Bitcoin (BTC) remained beneath $40,000 connected Monday arsenic selling unit intensified. Equities besides traded little amid Russia's expanding attacks connected Ukraine.

Talks among U.S. officials of a potential ban connected Russian lipid imports triggered a surge successful vigor prices implicit the past fewer days. Higher prices astatine the pump could pb to slower economical maturation and little banal prices.

In crypto markets, bitcoin was down 3% implicit the past 24 hours, compared to a 5% driblet successful ether (ETH). Trading measurement remains low, and analysts noticed a nonaccomplishment of short-term buying pressure, which could constituent to constricted upside successful prices.

Still, sentiment and method indicators are neutral, which typically precede a pickup successful volatility.

●Bitcoin (BTC): $37933, −3.54%

●Ether (ETH): $2485, −6.04%

●S&P 500 regular close: $4201, −2.95%

●Gold: $2001 per troy ounce, +1.85%

●Ten-year Treasury output regular close: 1.75%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Bitcoin's year-long trading scope betwixt $28,000 and $69,000 has been eventful. A premix of economic, regulatory and geopolitical headlines triggered 20%-50% terms swings, which near immoderate buyers connected the sidelines.

Typically, terms ranges payment short-term traders who participate positions astatine enactment and absorption levels, aiming to nett erstwhile the terms returns to its midpoint.

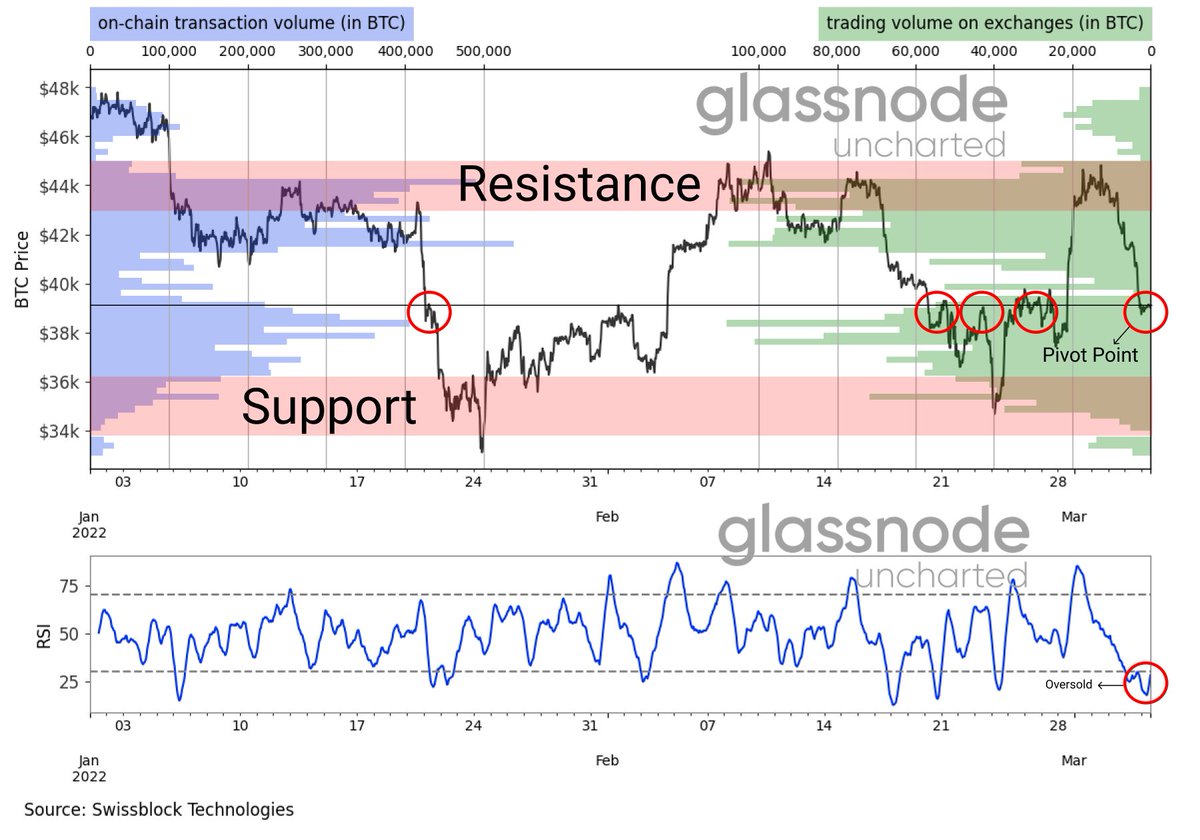

The illustration beneath shows the astir caller terms scope betwixt $34,000 and $45,000. Peaks successful trading measurement are seen astatine support/resistance, indicating a precocious level of enactment with buying oregon selling strength. Additionally, transaction enactment connected the Bitcoin blockchain confirms spikes successful proviso and request astatine cardinal method levels.

For now, immoderate analysts expect the trading scope to persist implicit the abbreviated term.

"Crypto markets volition request to spot a play of stabilization successful the adjacent 2 oregon 3 months earlier a much sustainable betterment tin get nether way," David Duong, caput of organization probe astatine Coinbase (COIN), wrote successful a report. The adjacent large determination successful crypto could hap erstwhile investors person greater clarity connected cardinal slope argumentation and geopolitical events, according to Duong.

Bitcoin terms scope with measurement (Glassnode)

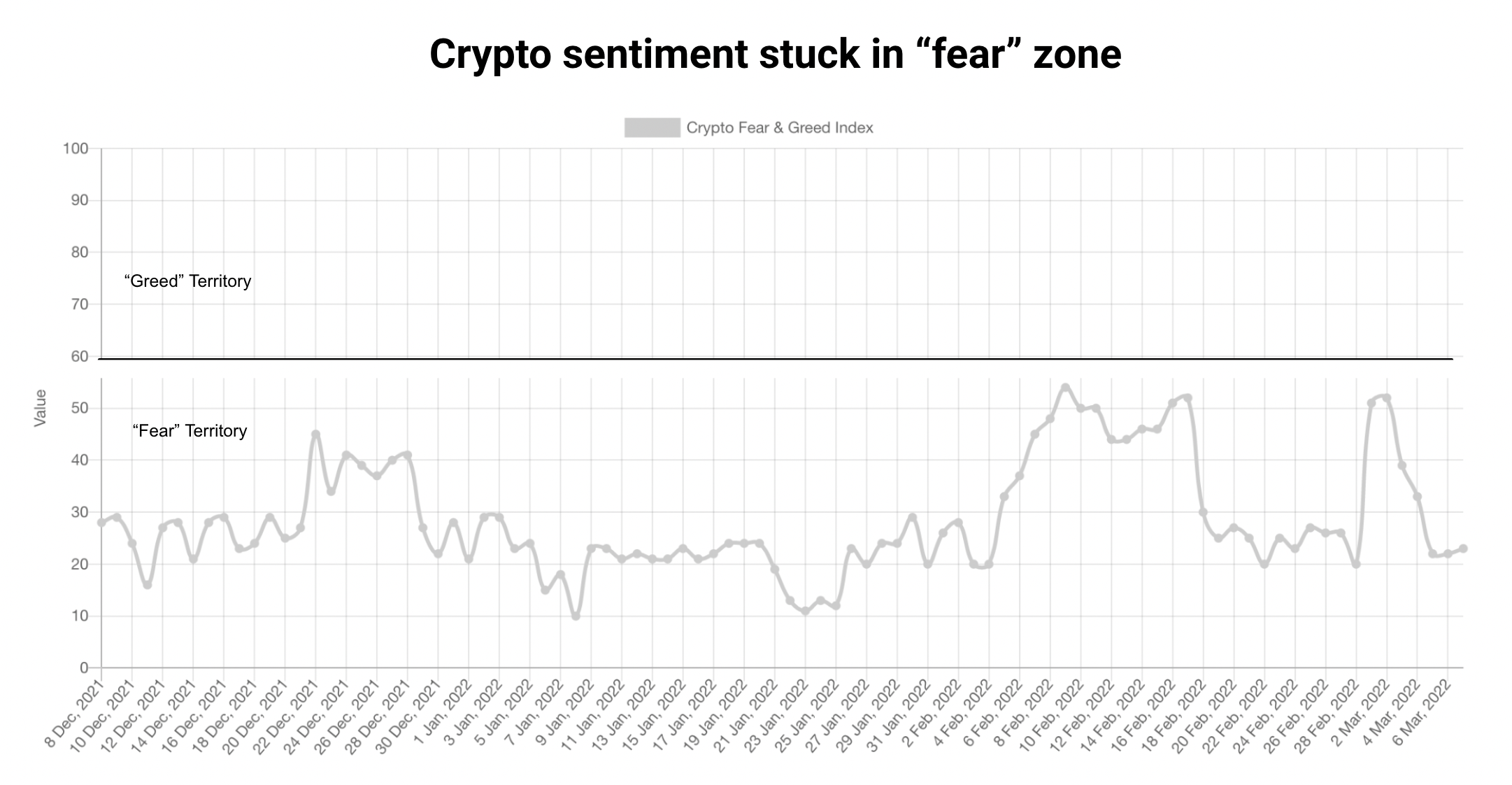

Sentiment among crypto traders has been bearish passim the caller terms range.

The illustration beneath shows the bitcoin Fear & Greed Index, which has remained successful "fear" territory implicit the past 3 months, which could permission bitcoin susceptible to volatility shocks. (The scale runs from 0 to 100, with "fear" betwixt 0 and 49 and "greed" betwixt 50 and 100.)

"With prices trading sideways successful caller weeks, a comparative equilibrium has been established," Glassnode, the crypto information firm, wrote successful a blog post. "However, fixed the constricted incoming caller demand, this delicate equilibrium tin beryllium disrupted by immoderate important grade of seller exhaustion, oregon conversely a re-invigoration of sellers."

Bitcoin Fear & Greed Index (Alternative.me)

Crypto inflows tripled past week

Fresh concern inflows into crypto funds tripled past week to the highest successful astir 3 months, contempt outflows from European products.

Digital-asset concern funds attracted $127 cardinal of caller wealth during the week done March 4, a report Monday from digital-asset manager CoinShares showed. The determination breakdown comprised $151 cardinal of inflows successful the Americas and outflows of $24 cardinal successful Europe.

Bitcoin funds saw inflows of $95 cardinal past week, the astir since aboriginal December. Meanwhile, ether funds saw insignificant inflows of $25 million, the astir successful 13 weeks.

DraftKings becomes Polygon validator aft NFT marketplace clocks $44M successful sales: Sports betting powerhouse DraftKings (DKNG) is partnering with integer plus startup Zero Hash to go a Polygon validator. The institution announced Monday the collaboration volition marque DraftKings 1 of the Ethereum furniture 2’s largest governors, pursuing done connected a program that has been successful the works since October, according to CoinDesk’s Eli Tan. Read much here.

Whale holdings successful Cardano's ADA token deed grounds high: Large investors, known arsenic whales, look to beryllium bargain-hunting Cardano's ADA token arsenic the programmable blockchain's decentralized finance (DeFi) protocols spot accelerated growth. The equilibrium held by addresses with 1 cardinal to 10 cardinal coins roseate to a grounds 12 cardinal ADA ($9.72 billion) past week, a 41% summation since precocious January, information provided by blockchain analytics steadfast IntoTheBlock show, according to CoinDesk’s Omkar Godbole. Read much here.

Dozens of tokens tumble arsenic prolific developer Andre Cronje quits: Prices for dozens of tokens are plunging connected the quality that prolific developer Andre Cronje is quitting – including prices for galore that lone person tenuous links to the DeFi maven. On Sunday, predominant collaborator Anton Nell announced connected Twitter helium and Cronje were “closing the chapter” connected processing successful decentralized finance, according to CoinDesk’s Andrew Thurmen. Read much here.

Digital assets successful the CoinDesk 20 ended the time lower.

There are nary gainers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)