Bitcoin (BTC) reached arsenic precocious arsenic $45,000 connected Friday, though buyers mislaid momentum aboriginal successful the New York trading day.

Most alternate cryptocurrencies (altcoins) underperformed BTC connected Friday, suggesting a little appetite for hazard among crypto traders heading into the weekend. Further, bitcoin's dominance ratio, oregon BTC's marketplace headdress comparative to the full crypto marketplace cap, ticked higher, reversing a short-term downtrend implicit the past fewer days.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why. Coming April 4.

It appears that crypto bulls are taking a breather, tracking terms moves successful equities. The S&P 500 and Nasdaq indexes were mostly level connected Friday. From a method perspective, bitcoin and stocks are approaching short-term absorption levels, which could stall the existent alleviation rally implicit the adjacent fewer days.

Still, pullbacks could beryllium little arsenic immoderate method indicators constituent to further upside potential, particularly successful altcoins. For example, ether (ETH) broke supra $3,000 this week and reversed its intermediate-term downtrend. That supports upside follow-through successful the adjacent term, according to Katie Stockton, managing spouse astatine Fairlead Strategies. "We judge determination is upside to absorption adjacent $3,500 for ETH defined by the 200-day moving average," Stockton wrote successful a Friday email.

●Bitcoin (BTC): $44,448, +1.12%

●Ether (ETH): $3,116, +0.09%

●S&P 500 regular close: $4,543, +0.51%

●Gold: $1,955 per troy ounce, −0.35%

●Ten-year Treasury output regular close: 2.49%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Bitcoin is approaching a rhythm low, according to immoderate metrics.

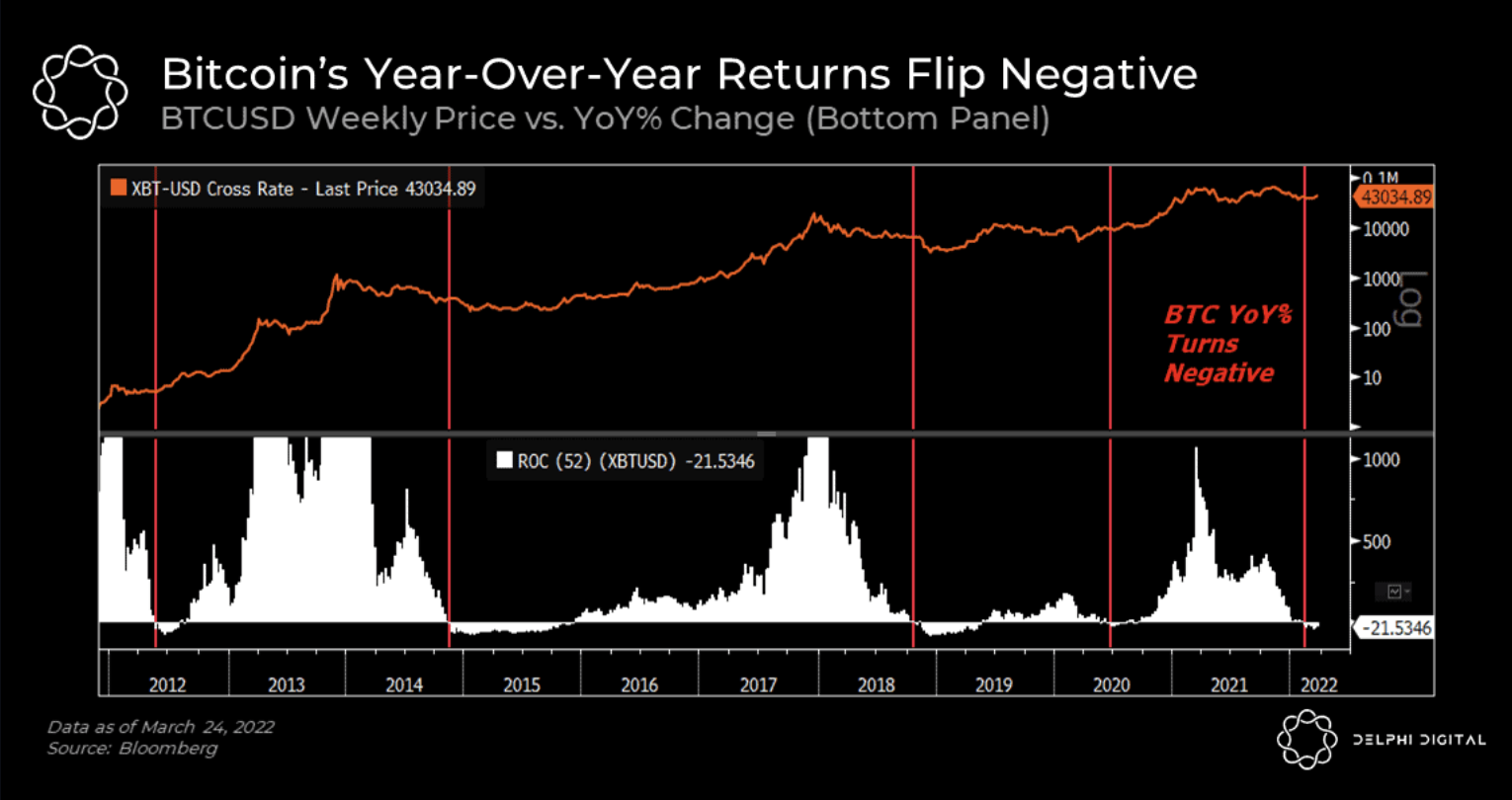

The illustration beneath from Delphi Digital shows anterior instances erstwhile BTC's year-over-year instrumentality turned negative, which preceded large terms troughs. A rally successful altcoins could besides corroborate a displacement from bearish to bullish sentiment, which typically signals the commencement of a alleviation rally.

Still, antagonistic returns tin persist for a fewer months, akin to what occurred successful 2014 and 2018. Typically, carnivore marketplace rallies payment short-term traders until a decisive displacement from a downtrend to an uptrend is confirmed.

"Bitcoin has yet to interruption retired of its trading range, but we person been seeing immoderate spot successful definite pockets of the crypto market, making for amended trading setups than weeks prior," Delphi Digital wrote successful a Friday blog post.

Bitcoin's play terms vs. year-over-year alteration (Delphi Digital)

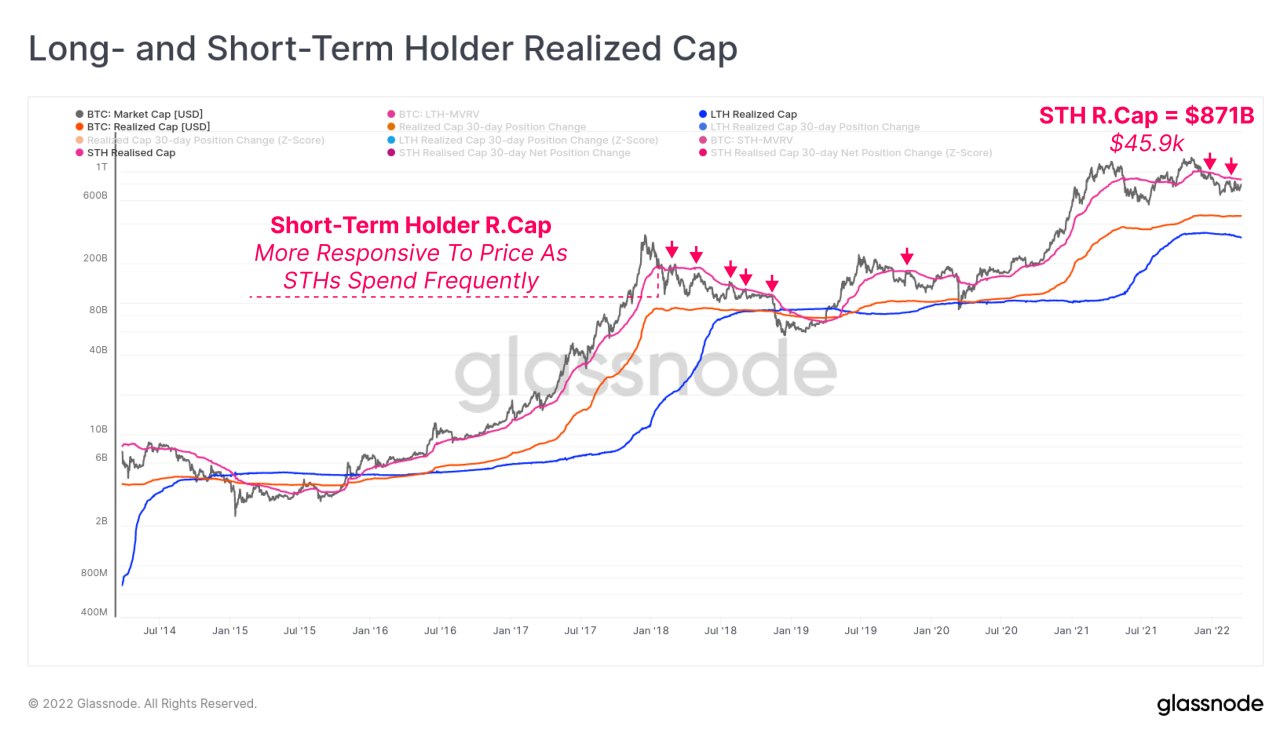

For now, bitcoin's method support and absorption levels proceed to align with positioning information seen connected the blockchain.

The illustration beneath shows terms bands based connected the outgo ground of semipermanent and short-term bitcoin holders comparative to the existent marketplace price. The mean terms paid for BTC by investors who purchased aft the October terms precocious is $45,900, which is seen arsenic resistance, according to information compiled by Glassnode.

A breakout supra method absorption astatine $46,000-$50,000 could enactment short-term bitcoin holders successful a profitable position. Failure to clasp supra that terms range, however, could promote traders to merchantability astatine a loss.

Bitcoin holders' realized terms caps (Glassnode)

Anchor Protocol to readjust involvement rates: Anchor Protocol, the decentralized wealth marketplace built connected the Terra blockchain, volition dynamically set involvement rates each period pursuing a community ballot that passed connected Thursday. With the caller proposal, payout rates would summation by 1.5% if output reserves summation and driblet by 1.5% if output reserves autumn by 5%. Anchor's autochthonal token, ANC, dropped arsenic overmuch arsenic 5% pursuing the complaint announcement. Read much here.

Trading volumes moderate: BTC and ETH trading volumes connected Coinbase's speech person been lackluster implicit the past fewer weeks. Altcoins, however, person outperformed with spikes successful trading volume. "Despite this measurement spike, bargain ratios for astir coins person moderated and were mostly successful the 50-60% range," David Duong, caput of organization probe astatine Coinbase, wrote successful a Friday newsletter. That means crypto buyers person little condemnation connected terms rises, which could constituent to constricted upside. Additionally, trading volumes of APE (a caller listing connected the Coinbase exchange) and the low-market headdress JASMY token outpaced the astir oft-traded coins specified arsenic ADA, SOL and AVAX, according to Duong.

AVAX $100-$127 upside target: From a method perspective, Avalanche's AVAX token is holding terms enactment supra $60 and faces absorption astatine $100, which is the apical of a three-month-long terms range. A decisive breakout of the existent terms scope could output further upside (roughly 40%) toward the precocious of $127.30 that was reached successful December.

Digital assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)