Bitcoin (BTC) and different cryptocurrencies ended February with a crisp rebound, which extended into March, albeit astatine a slower pace.

It appears that bearish sentiment is starting to slice contempt ongoing geopolitical risk. For example, the bitcoin Fear & Greed Index, which measures the temper among crypto traders, roseate from "extreme fear" territory and is backmost astir neutral levels.

Meanwhile, bitcoin's mean trading measurement crossed spot exchanges reached the highest level since December connected Tuesday, which could beryllium an aboriginal motion of capitulation among sellers. The ratio of bargain measurement comparative to merchantability measurement besides ticked higher implicit the past week, suggesting renewed bullish activity.

Still, different marketplace indicators are neutral arsenic immoderate buyers stay connected the sidelines.

Traders successful bitcoin's perpetual swaps marketplace are "not convinced by the caller rally," according to a study by Arcane Research. "Despite yesterday’s liquidation uptick, the perpetual swap open interest remained reasonably stable, falling from 223,000 BTC to 219,000 BTC, suggesting that traders are actively re-adjusting risk," the steadfast wrote.

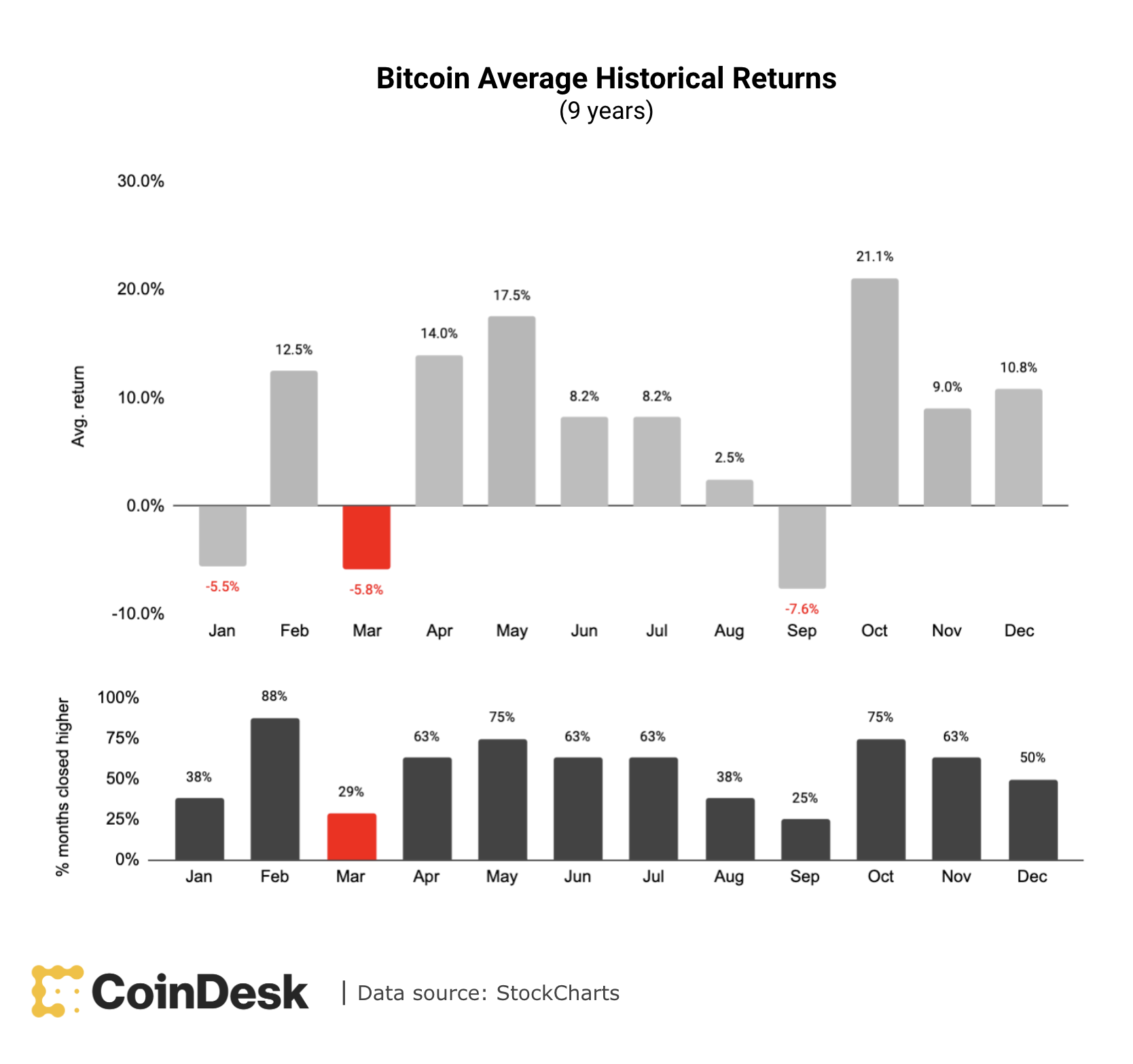

Historically, March tends to beryllium a hard period for bitcoin and equities. Analysts expect macroeconomic and geopolitical risks to linger, which could origin short-term volatility. At a aboriginal point, terms enactment could stabilize arsenic the probability of affirmative BTC returns increases implicit the adjacent fewer months.

●Bitcoin (BTC): $44035, +5.83%

●Ether (ETH): $2968, +5.36%

●S&P 500 regular close: $4306, −1.55%

●Gold: $1949 per troy ounce, +2.59%

●Ten-year Treasury output regular close: 1.71%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Mixed returns successful February

February was a volatile period successful crypto markets, triggered by macroeconomic and geopolitical risks. Still, determination were immoderate wide winners specified arsenic XRP, which outperformed the CoinDesk 20 crypto database with a 29% return. The CoinDesk 20 filters thousands of cryptocurrencies by marketplace capitalization and trading measurement crossed exchanges.

CoinDesk 20 February returns (CoinDesk Indices)

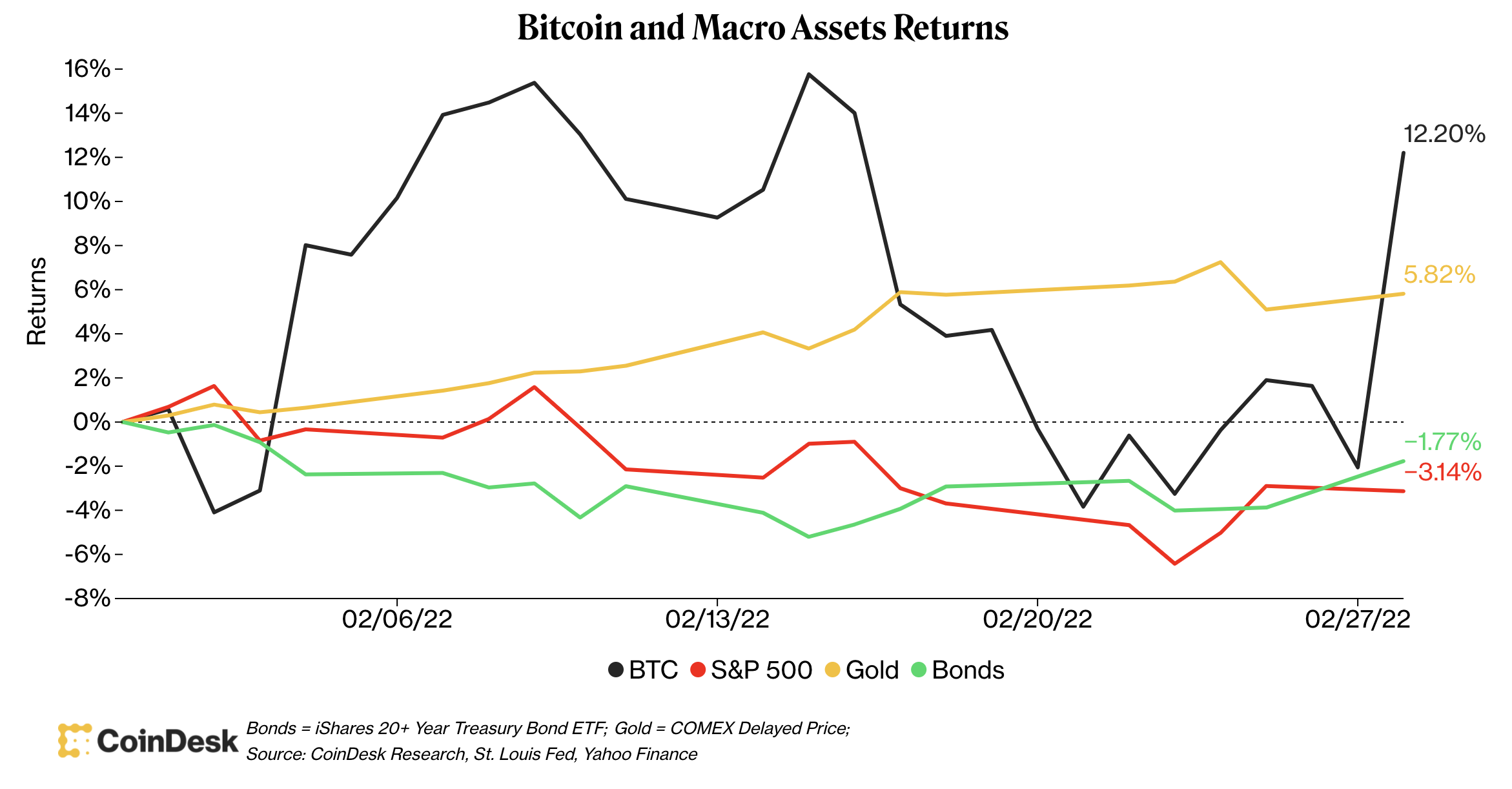

Bitcoin besides outperformed accepted markets successful February, albeit with greater volatility.

The illustration beneath shows bitcoin's leap toward the extremity of the month, which was good up of gold's 5% summation and the S&P 500's 3% loss.

Bitcoin's risk-adjusted return was besides greater than the S&P 500 banal scale implicit the past 30 days, but has lagged stocks implicit the past 3 months, according to information from IntoTheBlock. That means crypto investors experienced greater terms swings to make returns versus accepted investors.

Bitcoin and macro plus returns successful February. (CoinDesk Research, St. Louis Fed, Yahoo Finance)

On average, implicit the past 9 years, bitcoin has produced antagonistic returns successful March, according to information from StockCharts. While past returns are nary warrant of aboriginal returns, investors are inactive bracing themselves for economical and governmental uncertainty adjacent month.

"This is simply a precise hard situation for risky assets," Edward Moya, an anlyst astatine Oanda, wrote successful an email to CoinDesk. Inflation volition apt go the focal constituent among investors adjacent month, which could unit cardinal banks to beryllium much assertive with tightening monetary policy, according to Moya.

"If fiscal markets turn tense that the [U.S.] Federal Reserve volition go much assertive successful removing accommodation, bitcoin could settee backmost to the little boundaries of its widening trading scope conscionable beneath the $40,000 level," Moya wrote.

Still, Moya expects downside could beryllium constricted fixed the caller stabilization successful crypto prices.

Bitcoin mean humanities returns (CoinDesk, StockCharts)

One THETA trader mislaid $11M to liquidations arsenic prices jumped 18%: A lone trader mislaid much than $11 cardinal connected a azygous futures commercialized involving Theta Networks’ THETA token arsenic the terms jumped 18% successful 24 hours. The trade, among the largest for mid-cap cryptos successful caller months, occurred connected crypto speech Binance and formed the largest portion of the $11.67 cardinal successful liquidations connected THETA futures. Usually, the largest liquidations hap connected futures tracking bitcoin (BTC) oregon ether (ETH), the 2 most-traded cryptocurrencies, according to CoinDesk’s Shaurya Malwa. Read much here.

Terra’s LUNA jumps 25%: Terra’s LUNA token has jumped arsenic overmuch arsenic 25% since Feb. 28, starring gains among large cryptocurrencies successful a broader marketplace recovery. LUNA reached play highs of $95.36 earlier traders took profits and sent prices lower. Read much here.

SOL, ETH, AVAX, ADA, ATOM roseate with bitcoin: Solana (SOL) was up arsenic overmuch arsenic 11% since aboriginal Monday, portion ether (ETH) was up arsenic overmuch arsenic 11% implicit the aforesaid period. Ether’s unfastened involvement was up 6%. Avalanche (AVAX) was up arsenic overmuch arsenic 9%, portion Cardano's ADA token was up arsenic overmuch arsenic 5%. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)