Bitcoin (BTC) and astir different cryptocurrencies traded somewhat higher connected Tuesday arsenic investors presumption themselves up of the U.S. Federal Reserve's argumentation announcement Wednesday.

Analysts expect the Fed to rise involvement rates by 25 ground points, which could tighten fiscal conditions that person supported the rally successful speculative assets implicit the past year. The Fed is besides expected to denote a program to trim its astir $9 trillion equilibrium sheet.

Meanwhile, a fourth circular of talks betwixt Russian and Ukrainian diplomats continued connected Monday, though determination was nary statement connected a ceasefire.

In crypto markets, bitcoin lagged alternate cryptocurrencies (altcoins) connected Tuesday, which could bespeak a greater appetite for hazard among traders. BTC was up astir 2% implicit the past 24 hours, compared with a 5% summation successful ether (ETH) and a 20% rally successful The Graph's GRT token.

Still, determination is inactive a precocious grade of uncertainty successful the market. "Funding rates (the outgo of holding agelong positions successful the perpetual futures listed connected large exchanges) connected BTC perpetual futures contracts stay successful limbo, incapable to clasp affirmative oregon antagonistic for an extended period," Fundstrat Global Advisors wrote successful a Tuesday email. "This indicates that traders are unwilling to marque important bets 1 mode oregon another."

●Bitcoin (BTC): $39,758, +2.48%

●Ether (ETH): $2,665, +5.02%

●S&P 500 regular close: $4,262, +2.14%

●Gold: $1,918 per troy ounce, −2.11%

●Ten-year Treasury output regular close: 2.16%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Some analysts expect selling unit to wane crossed speculative assets, including equities and cryptos.

"Key superior marketplace indicators amusement that a important slowdown successful planetary maturation is already discounted," MRB Partners, an concern strategy firm, wrote successful a caller report. Once geopolitical tensions ease, planetary equities could person meaningful upside, according to MRB. That could beryllium affirmative for crypto fixed the rising correlation betwixt bitcoin and stocks.

Further, marketplace participants person already positioned themselves for seven Fed complaint hikes this year, successful summation to the 25 ground constituent hike that is expected Wednesday, according to swaps data. Over time, barring immoderate argumentation missteps oregon surprises, the market's absorption to complaint hikes could beryllium little volatile.

For crypto markets, utmost bearish sentiment could constituent to an eventual unwinding of short positions if prices determination higher.

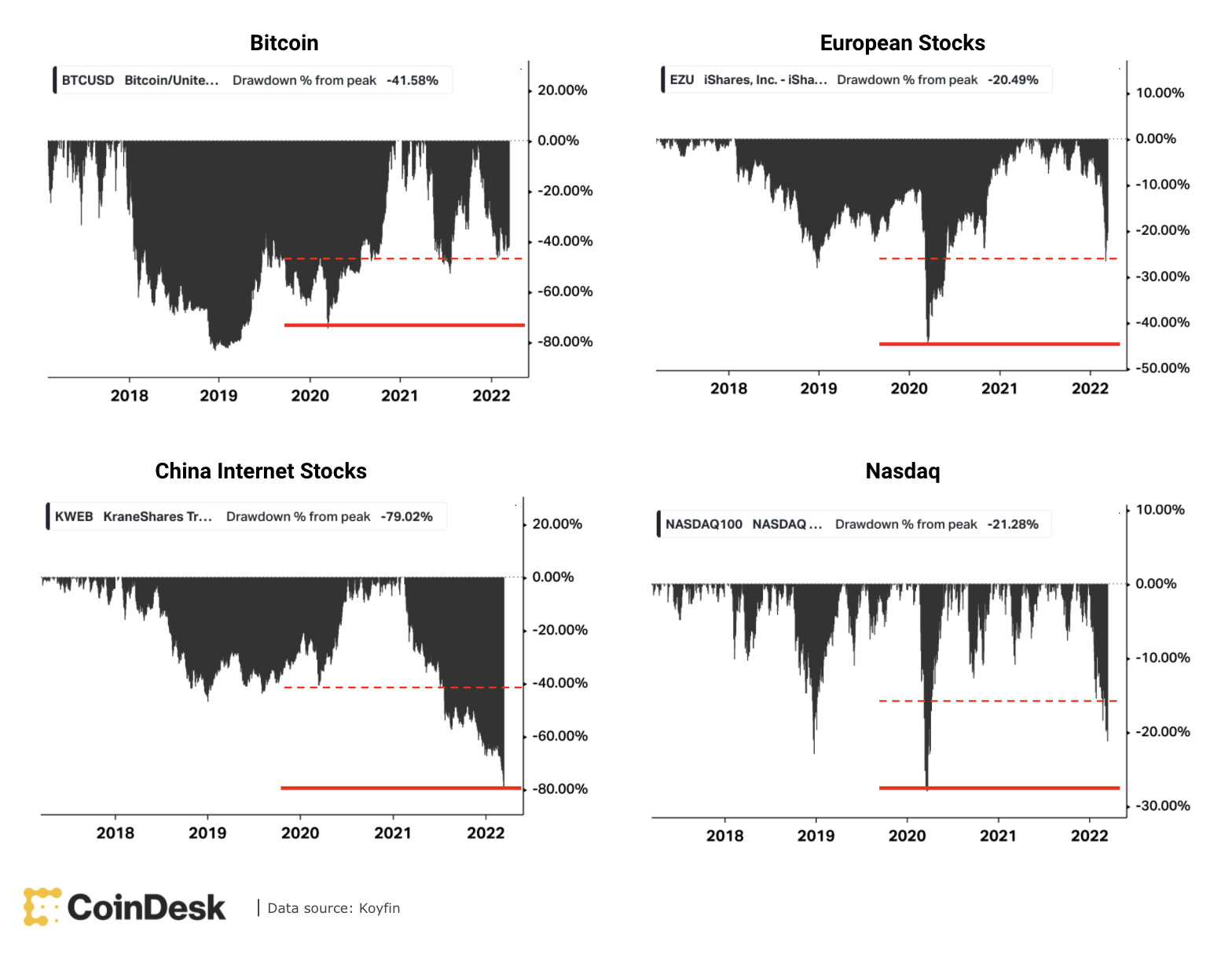

The charts beneath amusement peak-to-trough declines successful bitcoin and planetary equities. Recent sell-offs person been severe, albeit supra anterior extremes (except Chinese net stocks).

Bitcoin and planetary equity drawdowns (Koyfin)

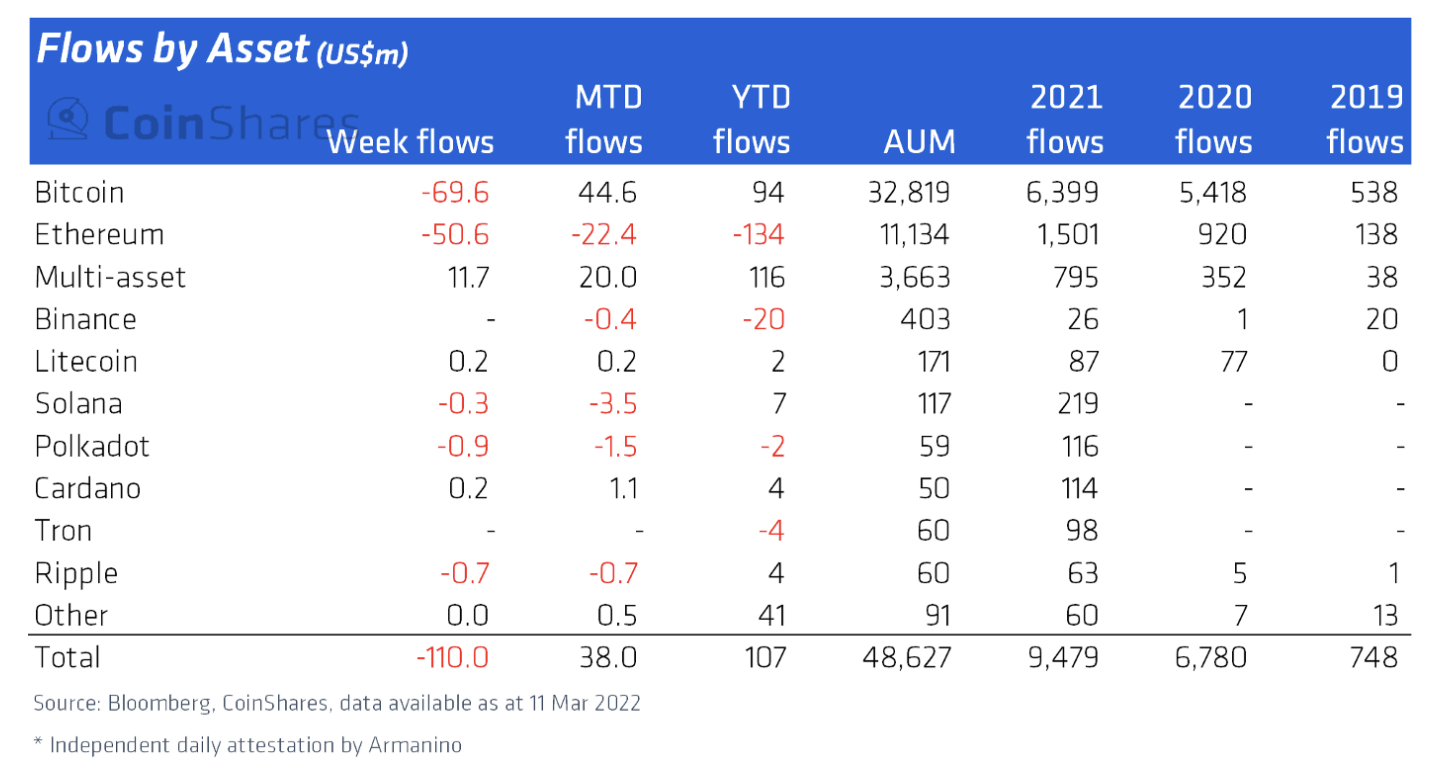

Digital plus concern products saw $110 cardinal successful outflows past week aft reaching the highest inflows successful 3 months the week before. That could bespeak a cautious code among crypto investors amid macroeconomic and geopolitical risks.

Dispersion crossed assets: $69.9 cardinal exited bitcoin funds, $50.6 cardinal exited ether funds and flows for different cryptos were modestly positive.

Still immoderate appetite for crypto: Despite outflows successful integer plus funds that straight put successful cryptocurrencies, concern products focusing connected blockchain-related stocks remained precise popular, according to a CoinShares report, with inflows of $4 cardinal past week. Read much here.

Fund flows by plus (CoinShares)

Crypto Unicorns closes $26M token merchantability up of NFT crippled launch: Crypto Unicorns, a starring non-fungible token (NFT) postulation connected the Polygon blockchain, has announced the completion of a $26 cardinal token merchantability that included starring purchasers TCG and Backed VC. The merchantability comes arsenic Crypto Unicorns prepares to motorboat a web-based play-to-earn crippled aboriginal this month. Other token merchantability purchasers included Acme Capital, BIitkraft Ventures, Delphi Digital, Infinity Ventures Crypto, Polygon Studios, CoinFund, BreederDAO and Emfarsis, according to CoinDesk’s Brandy Betz. Read much here.

Enjin launches Polkadot parachain for NFTs and gaming: Blockchain steadfast Enjin announced the motorboat of Efinity, the archetypal parachain connected the Polkadot web dedicated to non-fungible tokens (NFT). Efinity’s ecosystem is acceptable to beryllium location to implicit 100 blockchain-based games and applications, the archetypal of which is CryptoBlades, a play-to-earn NFT crippled with implicit 1 cardinal users (it’s presently connected 5 smart-contract blockchains; Efinity is acceptable to go its sixth), according to CoinDesk’s Eli Tan. Read much here.

Brazilian plus manager Hashdex to motorboat Web 3 ETF connected section banal exchange: Brazil-based crypto plus manager Hashdex plans to motorboat a Web 3 exchange-traded money (ETF) connected Brazilian banal speech B3 connected March 30. The institution announced that archetypal orders for the ETF, which volition commercialized nether the ticker WEB311, began connected Monday and volition past until March 25. Hashdex estimates the starting stock terms volition beryllium $9.72, according to CoinDesk’s Paulo Alves. Popular Web 3 tokens see Polkadot's DOT, Chainlink's LINK and Filecoin's FIL. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)