Bitcoin (BTC) roseate supra $36,000 connected Tuesday but was inactive down astir 0.38% implicit the past 24 hours, compared with a 0.76% autumn successful ETH. Considering the rebound earlier today, it appears that buyers are starting to return, but immoderate analysts expect choppy terms enactment up of the U.S. Federal Reserve's property league connected Wednesday. Fed officials kicked disconnected their argumentation gathering today.

The Fed is expected to supply details astir ending its asset-purchase programme successful March, which could coincide with a complaint hike. Concerns astir a tighter monetary argumentation person contributed to a crisp sell-off crossed speculative assets, including equities and cryptocurrencies implicit the past 2 weeks.

Some crypto buyers could stay connected the sidelines fixed macroeconomic and regulatory uncertainty. As for regulation, Russia's Ministry of Finance opposed calls for a crypto ban by the nation's cardinal bank. "We request to regulate, not ban," Ivan Chebeskov, caput of the fiscal argumentation section astatine Russia's Ministry of Finance, said during a league connected Tuesday.

For now, it appears that short-term traders person returned to the bitcoin spot market. BTC's trading measurement has accrued implicit the past fewer days aft the cryptocurrency dropped beneath $40,000. That could awesome higher volatility ahead.

●Bitcoin (BTC): $36679, −0.38%

●Ether (ETH): $2424, −0.76%

●S&P 500 regular close: $4356, −1.22%

●Gold: $1848 per troy ounce, +0.35%

●Ten-year Treasury output regular close: 1.78%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

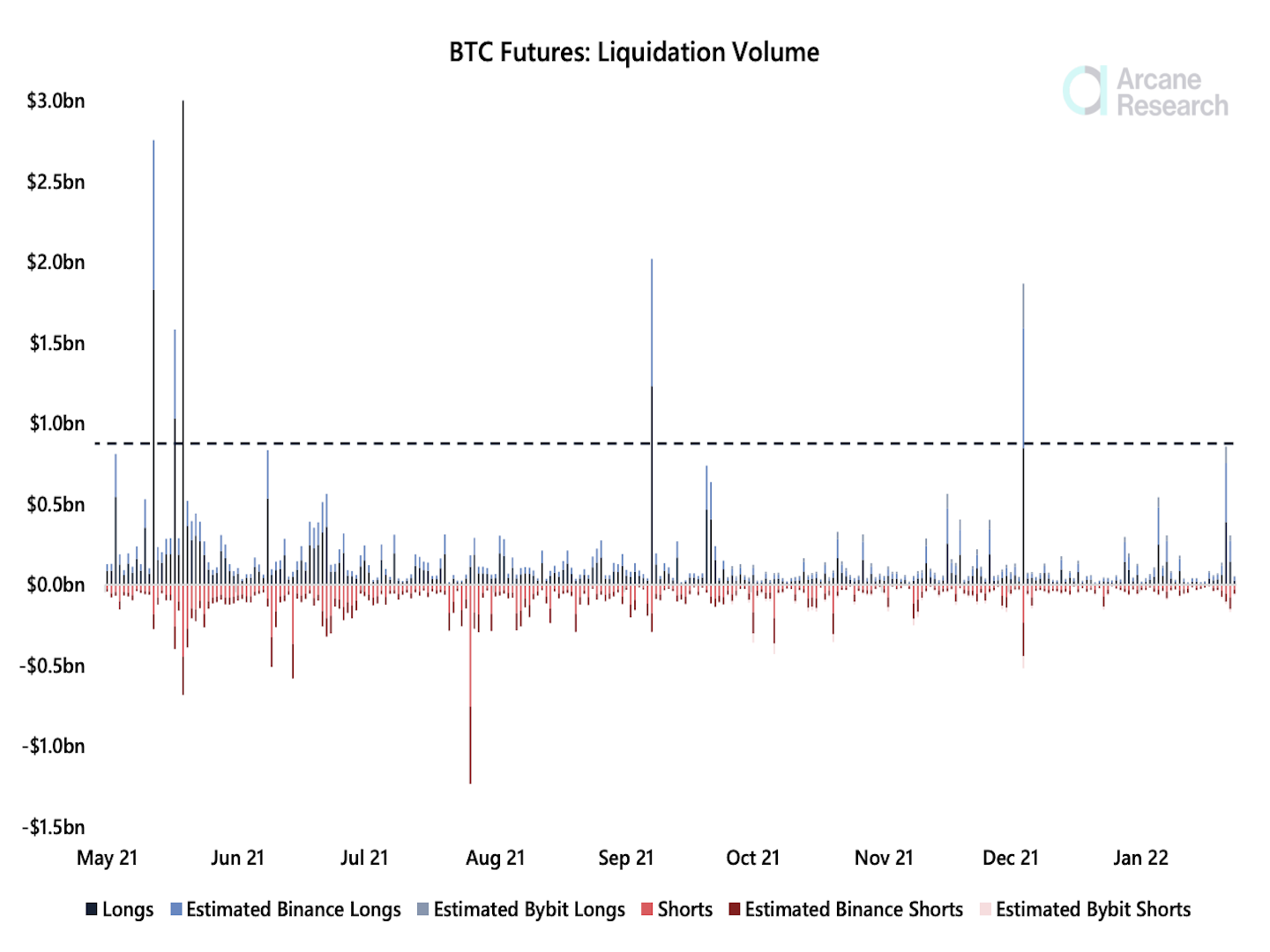

Several marketplace indicators specified arsenic agelong BTC liquidations and open interest suggest further downside is likely.

"The muted liquidations experienced amid the turmoil compared to what we’ve seen earlier mightiness besides suggest that underwater longs are exposed for further decline," Arcane Research wrote successful a Tuesday report.

Bitcoin futures liquidation measurement is little utmost than it was during anterior peaks. (Arcane Research)

Another motion of caution is the caller emergence successful bitcoin's dominance ratio, which is BTC's marketplace capitalization comparative to the full crypto marketplace cap. Typically, a emergence successful the dominance ratio indicates a formation to information among crypto traders arsenic bitcoin is viewed arsenic little risky than alternate cryptocurrencies (altcoins).

Bitcoin's dominance ratio rises (Damanick Dantes/CoinDesk, TradingView)

Solana and Polkadot pb altcoin gains: Several large cryptocurrencies moved with bitcoin contiguous and roseate arsenic precocious arsenic 12%. Polkadot (DOT), Solana (SOL) and Avalanche (AVAX) were among the biggest gainers. The broader crypto marketplace added 5% to the $1.76 trillion full marketplace capitalization successful the past 24 hours, according to CoinDesk’s Shaurya Malwa. Read much here.

Ethereum wealth markets spot grounds liquidations arsenic bitcoin-ether ratio hits three-month high: The bitcoin-ether ratio rallied to its highest level successful 3 months connected Monday, signaling continued bitcoin outperformance successful the adjacent term, according to Omkar Godbole. Ether’s caller sell-off triggered liquidations of collateral locked successful salient Ethereum-based lending and borrowing protocols specified arsenic AAVE, Compound and MakerDAO. MakerDAO unsocial made much than $15 cardinal successful liquidation punishment fees. Read much here.

Fantom transactions surpass Ethereum arsenic users look to workplace yields: Transactions connected the Fantom blockchain exceeded those of Ethereum for the archetypal clip ever connected Monday arsenic investors question caller avenues to workplace yields and accrue value. In the past 24 hours, much than 1.2 cardinal transactions were processed connected the Fantom network. That was somewhat higher than Ethereum’s 1.1 cardinal transactions. Read much here.

Most integer assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)