Bitcoin was down astir 4% implicit the past 24 hours on with equities connected Wednesday. The intraday sell-off occurred aft the U.S. Federal Reserve pointed to a imaginable interest complaint hike successful March, which is sooner than galore had expected.

But contempt the terms dip, immoderate analysts expect BTC volition stabilize successful a scope of betwixt $40,000 and $50,000, which could support volatility low.

Others are looking to alternate cryptocurrencies (altcoins) specified arsenic ETH, LINK, ICP, FTM that person outperformed BTC implicit the past week.

For example, immoderate decentralized finance (DeFi) tokens that fell retired of favour successful aboriginal 2021 inactive managed to clasp immoderate apical spots successful presumption of full worth locked, which represents the fig of assets that are staked successful a protocol.

“Perhaps arsenic they are considered much battle-tested and a safer store of superior compared to newer competitors,” Delphi Digital wrote successful a blog post.

For now, adjacent with altcoins successful the spotlight, volatility has declined successful some BTC and ETH recently.

“Our presumption is that this volatility compression is structural and volition beryllium a taxable for 2022,” crypto trading steadfast QCP Capital wrote successful a Telegram announcement. “With that said, we deliberation this dip successful the front-end [of the volatility curve] is overextended and we’re adding long gamma here.”

Traders are “long gamma profit” erstwhile the underlying plus moves much than expected.

Bitcoin (BTC): $43,943, -4.98%

Ether (ETH): $3,592, -5.85%

10-year Treasury output closed astatine 1.69%

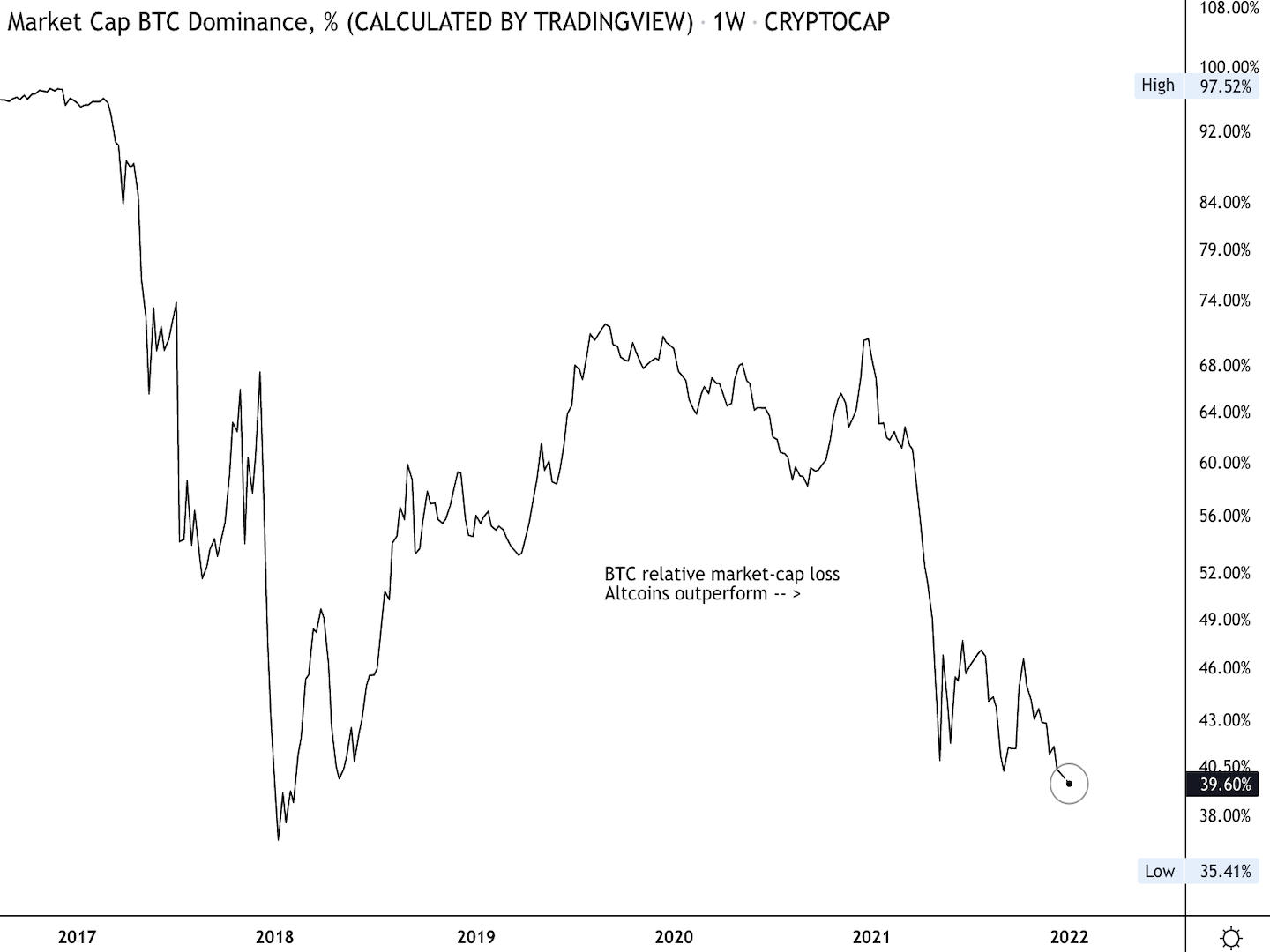

Bitcoin dominance declines

The bitcoin dominance ratio, oregon the measurement of BTC’s marketplace capitalization comparative to the full crypto marketplace capitalization, continued to diminution toward 39% connected Wednesday. The ratio is astatine the lowest level since April 2018, erstwhile cryptocurrencies were successful a carnivore market.

Typically, during periods of marketplace panic, immoderate traders would merchantability altcoins, which are deemed to beryllium risky. The remaining enactment for traders is to question comparative information successful BTC, which results successful a higher bitcoin dominance ratio.

This time, however, altcoins proceed to outperform bitcoin, which suggests capitalist appetite for hazard remains strong.

Bitcoin dominance ratio (TradingView)

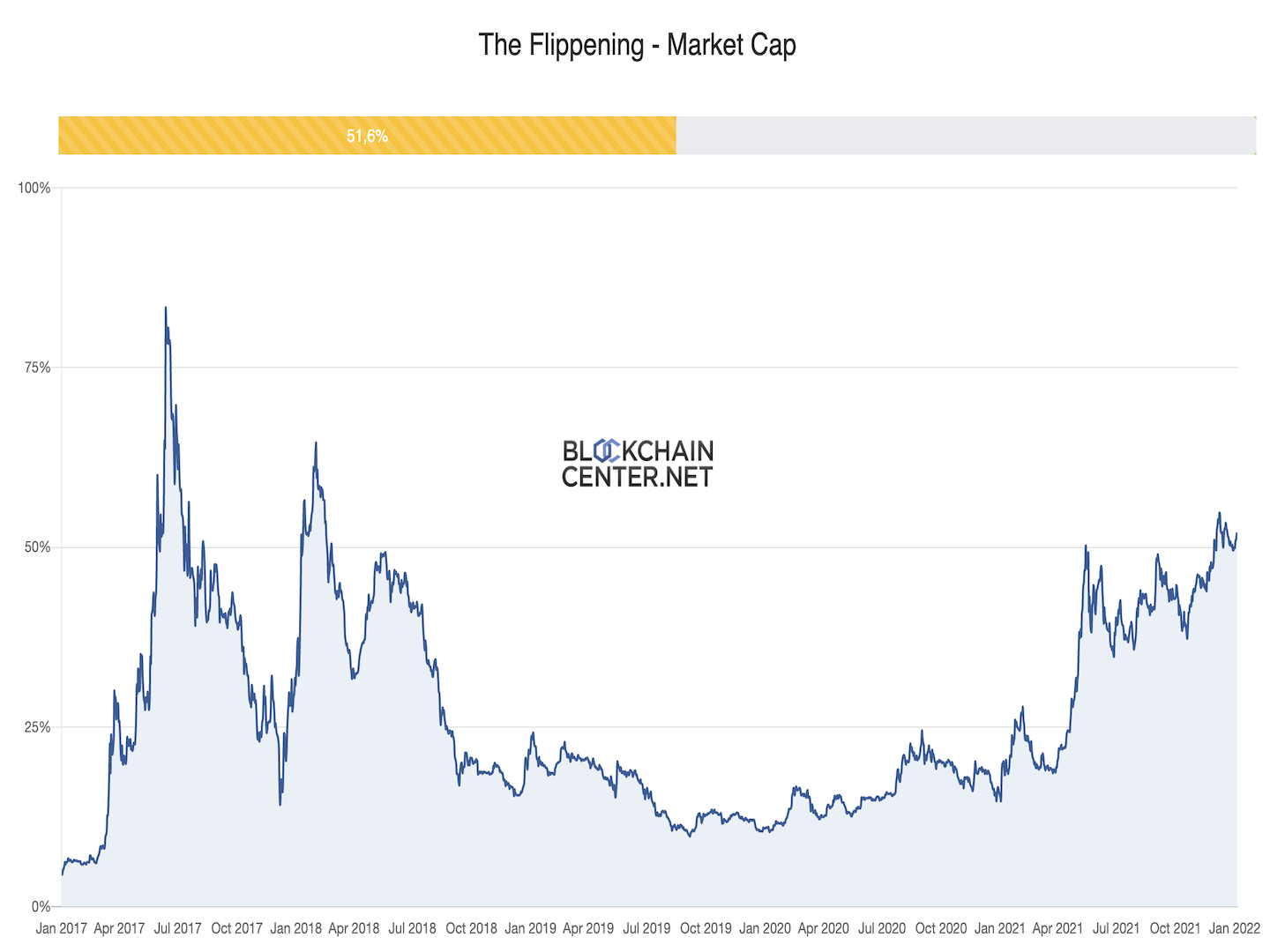

Ethereum’s marketplace headdress getting person to bitcoin’s

Ethereum, the second-largest cryptocurrency by marketplace cap, is astir 50% distant from overtaking bitcoin arsenic the largest cryptocurrency.

Some analysts notation to the conflict for crypto’s apical crown arsenic “The Flippening.” Over the past year, ether has gained crushed versus bitcoin crossed respective metrics, including progressive addresses, Google hunt involvement and transaction counts.

ETH's marketplace headdress vs. BTC (BlockchainCenter)

The emergence successful ether’s marketplace capitalization suggests investors are looking for imaginable opportunities for instrumentality beyond bitcoin.

“There are hard dates and a hard outline from the Ethereum Foundation to summation the web throughput and little transaction fees,” Katie Talati, caput of probe for crypto and blockchain plus absorption steadfast Arca, said during an interview connected CoinDesk’s “First Mover” show.

Ethereum’s web improvements could beryllium a catalyst to pull much funds to ether versus bitcoin, according to Talati.

The authorities of Ethereum’s interest market: CoinDesk’s Edward Oosterbaan examined the information for EIP 1559 and if aft 4 months, determination are immoderate existent impacts connected the Ethereum blockchain. So far, Coinbase noted it is redeeming 27 ETH per time from base-fee refunds and faster transaction confirmations by 11 seconds compared with earlier the London hard fork. On the opposing side, Galaxy Digital’s look into EIP 1559 reported issues owed to accrued artifact size (gas limits).

Chainlink (LINK) jumps, outperforming bitcoin: LINK led gains among large cryptocurrencies implicit the past 2 days arsenic the broader marketplace showed signs of a recovery. LINK is utilized to wage for terms feeds and different services connected Chainlink and has a marketplace capitalization of $12 billion, CoinGecko information show. The price, however, is down 50% from its grounds of $52 past May.

Algorand enters the metaverse: The Drone Racing League (DRL) and Web 3 crippled developer Playground Labs person tapped Algorand’s blockchain to make the archetypal play-to-earn drone crippled successful the metaverse, the league announced connected Wednesday. While the details are inactive to beryllium worked out, the league said “players volition contention DRL drones” (presumably integer ones) for cryptocurrency and non-fungible tokens connected Algorand. Read much here.

Most integer assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)