Bitcoin (BTC) traded little connected Wednesday aft a little terms bounce implicit the past 2 days. Buying enactment has been anemic pursuing the January sell-off, which is wherefore immoderate analysts stay uncertain astir BTC's short-term terms direction.

Market indicators specified arsenic volatility and trading measurement stay low, indicating a deficiency of condemnation among crypto buyers and sellers. "Bitcoin’s seven-day volatility is present astatine the lowest level since November 2020," Arcane Research stated successful a report. The steadfast expects short-term rises successful volatility to stay constricted arsenic BTC trades successful a choky range.

Still, a BTC breakout supra $40,000 oregon breakdown beneath $30,000 could beryllium a catalyst for a surge successful trading activity.

"Since the aboriginal November peak, determination person been 4 marked, step-like drops successful the crypto market," FundStrat, a planetary probe firm, wrote successful a Wednesday briefing. "After each driblet determination has been a betterment averaging 8.9% starring into the adjacent drop. A noticeable quality betwixt the existent betterment and the erstwhile ones is the volatility," FundStrat wrote.

The steadfast noted that during the past 3 terms recoveries bitcoin had an mean existent scope (ATR, a volatility indicator) of 151, but the existent recovery's ART is lone 109.

●Bitcoin (BTC): $37557, −2.55%

●Ether (ETH): $2724, −1.56%

●S&P 500 regular close: $4589, +0.94%

●Gold: $1807 per troy ounce, +0.34%

●Ten-year Treasury output regular close: 1.77%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Ether outperforms bitcoin

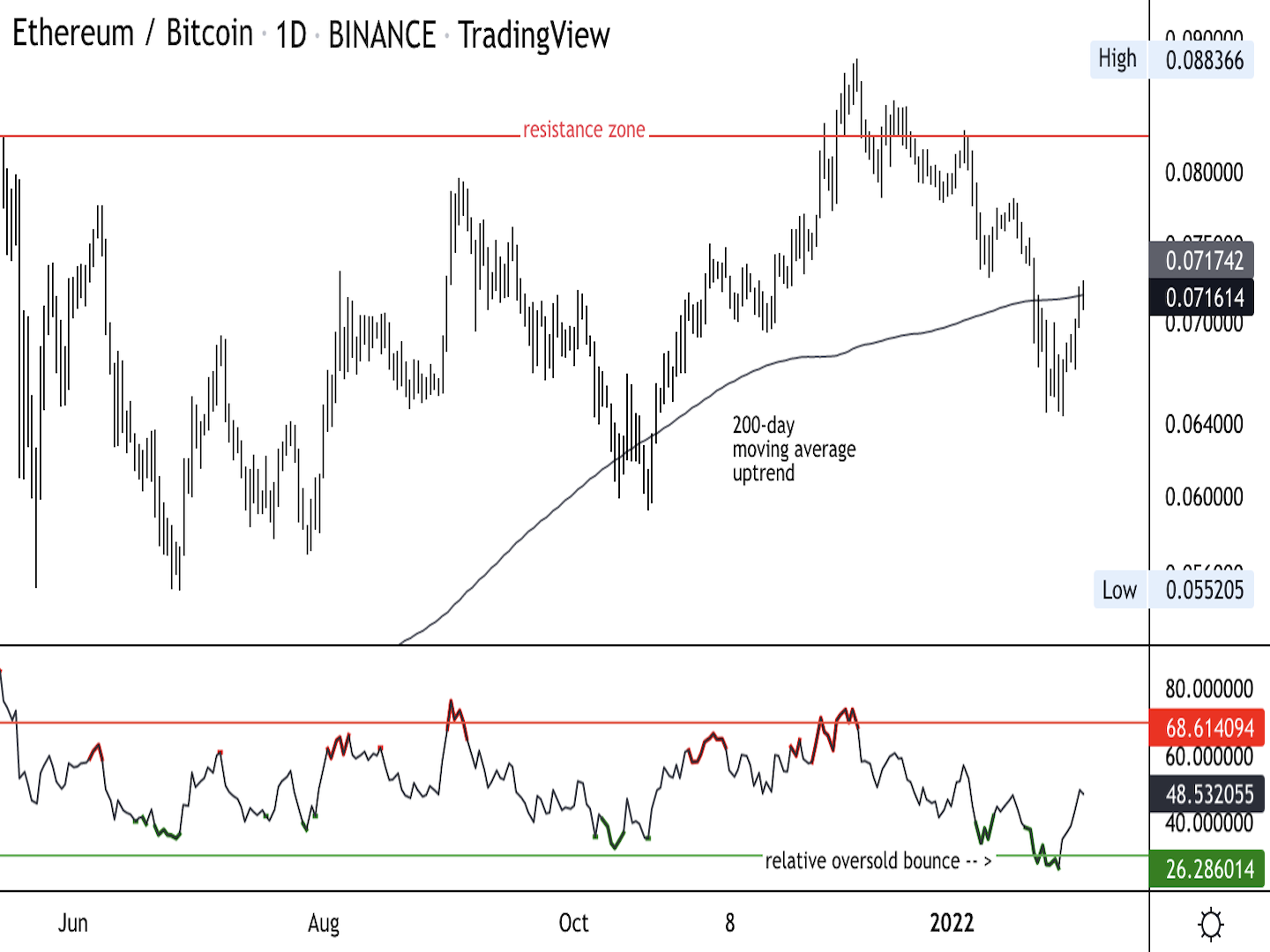

Ether (ETH), the second-largest cryptocurrency by marketplace capitalization, is starting to outperform bitcoin. The illustration beneath shows a bid of higher comparative terms lows successful the ETH/BTC ratio since July 2020. The adjacent level of absorption successful ETH/BTC is astatine 0.08, a important obstruction which could bounds further upside successful ETH comparative to BTC.

ETH/BTC terms ratio connected regular illustration shows support/resistance with RSI connected bottommost (Damanick Dantes/CoinDesk, TradingView)

Solana Pay ushers successful a caller payments era: Solana Pay, a decentralized, unfastened and peer-to-peer outgo protocol, was launched Tuesday. It aims to pave the mode for a aboriginal wherever integer currencies are prevalent and integer wealth moves done the net similar information – uncensored and without intermediaries taxing each transaction. The institution says the protocol provides a specification that allows consumers to nonstop integer dollar currencies, specified arsenic USDC, from their wallets straight into a merchant’s account, settling instantly with costs measured successful fractions of a penny. Read much here.

Sushi 2.0: SushiSwap is advancing into Sushi 2.0 with plans for immoderate cardinal improvements and merchandise releases this year. Developers are aiming astatine 3 overriding goals: scalability, sustainability and ratio – cardinal factors adjacent prevalent tokens are having trouble balancing. Read much here.

Cardano developers suggest artifact size increase: Input Output, the improvement institution down the Cardano network, projected expanding the network's artifact size by 11% connected Wednesday. The connection volition summation artifact size by a further 8 KB, taking it from 72 KB to 80 KB, according to CoinDesk’s Shaurya Malwa. Read much here.

Digital assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)