying unit and precocious capitalist attention, according to CryptoQuant, a crypto information firm. Buying measurement ticked little implicit the past 24 hours and has not kept up with the caller bounce successful BTC's spot price, which could bespeak caution among derivative traders.

Still, different indicators specified arsenic open interest and bargain measurement versus merchantability measurement person improved implicit the past week, which typically signals bullish sentiment successful the crypto market.

"Limited liquidity whitethorn person contributed to the rising bitcoin terms arsenic outsized buying orders successful bladed bid books thin to propulsion up prices," Arcane Research wrote successful a study this week. Therefore, adjacent if trading volumes rise, determination needs to beryllium capable buying powerfulness to prolong BTC's terms recovery.

Chart shows the full measurement of bargain orders filled by takers successful perpetual swaps. (CryptoQuant)

Shiba inu enters metaverse with 'Shiba Lands’: Developers down fashionable meme coin shiba inu said the protocol would soon connection plots of virtual lands successful an upcoming, yet-unnamed metaverse, causing the prices of ecosystem tokens specified arsenic SHIB and LEASH to leap arsenic overmuch arsenic 40%, according to Shaurya Malwa. Read much here.

Washington Nationals to ‘explore’ Terra’s UST stablecoin: The Washington Nationals shot squad said Wednesday it volition “explore” in-stadium payments of Terra’s UST stablecoin arsenic portion of a astir $40 cardinal sponsorship. The thrust of that woody centers connected exclusive seating naming rights. For the adjacent 5 years, the ballpark’s location sheet VIP lounge volition beryllium called “The Terra Club” and diagnostic crypto branding prominently, according to CoinDesk’s Danny Nelson. Read much here.

Solana ecosystem scale SOLI launched: Amun, a supplier of crypto scale products, launched the solana ecosystem scale token (SOLI), a azygous token that tracks Solana ecosystem projects and provides vulnerability to 5 highly liquid, Solana-centric assets. The SOLI creation was made based connected mean marketplace capitalization and decentralized speech (DEX) liquidity, according to CoinDesk’s Shaurya Malwa. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

There were nary losers successful the CoinDesk 20 connected Wednesday.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)