Some alternate cryptocurrencies (altcoins) besides edged higher connected Tuesday, adjacent arsenic alts' caller gains against bitcoin were starting to fade. For example, ether (ETH), the second-largest cryptocurrency by marketplace capitalization aft bitcoin, roseate supra $3,000 for the first clip successful 2 weeks and was up 3% implicit the past 24 hours, compared to a emergence of arsenic overmuch arsenic 4% successful BTC implicit the aforesaid period. Meanwhile, Terra's LUNA token was down 3% implicit the past 24 hours.

But immoderate analysts stay cautious contempt the caller terms rise. "This is not the archetypal specified leap successful BTC since the opening of March, successful opposition to the neutral oregon adjacent antagonistic sentiment successful the banal markets," Alex Kuptsikevich, an expert astatine FxPro, wrote successful an article. "Until now, specified impulses cannot beryllium connected a coagulated basis, due to the fact that the cardinal request for risks is nether evident pressure."

Elsewhere, planetary equities traded higher connected Monday portion gold, a accepted harmless haven, declined. The 10-year Treasury enslaved output continued higher, tracking gains successful lipid prices arsenic investors presumption themselves for precocious ostentation and rising involvement rates.

●Bitcoin (BTC): $42,365, +2.77%

●Ether (ETH): $2,991, +2.41%

●S&P 500 regular close: $4,512, +1.13%

●Gold: $1,921 per troy ounce, −0.38%

●Ten-year Treasury output regular close: 2.37%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Tactical displacement successful altcoins

For now, immoderate analysts spot the imaginable for a short-term alleviation rally successful altcoins, which could awesome a greater appetite for hazard among crypto investors. Altcoins thin to outperform successful bull markets due to the fact that of their higher hazard illustration comparative to bitcoin.

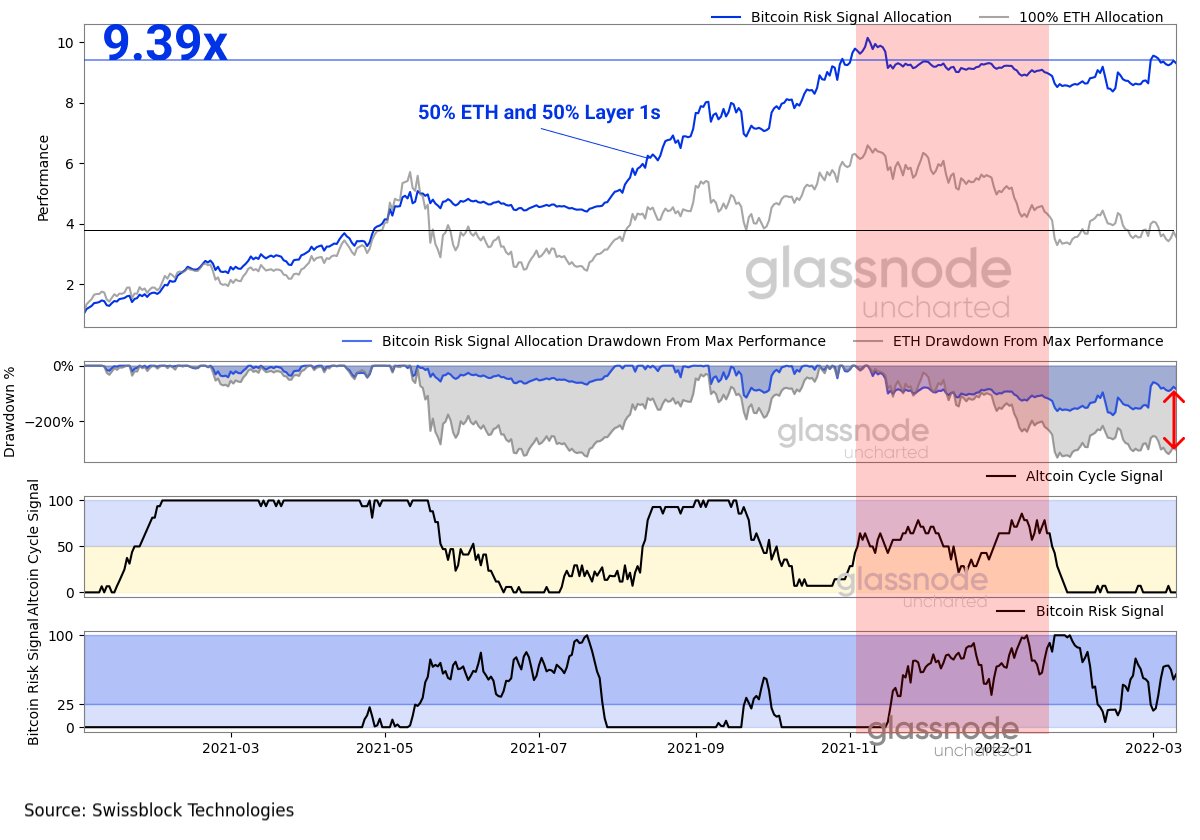

The illustration beneath shows the rhythm successful bitcoin and altcoins implicit the past year. When Glassnode's hazard indicators scope utmost highs, a greater allocation to bitcoin is warranted, akin to what occurred earlier this year. In contrast, erstwhile hazard is debased for an extended play of time, traders thin to displacement toward altcoins arsenic sentiment improves.

Currently, the hazard awesome (see past sheet below) is inactive supra 25, which does not suggest an assertive rotation to altcoins. Read much here.

Bitcoin hazard signals (Glassnode/Swissblock Technologies)

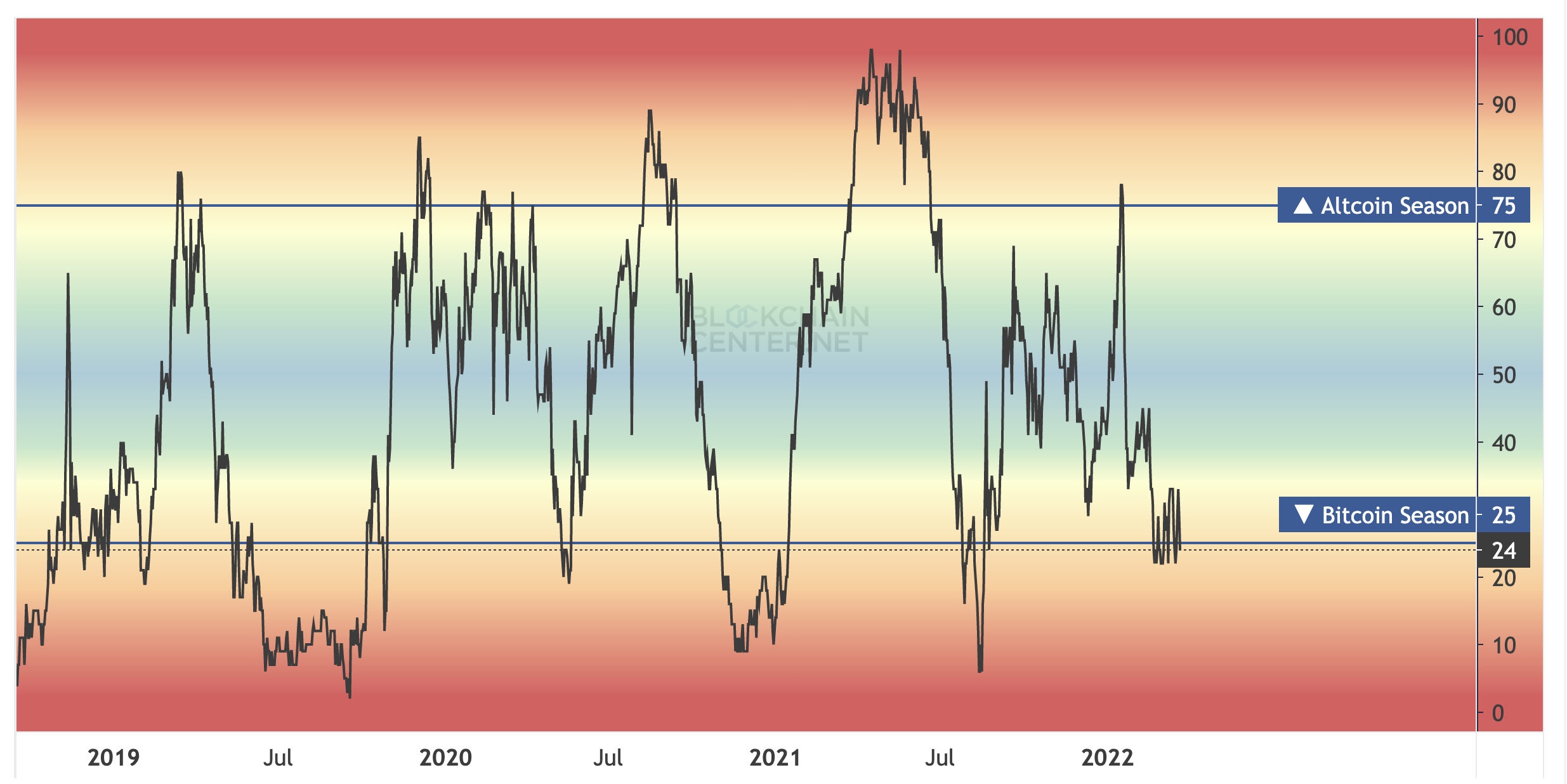

And present is the Altcoin Season Index by Blockchain Center. So far, astir 25% of the apical 50 coins are performing amended than bitcoin implicit the past 90 days, which is beneath the 75% threshold to awesome a bullish signifier for altcoins (possibly excessively precocious for traders looking for a caller trend).

Instead, based connected erstwhile cycles, altcoins thin to prolong their outperformance erstwhile the indicator crosses supra the 50% neutral mark.

Altcoin Season Index (Blockchain Center)

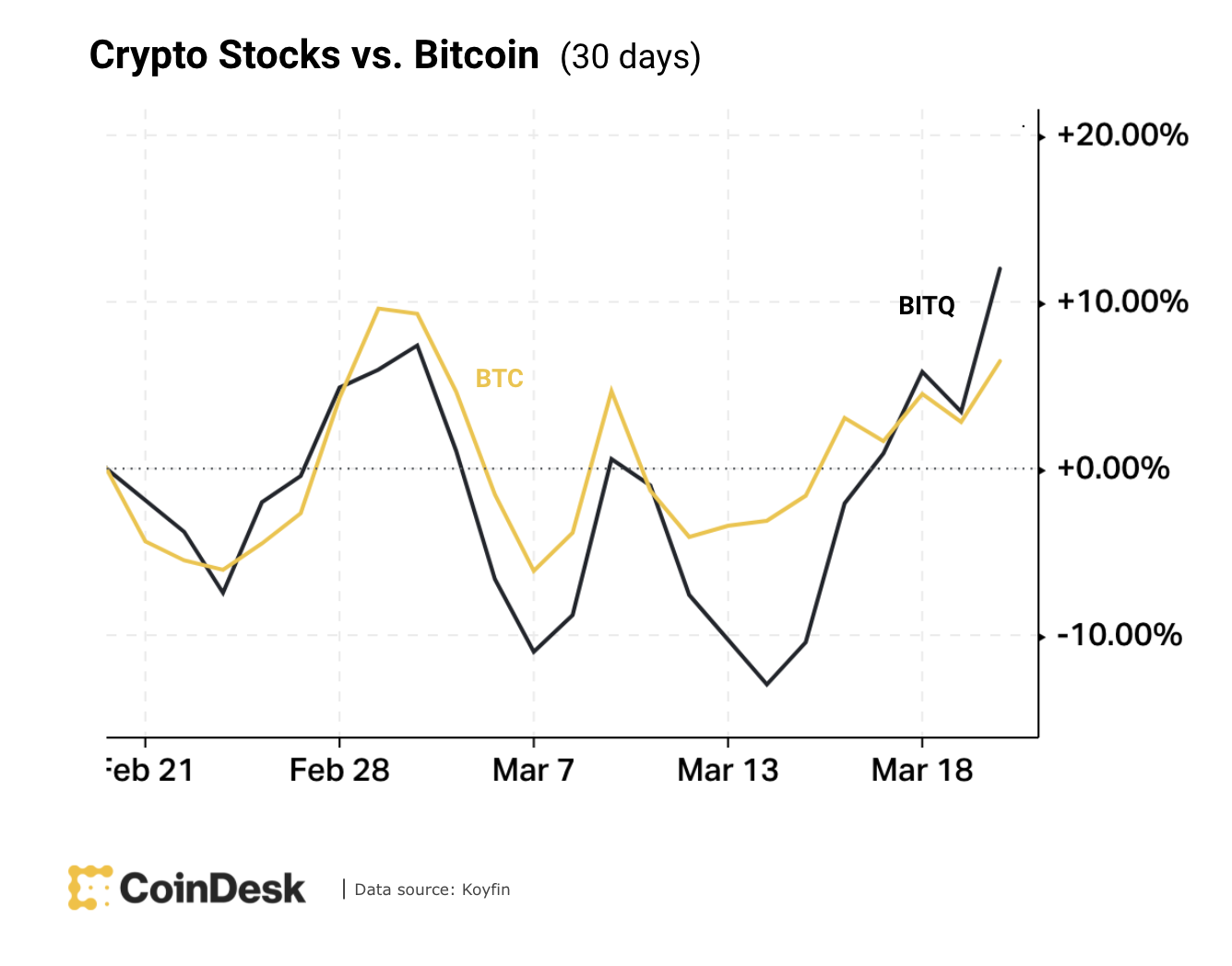

Another indicator of capitalist appetite for hazard is the show of crypto-related stocks comparative to BTC.

The illustration beneath shows the caller outperformance of the Bitwise Crypto Industry Innovators exchange-traded money (BITQ), which tracks the show of companies that make the bulk of their gross from their crypto concern activities. BITQ is present up of BTC implicit the past 30 days, which typically signals a bullish crook successful crypto markets.

BTC vs. BITQ (Koyfin)

Polychain Capital leads $22M concern successful NFT appraisal protocol Upshot: Upshot, a protocol that provides non-fungible token (NFT) appraisals, has raised $22 cardinal successful a Series A2 backing round led by Polychain Capital, Evaluating the worth of an NFT is simply a analyzable task due to the fact that the reply is fundamentally “what idiosyncratic is consenting to pay.” Pricing data, however, is important to person some arsenic a imaginable NFT trader and for developers exploring the intersection of decentralized finance (DeFi) and NFTs, according to CoinDesk’s Brandy Betz. Read much here.

$1 cardinal successful loans issued connected Maple successful conscionable 10 months: Maple, a protocol that enables undercollateralized loans for organization borrowers, announced that $1 cardinal successful loans person been issued connected the protocol. Launched successful May 2021, Maple’s debt-capital marketplace infrastructure is intended to alteration recognition experts to motorboat and turn steadfast lending businesses. Participants connected Maple are marketplace makers and market-neutral funds. They program to determination to beryllium multi-chain arsenic it launches connected Solana successful the adjacent future. Read much here.

mStable’s Process Quality Score was rated 93% from DeFiSafety: mStable, which calls itself a decentralized stablecoin ecosystem, was fixed a Process Quality Score (PQR) of 93%, putting it among the apical 5% of protocols reviewed by DeFiSafety. The autarkic ratings enactment evaluates decentralized concern products to nutrient a information people based connected transparency and adherence to champion practices.

Digital assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)